Bi-Weekly Transition - Controller's Office

advertisement

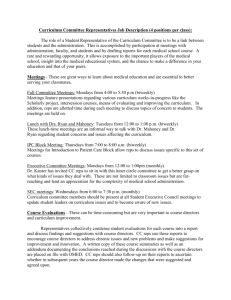

University of California, Berkeley Non-Exempts to a Biweekly Pay cycle Controllers Office, Central Payroll Last Updated 12/10/12 Overview Introduction Payroll Deductions Moving Forward Staying Informed Transition Assistance Program Financial Preparation Additional Questions Biweekly Pay Conversion UC Berkeley will transition approximately 10,500 non- exempt employees from the Monthly (MO), Monthly Arrears (MA), and the Semi-Monthly (SM) pay cycles. After conversion, all exempt employees will be on the MO pay cycle and all non-exempt employees will be on the BW pay cycle Why change to Biweekly Berkeley’s transition to a biweekly pay cycle is to comply with recent decisions at the UC Office of the President to implement a single payroll system across all ten campuses and five medical centers. In addition, standardizing pay cycles prepares Berkeley for the move of timekeeping processes to Campus Shared Services, improving the quality and efficiency. Who will convert to Biweekly Pay? Non-exempt Employees Employees currently paid on the 1st , 8th, and/or 23rd Eligible for overtime, shift, and on-call pay Report time worked as well as sick, vacation, comptime, and other leave to the nearest quarter hour Others Impacted by this change Exempt employees Currently paid on the 8th of the month Not eligible for over-time • Reports leave in whole day increments Will be converted to a monthly cycle and be paid on the 1st of the month Benefits of a Biweekly Pay Cycle Employees will receive overtime pay more frequently Employees will be paid every other week Will eliminate the need for timekeepers to project employee time each pay period Pay cycles will be standardized across the UC system UCB Pay Cycle Comparison Monthly Semi-Monthly Biweekly Pay Cycle Pay Period 1-31 1-15 16-31 12:01 a.m. Sunday to midnight Saturday Two-week intervals Paychecks Per Year 12 24 Minimum of 26 and maximum of 27 Paycheck Date 1st (MO) or 8th (MA) 8th and 23rd Second Wednesday following the close of the pay period except if second Wednesday is a holiday, then payday is the first working day prior to the holiday except for the New Years holiday for which the pay date will always be the first banking day after January 1st. Employees in Pay cycle Non-Exempt or Exempt, positive pay or exception employees, on variable/fixed schedules and on call shifts. Non-exempt, positive pay employees, on variable/fixed schedules and on call shifts. Non-exempt, positive pay employees, on variable/fixed schedules and on call shifts. Typical Monthly Pay Cycle Pay Period = 1st to last day of the month Standard pay date is 1st or 8th Receive monthly earnings on the 1st or the 8th of the following month (i.e. January earnings paid on Feb. 1st or 8th) 12 paychecks per year Typical Semi-Monthly Pay Cycle 1/1-1/15 paid 1/23 1/16-1/31 paid 2/8 2/1-2/15 paid 2/22 2/16-2/28 paid 3/8 3/1-3/15 paid 3/22 3/16-3/31 paid 4/8 Pay Period = 1-15 and 16-last day of month Standard pay date 23rd and 8th (unless pay day falls on a weekend, the pay day will be the proceeding Friday) January earnings paid on Jan. 23rd and Feb. 8th 24 paychecks per year *PPS = Pay Period Start, PPE = Pay Period End* Typical Biweekly Pay Cycle 1/6-1/19 paid 1/30 1/20-2/2 paid 2/13 2/3-2/16 paid 2/27 2/17-3/2 paid 3/13 3/3-3/16 paid 3/27 3/17-3/30 paid 4/10 Pay Period = Sunday to Saturday, 2 week period Standard pay date is every other Wednesday Overtime is included in each pay check 26 paychecks per year (maximum of 27) 80 hours per pay period *PPS = Pay Period Start, PPE = Pay Period End* 2013 Biweekly Calendar Hourly Pay Rate All non-exempt employees on a biweekly pay cycle will have an hourly pay rate. Take your annual rate divided by 2088 to determine your hourly rate $39,000/2088*=$18.68 OR Take your monthly rate and divide by 174 $3250/174=$18.68 *2088=174 x 12 Percentage and flat rate deductions Benefits Deductions Health and welfare deductions will be split between two biweekly checks (1/2 on each biweekly check). Fixed flat amount deductions such as parking, union dues, etc. will be split between two biweekly checks (1/2 on each biweekly check). Percentage amount deductions such as 403(b) and 457(b) plans, garnishments, etc. will be deducted from every biweekly paycheck Deduction Holidays There are two times a year when flat dollar deductions are not deducted from your paycheck. These paydays are referred to as deduction holidays A deduction holiday occurs when three biweekly pay period end dates fall within the same month The deduction holidays in 2013 will be April 10th and September 11th. They can be identified on the Biweekly payroll calendar by the bold black square surrounding the date. The biweekly payroll calendar is available at http://controller.berkeley.edu/payroll/biweekly/document s/UCBBiweeklyPayrollCalendar2013.pdf Benefit Deduction Comparison Current Process (Benefits are deducted once per month) Pay Cycle Pay Date Benefits Paid MO 2/1 February MA 2/8 February SM 2/8 February After Conversion Process (Benefits are deducted twice per month) BW 2/13 Split between the first two biweekly checks in the month (1/2 on each biweekly check). Example of deduction process is displayed above ½ March Premium Reviewing Deductions by Paycheck Monthly Compared to Biweekly Reviewing Deductions by Paycheck Semi-Monthly Compared to Biweekly How does this impact me? Non Exempt Employee View Will be paid more frequently Will consistently have an 80 hour pay period Will pay ½ my monthly benefit premium on the first two checks of the month Will receive overtime more timely If I am currently receiving a monthly pay rate, I will be converted to an hourly pay rate Will report time more frequently Will receive vacation accrual based on a factor accrual rate Department View What will change? HCM Appointments will be converted and need to be validated by departments Information in Payroll and Personnel System (PPS) Time Reporting deadlines and corresponding pay dates Employees FLSA status will determine whether they are on a Biweekly or Monthly pay cycle Non-Exempt employees will be on a factor accrual rate Payroll Expense Distribution