2016 Attachment O Presentation

advertisement

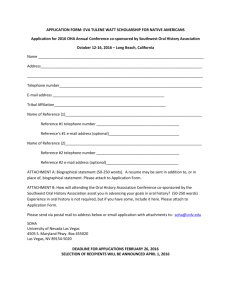

2016 ATTACHMENT O CUSTOMER MEETING OCTOBER 30, 2015 • • • • • • • Meeting Purpose Otter Tail Power Company Profile Attachment O Calculation Capital Projects Budget Risks Pending Updates to the Formula Template Question/Answer 2 LEGAL DISCLOSURE All numeric data provided in this presentation is preliminary and subject to change. All information will be finalized by 12/31/15. 3 • • • To provide an informational forum regarding Otter Tail’s forecasted Attachment O for 2016. The forecasted Attachment O for 2016 is calculated using the FERC Form 1 Attachment O template under the MISO Tariff with a projected net revenue requirement and projected load. Rates become effective on January 1, 2016 for the joint pricing zone comprised of Otter Tail, Great River Energy, and Missouri River Energy Services, Benson Municipal Utilities, Detroit Lakes Public Utilities, and Alexandria Light & Power. 4 SERVICE AREA LANGDON WIND ENERGY CENTER Rugby • 70,000 Square miles Devils Lake Crookston Garrison COYOTE STATION • 130,200 Customers SOLWAY COMBUSTION TURBINE Bemidji LUVERNE WIND FARM ASHTABULA WIND ENERGY CENTER ASHTABULA III Jamestown NORTH DAKOTA Fergus Falls Wahpeton Oakes HOOT LAKE PLANT Morris BIG STONE PLANT Milbank LEGEND • 785 Employees • 200 North Dakota • 90 South Dakota • About 800 MW owned generation • About 245 MW wind generation • About 5,400 miles of transmission lines Headquarters Customer service center • Avg. population about 400 • 495 Minnesota JAMESTOWN COMBUSTION TURBINE SOUTH DAKOTA • 422 Communities LAKE PRESTON COMBUSTION TURBINE 5 • • • • • Forward Rate Requirements Rate Base Operating Expenses Revenue Requirement and Rate Network Rate Summary 6 • By June 1 of each year, Otter Tail will post on OASIS all information regarding any Attachment O True-up Adjustments for the prior year. • By September 1 each year, Otter Tail will post on OASIS its projected Net Revenue Requirement including the True-Up Adjustment and load for the following year, and associated work papers. • Otter Tail will hold a customer meeting by October 31 each year to explain its formula rate input projections and cost detail. 7 RATE BASE 2016 Projected Rate Base Item 2015 Projected $ Change % Change Explanation Gross Plant in Service $ 429,186,735 $ 386,778,026 $ 42,408,709 11.0% The increase is primarily due to NERC work, Brookings being finished and other system improvements. Accumulated Depreciation $ 118,546,386 $ 112,631,484 $ 5,914,902 5.3% The increase is primarily due to Fargo Phase III and the remainder of Brookings in service all of 2016. Net Plant in Service $ 310,640,349 $ 274,146,542 $ 36,493,807 13.3% = Gross Plant - A/D Adjustments to Rate Base $ (62,249,278) $ (62,362,196) $ 112,918 (0.2%) CWIP for CON Projects $ 69,953,095 $ 40,886,235 $ 29,066,860 71.1% Land Held for Future Use $ 9,038 $ 9,038 $ - 0.0% Working Capital $ 6,995,332 $ 5,894,170 $ 1,101,162 18.7% Higher CWC related to higher O&Ms. Rate Base $ 325,348,536 $ 258,573,789 $ 66,774,747 25.8% = Net Plant + Adj + CWIP + Land + Working Capital Upcoming construction of Brookings to Big Stone and Big Stone to Ellendale; both are classified as MVP projects. Note: The above numbers are Transmission only 8 Expense Item 2016 Projected 2015 Projected $ Change % Change Explanation O&M $ 16,746,015 $ 14,024,094 $ 2,721,921 