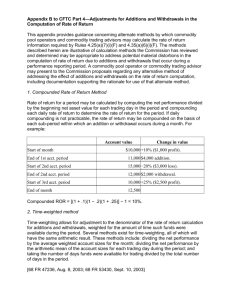

Chapter Five – Stages of Transaction

advertisement

The Regulations Governing the Commodity and Commodity-based Securities on the Iran Commodity Exchange Chapter One – Terms and Definitions The following definitions apply for the purposes of the terms used herein: 1- Clearing house means a department which is charged with the duty of settling and clearing the contracts traded on the Exchange. 2- Exchange means Iran Commodity Exchange Company (a public joint-stock entity) 3- Best purchase order means the purchase order with the highest value 4- Best sale order means the sales order with the lowest value 5- Bid/ask means a situation in which the buyer's broker is ready to purchase commodity or commodity-based securities in accordance with the Exchange prevailing rules. 6- Delivery tolerance means the authorized limit of difference in the weight of the commodity delivered compared to the commodity traded as determined by the Listing Council for each commodity and published in the prospectus. 7- Official trading session means a specific period during which the commodity or the commodity-based securities shall be traded as per the rules herein. 8- Minimum price movement (Tick) means the lowest price limit allowed for the orders entered in the trading system. 9- Minimum purchase means the lowest quantity of each commodity that a broker shall be allowed to buy on the Exchange. 1 10- Minimum purchase to determine the price means the quantity or a percentage of the offering of each trading symbol on the Exchange which shall have to be traded as per the rules so that the Exchange can approve the price so determined. 11- Minimum offer means the lowest quantity or limit allowed to be offered in each trading symbol as per the rules. 12- Minimum offer increase indicates a certain level of the commodity volume that the offerer is allowed to increase his offer up to such level at most during the trading session. 13- Maximum purchase means the highest quantity that a broker and/or a client shall be allowed to buy from each trading symbol during a trading session as per the rules in force. 14- Auction means a mechanism for trading commodity or commodity-based securities by a process of matching the client's purchase and sale orders with a view to the priorities given in the present regulations. 15- Trading system means a computer system through which the operations related to transactions including receipt and entry of purchase and sale orders, matching of orders and finally the transactions shall take place. 16- Order means the application for purchase or sale of commodity or commodity-based securities which is made to the broker by the client. 17- Force majeure means the external, unavoidable and unpredictable circumstances under which the obligor, whether the buyer or the seller, shall not be able to fulfill his obligations. 18- Domestic/Internal ring means the trading session used to trade in the commodities whose destinations are solely domestic markets. 19- Prorata method means a method by which the commodity or commodity-based securities allocated for each order shall equate the volume of registered orders divided by 2 the total registered orders and multiplied by the total commodity or commodity-based securities eligible to be offered. 20- Offer means a situation in which the seller's broker is ready to sell commodity or commodity-based securities as per the rules in force. 21- Contract means an agreement between the buyer and the seller to purchase and sell a certain quantity of commodity or a certain number commodity-based securities which is carried out through the buyers' and sellers' brokers on the Exchange. 22- Subcontract means a portion of the contract which is made on the back of the broker's allotment. 23- Base price means a specific price that the seller's broker has announced in his/its application for offering a commodity. Such price shall be indicated in the offering advice upon the Exchange's approval. 24- Offering price means a price which is entered in the trading system by the broker in the course of the auction. 25- Closing price means a price which is calculated and announced by the Exchange, at the end of each official trading session on the basis of the weighted average of the traded price for each trading system. 26- Broker means a legal person that, upon the receipt of the required licenses and its listing on the Exchange as per the rules in force, trades in a commodity or commodity-based securities for other parties and on their own account. 27- Broker/dealer is a legal person that, on the strength of the authorized licenses and its listing on the Exchange as per the rules in force, trades in a commodity or commodity-based securities for other parties and on their own account and/or in its own name and on its own account. 3 28- Aggregate code means a trading code which is defined in the trading system by the broker for simultaneous entry of the purchase orders, having the same price as placed by several clients. 29- Transaction certificate means a document which shall, at the end of transactions, be sent to the clearing house via the trading system after it has been confirmed by the buyer's broker, the seller and the transactions supervisor. 30- Consignment means a portion of the commodity whereby the orders entered should form a proper multiplier of it. 31- Base price limit means the maximum changes in the base price allowed in a trading symbol relative to the last price determined/set for it. 32- Authorized price movement means the maximum price changes in orders and transactions relative to the base price. 33- Customer/client means a person who applies for purchase or sale of commodity or commodity-based securities on the Exchange. 34- Transaction means the act of buying or selling the commodity or commodity-based securities listed on the Exchange. 