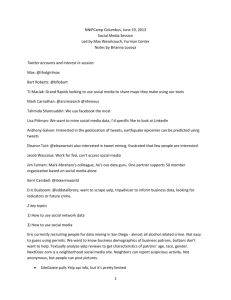

People who are motivated by connection

advertisement