part 1

advertisement

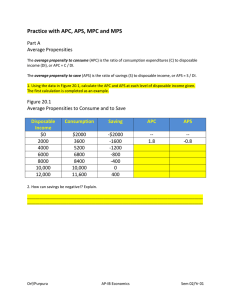

Unit 3—Aggregate Models Krugman Section 4 Module 16 Graphs: 5 Time: 2 weeks Consumption & Saving What can a person do with disposable income (money earned after taxes)? What is not spent is called savings DI – C = Savings Graphs Consumption in notes Savings in notes Consumption Savings Link Big graph number 4 Average Propensities to C & S Measures the average C (APC) or S (APS) at any level of disposable income APC = C / DI APS = S / DI C% and S% as DI APC + APS = 1 Marginal Propensities to C & S (marginal means extra) Proportion of any change in income C is called MPC or income Saved is called MPS MPC = ∆ C / ∆ DI MPS = ∆ S / ∆ DI MPC + MPS = 1 The only choice people have is to C or to Save. An additional dollar in income must result in a change in C and/or a change in Savings. Practice Worksheet APC/APS MPC/MPS Investment Demand Curve BIG GRAPH #5 Investment Spending on new plants, capital equipment, machinery, construction, etc. Investment decision weighs mb & mc The expected rate of return = mb The interest rate = mc Expected Rate of Return Found by comparing the expected economic profit (total revenue minus total cost) to cost of investment to get expected rate of return Woodworker wants to buy equipment for $1,000. He expects a $100 profit. The expected rate of return in 10%. In order to make a profit, the woodworker would not want to pay more than 10% interest on the investment. The Real Interest Rate The real interest rate, i, is the cost of the investment Real interest rate = nominal rate - inflation If i > expected rate of return, r, the investment should not be made Shifts in the Investment Demand Curve—IDC or DIgC Movement occurs with a change in the interest rate Shifts occur due to these determinants: 1. acquisition, maintenance and operating costs When cost falls, the r from prospective investment project rises, shifts the IDC to the right Higher electricity costs = shift to the left 2. business taxes in taxes = shift to the left Shifts Continued 3. technological change Development stimulates investment (shifts to the right) 4. stock of capital goods on hand When firms are overstocked, the r declines (shifts to the left) There is little incentive to invest in new capital when there is excess production When firms are under stocked, the r increases (shifts to the right) Shifts continued again . . . 5. Expectations Optimistic about future sales, the curve will shift to the right Pessimistic outlook = shift to the left