New Employee Orientation

advertisement

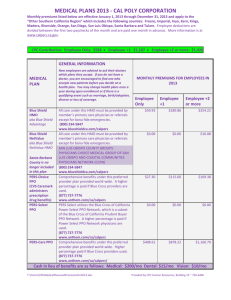

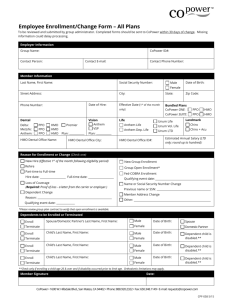

UCSB Human Resources - Benefits New Employee Orientation Benefits Office Hours 8:00 - Noon & 1:00 - 4:00 893-2489 July 2015 Overview Eligibility Enrollment Health and Welfare Plans Retirement and Savings Plans Welcome folder Benefits Packages Full Benefits Mid-Level Core Special Groups UC Transfers Rehired Retirees Postdoctoral Scholars A Complete Guide to Your UC Health Benefits, pages 9 – 11 Benefits of Belonging - Video http://ucnet.universityofcalifornia.edu Eligible Family Members Legal spouse, same sex/opposite sex domestic partner Child(ren) under 26 Legal Ward(s) under 18 Overage disabled child A Complete Guide to Your UC Health Benefits – pages 12-13 Life Events & Family Benefits Add an eligible family member 31 days to enroll Family member loses eligibility Notify Benefits Office to cancel coverage Family Changes Checklist on UCnet A Complete Guide to Your UC Health Benefits – pages 7-8 Imputed Income Your taxable income may increase if you enroll a same sex domestic partner not declared as a dependent on your federal taxes. Taxed on value of employer-paid medical A Complete Guide to Your UC Health Benefits – page 6 Your Responsibility Check eligibility requirements before enrolling a family member Family Member Eligibility Verification SECOVA will request documents to verify eligibility within a 30-60 days Your family members may be de-enrolled if you fail to respond to Secova’s request for documentation. When to Enroll Period of Initial Eligibility (PIE) PIE is first 31 days of employment If you miss PIE, 90 day delay for medical plan Open Enrollment Period Opportunity to change plans in November for next year Statement of Health How To Enroll – Period of Initial Eligibility UCnet ucnet.universityofcalifornia.edu Sign-in to At Your Service Online = Select “Benefit Enrollment” AYS Online New Employees Rehired Employees Status/Appointment Change Social Security Number Username Date of Birth Password Your Benefits at a Glance ucnet.universityofcalifornia.edu atyourserviceonline.ucop.edu/ayso Click on New to UC atyourserviceonline.ucop.edu/ayso Enter your Date of Birth as password MMDDYYYY More information Insurance Plan Websites Find a doctor or participating provider Summary of Benefits booklets Prescription drug list Contact information insert A Complete Guide to Your UC Health Benefits Health Plans Medical Dental Vision What are your priorities? Cost to enroll – monthly premium Cost of care Predictable, low cost copays Pay a % of each service Worst case scenario – Out of pocket maximum Choice of providers HMO medical group physicians PPO preferred network or any provider Effort to manage – coordinating care & bills Which medical plan is right for you? Medical Plans Summary of services Cost of care Monthly premiums Union Members Rates may be different HMO – Health Maintenance Organizations Health Net Blue & Gold HMO Sansum Clinic - Santa Barbara, Lompoc, Santa Ynez SB Select IPA - Santa Barbara Regal - Ventura Physician’s Choice - Santa Maria Kaiser HMO closest facilities Ventura & Los Angeles County Using the Health Net or Kaiser HMO Plan You select Primary Care Physician (PCP) When you need care go to your PCP PCP refers you to specialist, x-ray, lab, hospital Find a Doctor on UCnet Live or work within 30miles of medical group, in most cases Care is coordinated by PCP and medical group If away from group, plan will only cover urgent and emergency care Cost of Care with Health Net & Kaiser HMOs Predictable, low cost copays for services and drugs Service Copay Office Visit Labs, radiology Urgent Care Visit Outpatient Surgery Inpatient Hospital Emergency Room $20 $0 $20 $100 $250 $75 No Deductible Why select an HMO? Like lower monthly premiums Like low cost, predictable copays for care Like having a Primary Care Physician who helps manage your care Are satisfied with the specialists in the HMO medical group Don’t have family members living outside the California HMO service area PPO – Preferred Provider