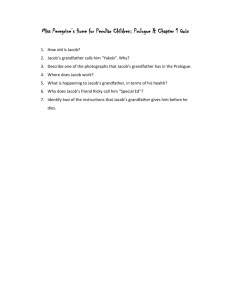

1439037752_295903

advertisement

Chapter 18 Partnerships 1 College Accounting 10th Edition McQuaig McQuaig Bille Bille Nobles PowerPoint presented by Douglas Cloud Professor Emeritus of Accounting, Pepperdine University 18–1 © 2011 Cengage Learning Types of Partnerships A general partnership (GP) is an association of two or more people or firms to carry on, as co-owners, of a business for profit. The partners are called general partners. A limited partnership (LP) is an organization with two or more people or firms with at least one general partner and one limited partner. A limited partner or partners have the largest share of invested capital, are not involved in the day-to-day operations, and usually cannot lose more than their capital contribution. A limited liability partnership (LLP) is an organization similar to a limited partnership except that all partners may take an active role in the business of the partnership 18–2 with only their invested capital at risk. Characteristics of a Partnerships Co-ownership of partnership property • According to the co-ownership concept, each partner owns half of each asset owned by the business. Limited Life • A partnership may be ended by the death, bankruptcy, incapacity, or withdrawal of a partner. • May also be ended by the expiration of a specified period of time or the completion of a project. Mutual Agency • The mutual agency concept allows each partner to enter into binding contracts in the name of the firm for the purchase or sale of goods or services within the normal scope of the firm’s business and based upon the provisions of the partnership agreement. 18–3 Characteristics of a Partnerships Taxation Federal income taxes are not levied against a partnership. A partner has to file an individual income tax return . Unlimited Liability General partners are personally liable for all debts that are incurred by the partnership. 18–4 Characteristics of Partnerships 18–5 Partnership Agreements A limited partnership and a limited liability partnership must be based upon a written contract, called a partnership agreement, with the following provisions: Effective date of the agreement Names and addresses of the partners Name, location, and nature of the business Type of partnership Management structure Duration of agreement Investment of each partner Procedure for sharing profits and losses Withdrawals to be allowed each partner Procedure for a partner’s exit from the business Provision for division of assets upon liquidation 18–6 Recording Investments— Formation of a Partnership Ron P. Duncan owns Duncan Accounting. Stephen A. James decides to join him and form a partnership. James invests $190,000 in cash into the partnership. 18–7 Recording Investments— Formation of a Partnership Duncan Accounting has the following account balances: Cash $183,300 Accounts Receivable 18,000 17,600 Allowance for Doubtful Accounts 200 Equipment 16,000 Accumulated Depreciation, Equipment 4,500 Accounts Payable 8,400 Notes Payable 1,600 The two men agree that $400 of Accounts Receivable is uncollectible. 18–8 Recording Investments— Formation of a Partnership Duncan Accounting has the following account balances: Cash $183,300 Accounts Receivable 18,000 17,600 Allowance for Doubtful Accounts 200 500 Equipment 16,000 Accumulated Depreciation, Equipment 4,500 Accounts Payable 8,400 Notes Payable 1,600 There is some doubt as to the collectibility of $500 of the remaining Accounts Receivable. 18–9 Recording Investments— Formation of a Partnership Duncan Accounting has the following account balances: Cash $183,300 Accounts Receivable 17,600 Allowance for Doubtful Accounts 500 9,000 Equipment 16,000 0 Accumulated Depreciation, Equipment 4,500 Accounts Payable 8,400 Notes Payable 1,600 An independent appraiser valued the equipment at $9,000. 18–10 Recording Investments— Formation of a Partnership 18–11 Additional Investments On October 1, each partner’s invests an additional $7,000. 18–12 Additional Investments At the end of the year, before the books are closed, R. P. Duncan, Capital appears as follows: At the end of the year, before the books are closed, S. A. James, Capital appears as follows: Withdrawals On March 17, Duncan withdrew $4,620 in cash from the partnership. On May 4, James withdrew cash from the partnership, $3,742. 