35- Transactions supervisor means a natural person(s) who will be chosen by the Exchange managing director from among the staff members of the Exchange and parts of the managing director's functions as to the supervision over the transactions made under the applicable rules will officially be delegated to him. 36- Trading symbol means a code which has been exclusively defined for each commodity or commodity-based securities on the trading system. This code may be in the form of characters, numbers or a combination of both. 4 37- Allocation base unit means the lowest quantity to be allocated on each trading symbol whereby the broker's allocations to clients should be a proper multiplier of it. Chapter Two – General Requirements for Transactions Article 2- Transactions on the Exchange shall be executed in accordance with the rules herein at the official trading session. Note- The conduct of transactions outside the official trading session shall be allowed solely with the approval of the SEO's board of directors and pursuant to the conditions laid down by this board. Article 3- The days for executing transactions, opening and closing hours and the number of official trading sessions for all listed commodities and commodity-based securities shall be established and notified by the Exchange board of directors. Note- Changes in the circumstances under this article shall be announced by the Exchange at least three business days before they take effect. Article 4- The Exchange managing director shall be authorized to change the opening and closing hours and the length of official trading session if any technical problem occurs. Such changes shall be made public in a manner considered most appropriate. The Exchange shall have to retain the evidence pertaining to the technical problems in its archives and present them to the SEO if requested. Article 5- The transactions on the Exchange shall be typically conducted on the basis of competitiveness and in one of the methods used at auctions. The orders shall be executed according to the price priority and in the case of equality in prices, according to the time priority of orders entry in the trading system. Note 1- In the transactions made at the attendance auction, where the seller's broker requests to make a purchase at a price being equal to those of other brokers, priority shall be given to other brokers to make the deal. 5 Note 2- The Exchange board of directors shall, in addition to the priorities mentioned in this article, be allowed to recommend other priorities to the SEO's board of directors for its approval. Such priorities shall not breach the fair and competitive principles of transactions. The Exchange shall, with the SEO's approval, have to make public any such changes at least three days before they take effect. Article 6- The commodity and commodity-based securities on the domestic ring shall be traded in local currency, i.e. rials. It shall be admissible to change the currency unit for transactions with the approval of the Exchange board of directors as it is made public before it takes effect. Article 7- The commodity and commodity-based securities shall be traded solely through the Exchange trading system and by the brokers admitted on the Exchange. Article 8- The Exchange shall have to define a separate trading symbol by the breakdown of the commodity and commodity-based securities which are offered on the Exchange and shall specify the market and the trading board relating to each one of them. The transactions of the trading symbols shall solely be executed in the market and on the board so specified. Note- The criteria used for defining the trading symbol on the Exchange shall have to be approved by the Exchange board of directors. Chapter Three – Types of Contracts Tradable on the Commodity Exchange Article 9- Types of tradable contracts on the Exchange include the following: 1- Spot contract is a contract on the basis of which the payment of the price of the traded commodity and its delivery at the time of trading shall be made in accordance with the settlement and clearing regulations. 6 2- Credit contract is a contract on the basis of which the commodity shall be delivered at the time of trading and its price shall be paid on the maturity date in accordance with the settlement and clearing regulations. 3- Short sale contract is a contract on the basis of which the commodity at an agreed price shall be delivered at a specified time in the future and its price shall be paid at the time of trading in accordance with the settlement and clearing regulations. 4- Futures contract is a contract on the basis of which the seller undertakes to sell a specified quantity of a particular commodity on a certain future date at the price set now and the other party reciprocally undertakes to buy the commodity with the given descriptions. In order to prevent withdrawal from the transaction by the parties involved, they shall mutually consent to deposit an amount as margin (guarantee fund) with the clearing house and further shall pledge to adjust the margin appropriate to the price changes in the futures contract. The clearing house shall be empowered by the parties to act and, appropriate to changes, transfer a part of either party's margin to the counterparty as entitlement for possession. The receiving party shall be permitted to use such amount until when both parties settle accounts on the maturity date. 5- Call option contract is a contract on the basis of which the option buyer shall, by paying a specific amount, have the right to buy a specified quantity of commodity or commodity-based securities from the option seller at an agreed price on a specified date and the option seller shall further undertake to sell the option buyer such specified quantity of commodity or commodity-based securities at the said agreed price at the option buyer's request. 