Ch. 11 MS-Word - Maine Legislature

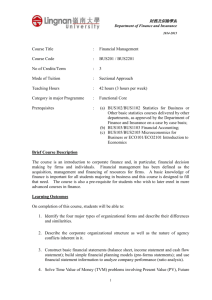

advertisement