What is the Financial Services Industry - bookkeeping

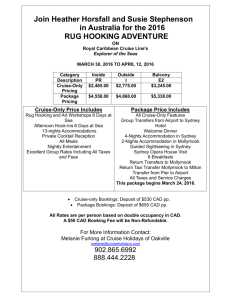

advertisement