Organization You direct your own care, you decide where to receive services You pay annual deductibles before plan pays After deductible, you share the cost of each service with the plan - coinsurance Your costs are lower if you select preferred providers “Out-of-pocket Maximum” limits your financial liability 25 PPO Plans for 2015 UC Care Blue Shield Health Savings Plan Core (default) UC Care PPO PPO plan designed for UC Administered by Blue Shield of California Blue Shield PPO network Claim administrator International plan Employee & family members may live anywhere Comprehensive coverage worldwide UC Care Providers – You choose any provider UC Select (Tier 1) Blue Shield Preferred (Tier 2) Non-Preferred Out-of-Network (Tier 3) UC Medical Centers In CA Blue Shield PPO Not contracted with Blue Shield in US Other local providers In US Blue Cross/Blue Shield Outside US BlueCard Network or any provider You have access to providers in all three tiers 28 UC Care – Network providers near UCSB UC Select (Tier 1) Blue Shield Preferred (Tier 2) Santa Barbara limited to: Blue Shield PPO physicians & facilities Sansum Clinics Quest Labs & Unilab A few other specialists Pacific Diagnostic Lab More complete networks in: Pueblo Radiology Cottage Hospitals Ventura Santa Maria Lompoc 29 Provider Directory: http://uc-care.org UC Care Costs UC Select (Tier 1) Blue Shield Preferred (Tier 2) Non-Preferred Out-of-Network (Tier 3) Copays Deductible Deductible 20% Coinsurance 50% Coinsurance • Your costs are based on the tier/network that the provider is in • Not all services are covered at the UC Select benefit tier • Some services are covered only at the Blue Shield Preferred and Non-Preferred tiers 30 Deductible, Coinsurance, Out of Pocket Max UC Care Example Individual Coverage Blue Shield Preferred (Tier 2) You pay You share cost with plan Plan pays 100% after you pay $250 Individual Deductible 20% Coinsurance $3000 OOPM 31 UC Care - Overview No HMO option, no PCP, no referrals – you select physicians and manage care You pay a copay or a percentage of fee for services depending on the provider you select Limited number of UC Select/Tier 1 providers in Santa Barbara Large network of Preferred PPO providers Higher premium than HMO You can live outside of California Why select UC Care? You like managing your own care You like being able to select any physician You don’t mind paying more for a larger choice of physicians You’re living outside of California OR out of the HMO service areas Blue Shield Health Savings Plan Combines high deductible PPO with savings account to pay out-of-pocket expenses + Medical Coverage Blue Shield PPO 35 Health Savings Account HealthEquity What’s different about the HSP? High deductible PPO medical plan Deductible and OOPM shared by all family members Medical and drug expenses apply to deductible and OOPM Health Savings Account (HSA) Use the pre-tax HSA funds to pay the deductible and other health expenses including dental and vision. UC makes an annual contribution to this account You may also make pre-tax contributions (optional) Funds rollover; you keep money in the account Who is eligible for HSP? Health Savings Account “owners” Must live in US You can’t be enrolled in: Health Flexible Spending Account (FSA) Other traditional health plan Medicare Part A or B Can’t be claimed as a dependent on someone else’s tax return HSP – Provider Networks & Coverage When in US Comprehensive coverage Blue Shield PPO network in CA Blue Cross Blue Shield network outside CA When traveling out of US Emergency and urgent care only NO routine care Use any provider Blue Shield PPO – Medical Plan Design In Network Out of Network $1,300 $2,600 $2,500 $5,000 20% • Plan pays 60% of allowed rate • You pay balance $4,000 $6,400 $8,000 $16,000 Deductible Single Family (2 or more) Member Cost Sharing (Coinsurance for medical services & drugs) Out-of-Pocket Max (includes deductible) Single Family (2 or more) Preventive Care by in-network providers is paid in full by plan How does HSA work? UC makes one annual contribution to HSA UC contribution is prorated based