19.4% The increase is mainly due to higher Schedule 26 and 26A expenses. Depreciation Expense $ 7,875,761 $ 7,140,892 $ 734,869 10.3% More plant is in service with the energization of Fargo III and remainder of Brookings. Taxes Other than $ Income 3,358,563 $ 3,133,563 $ 225,000 7.2% An increase in Total Company Property Tax Expense as a result of higher assessed values. Income Taxes $ 11,938,039 $ 9,822,603 $ 2,115,436 21.5% Higher rate base results in a higher return and subsequently more income tax expense. Operating Expense $ 39,918,378 $ 34,121,152 $ 5,797,226 17.0% = O&M + A&G + Depreciation + Taxes Note: The above numbers are Transmission only 9 2016 Projected 2015 Projected Long Term Debt 46.68% 48.35% (1.67%) Common Stock 53.32% 51.65% 1.67% Total 100.00% 100.00% Weighted Cost of Debt 5.56% 5.54% 0.02% Close to last year. Cost of Common Stock 12.38% 12.38% 0.00% Unchanged Rate of Return 9.19% 9.07% 0.12% = (LTD*Cost)+(Preferred Stock*Cost)+(Common Stock*Cost) Rate Base $ 325,348,536 Allowed Return $ Operating Expenses $ Change % Change Explanation Haven’t had a need to increase our LT Debt from year over year. = Debt + Equity $ 258,573,789 $ 66,774,747 25.82% From "Rate Base" Calculation 29,914,500 $ 23,465,923 $ 6,448,577 27.48% = Rate of Return * Rate Base $ 39,918,378 $ 34,121,152 $ 5,797,226 16.99% From "Operating Expense" Calculation Attachment GG Adjustments $ 18,550,354 $ 18,208,328 $ 342,026 1.88% Close to last year. Attachment MM Adjustments $ 13,285,520 $ 6,603,848 $ 6,681,672 101.18% Upcoming construction of CAPX Brookings and Big Stone to Ellendale; both are classified as MVP projects. Gross Revenue Requirement $ 37,997,004 $ 32,774,899 $ 5,222,105 15.93% = Return + Expenses - Adjustments Revenue Credits $ 6,509,939 $ 6,283,694 $ 226,245 3.60% Close to last year. 2014/2013 True-up (Including Interest) $ (3,117,851) $ (1,181,325) $ (1,936,526) 163.93% Net Revenue Requirement $ 28,369,215 $ 25,309,881 $ 3,059,334 12.09% = Gross Revenue Requirement - Revenue Credits + True-up 10 $/kw-month $3.50 $3.00 $2.50 $2.00 $1.50 $1.00 $0.50 $0.00 ($0.50) ($1.00) $3.24 $2.99 $0.25 or 8.4% increase $1.03 $0.08 ($0.10) $0.32 $0.12 ($0.04) ($0.23) ($0.10) ($0.04) ($0.79) 11 TOTAL TRANSMISSION REVENUE REQUIREMENT BREAKDOWN Total Rev. Req. = $60,205,088 Net Attch. O ATRR = $28,369,214 Attch. GG Rev. Req. = $18,550,354 Attch. MM Rev. Req. = $13,285,520 12 2016 TRANSMISSION PROJECTS 2016 Forecasted Spend (with AFUDC) Voltage In Service Date Repair/Replace Existing Transmission Structures ≥ 115 kV 12/31/2016 $ 252,000 Replace existing 230 kV and 115 kV transmission structures due to water damage. Proactive-Worst Performing 41.6 kV Lines 41.6 kV 12/30/2016 $ 321,000 Enhancements and/or rebuild of worst performing 41.6 kV lines. Relocate Colgate 41.6 kV Line 41.6 kV 12/31/2016 $ 302,000 Relocate existing 41.6 kV line near Colgate, ND due to rising water in existing ROW. $ Relocate existing 41.6 kV line between Martin – 201,000 Anamoose in ND due to rising water in existing ROW. Project Martin – Anamoose 41.6 kV Line Reroute 41.6 kV 12/20/2016 Description of Project 14 Project Rebuild Harvey – Rugby 115 kV Line Voltage In Service Date 115 kV 12/31/2021 Description of Project Rebuild existing line by replacing structures due to $ 268,000 age and condition using new framing with shield wire. Upgrade Max – Ryder 41.6 kV Line 41.6 kV Substation Security (CIP Ver. 5) ≥ 115 kV Clearbrook Area 115 kV Line 2016 Forecasted Spend (with AFUDC) 115 kV 12/31/2018 $ 399,000 Reconductor and rebuild existing transmission line due to age and condition. 