6- Put option contract is a contract on the basis of which the option buyer shall, by paying a specific amount, have the right to sell the option seller a specified quantity of commodity or commodity-based securities at an agreed price on a specified date and the option seller shall further undertake to buy from the option buyer such 7 specified quantity of commodity or commodity-based securities at the said agreed price at the option buyer's request. Note 1- Other tradable contracts on the Iran Commodity Exchange shall be approved by the Securities and Exchange High Council upon the recommendation made by the SEO's board of directors. Note 2- The provisions of paragraphs 4, 5 and 6 in this article shall be approved by the SEO's board of directors under separate rules and regulations. Note 3- The contracts mentioned in this article shall be settled and cleared under the settlement and clearing regulations which shall receive the approval of the SEO's board of directors. Chapter Four – Pre-Offering actions Article 10- All tradable contracts on the Exchange shall be defined solely on the basis of the listed commodities or commodity-based securities. The transactions of the commodities or commodity-based securities which have not been listed under the applicable law shall not be at all permitted. Article 11- In order to offer commodities on the Exchange, the offerer shall have to submit the sales order form completed by him along with the following information and evidence in the form of the offering advice to the Exchange not later than 12 noon of the business day prior to the offering date: 1- the descriptions of the commodity to be offered; 2- the volume of the commodity to be offered; 3- the maximum increase in the offer by the offerer; 8 4- type of transaction, making an indication of the commodity delivery date in the short (forward) sales and terms of payment in the credit deals; 5- base price; 6- offering date; 7- names of the supplier and producer; 8- type of settlement, whether made in cash or on credit, and in the event of credit settlement, indicating the precise amounts of cash and credit as well as the documents required for settlement; 9- the schedule and place of delivery; 10- type of packaging; 11- further information as requested by the Exchange. Note- The formats for the sales order forms and offering advice shall be approved by the Exchange board of directors. Article 12- When the documents and materials referred to in article 11 are presented to the Exchange in full and within the specified period of time, the Exchange shall, upon making certain of the compliance with rules, confirm the offering advice and send it to the clearing house not later than 2 p.m. of the same business day. The offering advice shall, upon the approval of the clearing house, be published by the Exchange not later than 4 p.m. of the same business day prior to the offering. Note- If the offering advice is not approved, the Exchange shall inform the matter to the offerer's broker by 2 p.m. of the same business day at the latest. Article 13- The offering advice published by the Exchange shall contain the following information: 9 1- paragraphs 1 to 10 of article 11 of the rules herein as supported by the Exchange; 2- restrictions on the base price limit; 3- restrictions on the authorized price limit, if any; 4- allocation base unit; 5- minimum purchase; 6- minimum purchase to determine the price; 7- minimum change in the orders price; 8- maximum purchase, if any, Note 1- The Exchange shall, prior to the opening of each trading session, announce the sequential time of offerings for that session. Note 2- Further general information on the commodity including the authorized delivery delay, standards of goods and warehousing charges shall be released in the form of a prospectus. The information made known in a prospectus shall be an integral part of the offering advice. Article 14- All the tasks and obligations of the parties to a transaction shall solely be set forth within the context of the terms indicated in the offering advice and pursuant to the rules in force. The terms of the deal shall not be altered after the offering advice has been published. Article 15- Upon release of the offering advice by the Exchange, the seller shall not be allowed to withdraw from offering the commodity on the Exchange unless he reports the matter and the grounds for his withdrawal to the Exchange and receives the Exchange's approval. 10 Article 16- If the offerer publishes the sale notice or announces the terms of commodity sale in any manner he/it considers appropriate, the information so published shall not be in conflict with the contents of the offering advice released by the Exchange. In case of any disagreement, the offering advice posted on the Exchange website shall prevail for the conduct of transaction. Chapter Five – Stages of Transaction Article 17- The transactions on the Exchange shall be executed in two ways: the attendance auction and the continuous auctions. Article 18- The stages of trading in commodity by the method of attendance auction include: 1- Pre-opening stage: it is possible to enter, change or delete orders by the buyer's broker and the seller's broker shall only have to enter his/its offer at the base price and with the volume provided in the offering advice. But no transaction whatsoever can be achieved at this stage. 