Handout - Casualty Actuarial Society

advertisement

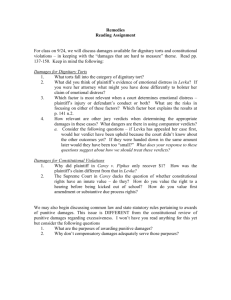

“MANAGING THE MANAGED” CHANGING LIABILITIES WITHIN THE HEALTH CARE SYSTEM PAST - Fee for Service Arrangement Patient Physician/Hospital Fee-for-service Insurer PRESENT - Managed Care Arrangement Patient Managed Care Insurer Utilization Review Capitation Profit Sharing Per Diem Physician/Hospital FUTURE - Integrated Health System Arrangement Patient Physician Insurer Hospital Managed Care Organizations • • • • • Staff Model HMO Group Model HMO Preferred Provider Organization (PPO) Physician Hospital Organization (PHO) Independent Physician Association (IPA) Managed Care Organizations (Continued) • • • • Management Services Organization (MSO) Provider Sponsored Organization (PSO) Utilization Review Organization (URO) Credentialing Verification Organization (CVO) • Physician Practice Management (PPM) Damages Types • Bodily injury (BI) • Economic Applicable Liability Policies • • • • Errors & Omissions (E&O) Medical Malpractice Directors & Officers (D&O) Blended or Integrated Products Typical Managed Care E&O Exposures • • • • • • • Negligent utilization review Vicarious liability Negligent credentialing Provider exclusion Antitrust Adverse financial incentives Provider contracting Typical Managed Care E&O Exposures (Continued) • • • • • • • Breach of fiduciary obligations Breach of contract, warranty, or guarantee Bad faith claim denial Misrepresentation Trademark/slogan infringement Advertising/marketing claims Medical malpractice Typical Managed Care D&O Exposures • Anticompetitive acts (claims by government or regulators, competitors, or providers) – Price fixing – Monopolization – Unfair competition • Mergers and acquisitions Typical Managed Care D&O Exposures (Continued) • Mismanagement – – – – Waste or neglect of assets Failure to manage properly/nonsupervision Improper delegation of authority Breach of duty or loyalty • Securities actions • Fraud; abuse; dishonesty • Employment practices Typical Managed Care Medical Malpractice Exposures • • • • Direct provision of care - Staff Model HMO Nurse call lines Demand management Negligent denial of care (Texas law, SB 386) Managed Care - Changing Exposure Landscape • Expanding fiduciary liability – Shea v. Esensten, 107 F.3d 625 (8th Cir, 1997), cert. den. 118 S. Ct. 297 (1997) • HMO that administered an employer’s benefit plan had a fiduciary obligation to disclose its financial incentive structure that may impact care provided to enrollees. – Herdrich v. Pelgram, 154 F.3d 362 (7th Cir, 1998) • A managed care plan’s incentive program which paid employee physician executives year-end bonuses for meeting utilization targets may constitute a breach of fiduciary duty under ERISA when such physicians make decisions about a patient’s care. Managed Care - Changing Exposure Landscape (Continued) • More direct medical malpractice exposure – Shannon v. McNulty, 718 A.2d 828 (3rd Cir, 1998) • Advice provided by nurses constituted medical advice and therefore the employer HMO could be found liable for medical malpractice if further proceedings prove the advice given deviated from the standard of care. • State laws, like Texas and Missouri. Managed Care - Changing Exposure Landscape (Continued) • Punitive damages – Goodrich v. Aetna, No. RCV 020499, January, 1999 • California jury awarded widow and children $116 million in punitive damages and $4.5 million in compensatory damages finding that an HMO acted with malice, oppression, and fraud in handling her husband’s treatment requests. – Johnson v. Humana Health Plan, Inc., No. 96-CI00462, KY. Cir., 1999 • A jury awarded more than $13 million in punitive damages to a woman who was allegedly denied coverage for a hysterectomy her doctor said would have cured her of her cervical cancer. Managed Care - Changing Exposure Landscape (Continued) • Erosion of ERISA – Pappas v. Asbel, 1998 WL 892074 (PA S. Ct., 1998) • Tort claims against HMOs under state law are not pre-empted by ERISA. ERISA • ERISA supersedes state laws that relate to employee benefit plans – HMO’s successfully argue cause of action is not medical malpractice, but a claim related to an ERISA plan • ERISA protection is eroding – Federal legislation proposals – State court decisions Managed Care E&O Percentage of Claim Counts Vicarious Liability Credentialing 17% 13% Other Utilization Review 37% 33% Man aged Care D&O P ercentage of C laim C ounts Utilization Review 15% V icarious Liability C redentialing 3% 11% E mployment Other 35% 36% “MANAGING THE MANAGED” CHANGING LIABILITIES WITHIN THE HEALTH CARE SYSTEM Exposures and Ratemaking Policies Exposed Medical Malpractice Bodily Injury E&O D&O Economic Policy Interaction Why does Type of Policy Exposed Matter? • Policy types tend to have different deductibles / limits • Policies may be provided by different insurers • Policies may have different reinsurers • Policies may have different ALAE limits and duty to defend (ALAE may be More Significant than Indemnity) Typical Policy ALAE Coverage