sukuk

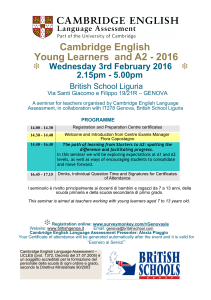

advertisement

Manajemen Investasi Islami Pasar Modal syariah : Sukuk P S T T I - U N I V E R S I TA S I N D O N E S I A Obligasi (Bonds) Bersifat Surat Hutang atau I Owe You (IOU) Pembayaran atas kupon bunga secara periodik Pembayaran Pokok saat Jatuh Tempo Sukuk Sukuk berasal dari bahasa arab, yaitu dari kata صكdengan bentuk jamaknya (plural) adalah صكوك, yang berarti ‘certificate’. Dalam Sharia Standar yang dikeluarkan oleh AAOIFI, sukuk diartikan sebagai Investment Sukuk()صكوك اإلستثمار, yang berarti sertifikat yang merepresentasi kepemilikan atas aset. Obligasi Syariah/Sukuk Kenapa? Perbedaan: 1) Sukuk bukan merupakan Surat Hutang, tapi Sertifikat Investasi (Investment Certificate). 2) Menghindari riba Hadist Nabi: “Setiap pinjaman yang memberikan kelebihan adalah riba”. كل قرض جر منفعة فهو راب 3) 4) 5) Sukuk dijamin oleh ‘dirinya sendiri’ karena setiap transaksi syariah harus ada underlying asset-nya. Income stream yang dihasilkan oleh sukuk berasal dari underlyingnya. Fleksible dalam pemasaran: Sukuk dapat dibeli oleh LK Konvensional namun tidak sebaliknya. Obligasi Syariah (Sukuk) Definisi Obligasi Syariah menurut Dewan Syariah Nasional (DSN MUI) Fatwa No. 32/DSN-MUI/IX/2002: “Surat berharga jangka panjang berdasarkan prinsip syariah yang dikeluarkan oleh Emiten kepada pemegang obligasi syariah yang mewajibkan Emiten untuk membayar pendapatan kepada pemegang obligasi syariah berupa bagi hasil/margin/fee serta membayar kembali dana obligasi pada saat jatuh tempo.” Obligasi Syariah (Sukuk) Jenis akad yang digunakan untuk Obligasi Syariah (Fatwa No. 32) adalah: Mudharabah (fatwa No. 33) -> bagi hasil Musyarakah -> bagi hasil Murabahah -> margin Salam -> margin Istishna -> margin Ijarah (fatwa No. 41) -> fee (imbal hasil) Perbedaan Sukuk, Obligasi Konvensional dan Saham (1) Sukuk Bonds Shares Nature Not a debt but undevided ownership of assets/projects/services Debt of issuer Ownership share in a corporation Asset backed A minimum 51% of tangible assets for their contracts are required to abck issuance of sukuk al-ijarah Generally not required Not required Claims Ownership calims on the specific underlying assets/projects/service Creditors claims on the borrowing entity and in some cases liens on assets Ownership claims on the company Security Secured by ownership rights in the underlying asses or projects in addition to any additional collateral enchancements structured Generally unsecured debentures Unsecured Perbedaan Sukuk, Obligasi Konvensional dan Saham (2) Sukuk Bonds Shares Principal & Return Not guaranteed by issuer Guaranteed by issuer Not guaranteed by company Purpose Must be issued only for Islamically permissible (halal) purposes Can be issued for any purposes Can be offered for any purposes Trading of Security Sale of an ownership interest in a specific asset/project/service etc. Sale of debt instrument Sale of share in a company Responsibility of holders Responsibility for defined duties relating to the underlying assets/projects/ transactions limited to the extent of participationj in the issue Bondholders have no responsibility for the circumstances of the issuer Responsibility for the affairs of the company limited to the extent of holding in the company Definisi Sukuk (AAOIFI) AAOIFI (Accounting and Auditing Organization for Islamic Financial Institution): Investment Sukuk: Sertificates of equal value representing undivided shares in ownership of tangible assets, usufructs and services or (in the ownership of) the assets of particular projects or special investment activity, however, this is true after received of the value of the sukuk, the closing of subscription and the employment of fund received for the purpose for