on the month the plan starts (see chart on UCnet) You may contribute to HSA up to annual max (optional): Pre-tax payroll deduction Post-tax contributions paid to HealthEquity Pay expenses or reimburse yourself from HSA using: HealthEquity debit card HealthEquity website Funds rollover; you can invest HSA dollars over $2000 Annual Contributions to HSA 2015 IRS Annual Limit UC Annual Contribution (plans starting in January) Single Family (2 or more) $3,350 $6,650 $500 $1,000 Catch-up contribution, age 55+: $1000 Call HealthEquity if you have questions about contribution limits. Why select the Blue Shield HSP? You like lower monthly premiums You like the tax advantages of the HSA You want to build-up a saving account for future expenses You have few medical or drug expenses and expect to rollover HSA dollars You have many medical or drug expenses and will contribute to HSA so you can save taxes on health expenses You like managing your own care You don’t mind managing medical accounts Core - Fee for Service Catastrophic medical plan (default) PPO plan design Premium paid in full by UC $3,000 annual deductible per individual 20% co-insurance for medical and drug OOPM: Individual $6,350; Family $12,700 You select Blue Shield PPO providers or non-Blue Shield provider Prescription Drugs Preferred Drug List (Formulary) is different for each carrier HMO UC Care Retail (30 day) • Generic • Brand • Non-formulary Mail Order (90 day) Retail (Maintenance) • Generic • Brand • Non-formulary 45 $5 $25 $40 $10 $50 $80 Blue Shield HSP CORE You pay full cost of medication until you satisfy the deductible After deductible, you pay 20% at preferred pharmacies Preventive Care All medical plans cover preventive care at 100% with in-network providers Preventive care includes: Annual well visit and labs Well woman visits and labs Preventive screening tests Immunizations See list of preventive services on the plan websites 46 Optum – Behavioral Health Counseling and substance abuse treatment Care by therapists, psychologist, psychiatrist Plans have different provider options and benefits Optum Only Optum & Non-Optum Health Net Kaiser UC Care Blue Shield HSP Call Optum to confirm provider is in-network Dental Insurance Plans Choice of two plans Delta Dental PPO DeltaCare USA (HMO) Premium paid in full by UC A Complete Guide to Your UC Health Benefits, Pages 22 – 25 Dental Plan Comparison Delta Dental PPO Delta Care USA (HMO) Worldwide Coverage California Service Area Choose Delta PPO or non-Delta • Large network in Santa Barbara Assigned to dental group • Small network in Santa Barbara Coinsurance 20% - 50% Copays - upgrades cost more Maximum benefit up to $1700 No maximum benefit Preventive care covered 100% Delta Dental PPO Why select this plan? You like being able to select any dentist You don’t mind paying more for a larger choice of dentists You don’t expect to exceed the annual maximum benefit of $1,700 You’re living outside of California DeltaCare USA (HMO) Why select this plan? You don’t mind having a limited choice of dentists You like lower out of pocket costs You expect to have major dental work that will exceed the Delta PPO maximum benefit You or a family member needs orthodontic services VSP - Vision Service Plan Routine vision care Exam – 1 per calendar year ($10 co-pay) Lenses - one set every year Frames every other year ($130 allowance) OR Contact lenses ($110 allowance) per calendar year Select VSP doctor for lower costs Limited reimbursements for non-VSP doctor Premium paid in full by UC Find VSP Choice providers: www.vsp.com Other Insurance Disability Life Flexible Spending Accounts See the booklet for these plans Accidental Death and Dismemberment – page 39 Legal – page 43 A Complete Guide to Your UC Health Benefits Disability Insurance Disability Insurance replaces lost income while you are away from your job due to a non-work related illness or injury, including childbirth. Disability Insurance – Overview of Plans Liberty Mutual Insurance Company Short-Term Disability Employer-paid Short-term benefits only Supplemental Disability Voluntary / employee-paid Short-term supplement and long-term benefits No State Disability Insurance (SDI) coverage Worker’s Compensation (work related only) Short-Term Disability Enrollment is automatic; paid by UC 7-day waiting period If you have accrued sick leave, you must first use up to 22 working days of sick leave before benefits start Monthly benefit = 55% up to $800/mo. maximum 26 week disability period Provides benefits for non-work related disabilities Does not include long-term coverage Supplemental Disability Enroll during PIE or with Statement of Health Employee paid - premium based on age, waiting period and full-time salary rate Choice of 7, 30, 90, or 180-day waiting period If you have accrued sick leave, you must first use up to 22 working days of sick leave before benefits start Coverage for duration of disability up to age 65 Supplements other income to 70% up to $15,000/month maximum Why enroll in Supplemental Disability now? After PIE – statement of health is required and you can be denied coverage Can’t enroll during annual Open Enrollment If you can’t work, can you afford to live on $800/month? You are planning a pregnancy? Calculating Your Premiums Example: Supplemental Disability & Supplement Life Flexible Spending Accounts (FSA) Save taxes on eligible expenses Health FSA medical, dental, vision, prescription drugs, etc Dependent Care FSA child care adult day care Make monthly payroll contribution with pre-tax earnings Submit claims for reimbursement or use Health Spending Card Effective date is the 1st of the month following enrollment; subject to payroll deadlines Blue Shield HSP members may not enroll in Health FSA A Complete Guide to Your UC Health Benefits, pages 45-46 Flexible Spending Account – Use it or lose it Expenses incurred in 2015 will be reimbursed from your 2015 contributions If you do not use all your funds by 12/31/15: Health FSA You can carry over up to $500 of unused funds into 2016. Even if you do not enroll in the 2016 plan You will forfeit unclaimed funds above the $500 Dependent Care FSA You forfeit any unclaimed funds Estimate your expenses carefully Retirement Plans Mandatory Plans University of California Retirement Plan (UCRP) OR Defined Contribution Plan (DCP for Safe Harbor) Voluntary Retirement Savings Programs Tax-Deferred 403(b) 457(b) Deferred Compensation A Complete Guide to Your UC Retirement Benefits University of California Retirement Plan (UCRP) 2013 Tier Members Vesting = 5 years of Service Credit (100% full-time) Minimum age 55 Defined Benefit Plan: Age x Years of UCRP Service Credit x Highest Average Plan Compensation (HAPC) Coordination with Social Security Example: Benefit Percentages Retire at age 65 with 20 years of UCRP Service Credit Pension Benefit = .5000 of HAPC Years of UCRP Service Credit Retirement Age 55 60 65 5 .0550 .0900 .1250 10 .1100 .1800 .2500 20 .2200 .3600 .5000 30 .3300 .5400 .7500 40 .4400 .7200 1.000 UCRP Contributions – 2013 Tier Mandatory pre-tax contributions Employees contribute 7% of gross earnings Contribution is subject to collective bargaining Defined Contribution Plan (DCP Safe Harbor) Mandatory monthly pre-tax employee contributions of 7.5% (in lieu of paying Social Security taxes) Administered by Fidelity Contributions default to UC-managed “Savings Fund” You may invest in other Fidelity funds Retirement Savings Plans Voluntary employee pre-tax savings programs Tax-Deferred 457(b) 403(b) Deferred Compensation Administered by Fidelity Maximum annual contribution limits Investment options: Core Funds and other expanded options www.netbenefits.com Enroll at any time – NOT subject to PIE Next Steps Explore benefit options UCnet – plan descriptions, cost calculator tools, medical plan chooser Health Plans – providers lists, coverage details, preferred drug lists (formulary) Enroll before end of “PIE” Medical, dental, vision insurance Life, Disability, AD&D, Legal insurance Flexible Spending Accounts After You Enroll Check your Earnings Statement on AYSO Are enrollments and deductions correct? Attend Retirement Workshops UCnet - UCRP Fidelity – DCP, 457b, 403b