Vacancy/Un-Occupancy Situations - Insurance Community University

advertisement

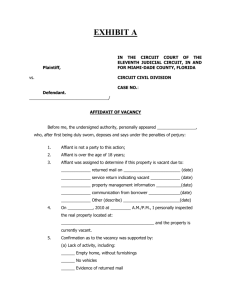

Vacancy, Un-Occupancy, Foreclosures A Sign of Our Times Presented By: Insurance Community Center . www.InsuranceCommunityUniversity.com Disclaimer Not only are policy forms, clauses, rules and court decisions constantly changing, but forms vary from company to company and state to state. This book is intended as a general guideline and might not apply to a specific situation. Information which is copyrighted by any proprietary to Insurance Services Office, Inc. (“ISO Material”) is included in this publication. Use of the ISO Material is limited to ISO Participating Insurers and their Authorized Representatives. Use by ISO Participating Insurers is limited to use in those jurisdictions for which the insurer has an appropriate participation with ISO. Use of the ISO Material by Authorized Representatives is limited to use solely on behalf of one or more ISO Participating Insurers. The author and any organization for which this seminar is conducted shall have neither liability nor responsibility to any person or entity with respect to any loss or damage alleged to be caused directly or indirectly as a result of information contained in this book. Contact Info: 714.206.9583 www.insurancecommunitycenter.com . 2 www.InsuranceCommunityUniversity.com What This Course Will Cover 1. Background on the current crisis affecting homes and commercial buildings 2. New realities and New Challenges 3. Insurance issues relating to vacancy and unun-occupancy 4. What are the solutions? . 3 www.InsuranceCommunityUniversity.com Background The crisis that has swept the nation . www.InsuranceCommunityUniversity.com What Happened? It’s a Complex Question Crisis for both the “homeowner” and business. Homeowners losing their homes Homeowners filing personal bankruptcy Businesses going bankrupt and foreclosing on properties Property owners supporting vacant buildings Banks foreclosing and taking on liabilities or NOT foreclosing . 5 www.InsuranceCommunityUniversity.com 1. Sub-Prime Loans Enticement 2. The economy took a downturn 3. Foreclosures and Bankruptcy Wall Street Panicked 5. People Get Desperate/Squat Burn it Strip the Property 4. Mortgage Company and Bank Failures Banks Left Holding the Bag 6. Insurance Company New Exposures New Claims New Underwriting . 6 www.InsuranceCommunityUniversity.com New Realities & New Challenges Foreclosures and Bankruptcy . www.InsuranceCommunityUniversity.com Foreclosures (International Business News) Total foreclosures in 2009 reached 2.8 million, a 21 percent increase over 2008 and a 120 percent rise compared to 2007, according to foreclosure sales Web site RealtyTrac in a yearend report released Wednesday. $1,900,000 in foreclosures in first six months of this year Number of Foreclosures /state www.ResponsibleLending.org . 8 www.InsuranceCommunityUniversity.com Foreclosures (International Business News) The 10 states with the highest foreclosure rates in 2009 were: Nevada, Arizona, Florida, California, Utah, Idaho, Georgia, Michigan, Illinois, and Colorado. California, Florida, Arizona, Illinois account for 50 percent of the foreclosures. The other 10 states with the largest numbers of foreclosures are Michigan, Nevada, Georgia, Ohio, Texas, and New Jersey. . 9 www.InsuranceCommunityUniversity.com Renting becomes a reality The number of renters in America is on the rise as foreclosures continue to take out homeowners everyday. In fact, a staggering 37.1 million housing units were occupied by renters in the second quarter, up from 34.3 million units in 2006, per Census Bureau data. . 10 www.InsuranceCommunityUniversity.com National Association of Realtors National Commercial Vacancy Office space 16.7% Industrial vacancies 13.9% . 11 www.InsuranceCommunityUniversity.com Types of Foreclosures Counties Foreclosures County can foreclose on the home for unpaid property taxes, and the mortgage company will be pursuing a lawsuit for the defaulted mortgage contract . 12 www.InsuranceCommunityUniversity.com Judicial Foreclosure Both judicial and non-judicial foreclosures are permitted by law depending on the state This where the lender needs to file an official complaint against the borrower This complaint should be approved by the local courts . 13 www.InsuranceCommunityUniversity.com Non Judicial Foreclosures These foreclosures come about because of language contained in the mortgage agreement whereby the lender is authorized to sell the property if there is a delinquency in payments. Normally, non-judicial foreclosures are not utilized frequently and some states even prohibit them. That's why it's important to know all of your state's foreclosure laws. . 