PPP5302 report Getting ready for the Biweekly Conversion What should an employee do to prepare for the change? Start early and plan ahead Review your personal budget situation and determine your income needs based on the new Biweekly pay schedule. Review your current tax withholding elections and make any necessary changes especially additional tax withholding amounts. Request that creditors/lenders/financial institutions adjust your automatic withdrawal or bill-pay dates to align with your new pay schedule. What Financial tools will help me plan? Biweekly Conversion Calculator (see the Biweekly website) Biweekly Pay Planner (see the Biweekly website) Analyze your Cash Flow (see the following example) Analyze your Annual Cash Flow Employees will receive pay more frequently however the check amount will be less. Employees will receive 26* biweekly paychecks in a year (currently receiving 12 paychecks in a year) 10 months per year employees will receive 2 paychecks per month 2 months per year employees will receive 3 paychecks per month *maximum of 27 pay cycles in a year Vacation & Comp-Time Payout and No Interest Loan Transition and Loan Assistance Program Employees that meet certain eligibility requirements will have the option of a no interest loan and/or vacation/comp time accrual cash out Loan: minimum of $100 and a maximum of $1000 Vacation/Comp Time Payout: Up to 80 hours Application forms must be submitted during the program request period (to be announced) Human Resources will review and approve applications Central Payroll will pay loan and/or vacation/comp time on January 16, 2013. VACATION/COMP TIME PAYOUT Description Cash out from employee’s existing accrued vacation and/or compensatory time Who is Eligible? Any non-exempt career, contract, limited and per diem employee converting to biweekly and meets the following criteria: - Employee appointment ≥ 50% - Employment status of “Active” - Hired prior to a date to be determined - Employee has existing accrued vacation/comp time How much Up to 80 hours (hours are subject to verification of actual vacation/comp time employee has accrued) Program Request Period Application period will be announced to campus Terms of Participation Maximum of one request per eligible employee for a no interest loan and/or vacation/comp time cash out during the program request period Process Employee must complete, sign and submit the Transition Assistance Program application to Human. Disbursement Schedule Vacation/comp time accrual cash-out will be paid on a date to be determined and announced to campus. Method of Disbursement Payment will be made by Central Payroll via employees current payment option, e.g, direct deposit or paper check NO INTEREST LOAN Description Short-term, no interest loan from the University through a newly created Transition Assistance Program Who is Eligible? Any non-exempt career, contract, limited and per diem employee converting to biweekly and meets the following criteria: - Employee appointment ≥ 50% - Employment status of “Active” - No known separation by TBD - Hired prior to a date to be determined How much Minimum: $100 Maximum: $1,000 Program Request Period Application period will be announced to campus Terms of Participation Maximum of one request per eligible employee for a no interest loan and/or vacation /comp time cash out during the program request period Process Employee must complete, sign and submit the Transition Assistance Program application to Human Resources by close of business day on 12/7/12. Disbursement Schedule Target disbursement date will on a date to be determined an announced to campus. Terms of Repayment • Via payroll deduction • First installment repayment will be deducted from biweekly pay. • Paid in equal installments per biweekly pay cycle. Entire loan balance must be repaid by a date to be determined. This deduction is not taken on the payday corresponding to a third biweekly pay period end date in a month, aka “deduction holiday.” • Repayment formula: Loan amount/12 biweekly pay cycles = amount per biweekly pay day Method of Disbursement Paid on employees check scheduled for a date to be determined. Must follow employee’s current payment option, e.g, direct deposit or paper check Planning your Transition Contact financial institutions, lenders, banks, etc. and request to: Move bill due dates to later in the month Pay half in early February and half in later February Use the Biweekly pay calculator located on the UCB Payroll website to assist you in estimating what your biweekly pay will be Consider the Transition Assistance Program: No-interest loan (min of $100 up to a max of $1,000) and/or Cash out of up to 80 hours of leave from accrued vacation time and/or accrued comp time How to Prepare A variety of informational resources are available to assist employees through this transition process. Biweekly information web page Biweekly Pay Quick Facts 2013 Biweekly Pay Date Calendar Employee Checklist 2013 Biweekly Pay Planner Biweekly Conversion Calculator All information is available at http://controller.berkeley.edu/payroll/biweekly/ CalTime Timekeeping CalTime is an automated timekeeping system using Kronos software. It is an Operational Excellence project, sponsored by Human Resources . The CalTime initiative is intended to improve and standardize timekeeping across campus by consolidating it into a single online tool The CalTime team has been working with department timekeepers and key stakeholders to help them prepare for the changes in how employees report their time and submit their timesheets. Additional information on the many resources available to help all employees prepare for the change to an automated system and standardized time reporting is available at the http://caltime.berkeley.edu/ CalTime will be available for non-exempt employees when we go to biweekly pay Additional Questions? Please review the frequently asked questions and biweekly toolkit by visiting the Central Payroll website at: http://controller.berkeley.edu/payroll/biweekly/index.htm You may also email biweekly@lists.berkeley.edu For time reporting questions, please visit: http://caltime.berkeley.edu/ You may also email caltimehelp@berkeley.edu