18–14 Closing Entries for a Partnership STEP 1. Close the revenue accounts into Income Summary. STEP 2. Close the expense accounts into Income Summary. STEP 3. Close Income Summary into each partner’s Capital account by each partner’s share of the net income or net loss. STEP 4. Close each partner’s Drawing account into their respective Capital accounts. 18–15 Division of Net Income or Net Loss The share of net income (or net loss) allocated to each partner is know as his or her distributive share. Four methods for sharing earnings: 1. Division of income based on fractional shares 2. Division of income based on the ratio of capital investments 3. Division of income based on salary allowance 4. Division of income based on interest allowance 18–16 Division of Net Income or Net Loss EXAMPLE 1 Net Income D. R. Durr, Capital D. R. Durr, Drawing N. A. Jacob, Capital N. A. Jacob, Drawing $248,000 300,000 120,000 75,000 20,000 18–17 Division of Net Income or Net Loss Assume that the partnership agreement stipulates that profits and losses are to be divided three-fourths to Durr and one-fourth to Jacob, or a 3-to-1 ratio. We turn the ratio into a fraction by making the partner’s share the numerator and the total shares the denominator, thus ¾ and ¼. 18–18 Division of Income Based on Fractional Shares In Example 1, the net income is $248,000. Durr is allocated ¾ and Jacob ¼, as follows: Durr: $248,000 x ¾ = $186,000 Jacob: $248,000 x ¼ = $ 62,000 18–19 Division of Income Based on Fractional Shares STEP 3. Close Income Summary to the Capital accounts. STEP 4. Close drawing accounts into the capital accounts. Division of Income Based on Fractional Shares 18–21 Division of Income Based on Fractional Shares Net Loss $ (4,000) D. R. Durr, Capital 300,000 D. R. Durr, Drawing 120,000 N. A. Jacob, Capital 75,000 N. A. Jacob, Drawing 20,000 The net loss is $4,000. Durr’s portion is ¾ and Jacob’s portion is ¼. The loss is divided as follows: Durr: $(4,000) x ¾ = $(3,000) Jacob: $(4,000) x ¼ = $(1,000) EXAMPLE 2 Division of Income Based on Fractional Shares STEP 3: Closing entries. 18–23 Division of Income Based on Fractional Shares STEP 4: Closing the drawing accounts provides the same result as shown in Example 1. 18–24 Division of Net Income or Net Loss Based on Ratio of Capital Investments EXAMPLE 1 Assume that the partnership agreement stipulates that profits and losses are to be divided according to the ratio of their investments at the beginning of the year. Net Income D. R. Durr, Capital D. R. Durr, Drawing N. A. Jacob, Capital N. A. Jacob, Drawing $248,000 300,000 120,000 75,000 20,000 18–25 Division of Net Income or Net Loss Based on Ratio of Capital Investments In Example 1, the net income is $248,000. Durr is allocated $300,000/$375,000, while Jacob is allocated $75,000/$375,000. We can now calculate their respective shares as follows: Durr: $300,000/$375,000 (or 80%) = $198,400 Jacob: $75,000/$375,000 (or 20%) = $ 49,600 18–26 Closing Entries 18–27 Division of Net Income or Net Loss Based on Ratio of Capital Investments EXAMPLE 2 Net Loss D. R. Durr, Capital D. R. Durr, Drawing N. A. Jacob, Capital N. A. Jacob, Drawing $ (4,000) 300,000 120,000 75,000 20,000 18–28 Division of Net Income or Net Loss Based on Ratio of Capital Investments In Example 2, the net loss is $4,000. Durr’s portion is 80 percent and Jacob’s portion is 20 percent. The loss is divided as follows: Durr: $(4,000) x 0.80 = Jacob: $(4,000) x 0.20 = $(3,200) $ (800) 18–29 Division of Net Income or Net Loss Based on Ratio of Capital Investments STEP 3: Closing entries. STEP 4: Closing the drawing accounts provides the same result as shown in Example 1. 18–30 Division of Income Based on Salary Allowance EXAMPLE 1 When there is a net income of $248,000, the Division of Net Income Section of the incomes statement is as follows: Net income Less amount allocated to salaries ($60,000 + $40,000) Remainder $148,000 Remainder ÷ 2 = = $74,000 2 $248,000 (100,000) $148,000 18–31 Closing Entries 18–32 Division of Loss Based on Salary Allowance EXAMPLE 2 Net loss Less amount allocated to salaries ($60,000 + $40,000) Remainder $104,000 Remainder ÷ 2 = = $(52,000) 2 $ (4,000) (100,000) $(104,000) 18–33 Division of Loss Based on Salary Allowance 18–34 Division of Loss Based on Salary Allowance 18–35 Division of Income Based on Interest