14 www.InsuranceCommunityUniversity.com ACORD Application 2009/10 General Information Has applicant had a foreclosure, repossession, bankruptcy or filed for bankruptcy during the past five (5) years? Has applicant had a judgment or lien during the past five (5) years? . 15 www.InsuranceCommunityUniversity.com ACORD Application 2009/10 DURING THE LAST FIVE (5) YEARS [TEN (10) YEARS IN RHODE ISLAND], HAS ANY APPLICANT BEEN INDICTED FOR OR CONVICTED OF ANY DEGREE OF THE CRIME OF FRAUD, BRIBERY, ARSON OR ANY OTHER ARSON-RELATED CRIME IN CONNECTION WITH THIS OR ANY OTHER PROPERTY ? (In RI, failure to disclose the existence of an arson conviction is a misdemeanor punishable by a sentence of up to one (1) year of imprisonment.) . 16 www.InsuranceCommunityUniversity.com Commercial “Foreclosures/Bankruptcy” . www.InsuranceCommunityUniversity.com17 Commercial Hardships Massive and rising unemployment levels Reduced consumer spending, Frozen credit markets Internet revolution all mean that shopping center and office property demand have fallen. http://www.realtytrac.com/content/newsand-opinion/foreclosures-are-commercialproperties-next-4971 . 18 www.InsuranceCommunityUniversity.com Commercial Hardships As chain stores have gone out of business, massive volumes of retail space have become available. Current tenants bartering for lower prices New Debt Less Equity . 19 www.InsuranceCommunityUniversity.com Commercial Building Vacancy / Unoccupancy Causes Business reduces – use of building reduces Business fails – building retained but not used Tenants move out and not replaced Loan default – foreclosed by mortgagee . 20 www.InsuranceCommunityUniversity.com Insurance issues relating to vacancy and un-occupancy . www.InsuranceCommunityUniversity.com21 Homeowner Defaults Payments to the Bank Short Sales or Bank Forecloses or Not Forecloses Homeowner may declare Bankruptcy May vacate OR may stay (Squat) OR may burn it down Homeowner Vacates Home Strip Their Home Jingle Mail Cash for Keys Insurance Don’t Pay for Coverage Cancel Coverage . Bank Must Place Coverage 22 www.InsuranceCommunityUniversity.com Short Sale vs. Foreclosure Short Sale A short sale is when the bank agrees to take less than what's owed on the house. Borrower still owns the home Typically must list for at least 3 months Borrower must still carry insurance . Foreclosure A foreclosure is where the bank taken back the property REO Real Estate Owned Could still have a deficiency judgment after sale Bank insures property Problem arises if borrower is squatting 23 www.InsuranceCommunityUniversity.com Homeowner Defaults Payments to the Bank Bank Forecloses Bank Does Not Foreclose • • • • • Must evict the homeowner Must provide the insurance Must take it into inventory Must manage the property Must sell the property • Many choosing NOT to foreclose • Allowing the debt to accrue • Adding the insurance payments to the delinquent payments • Do not want to take on the liability . 24 www.InsuranceCommunityUniversity.com New Realities Cash for Keys Done by some banks for homeowners to receive cash in exchange for surrendering the keys and vacating with the stipulation that the home will be left in good condition and cleaned. Jingle Keys Jingle mail is a phrase used to describe the envelopes containing house keys, which are mailed by homeowners to mortgage lenders, without authorization from the lender. Home owners decide to mail the house keys to the lender because the owners believe their home is no longer worth keeping, and they want to give the home to the lender. . 25 www.InsuranceCommunityUniversity.com Vacant Exposures A vacant properties are an "attractive nuisance" that appeals to vandals and thieves Vacant homes also present numerous liability issues "Kids climbing over a dilapidated fence could get hurt, or teens partying in a vacant home could fall and slip . 26 www.InsuranceCommunityUniversity.com Who is occupying the foreclosed homes? Homeowners squatting in their own home Homeless moving into vacant homes Renters whose landlords were foreclosed on Gang members, using empty houses as crash pads and for drug stashes New term: Rent Skimmers . 27 www.InsuranceCommunityUniversity.com Glut of Foreclosed Homes Encourages Scams, Desperation 3/29/09 PBS News With the national foreclosure rate still climbing, some chose to live in foreclosed homes while others have been the victims of "rent skimmers," people who pretend to own a foreclosed property and scam tenants out of thousands of dollars in security deposits and fees. Special Correspondent Jeffrey Kaye reports from Los Angeles . 