COURSE INFORMATON

advertisement

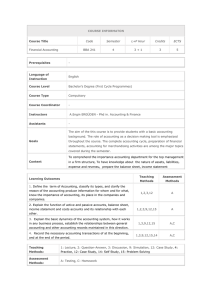

COURSE INFORMATON Course Title PUBLIC FINANCE Code Semester L+P Hour Credits ECTS ECON 361 5 3+0 3 6 Prerequisites - Language of Instruction English Course Level Undergraduate Course Type Compulsory Course Coordinator Asst. Prof. Dr. Alper Altınanahtar Instructors Asst. Prof. Dr. Alper Altınanahtar Assistants -- Goals The objective of this course is to develop students` ability in analyzing and formulating public economic problems and policies. Content This course focuses on the application of economic theory to the analysis of the issues pertaining to public expenditures and taxation. Learning Outcomes 1) Defines public economics and its ideology. 2) Using pozitive and normative analysis for problem solving . Program Learning Outcomes 1,2,4,8,9 1,2,4 3) Studies the factors that causes markets to fail. 1,2 4) Compares public and private provision of goods and services. 1,2 5) Investigates the daily use of cost benefit analysis. 1,2 6) Analyses the public and private provision of goods and services in different sektors. 1,2 Teaching Methods Assessment Methods 1,2,3 A,C 1,2,3 A,C 1,2,3 A,C 1,2,3 A,C 1,2,3 A,C 1,2,3 A,C Teaching Methods: 1: Lecture, 2: Question-Answer, 3: Discussion, 9: Simulation, 12: Case Study Assessment Methods: A: Testing, C: Homework COURSE CONTENT Week Topics Study Materials 1 Public Finance and Ideology Chapter 1 2 Tools of Positive Analysis Chapter 2 3 Tools of Normative Analysis Chapter 3 4 Tools of Normative Analysis cont’d 5 1st MID-TERM EXAMINATION 6 Public Goods Chapter 4 7 Externalities Chapter 5 8 Externalities cont’d 9 Education 10 2nd MID-TERM EXAMINATION 11 Cost Benefit Analysis 12 Cost Benefit Analysis cont’d 13 The Health Care Market 14 Review Chapter 6 Chapter 7 Chapter 8 RECOMMENDED SOURCES Public Finance by Harvey S. Rosen and Ted Gayer, McGraw-Hill, 9th ed Textbook Additional Resources MATERIAL SHARING Documents Lecture notes and Chapter slides Assignments End of Chapter problems and Homework Assignments Exams Quiz questions ASSESSMENT IN-TERM STUDIES NUMBER PERCENTAGE Mid-terms 2 75 Quizzes 5 10 Assignment 5 15 Total 100 CONTRIBUTION OF FINAL EXAMINATION TO OVERALL GRADE 40 CONTRIBUTION OF IN-TERM STUDIES TO OVERALL GRADE 60 Total COURSE CATEGORY 100 Expertise/Field Courses COURSE'S CONTRIBUTION TO PROGRAM Contribution No Program Learning Outcomes 1 2 3 4 5 1 To acquire a sound knowledge of theoretical and quantitative skills in the field of economics so that a contribution to solution of current economic problems can be made. 2 To acquire professional competence and knowledge in economics which can be implemented in real life. 3 To possess the skills for writing, presentation and virtual sharing platforms that are used in problem solving and knowledge accumulation. 4 To be able to evaluate and criticise the theories and abilities in economics teaching in order to determine further learning needs. 5 To take personal responsibility to unpredictable and complex in practise. 6 To able to participate in and to contribute efficiently to professional, regional and academic networks. 7 To enlighten individuals and institutions and to earn ability to present solutions to economic problems. 8 To possess social, scientific and ethical values at the data collection, interpretation and dissemination stages of economic analysis. X 9 To have the ability to evaluate his/her advance (post graduate) level educational needs and do the necessary planning to fulfill those needs through the acquired capability to think analytically and critically. X 10 To be able to use English language efficently in order to achive progress in academic and professional life. solve problems which X x X X are X the global, X X X ECTS ALLOCATED BASED ON STUDENT WORKLOAD BY THE COURSE DESCRIPTION Quantity Duration (Hour) Total Workload (Hour) Course Duration (Including the exam week: 16x Total course hours) 16 3 48 Hours for off-the-classroom study (Pre-study, practice) 16 5 80 Mid-terms 2 3 6 Homework 5 2 10 Final examination 1 3 3 Activities Total Work Load 147 Total Work Load / 25 (h) 5.88 ECTS Credit of the Course 6