Chapter 13 & 14- The Agency Relationships

advertisement

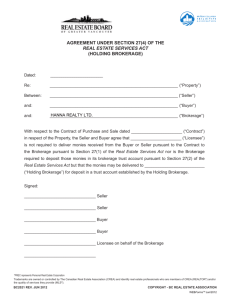

The Agency Relationships Relationship between a salesperson and client is referred to as master/servant relationship An official agent is always a brokerage ◦ Agency = relationship between client and brokerage ◦ Salesperson is always intermediately Client is a Master, we are a Servant ◦ We deal with two kinds of people Customer Client ◦ Everyone is a customer but only someone who has signed an agency agreement is a client ◦ Brokers/salespersons deal with clients and customers ◦ We owe general, fiduciary and regulatory duties to clients ◦ We only owe regulatory duties to customers Regulatory duties: 1. Due care 2. Ethical treatment 3. Duty to disclose material facts (which impact customer) – full disclosure is the most important duty Fiduciary duties = COGA: 1. 2. 3. 4. Competency and confidentiality Obedience Good and faithful Accountability and loyalty Law is the most important duty, followed by loyalty followed by COGA Nothing is more important than client duties except the law Loyalty is most important duty after legal duties Following this is COGA Indemnification 1. ◦ ◦ Clients are responsible for any loss to their property as long as we are acting within granted authority We are not liable unless we are acting unlawfully Remuneration 2. ◦ We are entitled to remuneration for the work we do There are 5 ways to create agency 1. Express Agreement a. Written agreement (more common) created immediately between broker/salesperson once signed/executed b. Oral agreement would be a customer. There is no signed agreement. 2. Ratification Agency initially created verbally but agreed in writing (ratified) at a later point For instance, unauthorized salesperson shows house and drafts offer. The seller may ratify the offer even though they did not authorize the salesperson earlier 3. Estoppels Conduct This occurs when the client (principal) acts in such a way that the third-party believes that another party (the agent) has authority to act on behalf of the principal E.g. A seller suggests to a prospective buyer that a brokerage has authority to negotiate and sign an Agreement of Purchase on their behalf when in reality the brokerage house and seller have no agency agreement It commonly occurs when an old client or customer refers a new customer to you, who may believe that you are representing them 4. Operation of law This typically applies through some kind of necessity, i.e. when an emergency like a foreclosure occurs Implied authority applies to all four relationships ◦ Express agencies must be specifically stated or written down, but implied authority can be derived from existing facts and circumstances ◦ E.g. Client and brokerage act in such a way to imply that they have an express agreement, even though no formal agreement between them actually exists Examples ◦ If a salesperson goes to a customer and explains the agency, including how we get paid, if the customer wishes to become a client and signs an agreement, this becomes an express agreement ◦ If customer says he wishes to buy a house, to show him a few houses after which he will sign for one, this is initially verbal and later written and so it is a ratification ◦ If someone refers a customer to you and the customer tells prospective buyers of the property to negotiate through you, this is estoppels conduct ◦ If customer comes to you saying bank has threatened to take their home, you list it immediately to prevent them from losing their equity and relationship created via operation of law ◦ Implied can exist in any of the four kinds of creation if the agent, intermediately or principle act in a way to imply existence of agency agreement Multiple Representation (Dual Agency) 1. Occurs when two clients are represented by same brokerage ◦ Co-operating Brokerage 2. Occurs when two clients are represented by two different brokerages ◦ Single Agency (Single-representation) 3. When a client and customer are represented by same brokerage ◦ This ensures maintaining of loyalty because only one party is involved in transaction Multiple representation/dual agency creates problems because one brokerage represents both parties Breach of loyalty happens when another’s interests are given preference over your client’s interests (clients duties are more important than anything except law) Sub-agency 4. ◦ ◦ 1 customer is represented by 1 brokerage while 1 client is represented by another brokerage If your brokerage represents the customer, then your brokerage owes the other brokerage’s client general, fiduciary and regulatory obligations Unintended multiple representation 5. ◦ This occurs when 2 customers are represented by the same brokerage X lists a property and a buyer from Y Realty submits an offer and signs customer agreement with Y Realty ◦ X is listed, Y is customer ◦ There are 2 brokerages, 1 client and 1 customer which means this is a sub-agency If X works with both buyer and seller, it is an unintended dual agency and not a dual agency because we were not told if the person is a client or customer ◦ In absence of knowledge of any written agreement, we assume that the person is a customer Mutual consent / release 1. ◦ Revocation 2. ◦ ◦ 3. Both parties agree to terminate the contract Either party may revoke the contract You may be able to sue for revocation but specific performance of contract unlikely since court will not force buyer to buy or seller to sell Expiry ◦ The agency contract may expire if the contract was made to last only a fixed period of time Performance 4. ◦ The purpose of the agency has been completed and the client has purchased or sold their property Impossibility 5. ◦ Contract becomes impossible to performance – e.g. the house listed burns to the ground Death/Mental Incapacity/Bankruptcy Registration Cancellation 6. ◦ Brokerages terminated by RECO