Allowance In addition to their salary allowances of $60,000 and $40,000, the partners at Durr & Jacob are allowed a 6 percent interest on their Capital balances at the beginning of the fiscal year, calculated as follows: Interest allowance for Durr Interest allowance for Jacob $300,000 x 0.06 = $18,000 $75,000 x 0.06 = $ 4,500 18–36 Division of Income Based on Interest Allowance The accountant calculates the remainder in the following way: Net income Less: Amount allocated as salaries ($60,000 + $40,000) Amount allocated as interest ($18,000 + $4,500) Remainder Remainder ÷ 2 $248,000 $(100,000) (22,500) (122,500) $125,500 $ 62,750 18–37 Division of Income Based on Interest Allowance 18–38 Division of Loss Based on Interest Allowance EXAMPLE 2 The partnership has a loss of $4,000. Net loss Less: Amount allocated as salaries ($60,000 + $40,000) Amount allocated as interest ($18,000 + $4,500) Remainder Remainder ÷ 2 $ (4,000) $(100,000) (22,500) (122,500) $(126,500) $ (63,250) Division of Loss Based on Interest Allowance 18–40 Division of Loss Based on Interest Allowance 18–41 Statement of Partners’ Equity 18–42 Sale of a Partnership Interest At the end of a given year, N. A. Jacob has a Capital balance of $163,520 and decides to sell his interest to K. R. Gott for $182,000. 18–43 Partner Withdraws Book Value of His or Her Equity After Revaluation J. W. Navarro is retiring from the partnership of Turner, Navarro, and Teague, LP. The partnership agreement stipulates that net income and net loss shall be shared on an equal basis. It also provides for revaluation of assets in the event that a partner retires. At this point, an accountant (usually someone from outside the firm) examines the books and the firm’s assets are appraised. The review and appraisal indicate that Merchandise Inventory is undervalued by $9,600, that Allowance for Doubtful Accounts should be increased by $300, and that Equipment is overvalued by $2,100. Partner Withdraws Book Value of His or Her Equity After Revaluation Partner Withdraws Book Value of His or Her Equity After Revaluation J. W. Navarro is issued a check equal to her equity in the firm. 18–46 Partner Withdraws More Than Book Value of His or Her Equity When Navarro announced that she was going to retire, Turner and Teague agreed to pay her $99,400 for her interest in the partnership. The partners share profits and losses equally, so the excess of $1,000 ($99,400 – $98,400) is deducted equally from the remaining partners’ Capital accounts. 18–47 Partner Withdraws Less Than Book Value of His or Her Equity Navarro is willing to withdraw if she gets just $94,200 cash out of the business. The difference of $4,200 ($98,400 – $94,200) represents a bonus to the remaining partners. Assuming they split profits and losses equally, each remaining partner’s Capital increases by $2,100. Death of a Partner The death of a partner automatically ends the partnership. The partner’s estate is entitled to receive the amount of his or her equity. Partnership agreements usually provide for an examination and revaluation of the assets at this time. To insure that there is enough cash, partners and partnerships often carry life insurance policies. 18–49 Liquidation of a Partnership A liquidation means an end, not only of the partnership, but of the business itself. STEP 1. Sale of the assets, using the Loss or Gain from Realization account. STEP 2. Allocation of the loss or gain. STEP 3. Payment of the liabilities. STEP 4. Distribution of the remaining cash to the partners, in accordance with the balances of their Capital accounts. 18–50 Assets Sold at a Profit The firm sells its merchandise inventory for $46,000 and the other assets for $70,000. At the time of liquidation Merchandise Inventory has a balance of $40,000 and the other assets are listed at $60,000. 18–51 Assets Sold at a Profit 18–52 Assets Sold at a Profit 18–53 Assets Sold at a Profit 18–54 Assets Sold at a Loss: Partners’ Capital Account Sufficient to Absorb Loss The firm sells its merchandise inventory for $36,000 and the other assets for $52,000. At the time of liquidation Merchandise Inventory has a balance of $40,000 and the other assets are listed at $60,000. 18–55 Assets Sold at a Loss 18–56 Assets Sold at a Profit 18–57 Assets Are Sold at a Loss: Partners’ Capital Account Sufficient to Absorb Loss 18–58