28 www.InsuranceCommunityUniversity.com Rent Skimming DET. ERIN CAMPHOUSE, Los Angeles Police Department: Rent skimming, it is epidemic in the city of L.A. right now. DET. ERIN CAMPHOUSE: They might drive a neighborhood and see three homes in that area, write down the addresses, and then go back and advertise those homes for rent. And when they advertise them for rent, it's usually a monthly rental price that's probably under market. . 29 www.InsuranceCommunityUniversity.com Bank Insurance (Title Insurance) IRMI Title insurance in the United States is indemnity insurance against financial loss from defects in title to real property and from the invalidity or unenforceability of mortgage liens. Title insurance is principally a product developed and sold in the United States as a result of the comparative deficiency of the U.S. land records laws. It is meant to protect an owner's or a lender's financial interest in real property against loss due to title defects, liens or other matters. It will defend against a lawsuit attacking the title as it is insured, or reimburse the insured for the actual monetary loss incurred, up to the dollar amount of insurance provided by the policy. . 30 www.InsuranceCommunityUniversity.com Bank Insurance—Mortgagee Impairment Insurance Policies are one way to insure a customer's property when the customer fails to obtain insurance The amount of coverage is usually the amount of the outstanding loan. Banks can (in most states) charge the premium back to the customer's account. Most forced-placed policies are on a reporting form. . 31 www.InsuranceCommunityUniversity.com Bank Insurance—Mortgagee Impairment Insurance Usually written on independently filed forms The policy may be written to cover loss due to required perils only (that is, only those perils for which the borrower is required to maintain insurance on the mortgaged property—fire, explosion, etc.) or extended to cover loss due to certain "non-required perils" (such as earthquake) as well. . 32 www.InsuranceCommunityUniversity.com Bank Insurance—Mortgagee Impairment Insurance Often, mortgage impairment policies also provide liability insurance for certain liability loss exposures of the lender that are associated with servicing the mortgage, such as liability for mishandling of escrowed insurance premiums and causing a lapse of the borrower's coverage, failing to pay taxes on behalf of the borrower . 33 www.InsuranceCommunityUniversity.com Homeowner’s Property Coverage . www.InsuranceCommunityUniversity.com Homeowners Insurance and Vacancy or Un-Occupancy Intended for an owner who is in residence Typically the coverage requires they occupy within 30 days of the inception of the policy. If an insured does not occupy then coverage would be jeopardized. . 35 www.InsuranceCommunityUniversity.com Homeowners Insurance and Vacancy or Un-Occupancy CRUCIAL: If the home is NOT occupied the insurance company must be made aware Reluctance because company might cancel Reluctance because policy might cost more Reluctance because might lose the client Reluctance because don’t have a market . 36 www.InsuranceCommunityUniversity.com Vacancy/Un-Occupancy Situations Secondary Home Seasonal Endorsement Rental Property Typically a Dwelling form unless occasional rental Owner intends to occupy but is making improvements before they move in . 37 www.InsuranceCommunityUniversity.com Vacancy/Un-Occupancy Situations Spec Home Question on Application—For Sale? Occupied and doing renovations Unoccupied and doing renovations Is it under construction or not? Applications may specifically state that the home must be occupied within 30 days or NO coverage Is the insured aware…is the company aware . 38 www.InsuranceCommunityUniversity.com Vacancy/Un-Occupancy Situations Home becomes vacant or unoccupied after the policy has been issued Has the insured informed the agent If the agent was informed they MUST notify the company The company will probably cancel the coverage Often times notice of cancellation has been sent for non-payment and that is how the agent finds out . 39 www.InsuranceCommunityUniversity.com Vacancy/Un-Occupancy Situations Client may contact the agent and put them on notice that their home is going to be foreclosed. They may ask what they are supposed to do in terms of insurance. GOOD QUESTION . 40 www.InsuranceCommunityUniversity.com Process of Review Underwriting Guidelines Application Policy Definitions Coverage A Dwelling Coverage Coverage B Other Structure Coverage Causes of Loss and Vacancy Vandalism Other Deductible . 