which the sukuk were issued. (Sharia Standard No. 17) Akad Investasi Sukuk (AAOIFI) Item AAOIFI Sharia Standard No. 17 3/1 Certificates of ownership in leased assets 3/2 Certificates of ownership of usufructs 3/3 Salam Certificates 3 /4 Istishna Certificates 3/5 Murabaha Certificates 3/6 Musharaka Certificates 3/7 Muzara’a (sharecropping) Certificates 3/8 Musaqa (irrigation) Certificate 3/9 Mugharasa (agriculture) Certificates Jenis-Jenis Sukuk 3/1 Certificates of ownership in leased assets These are certificates of equal value issued by the owner of a leased asset or a tangible asset to be leased by promise, or they are issued by a financial intermediary acting on behalf of the owner with the aim of selling the asset and recovering its value through subscription so that the holders of the certificate become owners of the assets . Jenis-Jenis Sukuk 3/2 Certificates of ownership of usufructs There are four types: 3/2/1 Certificates of ownership of usufructs of existing assets 3/2/2 Certificates of ownership of usufructs of described future assets 3/2/3 Sertificates of ownership of services of a specified party 3/2/4 Certificates of ownership of described future services Jenis-Jenis Sukuk 3/2/1 Certificates of ownership of usufructs of existing assets, they are two types: 3/2/1/1 Certificates of equal value issued by the owner of an existing asset either on his own or through a financial intermediary, with the aim of leasing the asset and receiving the rental from the revenue of subscription so that the usufruct of the assets passes into the ownership of the holders of the certificates. 3/2/1/2 Certificates of equal value issued by the owner of the usufruct of an existing asset (lessee), either on his own or through a financial intermediary, with the aim of sub-leasing the usufruct and receiving the rental from the revenue of subscription so that the holders of the certificates become owners of the usufruct of the asset. Jenis-Jenis Sukuk 3/2/2 Certificates of ownership of usufructs of described future assets These are certificates of equal value issued for the purpose of leasing out tangible future assets and for collecting the rental from the subscription revenue so that the usufruct of the described future asset passes into the ownership of the holders of the certificates Jenis-Jenis Sukuk 3/2/3 Certificates of ownership of services of a specified party These are certificates of equal value issued for the purpose of providing services through a specified provider (such as educational benefits in a nominated university) and obtaining the service charges in the form of subscription income so that the holders of the certificates become owners of these services. Jenis-Jenis Sukuk 3/2/3 Certificates of ownership of described future services These are certificates of equal value issued for the purpose of providing services through a described provider (such as educational benefits from a university without naming the educational institution) and obtaining the fee in the form of subscription income so that the holders of the certificates become owners of these services. Jenis-Jenis Sukuk 3/3 Salam Certificates These are certificates of equal value issued for the purpose of mobilizing salam capital so that the goods to be delivered on the basis of salam come to be owned by the certificate holders. 3/4 Istishna` Certificates These are certificates of equal value issued with the aim of mobilizing fund to be employed for the production of goods so that the goods produced come to be owned by the certificate holders. Jenis-Jenis Sukuk 3/5 Murabaha Certificates These are certificates of equal value issued for the purpose of financing the purchase of goods through murabaha so that the certificate holders become the owners of the murabaha commodity. 