Exchange Rates and Interest

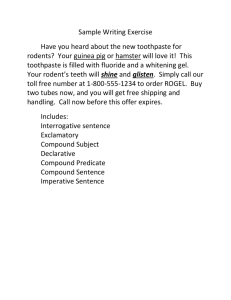

advertisement

Types of Taxes • Proportional Tax: Same % rate of tax on everyone, regardless of income (Social Security) • Progressive Tax: Higher % rate of tax on persons with higher incomes (Personal income tax) • Regressive Tax: Higher % rate of tax on people with lower incomes (Sales tax) Examples of Taxes • • • • • • • • • • • • • • • • Taxes Income Taxes Paid % of Income Proportional Tax-aka Flat Tax 1 $10,000 2 $50,000 3 $100,000 $1,000 $5,000 $10,000 10% 10% 10% Regressive Tax 1 2 3 $10,000 $50,000 $100,000 $500 $2,000 $3,000 5% 4% 3% Progressive Tax 1 2 3 $10,000 $50,000 $100,000 $300 $2,000 $5,000 3% 4% 5% Just For Fun 1. The town of Mableton charges a tax of 1.2% of household income for each property. This is a ____________ tax. 2. Both millionaires and poor people pay a 6% sales tax when they go shopping. This is a __________ tax. 3. People who make $100,000 pay a higher % of income tax than people who make $10,000. This is a __________ tax. Exchange Rates Exchange rate – the price of one nation’s _________ (money) in terms of another nation’s _________. Exchange Rate • Chart of Exchange Rates for the American Dollar (as of October 2007) Value of $1 U.S. (in foreign country) Canadian Dollar 0.97 Mexican Peso 10.84 Japanese Yen 113.94 Euro 0.70 http://www.xe.com/ucc/convert.cgi?Amount= 1&From=USD&To=EUR&x=39&y=15 Exchange Rates • Dollar (Appreciated) – When ____________ • • • • _______ increase and are cheaper for us to buy Traveling is ________ for U.S. tourists U.S. _________ decline The trade deficit increases Exchange Rates • Dollar (Depreciation) – When _______________ • _________ increase and the prices of exports go up • Travel abroad is more expensive • U.S. _________ decline and _______ of importing increase Using Credit • Simple Interest – you are charged interest ONLY on the original amount of the loan. First year: $1,000 (10% interest rate) + (1,000 * .10) --------------------1,000 + 100 = $1,100 Second year: $1,000 + (1,000 * .10) + (1,000 * .10) ------------------------------------1,000 + 100 + 100 = $1,200 Compound Interest • Most credit card companies, however, use compound interest • Compound Interest – interest is charged not only on the original amount you borrowed, but on the existing amount you owe (so INTEREST on-top-of INTEREST as well) Compound Interest First year: $1,000 + (1,000 * .10) --------------------1,000 + 100 = $1,100 Second Year: $1,100 + (1,100 * .10) ----------------------1,100 + 110 = $1,210 Simple vs. Compound (Interest on $1,000 borrowed) Years Passed Simple Interest Compound Interest 1 100 (1,100) 100 (1,100) 2 100 (1,200) 110 (1,210) 3 100 (1,300) 121 (1,331) 5 100 (1,500) 279.51 (1,610.51) 10 100 (2,000) 983.23 (2,593.74) 15 100 (2,500) 1583.51 (4,177.25) Pg. 102 • • • • Certificate of Deposit (CDs) Savings Bond Mutual Fund Stocks