PEST and Industry Analysis of American Express

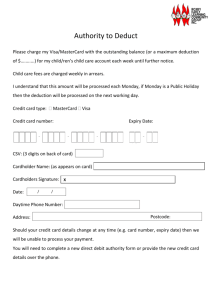

advertisement

Andrew Clos Founded by Henry Wells and William G. Fargo in 1850 as a delivery service company International company that operates in more than 130 countries but headquartered in New York Quickly evolved into a traveling expenses company with the Traveler’s Cheque and later, travel charge card Sales come from many countries because AMEX continually works with international merchants on accepting their credit card so sales are growing internationally Credit issued in US, Canada, Australia, Mexico, Italy, Japan, and many more Employees a total of 60,500 people as of 2010 Average cardholder spent $11,213 per year This is 2 to 4 times higher than competitors Shows heavy card use for business cardholders rather than individual consumer cardholders Issued the first widely accepted plastic charge card in 1958 Credit card sector became one of their most profitable branches within a decade Target market: high net worth/big spending individuals and businesses Sales (TTM) are 27 billion dollars Market share of the four largest credit card companies worldwide Kenneth Chenault named CEO in 2001 Government Regulations The Credit Card Accountability, Responsibility and Disclosure (CARD) Act Restrictions on interest rate increases 45 day notice before changing interest rates Restrictions on fees that can be charged Requirements for more disclosure Limits on the ability of people under the age of 21 to obtain cards These regulations could result in less transactions, transaction amounts, and a negative impact on earnings because of increased rates and decrease on credit extended Proposed regulation that could limit interchange fees to just 12 cents per transaction This would not affect companies that have a direct relationship with cardholders The Federal Reserve’s open market policy of buying or selling securities affects interest rates Political unrest could cause security concerns in countries Potential to reduce traveling abroad Unemployment rates The FED does not see unemployment rates dropping dramatically in the foreseeable future Causes individual consumers to have less money to spend Economic recession Consumers would limit spending, especially on credit cards Cause individuals/businesses to save the money they do have, rather than spend Individuals/Businesses may be more likely to pay off credit card balances Could potentially hurt small business more so, than corporations because they do not have the same availability of funds during economic downturns Businesses would limit expenses on international travel Consumer trends in payment means Consumers started spending more on credit cards than cash/check in 2006 Spending on credit cards has reduced since then though but back on the rise Debit card usage has doubled over the past few years This has reduced the market for the use of credit cards Perception of debt after the credit crisis Debt is perceived as major factor of economic meltdown Contact-less payments that eliminates swiping the card through a machine Cardholder just taps the machine instead of sliding the card through so just saves time Mobile applications that can keep track of a person’s account Applications that show the status and balance of cardholders’ accounts Applications that serve as a virtual wallet, could replace the physical card if it catches on with consumers and businesses Factor Political Trend Evaluation (O=Opportunity ; T=Threat) Impact (1 = low; 5 = High) T 4 O/T 4 T 4 Unemployment Rates T 3 Economic Recession T 5 O/T 3 T 4 Contact-less Payment O 1 Mobile Applications O/T 3 Government Regulations Fed’s Open Market Policy Rank in terms of importance 2 Security Concerns Economic Social Trends in Payment Means Perception of Debt Technological 1 3 4 The credit services industry is an industry that gains profit from an interchange fee charged to merchants with every transaction as well as interest payments and fees from the cardholder. Credit card companies provide loans, in a basic sense, for their costumers to buy goods and services. The credit card company pays the merchant and the customer pays the balance of the “loan” at a later date. So it is a financial service that provides a convenience for the consumer to buy products without having the funds at the time of transaction. Buyers Individual Consumers Small Businesses Corporations Competitors Visa MasterCard Discover Suppliers (Funds) Federal Reserve Banks Substitutes Paying for products using: 1. Cash 2. Checks 3. Debit Cards 4. Small loan from a bank Do not purchase as many goods/services Factor Degree of Power Number of Buyers High Purchases volume Low Product Differentiation Medium* Vendor Switching Costs Low Degree of backward integration High Buyers have an abundance of options to choose from that are slightly differentiated *Differentiation occurs in the fees, interest rates, and promotions The basic service remains standard because it is just money a customer can pay back later Factor Switching costs Degree of Power Medium Suppliers offer differentiated products Low Number of substitutes available High The product suppliers would be offering credit services companies would be money Funds could be received from commercial banks, or from the Federal Reserve at lower rates because AMEX converted into a bank holding company to become a Federal Reserve member and receive the benefits from being a member Rates would slightly vary on the received funds Many possibilities for a company to create more capital Power Number of competitors Industry Growth Exit Barriers Degree of Power High Medium High Nature of Threat of Substitutes Quality of substitute Buyers’ willingness to substitute Extent of Threat High Medium Relative performance of substitutes High Costs of switching to substitutes Low Nature of Barrier Extent of Barrier Capital Requirements High Incumbency advantages independent of size High Customer-switching costs Low Unequal access to distribution channels High Restrictive Government Policy High There is also brand loyalty associated with all the major