3/6 Musharakah Certificates These are certificates of equal value issued with the aim of using the mobilized for establishing a new project, developing an existing project or financing a business activity on the basis of any partnership contract so that the certificate holders become – (cont..) Jenis-Jenis Sukuk the owners of the project or the assets of the activity as per their respective shares, with the musharaka certificates being managed on the basis of participation or Mudaraba or an investment agency. 3/6/1 Participation certificates These are certificates representing projects or activities managedon the basis of Musharaka by appointing one the partners or another person to manage the operation. Jenis-Jenis Sukuk 3/6/2 Mudaraba Sukuk These are certificates that represent projects or activities managed on the basis of Mudaraba by appointing one of the partners or another person as the mudarib for the management of the operation. 3/6/3 Investment Agency Sukuk These are certificates that represent projects or activities managed on the basis of an investment agency by appointing an agent to manage the operation on behalf of the certificate holders. Jenis-Jenis Sukuk 3/7 Muzara’a (sharecropping) certificate These are certificates of equal value issued for the purpose of using the mobilized through subscription for financing a project on the basis of Muzara’a so that the certificate holders become entitled to a share in crop according to the terms of the agreement. Jenis-Jenis Sukuk 3/7 Muzara’a (sharecropping) certificate These are certificates of equal value issued for the purpose of using the mobilized through subscription for financing a project on the basis of Muzara’a so that the certificate holders become entitled to a share in crop according to the terms of the agreement. Jenis-Jenis Sukuk 3/8 Musaqa (irrigation) certificate These are certificates of equal value issued for the purpose of employing the fund mobilized through subscription for the irrigation of fruit bearing trees, spending on them and caring for them on the basis of Musaqa contract so that the certificate holders become entitled to a share in crop as per agreement. Jenis-Jenis Sukuk 3/8 Mugharasa (agricultural) certificate These are certificates of equal value issued on the basis of Mugharasa contract for the purpose of employing the funds for planting trees and undertaking the work and expenses required by such plantation so that the certificate holders become entitled to a share in the land and the plantation. Obligasi Syariah Mudharabah Indosat 2002 Pemodal Issuer Rp ekspertise Shahibul Maal Mudharib Kegiatan Nisbah Usaha Nisbah Rp Rp Pendapatan Yang dibagi Hasilkan Rp Modal Pengembalian Dana Obligasi Syariah Mudharabah Indosat 2002 Jumlah Emisi: Rp 175 miliar Penggunaan Dana: Modal Kerja Pendapatan yang dibagihasilkan: 1. Pendapatan Satelit 2. Pendapatan Internet (IM2) Dasar Bagi Hasil: Sumber: Prospektus Revenue Sharing Obligasi Syariah Mudharabah BLTA Sumber: AAA Securities Obligasi Syariah Mudharabah BLTA Sumber: AAA Securities Skedul Pembayaran Obligasi Syariah Mudharabah BLTA Sumber: AAA Securities Skema Obligasi Syariah Mudharabah Indosat 2002 (Fatwa DSN No. 33) Pemodal Indosat Rp ekspertise Shahibul Maal Mudharib Kegiatan Nisbah Usaha Nisbah Rp Rp Pendapatan Yang dibagi Hasilkan Rp Modal Pengembalian Dana Skema Obligasi Syariah Ijarah (manfaat dijual kepada end-users) Fatwa DSN No. 41 2 Akad Wakalah dan Kafalah 1 Akad Ijarah Pemodal Rp Issuer OSI 4 Hak atas manfaat Obyek Ijarah 3 Menjual manfaat Atas nama Pemodal End-User Imbalan Ijarah (Ijarah Fee) melalui Issuer Skema Obligasi Syariah Ijarah (Manfaat digunakan sendiri oleh Issuer) Fatwa DSN No. 41 Akad Ijarah Pemegang