Medical Malpractice • ALAE Outside the Limit • Duty to Defend E&O • ALAE Included in the Limit • Duty to Defend D&O • ALAE Included in the Limit • No Duty to Defend Policy Interaction • Liability may Tend towards Policy with Greatest Coverage • Quality of Healthcare Provider’s Underlying Medical Malpractice Coverage affects Potential MCO E&O Exposure • Depends on Relationship Between MCO and Healthcare Provider MCO/Provider Integration Spectrum Low High Facilitator Provider IPA NetworkModel HMO StaffModel HMO • MCO’s Position on Spectrum Depends on Program Design Managed Care Liability Ratemaking • Coverage Generally Offered by Traditional Medical Malpractice or D&O Writers • Insurers use Their Own Ratemaking Expertise/Data Combined with Judgment – e.g., A Medical Malpractice Writer may Develop a Rate that is a Multiple of the Medical Malpractice Rate • Wide Range of Rates on the Market MCO E&O Exposure Bases • Per Member Per Month – Reflects Size of Insured Population – Does Not Work for MCO’s that Handle a Portion of a Covered Population (e.g., IPA) – Does Not Consider Physician Specialty of Case Mix – Does Not Reflect Economic Damages Exposure MCO E&O Exposure Bases • Gross Revenue – Reflects Economic Damages Exposure – Does not Reflect Bodily Injury Exposure – Does not Reflect Territorial Variations • Medical Malpractice Premium – Reflects Bodily Injury Exposure – Reflects Territorial Variations – Does not Reflect Economic Damages Exposure Suggested Exposure Bases Separate Medical Malpractice Policy or No Bodily Injury Exposure (e.g., Staff Model HMO or TPA): Economic Damages: Gross Revenue Bodily Injury: N/A Suggested Exposure Bases No Separate Medical Malpractice Policy and All Member Services (e.g., Network Model HMO or PPO): Economic Damages: Per Member Per Month Bodily Injury: Medical Malpractice Premium Suggested Exposure Bases No Separate Medical Malpractice Policy and a Portion of Member Services (e.g., IPA): Economic Damages: Per Provider Bodily Injury: Medical Malpractice Premium Ratemaking Procedure • Judgmental Determination of MCO/ Provider Integration • Pure Premium Approach • Contingency Load • Consideration of State ERISA Laws • Consideration of Punitive Damages Pure Premium Approach • Select Appropriate Exposure Bases • Data Sources: – Company Medical Malpractice Data and D&O data – Industry Medical Malpractice Data and D&O data – Jury Verdict Research Data Contingency Load • Actuarial Standard of Practice No. 30 Treatment of Profit and Contingency Provisions and the Cost of Capital in Property/Casualty Insurance Ratemaking – Section 3.7: “...include a contingency provision if the assumptions used in the ratemaking process produce cost estimates that are not expected to equal average actual costs.” Contingency Load • Costs are Likely to be Higher than Historical Averages: – “Patients Bill of Rights” Passed with Bipartisan Support in House and Senate - Allows Consumers the Right to Sue – Supreme Court Rulings Since 1995 Have Expanded States Ability to Regulate Healthcare Increasing Litigation and Legislation Contingency Load • Costs are Likely to be Higher than Historical Averages (Cont.): – Recent Lawsuits Seeking “Class-Action” Status (Tobacco Plaintiff Attorneys - Awarded ~ $10B in Fees - are now Pursuing MCO’s) • Blacklisting Physicians or Groups • Retaliation Against Physicians who put Patients First • Violate State Anti-Trust Laws • Violate RICO (Racketeer Influenced, and Corrupt Organization) Act Contingency Load • Costs are Likely to be Higher than Historical Averages (Cont.): – Recent Laws in California and Other States Increase Patients Ability to Sue - Supreme Court Decision in Illinois Allows Patients Right to Sue – Public Opinion Punitive Damages • Treatment of Punitive Damages in State where Rates Apply • MCO’s Public Image May Lead to More Severe Punitive Damages Awards • Key Punitive Damages Exposure: – Denial of Benefits – Failure to Refer Punitive Damages Component - Example • JVR Medical Malpractice Data: – – – – a. b. c. d. Median Award: Awards with Punitive Damages: State Recovery %: Partial Severity: (a)x(b)x(c) $600,000 2% 30% $3,600 Rate Calculation Example • PPO - A Large Organization, Uniquely Rated • Underwriter has Determined through Conversations with the Insured that the Organization is in the Middle of the Economic Integration Spectrum • Assume no ERISA Exemption • Assume Punitive Damages are Insurable Rate Calculation Example Premium = [(Economic Damages Rate) x (# of Members)] + [(Bodily Injury %) x (Med Mal Premium)] • Economic Damages Components – – – – Pure Premium Based on Company or Industry Data Judgmental Contingency Load Punitive Damages Load Other Profit and Expense Loads Rate Calculation Example Premium = [(Economic Damages Rate) x (# of Members)] + [(Bodily Injury %) x (Med Mal Premium)] • Bodily Injury Component – Based on Degree of Economic Integration, and Other Plan Parameters – Medical Malpractice Premium Determined through Existing Rate Manuals – Punitive Damages Load – Other Profit and Expense Loads