2- Quotation: all active orders at the end of the pre-opening stage shall be transferred to this stage. The conditions at this stage include: 2-1- it is not possible to enter or delete orders, 2-2- it is not possible to increase the volume of buyers' demands and decrease the volume of sellers' offers, 2-3- the sellers shall be allowed to increase the volume of their offers solely during the initiated one third of the stage, 2-4- the sellers may reduce their prices to the level of the best entered purchase order at the very most, 11 2-5- the buyers may raise their prices to the level of the best entered sales order at the very most; 2-6- it shall be possible to decrease the volume of each order solely before its price becomes equal to the price of the best entered sales order; 2-7- where the volume of offer exceeds the total demands which agree with the seller's price, the transaction shall be carried out at the seller's price and with a volume totaling the demands of the buyers who have agreed with the seller's price; 2-8- if at the end of this stage no buyers agree with the seller's price, it shall be possible to revise the quotation stage by the transactions supervisor only for one more time. 3- Competition: if at the end of the quotation period, the total demands of the buyers who have agreed with the seller's price exceed the total volume of offers, the orders placed by such buyers shall enter into competition. The conditions at this stage include: 3-1- the orders placed by sellers shall not be subjected to any change; 3-2- the buyers shall not be allowed to change the volume of demands arrived; 3-3- the buyers may only change the price of their demands; 3-4- at the end of the competitive stage, transactions shall be executed on the basis of the priorities set out in article 5 of these rules; 3-5- if, owing to the authorized price movement, the volume of the demands which has agreed to the authorized price limit shall be in excess of the total volume of offers, the offer shall be made by the prorata method. Upon the application of the prorata method, the amounts so allocated shall be rounded for any of the brokers proportionate to the allocation base unit. 12 4- Supervision: this stage is carried out by the market supervisor at the end of the trading time which will also include the approval of the transactions. 5- Surplus offer: if the volume of offers at the end of the quotation stage exceeds the request which have agreed to offerer's price, it shall be possible to trade the surplus offer at this stage. The buyers may, by delivering the purchase applications, take up the surplus offers at the price of the trades accomplished at the end of the quotation stage. The stage of surplus offer shall start from the end of the supervision stage and shall continue by the end of a time during the current trading day which is determined by the board of directors. The following conditions shall prevail to trade in the surplus offer: 5-1- if a portion of the declared offer volume is not traded as per the offering advice or the offer increased at the quotation stage, this surplus shall remain in the trading system and may be traded by the end of the surplus offer. 5-2- upon the offerer's recommendation and with the approval of the Exchange, the surplus offer may be traded by the end of the business day before the day of the next trading symbol offer or one week after the offering day whichever is shorter; 5-3- if the surplus offer is transferred to the following business day, the offere's broker shall, only by 9 a.m. of the next business day, be allowed to delist the surplus offer from the trading system. Failing that, the surplus offer can be traded until the end of the stage of surplus offer for that trading day; 5-4- if at the end of the supervision stage, the offerer's broker makes a request for an increase in the surplus offer, such increase may be possible with the approval of the Exchange. Note- The length of any of the foregoing stages shall be established by the Exchange board of directors and shall be made public at least three business days before they take effect. It shall not be allowed to change the length of the foregoing stage in the course of the trading session. 13 Article 19- The stages of trading in the commodity-based securities by means of continuous auction shall be carried out as follows: 1- Pre-opening stage is the initial stage during which it is possible to enter, change or delete orders but no transaction can be achieved. 2- Opening stage happens immediately after the pre-opening stage by executing the orders available in the trading system and on the basis of the single-price auction mechanism. 3- Continuous stage happens after the opening stage during which a transaction is executed as soon as the price of the order entered in the trading system has been matched. 4- Closing single-price auction stage happens at the termination of continuous stage. It is possible to enter, change or delete orders by brokers in the course of this stage but no transaction can be achieved. At the end of this stage, transactions are conducted by executing the orders available in the trading system and on the basis of the single-price auction mechanism. 5- Closing stage happens at the end of the trading session during which it is possible to enter orders and execute transactions merely at closing price. Note 1- It is mandatory to accomplish the preceding stages of one to three in the attendance auction. Upon approval of the Exchange and when the matter is made public, it shall be possible to implement the stages four to five at least three business days before they take effect. Note 2- The Exchange board of directors may, in the continuous auction, appoint a time outside the trading session to enter the orders. Note 3- The Exchange board of directors shall determine the length of time for each of the preceding stages which shall be made public at least three business days before they take effect. It shall not be authorized to change the length of time for the preceding stages during the course of the trading session. 