Dimension 6: Balancing Social and Financial Performance

advertisement

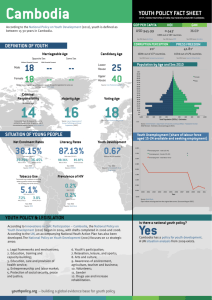

Dimension 6: Balance Financial and Social Performance The Universal Standards Implementation Series Today’s speakers: Wesley Jordan, CFO, VisionFund Cambodia Yamini Annadanam, Independent Consultant July 23, 2015 Agenda • Review of Dimension 6 of the Universal Standards for SPM • Presentation by Wesley Jordan, VisionFund Cambodia • Discussion with Participants • Wrap-up There are 19 standards, organized into six dimensions. Today we will discuss dimension 6. Dimension 6 of the Universal Standards • Title: Balance Financial and Social Performance • Rationale: An institution’s financial decisions and results should reflect their social goals • Four standards: ▫ ▫ ▫ ▫ 6a- Growth 6b- Returns & financing structure 6c- Pricing 6d- Executive compensation Dimension 6: 4 Standards • 6a- The institution sets and monitors growth rates that promote both financial sustainability and client wellbeing • 6b- Equity investors, lenders, board and management are aligned on the institution’s double bottom line and implement an appropriate financial structure in its mix of sources, terms, and desired returns • 6c- Pursuit of profits does not undermine the long-term sustainability of the institution or client well-being • 6d- The institution offers compensation to senior managers that is appropriate to a double bottom line institution 6a- The institution sets and monitors growth rates that promote both financial sustainability and client well-being. Essential Practices • Set a policy on sustainable target growth rates, for all branches/regions and all product types, considering the institution's growth capacity and the markets being targeted • Analyze growth rates and market saturation to assess whether growth policies ensure both financial sustainability and client well-being • Monitor whether internal capacity is keeping pace with institutional growth in number of clients and amount of loans and deposits, and enhance that capacity as needed 6b- Equity investors, lenders, board and management are aligned on the institution’s double bottom line and implement an appropriate financial structure in its mix of sources, terms, and desired returns. Essential Practices • Set clear policies on desired level of returns and on how those returns will be used • Engage with funders whose expectations for financial returns, timeframe and exit strategies are aligned with your social goals and stage of development • When deciding on funding sources, understand what cost would be passed on to the client • Protect client savings and cash collateral • Maintain a transparent financial structure 6c- Pursuit of profits does not undermine the longterm sustainability of the institution or client wellbeing. Essential Practices • Set market-based, non-discriminatory pricing • Ensure efficiency ratios are aligned with peers • Do not charge excessive fees • Monitor whether pricing levels are consistent with your policies on returns • Establish a field-officer-to-client ratio that promotes high service quality for clients 6d- The institution offers compensation to senior managers that is appropriate to a double bottom line institution. Essential Practices • Ensure that compensation of the CEO/Managing Director and other senior employees is in line with your social goals • If senior management compensation is in part incentive-based, include the social performance evaluation • Upon request, transparently disclose compensation to regulators, auditors, raters, donors, lenders, and investors • Calculate the difference between the average compensation of top level executives and field employees, and analyze whether this spread is consistent with the your mission Reminder! Use the SPI4 Tool to Assess Your SPM Practices • SPI4 is the common data collection and assessment tool for the Universal Standards Dimensions Standards • Evaluates implementation based on indicators Essential Practices Indicators SPI4 Indicators Corresponding to Essential Practice 6A…. Agenda • Review of Dimension 6 of the Universal Standards for SPM • Presentation by Wesley Jordan, VisionFund Cambodia • Discussion with Participants • Wrap-up Meet your Speakers! Name: Wesley Jordan Title: Chief Financial Officer Organization: VisionFund Cambodia Email: wesley_jordan@wvi.org Name: Yamini Annadanam Title: Independent Consultant Email: yamini.avk@gmail.com Introduction to VisionFund Cambodia “Our vision for every child, life in all its fullness; our prayer for every heart, the will to make it so.” • We improve lives of children • We empower poor women • We unlock the potential for community • Started as an MED program by World Vision in 2000, the transformation into VisionFund Cambodia took place in 2003. Within two years, the entity achieved sustainability. • Currently, VisionFund Cambodia works in 25 provinces and reaches to 280,000 clients with loans & savings. CLIENTS & PORTFOLIO AS OF JUN-15 METHODOLOGY # CLIENT % $ PORTFOLIO % COMMUNITY (CB) 190,220 80.0% 40,775,872 38.72% SOLIDARIY (SG) 2,415 1.0% 858,875 0.82% INDIVIDUAL (IL) 45,256 19.0% 63,683,271 60.47% TOTAL 237,891 100% 105,318,018 100% 15 | VISIONFUND CAMBODIA| INVESTING IN A BETTER LIFE FOR CHILDREN CLIENT GROWTH 2002-15 16 | VISIONFUND CAMBODIA| INVESTING IN A BETTER LIFE FOR CHILDREN IMPACT OF VFC GROWTH # of clients (being empowered): Women % clients: family) 237,891 94% (more likely to benefit the Estimated no. of children benefited: 776,683 100% Cover in all 55 WV’s ADPs in 9 Provinces (i.e. 85% of villages): Hence those who have progressed under WV’s ADP program will have access to financing to help liberate themselves from the poverty cycle ~$443 Average loan size per client: (40% of Cambodian GDP/capita) reaffirms our mission to benefit the poorer segment 17 | VISIONFUND CAMBODIA| INVESTING IN A BETTER LIFE FOR CHILDREN What mechanisms have you put in place for meeting the standards of the dimension “balancing social and financial performance”? • Social Performance committee at both Board and Management level • Margin guidelines across products • Specialization of field-based roles • Systems provide real-time reporting, down to loan officer level via mobile devices VisionFund Cambodia has grown in the past 10 years. How did you manage and monitor the growth without compromising on client well-being? • Key performance indicators reflect social performance across MFI • Full reinvestment in portfolio • Moderate growth targets • Continued diversifying products to enhance social performance targets – loans, savings, insurance How did you ensure that profitability is intact while balancing long term sustainability and client well-being? • Ongoing process review in order to improve & reduce costs • Pricing should not mask inefficiencies • Over-indebtedness risks for both MFI and client Board members and management play a significant role in monitoring financial performance. What role did they play at VisionFund to balance social and financial performance? • Maintain Social Performance as priority at a strategic level • Set guidelines on profitability & pricing • Ensure integration with activities of World Vision and other NGO partners How do these practices benefit clients and staff? Clients: • Improved sanitation (62%) • Additional clothing, shoes for children (59%) • Child health costs covered (57%) Staff: • Concern for whole client & household, not just business • Reward & Recognition of branches with SP emphasis What is your advise for other practitioners? • Secure strategic support from Board • Processes – use technology and continuous improvement to reduce costs • Reconsider pricing levels & profitability targets Agenda • Review of Dimension 6 of the Universal Standards for SPM • Presentation by Wesley Jordan, VisionFund Cambodia • Discussion with Participants • Wrap-up Agenda • Review of Dimension 6 of the Universal Standards for SPM • Presentation by Wesley Jordan, VisionFund Cambodia • Discussion with Participants • Wrap-up Take Action: Use the Implementation Guide! • Download the guide here: http://sptf.info/spmstandards/universalstandards Take Action: Consult the Resource Center! • Visit the resource center here: http://sptf.info/resources/resource-center Where to find more information: • The Universal Standards of SPM Manual: http://sptf.info/spmstandards/universal-standards • The SPI4 social audit tool: http://cerise-spi4.squarespace.com • The presentation and recording from today’s session: http://www.sptf.info/onlinetrainings/universalstandards implementation • The SPTF Resource Center: http://www.sptf.info/resources/resourcecenter • The SPM Implementation Guide: http://sptf.info/spmstandards/universal-standards Thank you for your participation!