Sukuk Ijarah / Pemodal 5) Menyewa Obyek Ijarah Akad Wakalah Perseroan sebagai Wakil 1) Dana Sukuk Perseroan sebagai Penyewa Emiten Sebagai Wakil 6) Fee/Imbalan Ijarah 2) Sukuk Ijarah 3) Menyewa Obyek Ijarah 4) Manfaat Obyek Ijarah Akad Wakalah: Pemegang Sukuk Ijarah mewakilkan kepada Perseroan untuk menyewa Obyek Ijarah atas nama Pemegang Sukuk Ijarah Objek Ijarah (Jasa Angkutan) Akad Ijarah: Perseroan menyewa manfaat Obyek Ijarah dari Pemegang Sukuk Ijarah untuk keperluan transportasi Pemilik Obyek Ijarah Sovereign Sukuk (Bahrain) BMA (for the Kingdom of Bahrain) 7. At maturity BMA will purchase the assets 5. 10 semi-annual For $100M lease rentals (variable rate) 3. Ijara wa iqtina lease for 5 years 6. Periodic distribution and capital amount sukuk SPV proceed 2. Payment of $100 M SPV is owned by a subsidiary Of Liquidity Management Centre, Bahrain 1. 4. SPV issued Sukuk with par of $100 M Sold certain Government Warehouse Islamic Financier BMA (for the Kingdom of Bahrain) Secondary Market Sovereign Sukuk (QATAR) Qatar 4. Lease rentals & Exercise price on Dissolution event 2. Leases land parcels & gift at maturity 5. Periodic & dissolution distributio amount 1.Sells land parcels For $70M Qatar $70 M sukuk SPV proceed 3. SPV issued Sukuk with par of $70 M Islamic Financier SPV: Qatar Global Sukuk QSC Land Parcel: Land in Doha Designated for the development of Hamad Medical City Secondary Market Proses Penerbitan Sukuk Proses Penerbitan Sukuk (2) Proses Penerbitan Sukuk (3) Perkembangan Pasar Sukuk Internasional Source: Likuidity Market Center - Bahrain, diolah kembali Perkembangan Pasar Sukuk Internasional Source: Bapepam - LK, diolah kembali Source: Addulkadeer Thomas, 2006 Beberapa contoh Sovereign Sukuk Source: diolah dari beberapa sumber Penerbit Malaysia Global Sukuk Inc. Qatar Global Sukuk QSC Dept of Civil Aviation Pakistan Intl Sukuk Co. Ltd. Stichting Sachsen Anhalt Trust Sukuk (Brunei) Inc. Obligor Pemerintah Malaysia Pemerintah Qatar Pemerintah UAE Pemerintah Pakistan Pemerintah Sachsen Anhalt Germany Pemerintah Brunei Struktur Ijarah Ijarah Ijarah Ijarah Ijarah Ijarah Volume: US$600 juta US$700 juta US$1 milyar US$600 juta US$ 100 juta BN$500 juta (max US$1 milyar) Terbit / Jatuh Tempo: 2002/2007 2003/2010 2004/2009 2005/2010 2004/2009 2006/2007 (365 hari) Kupon 6-mo Libor +95bps 6-mo Libor +40bps 6-mo Libor +45bps 6-mo Libor +220bps 6m Euribor +1.00% Zero Coupon/ - Deskripsi Sovereign sukuk int’l pertama di dunia Sovereign Sukuk al-Ijara pertama di GCC dengan format Reg-S Int’l soverein Sukuk terbesar Sukuk noninvestment grade pertama Sovereign sukuk pertama di Eropa Shorterm sukuk pertama Sukuk Negara Indonesia (SBSN) Surat Berharga Syariah Negara (Sukuk Negara) Seri Jenis Akad Nilai (Rp miliar) Imbal Hasil (per tahun) Tanggal Terbit Jatuh Tempo IFR-0001 Ijarah 2.714,7 11,80% 26 Agt 2008 15 Agt 2015 IFR-0002 Ijarah 1.985,0 11,95% 26 Agt 2008 15 Agt 2018 SR-001 (Ritel) Ijarah 5.556,0 12,00% 26 Feb 2009 26 Feb 2012 Sukuk Global SNI 14 Ijarah 6.500,0* 8,8% 23 Apr 2009 23 Apr 2014 IFR-0003 Ijarah 200 + 527 9,25% 29 Okt 2009 15 Sept 2015 IFR-0004 Ijarah 550 9% 12 Nov 2009 15 Okt 2013 TOTAL 18.032,70 •Nilai Sukuk Global US$650 juta (dengan kurs Rp10.000 maka Rp6,5 Triliun) * Sampai Dec 2009 Source: Depkeu, diolah kembali Perkembangan Penerbitan Sukuk Korporasi Indonesia (1) Source: KSEI, diolah kembali Dec Mudharabah : 10 * Ijarah : 29** Jumlah : 39 Total nilai emisi sebesar Rp 6,58 triliun * 4 sukuk telah jatuh tempo * 1 sukuk dilunasi lebih awal ** 6 sukuk telah jatuh tempo Perkembangan Penerbitan Sukuk Korporasi Indonesia (2) Source: KSEI, diolah kembali Dec Perkembangan Penerbitan Sukuk Korporasi Indonesia (3) Dalam milyar rupiah Dec TERIMA KASIH والسالم عليكم ورمحة هللا و بركا ته