CIG-one-sheet-updated-June-2015_v6

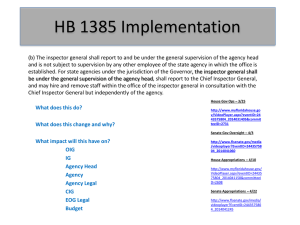

Private Equity Investment Focus and Approach

Preferred Industry

• Food and Beverage

Company Size

• $10 million+ in Revenues

• Up to $7 million EBITDA

• Obtainable EBIT margins of at least 10%

Investment Size and Philosophy

• $5 million to $75 million in Enterprise Value

• Minimal to no use of leverage

• Majority control positions

Management

• Proven entrepreneurial approach

• Motivated team that will continue to oversee dayto-day operations

Company Characteristics

• Compelling business model

• Track record of growth or clear pathway to growth with additional capital and operational assistance

Geography

• Continental U.S

Investment Horizon

• Long-term/Indefinite

Who we are

Consolidated Investment Group (CIG), the family office of David Merage, is an entrepreneurial investment company that manages a diverse portfolio of approximately $2B. Since 2003, CIG has actively invested in private equity, capital markets, real estate, and philanthropy. We are committed to an environment founded on high ethical standards that puts its people first, fosters collaboration, and inspires dedication.

History

In 1977, David Merage co-founded Chef America, the national food manufacturer known for creating the Hand-held

Frozen food category with the launch of their HOT POCKETS® brand of stuffed sandwiches. At the time of its sale to

Nestlé in 2002 for $2.6B, the company had reached $750 million in annual sales, employed 1,800 people, and was growing at a rate of 15% per year, making it one of the most successful food companies in the world. After the sale of Chef

America, David Merage founded Consolidated Investment Group.

Representative Portfolio Company

• Funkychunky creates unique customized gifts and artisanal gourmet snack items

• Utilizing CIG’s capital and operational resources, Funkychunky has accelerated its growth and added distribution channels

Please contact CIG with any potential investment opportunities:

Tyler Swoyer, Private Equity Deal Sourcing Manager

(E) tswoyer@ciginvest.com (P) 303.789.2664 x274

Benjamin Levy, Private Equity Manager

(E) blevy@ciginvest.com (P) 303.789.2664 x258