41 www.InsuranceCommunityUniversity.com Underwriting Guidelines OCCUPANCY REQUIREMENTS The named insured must occupy the described premises as his principal residence. The building must be occupied by the insured exclusively for residential purposes . 42 www.InsuranceCommunityUniversity.com Underwriting Guidelines This is an excerpt from “UNACCEPTABLE RISKS” Vacant buildings unless recently purchased and to be occupied within 30 days. . 43 www.InsuranceCommunityUniversity.com Application What does it say Who filled it out Who signed the application Was there any discussion about “unoccupancy or vacancy” Does it say the insured must occupy in 30 days Insurance companies rescinding coverage— what does that mean? . 44 www.InsuranceCommunityUniversity.com ACORD Application OCCUPANCY UNOCCUPIED OWNER TENANT VACANT 7. IS THE DWELLING / HOME FOR SALE? (no explanation required) (Some homes are continuously on sale) . 45 www.InsuranceCommunityUniversity.com ACORD Application APPLICANT'S STATEMENT: I HAVE READ THE ABOVE APPLICATION AND ANY ATTACHMENTS. I DECLARE THAT THE INFORMATION PROVIDED IN THEM IS TRUE, COMPLETE AND CORRECT TO THE BEST OF MY KNOWLEDGE AND BELIEF. THIS INFORMATION IS BEING OFFERED TO THE COMPANY AS AN INDUCEMENT TO ISSUE THE POLICY FOR WHICH I AM APPLYING. Producer Signature Producer Name State Producer License # Applicants Signature Date National Producer # . 46 www.InsuranceCommunityUniversity.com ACORD Application How many times has the applicant NOT signed the ACCORD application How many times has the agent signed the application on behalf of the insured. I hope NEVER! . 47 www.InsuranceCommunityUniversity.com ISO Homeowners Definition 8."Residence premises" means: a. The one family dwelling, other structures, and grounds; or b. That part of any other building; where you reside and which is shown as the "residence premises" in the Declarations. Requires residency of Named Insured . 48 www.InsuranceCommunityUniversity.com ISO COVERAGE A – Dwelling We cover: 1.The dwelling on the "residence premises" shown in the Declarations, including structures attached to the dwelling; and Coverage could be compromised if Named Insured is not in residence . 49 www.InsuranceCommunityUniversity.com ISO COVERAGE B – Other Structures We cover other structures on the "residence premises" set apart from the dwelling by clear space. This includes structures connected to the dwelling by only a fence, utility line, or similar connection. Coverage could be compromised if Named Insured is not in residence . 50 www.InsuranceCommunityUniversity.com ISO Glass or Safety Glazing Material We cover: a. The breakage of glass or safety glazing material which is part of a covered building, storm door or storm window; and b. Damage to covered property by glass or safety glazing material which is part of a building, storm door or storm window. This coverage does not include loss on the "residence premises" if the dwelling has been vacant for more than 30 consecutive days immediately before the loss. A dwelling being constructed is not considered vacant. . 51 www.InsuranceCommunityUniversity.com ISO Homeowner’s Perils of Insurance COVERAGE A – DWELLING and COVERAGE B – OTHER STRUCTURES We do not insure, however, for loss: 2. Caused by: d. Vandalism and malicious mischief if the dwelling has been vacant for more than 30 consecutive days immediately before the loss. A dwelling being constructed is not considered vacant; . 52 www.InsuranceCommunityUniversity.com Direct Writer Form “Vandalism or Malicious Mischief or Arson if the dwelling is vacant” We do not insure loss or damage directly or indirectly caused by, arising out of, or resulting from: Vandalism or malicious mischief if The dwelling has been vacant beyond a period of 30 days or no person has actually legally lived in the dwelling for a period of 30 days or Committed by any person who is regularly residing on the residence premises or Arson, whether a result of vandalism or malicious mischief if the dwelling has been vacant for a period beyond a period of 60 consecutive days . 53 www.InsuranceCommunityUniversity.com ACE If your residence has been vacant for more than 30 consecutive days immediately before a covered loss, we will apply the greater of the deductible amount shown in the Declarations or: (a) 5% of the Dwelling limit for a dwelling where the loss occurs; or (b) 5% of the Personal Property limit or 5% of the Building Additions And Alterations limit, . 54 www.InsuranceCommunityUniversity.com ACE This deductible applies to your residence, personal property and Extra Benefits. If your residence is increased because of d. Full Replacement Cost Protection below, the deductible will be based on the increased limit. This vacancy deductible does not apply if we give our prior written consent. . 