12/31/2017 $ 255,000 Install necessary security equipment at applicable substations to comply with NERC standards. 10/31/2018 $ Construct a new, approximately 16-18 mile 115 kV transmission line in the Clearbrook area of north 2,500,000 central MN with new 230/115 kV substation near Bagley. 15 Project NERC Facility Ratings Alert Voltage ≥ 115 kV 2016 Forecasted Spend (with AFUDC) In Service Date Description of Project Line upgrades to numerous transmission 4,100,000 facilities across the OTP service territory that violate NESC clearance requirements. 12/31/2016 $ 7/31/2017 $ 692,000 Rolette 230/69/41.6 kV Substation 230 kV Install a new 230/69/41.6 kV substation near Rolette, ND. Voltaire 115/41.6 kV Substation 115 kV 12/31/2016 $ 3,600,000 Install a new 115/41.6 kV substation near Minot, ND. Rugby 41.6 kV Switching Station 41.6 kV 6/30/2017 $ 2,200,000 Install a new 41.6 kV switching station near Rugby, ND. 16 Project Voltage 2016 Forecasted Spend (with AFUDC) In Service Date Description of Project Attachment GG J262/J263 Courtenay Wind Farm Interconnection Project Buffalo 345/115 kV Transformer (Buffalo – Casselton Line) J290 Border Winds Generator Interconnection Project 345 kV 345 kV 230 kV 10/31/2016 4/30/2017 12/31/2015 $ Expand Jamestown 345/115 kV Substation and replace two existing 345/115/41.6 kV transformers to 4,700,000 accommodate Generator Interconnection Project J262/J263. $ Underlying System improvements for 115 kV line 3,500,000 from Casselton – Buffalo. Add more transformer capacity at Buffalo, ND. $ Expand Rugby 230/115 kV Substation and add a 204,000 second 230/115 kV transformer to accommodate Generator Interconnection Project J290. Attachment MM Big Stone South – Brookings Line 345 kV 9/30/2017 $ 53,400,000 Build new 345 kV line from Big Stone South – Brookings with Big Stone South Substation in SD. Big Stone South – Ellendale Line 345 kV 9/30/2019 $ 37,400,000 Build new 345 kV line from Big Stone South – Ellendale in SD and ND. 17 Demand/ Weather Revenue Outages Regulatory Filings Timing of Capital Projects Financing Tight Budgets 18 PENDING UPDATES TO FORMULA TEMPLATE • Otter Tail anticipates making a change to its Attachment O rate template concerning the treatment of accumulated deferred income taxes (“ADIT”) based on recent IRA Private Letter Rulings. • The revisions modify the method used to calculate average ADIT balances. • Otter Tail is working with other MISO Transmission Owners to file an updated formula template with FERC and will request this update become effective January 1, 2016. • Otter Tail is still working through the calculations and does not have a final impact at this time. • Otter Tail will post the updated 2016 revenue requirements for Attachment O, GG and MM on OASIS once the calculation is completed and the template change request filing has been filed with FERC. • The information in this presentation is based on the currently effective rate template. 19 If you have any additional questions after the meeting, please submit via e-mail to: Stacie Hebert shebert@otpco.com Questions and answers will be posted on Otter Tail’s OASIS website (http://www.oasis.oati.com/OTP/index.html) within two weeks from the date of inquiry. 19