players in the credit services industry Factor Evaluation Buyer Power Strong Force Supplier Power Benign Force Intensity of Rivalry Strong Force Threat of Substitute Products Strong Force Threat of New Entrants Weak Force American Express competes in a red ocean Hard to differentiate the product of a loan Would firmly need to entrench itself in a market segment that the other players do not compete in AMEX would need to continue to capture the “big spenders” market With their products such as the Centurion (Black) Card and Green Rewards Business Card The Black Card is a status symbol for rich people The only way AMEX can develop a Blue Ocean would be by: To continue differentiation of rewards Increase the focus on market segments that are not as competitive Strengthen the already established brand name to high net worth individuals American Express competes in a highly competitive industry, where all the major players are firmly established and branded. The economy and government have a major impact on the company as well as the rest of the industry. AMEX has produced profits because they earn so much per swipe compared to the competition because of the big spending individual and business cardholder. Technology has minimal impact on the industry relative to other factors but has been an increasing recently over the recent past. Needs to continue to dominate this niche to produce high profits They also need to look into acquiring competitors, if possible, which could reduce the intensity of competition and buying power of customers. Company Headquarters American Express New York, NY Visa San Francisco, CA Mastercard Purchase, NY Discover Riverwoods, IL Activity Credit Payment Card Services American Express Visa Mastercard Discover x Debit Payment Card Services Prepaid Cards Contactless Payment x x x x x x x x x x x x American Express Discover Mastercard Visa Market Cap 55.5 billion 13.54 billion 33.73 billion 53.59 billion Employees 61,000 10,300 5,600 6,800 Sales Growth 23.4% 71.9% 10.7% 14.2% Profit Margin 15.84% 22.16% 33.33% 37% Revenue 25.61 billion 3.45 billion 5.54 billion 8.34 billion Net Income 4.01 billion 667.94 million 1.84 billion 3.09 billion Stock Price 37.13 – 46.29 12.11 – 24.90 191 – 269.22 64.90 – 97.19 Sales growth is measured quarterly Stock price is a 52 week range All the companies were near their high except for Visa Amex does not use banks as a distribution channel for their credit card so that could be a reason for the need of more employees Company Product Diversity American Express Personal , Small Business, Corporate, and Prepaid Cards Visa Mastercard Discover Personal and Business Cards; Debit and Prepaid Cards Personal and Business Cards; Debit and Prepaid Cards Cashback Cards, Miles Cards, Business Cards, Student Cards, and Debit Cards Reach of Sales Marketing Focus Global Recent focus has been on travel/entertainment, rewards, and security on cards. Global Focus has been on the debit/check card and the wide acceptance of their card by merchants Global Over the past few years the focus has been on the “Priceless” campaign and how a person can buy almost anything with their card Global Focus has been on superior service and rewards comparatively Based upon the marketing of the main competitors in the industry it can be seen that each company brands itself Even though American Express is late on offering debit cards (because of no bank affiliations), they can not be counted out by the other companies do to the fact of reward alignments with air travel companies which attract businesses and high spending individuals Company Objectives American Express Wants to make it easier, safer, and more rewarding for consumers and businesses to purchase the things they need Visa Wants to make it easier to pay and be paid from both the consumer and merchant prospective Mastercard Wants to be a driving force in worldwide commerce Discover Wants to strive to be the best in customer service and reward programs Each competitor has to be able to adjust with economic conditions by competitive pricing through rates. They also have to keep up with the technology that save people time and is convenient for cardholders. Each company also has a strong marketing and advertisement campaign which continues to brand the product to consumers and businesses Each competitor offers a product that is attractive to cardholders in these ways: Comparable fees Reward Programs Security/Service •The fees need to be comparable to all the other major competitors •Must offer rewards that people would want •Differentiation of rewards can also brand a company toward a particular type of reward •The card needs security measures so fraudulent charges are avoided, which ties into high quality service Company Number of Countries that Accepts Card American Express 130+ Visa 200+ Mastercard 210+ Discover 185+ Discover was the first widely accepted card in China which was a major advantage in such a large and growing market Company Competency American Express Number one in customer satisfaction Visa Half the credit cards in circulation worldwide are Visa cards Mastercard The high acceptance rate by merchants Discover High satisfaction with rewards Cards in Circulation Worldwide (Year End 2010) 10% 9% 31% 50% American Express Mastercard Visa Discover Visa and Mastercard have major distribution advantages concerning card circulation because they use banks to issue their cards Purchase Volume Worldwide (billions) in 2009 120.14 471.1 631.4 American Express Visa 951.74 Mastercard Discover Trend Result Global Banking Relatively regional in the United States and need to infiltrate emerging markets such as Africa and Asia E-Banking 3.5 billion people have cell phones with a 10-20% year over year growth and transactions are taking place more and more through cell phones Self-Service Customers can check the status of their account instantly and have access to available services Growth is definitely prevalent in the emerging markets such as China, India, and South Korea Credit card growth in developed countries is limited because the market is already so saturated with