14 Article 20- The orders entered in the trading system shall at least contain the following items: 1- trading symbol 2- indication of sale or purchase order 3- order validity 4- order volume 5- type of order and its price terms 6- trading code Note 1- The types of orders in terms of price and order validity shall be specified by the Exchange board of directors and made public at least three business day before they take effect. Note 2- The Exchange shall have to prevent the entry of orders in which the requirements of offering advice have not been fulfilled. Chapter Six – Applicable Rules on the Trading Floor Article 21- The trading floor shall be run under the direction of the transactions supervisor within the scope of his assigned powers and responsibilities and pursuant to the rules in force. Article 22- If the Exchange board of directors defines an authorized price movement for a ticker symbol, all the orders entered in the trading system for the symbol shall be within the limit of such authorized price movement. The authorized price movement shall be approved by the Exchange board of directors and shall be made public by the end of the day prior to the offering. Article 23- If the base price asked in the offering advice is outside the base price limit, the Exchange shall be authorized to preclude the release of offering advice. 15 Note- The base price limit shall be established by the Exchange board of directors and shall be made public at least three business days before it comes into effect. Article 24- The Exchange may announce the method of calculating the base price of certain listed commodities according to a specific formula. In such a case, the offerer shall have to offer his/its commodity at the base price figured out based on the given formula. Note- The formula for calculating the base price shall, upon the offerer's proposal, be approved by the Exchange and shall be made public at least three business days before it is put into effect by Exchange. Article 25- The limits of allocation base unit, minimum purchase, minimum order price limit, minimum offer and maximum purchase shall be approved by the Exchange board of directors. The brokers shall have to abide by such limits when they receive, enter and allocate orders. The Exchange shall preclude the entry of orders and conduct of transactions in which the given limits have not been taken into account. Note- The imposition of any restriction on the volume or quote to buy, sell and/or allocate commodities shall not be allowed outside the items specified in this article. Article 26- Where the matched orders of a symbol during a trading session are lower than the minimum purchase to determine the price, the matching of such orders shall not be approved by the Exchange and no transaction shall be executed. Note- The minimum purchase to determine the rate shall be established by the Listing Council and shall be made public by the end of the day before the offering. Article 27- In order to prevent the creation of monopoly, any package offering of the commodity shall solely be possible with the Exchange managing director's agreement and upon inclusion in the offering advice. Article 28- Where an attendance auction is held for a trading symbol and, if owing to insufficient demands, no transaction is carried on such symbol, it shall be possible to repeat 16 the auction until the end of that trading session. In such a case, the brokers applying for purchase shall have to present their applications to the Exchange before the end of the trading session. If the Exchange approves of repeating the offer, the offerer shall have to carry out reoffering at the same trading session. Article 29- The brokers shall be allowed to use an aggregate code in order to enter the competition for purchase. The aggregate code shall be used according to the clients' orders entered in the trading system and upon the control exercised over the orders entry rules. Note- The brokers shall, upon finalization of the deal and based on the orders entered before the deal, have to allocate the commodity and the commodity-based securities purchased for any of the clients subject to the regulations on the commodity orders entry in the Iran Commodity Exchange. Article 30- The Exchange managing director shall be entitled not to approve all or a number of transactions in the following circumstances: a) at the broker's request on the ground of the errors which fall within the limit approved by the SEO's board of directors; b) the transactions with unusual price fluctuation; c) a transactional error arising from a problem in the trading system; d) non-adherence to the declared volume limits; e) non-compliance with the orders entry rules; f) other circumstances as per the laws and regulations. Note 1- The Exchange shall have to notify the disapproval of the transaction to the seller's broker and the buyer's broker in any manner considered appropriate. Note 2- All documents, records and evidence implying the disapproval of transactions under this article, shall have to be kept with the Exchange and shall, when requested, be sent to the SEO. 17 Article 31- For all the transactions finalized by the Exchange, a certification proving the execution of such transactions shall be issued and sent to the clearing house for settlement processing. Chapter Seven – Other Provisions Article 32- In case that, on the grounds of force majeure, it is impossible to perform a part of the functions or responsibilities assigned to the parties involved in the transaction, the parties hereto shall not be held liable on the strength of a competent authority's decision. Article 33- The rates established for services and Exchange handling charges and the manner of collecting them within the limits prescribed by the SEO's board of directors shall be approved and applied by the Exchange board of directors. Article 34- All the circumstances which are required to be notified, released or made public under these rules shall be accomplished through the Exchange website. Article 35- The present by-law will come into effect two months after its notification and the bylaw concerning the transactions on Tehran Metals Exchange approved on August 25, 2003 by the Metals Exchange Council would become null and void. As regards all the transactions carried out on the Iran Commodity Exchange prior to the entry into force of the present by-law, the rules of the by-law for transactions on Tehran Metals Exchange approved on August 25, 2003 by the Metals Exchange Council shall prevail. 18