Problems 19 to 21

advertisement

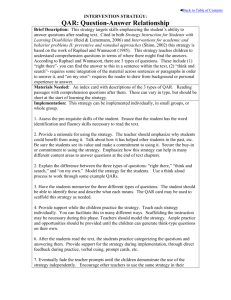

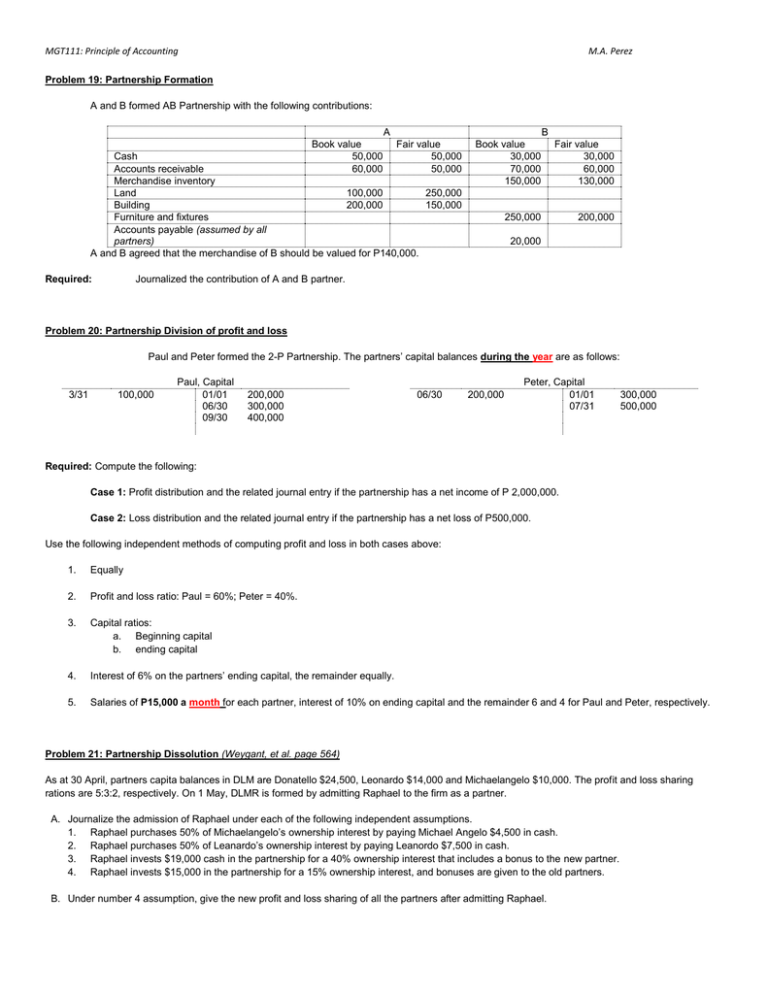

MGT111: Principle of Accounting M.A. Perez Problem 19: Partnership Formation A and B formed AB Partnership with the following contributions: A Book value 50,000 60,000 B Fair value 50,000 50,000 Cash Accounts receivable Merchandise inventory Land 100,000 250,000 Building 200,000 150,000 Furniture and fixtures Accounts payable (assumed by all partners) A and B agreed that the merchandise of B should be valued for P140,000. Required: Book value 30,000 70,000 150,000 Fair value 30,000 60,000 130,000 250,000 200,000 20,000 Journalized the contribution of A and B partner. Problem 20: Partnership Division of profit and loss Paul and Peter formed the 2-P Partnership. The partners’ capital balances during the year are as follows: 3/31 100,000 Paul, Capital 01/01 06/30 09/30 200,000 300,000 400,000 06/30 200,000 Peter, Capital 01/01 07/31 300,000 500,000 Required: Compute the following: Case 1: Profit distribution and the related journal entry if the partnership has a net income of P 2,000,000. Case 2: Loss distribution and the related journal entry if the partnership has a net loss of P500,000. Use the following independent methods of computing profit and loss in both cases above: 1. Equally 2. Profit and loss ratio: Paul = 60%; Peter = 40%. 3. Capital ratios: a. Beginning capital b. ending capital 4. Interest of 6% on the partners’ ending capital, the remainder equally. 5. Salaries of P15,000 a month for each partner, interest of 10% on ending capital and the remainder 6 and 4 for Paul and Peter, respectively. Problem 21: Partnership Dissolution (Weygant, et al. page 564) As at 30 April, partners capita balances in DLM are Donatello $24,500, Leonardo $14,000 and Michaelangelo $10,000. The profit and loss sharing rations are 5:3:2, respectively. On 1 May, DLMR is formed by admitting Raphael to the firm as a partner. A. Journalize the admission of Raphael under each of the following independent assumptions. 1. Raphael purchases 50% of Michaelangelo’s ownership interest by paying Michael Angelo $4,500 in cash. 2. Raphael purchases 50% of Leanardo’s ownership interest by paying Leanordo $7,500 in cash. 3. Raphael invests $19,000 cash in the partnership for a 40% ownership interest that includes a bonus to the new partner. 4. Raphael invests $15,000 in the partnership for a 15% ownership interest, and bonuses are given to the old partners. B. Under number 4 assumption, give the new profit and loss sharing of all the partners after admitting Raphael.