55 www.InsuranceCommunityUniversity.com Solutions ISO has no endorsement for vacancy on a homeowners policy Insurance companies may have an endorsement such as State Farm “However, by purchasing an endorsement, homeowners "buy back" that exclusion for a cost for such an endorsement is usually under $100, and coverage lasts for the duration of the policy period” (State Farm Web Site) . 56 www.InsuranceCommunityUniversity.com Solutions Some companies will “allow” the home to be vacant if they are notified and will charge an additional premium. Other companies such as Farmers, who do not write vacant homes, have a relationship with Foremost Insurance who writes vacant homes up to a specific limit . 57 www.InsuranceCommunityUniversity.com Solutions Specialty companies are emerging that write vacant homes. Check out http://www.vacanthomeinsurancenow.com/p rograms One thing for sure. DO NOT expect your homeowners policy to respond if the company is not notified or it is unendorsed . 58 www.InsuranceCommunityUniversity.com Commercial Property Coverage . www.InsuranceCommunityUniversity.com Process of Review Application Policy Definitions Building Causes of Loss and Vacancy Vandalism Other Deductible . 60 www.InsuranceCommunityUniversity.com ISO 6.Vacancy—Description of Terms a. Description Of Terms (1) As used in this Vacancy Condition, the term building and the term vacant have the meanings set forth in (1)(a) and (1)(b) below: a) When this policy is issued to a tenant, and with respect to that tenant's interest in Covered Property, building means the unit or suite rented or leased to the tenant. Such building is vacant when it does not contain enough business personal property to conduct customary operations. . 61 www.InsuranceCommunityUniversity.com ISO 6.Vacancy—Description of Terms (b)When this policy is issued to the owner or general lessee of a building, building means the entire building. Such building is vacant unless at least 31% of its total square footage is: (i) Rented to a lessee or sub-lessee and used by the lessee or sub-lessee to conduct its customary operations; and/or (ii) Used by the building owner to conduct customary operations. (2)Buildings under construction or renovation are not considered vacant. . 62 www.InsuranceCommunityUniversity.com ISO 6. Vacancy Provisions If the building where loss or damage occurs has been vacant for more than 60 consecutive days before that loss or damage occurs: (1) We will not pay for any loss or damage caused by any of the following even if they are Covered Causes of Loss: (a) Vandalism; (b) Sprinkler leakage, unless you have protected the system against freezing; (c) Building glass breakage; (d) Water damage; (e) Theft; or (f) Attempted theft. (2) With respect to Covered Causes of Loss other than those listed in b.(1)(a) through b.(1)(f) above, we will reduce the amount we would otherwise pay for the loss or damage by 15%. . 63 www.InsuranceCommunityUniversity.com Vacancy Permit CP 04 50 07 88 Issue: The insured has a vacant building to insure. The BPP Coverage Form eliminates coverage for certain specified types of losses and reduces payment by 15% for others. . 64 www.InsuranceCommunityUniversity.com Vacancy Permit CP 04 50 07 88 Solution: This endorsement eliminates the vacancy limitation condition in the Business and Personal Property Coverage Form. Allows coverage to continue at full value when a building is deemed vacant beyond 60 days. Can be used to cover vandalism and/or sprinkler leakage. . 65 www.InsuranceCommunityUniversity.com Vacancy Changes CP 04 60 10 00 Issue: The insured has a partially occupied building to insure. The BPP Coverage Form eliminates coverage for certain specified types of losses and reduces payment by 15% for others unless the building is occupied or 31% is rented. . 66 www.InsuranceCommunityUniversity.com Vacancy Changes CP 04 60 10 00 Solution: This endorsement may be used to reduce the occupancy requirement down as low a 10% which then allows coverage to continue with reduction of loss payment or elimination of certain covered perils. . 67 www.InsuranceCommunityUniversity.com Summary Ask the right questions of your insured Make certain the application is complete, correct, signed by the insured, and explained to the insured If you are notified that an insured’s property is being foreclosed on; vacant; or not vacant and the insured is still residing there inform the insured of their obligations You must notify the insurance company even at the risk of having to write the coverage with a different carrier at a higher rate . 68 www.InsuranceCommunityUniversity.com