them Growth can also be seen in revenue in all the major competitors Key Customers: Individual Consumers Small Businesses Corporations Social media provides a cheap way to reach many potential cardholders. Many businesses are on facebook and twitter so even B2B can be targeted by the credit card companies. Social media can also point the companies in the right directions to fill job openings. The credit services industry is highly competitive and dominated by only a few companies Marketing, branding, and loyalty are crucial parts to all the major players in the credit card industry Each player is able to survive in the industry by implementing unique strategies Each competitor tries to align itself with something different such as: Best service Differentiated Rewards Most Widely Accepted Card There is definitely a place for social media in this industry because advertising and marketing are such huge ways that the competitors implement their strategy Social media provides a cheap way to do so Focuses on satisfying the customer and building loyalty Operates the most successful closed-loop credit card network in the United States and many other around the world Spend-centric rather than lend-centric like their competition Well- respected and widely known brand Well-managed rewards program 2006 2007 2008 2009 2010 % Change Revenue (in millions) 25,900 27,731 28,365 24,523 27,819 13% Net Income 3,707 4,012 2,699 2,130 4,057 90% Revenues have had a steady increase with the exception of 2009 American Express has reduced expenses in 2010 to reach a five-year high in net income Percent Change measures the change between 2009 and 2010 Amex gushes cash at the moment, which allows the firm to return capital to investors They did suffer during the financial distress Segmented into three main businesses U.S. card services International card and global commercial services Global network and merchant services Had a former financial advisor segment (American Express Financial Advisors) that spun off to shareholder in 2005 and now known as Ameriprise Asset 2008 2009 2010 % Change last two years Cash and cash equivalents 8 billion 11 billion 16 billion 45% Receivables 37 billion 38 billion 40 billion 5% Investments 25 billion 24 billion 14 billion 41% Loans 40 billion 30 billion 53 billion 76% Property and equipment 3 billion 3 billion 3 billion 0% Resource Explanation Benefit Global distribution Their card is accepted in 130 countries The card has shown promise in those countries and can continue to try and penetrate other emerging markets Historic Brand First company to issue a plastic Helps to be synonymous charge card with credit cards The big four of the industry (Visa, Mastercard, American Express, and Discover) have the majority of the total market share of credit cards The market for credit cards has been dwindling recently due to the increase use of debit cards and other payment means The most important activity of Amex when it comes to the value chain would be marketing and sales. In the credit card industry it is very important to be branded which can be accomplished through effective marketing Strengths • • • • • • • Large amount cash on hand at the • moment Brand name • One of the top global market leaders • Customer Loyalty Unique Financial Products Cost saving systems Diversified revenues through customer spending, lending, and fees Weaknesses Depends on securitization market to fund credit card loans Lack of debit cards Declining Traveler’s check business Opportunities • • • • Global expansion/emerging markets Acquisitions Financial innovations New financial technologies Threats • • • • • • • The U.S. unemployment rate may remain high for a prolonged period Credit market crisis Political risk in other countries Changing spending habits Government regulations Intensely competitive industry Credit card write offs in bad economic times Generic Strategy • Differentiation Focus Grand Strategy • Disposals/ Acquisitions Strategic Clock • High perceived services benefit • Differentiated product Competitive Scope Narrow Broad Comparative Advantage Low Cost Higher Cost Overall Cost Leadership Differentiation Cost focus Differentiation focus American Express does not compete in low rates such as other companies like Visa. So they focus on differentiation themselves from the competition. They do not try to appeal to everyone. They have more of a focus on the big spenders. High Differentiation Hybrid Focused Differentiation Perceived Service Benefits Low Price American Express provide customers with high perceived service benefits and a differentiated product but at a higher price. They have had this same strategy since it first pioneered the credit card industry No Frills Strategies Destined for Failure Low High Price Recently divested American Express International Deposit Corporation and American Express Bank •This signified a greater focus on their core business – credit cards •Would free up money to make investments in the credit card area Amex should consider both market penetration and product development Use the market penetration for emerging markets Product development, such as debit cards, in the United States Scope Focus Segment Main focus is on small business and high spending individuals Geographic Main focus right now is to get their card accepted by as many locations as possible worldwide The focus on segment alludes to the fact that they want their card swiped as many times as possible for large amounts of money Amex is trying to get on the same level as Visa and Mastercard in terms as being the most widely accepted card worldwide The credit card market as a whole still remains relatively strong The high cash on hand should be a very positive aspect of American Express They can use that cash on hand to continue along with their current strategies that are in place Continue to use the concept of a differentiated product to benefit the company Also continue to focus on market segments that benefit the company most Do not waste the investment dollars available on marketing or acquisitions, that do not fit with the current business model