The role of HMOs in the Health Insurance Sector in Nigeria

advertisement

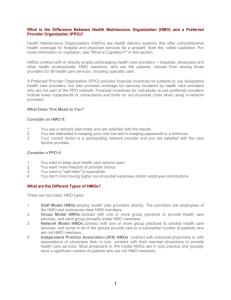

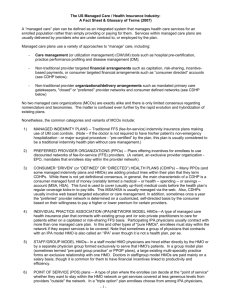

By M.A. Arogundade Introduction to Managed Care Types of Managed Care Brief History of HMO Characteristics of a HMO HMO in Nigeria -Entry-Registration -Operations/Functions/Role -Exit ‘Managed care’ conjures different interpretations among different people. This lack of clarity is particularly acute in developing countries, where many think of managed care as a panacea for all their health sector problems—including issues of access, costs or financing. The term "managed care" is used to describe a variety of techniques intended to reduce the cost of providing health benefits and improve the quality of care ("managed care techniques"), organizations that use those techniques or provide them as services to other organizations ("managed care organizations"), or systems of financing and delivering health care to enrollees organized around managed care techniques and concepts ("managed care delivery systems"). “Managed Care is a system of health care delivery that tries to manage the cost of healthcare, the quality of that health care, and access to that care.” Managed care systems typically combine the financing and delivery of health services. They do this by covering some or all of the costs of health care services (financing), while encouraging members to obtain services from the organization’s network of providers (delivery system). Managed Care is the enrolment of patients into a plan that makes capitated payments to health care providers on behalf of its members, thus shifting the financial risk for health care from patients and payers to providers. The intent of this shift is to provide incentives to health care professionals to reduce their utilization of resources, ideally through measures such as health promotion and disease prevention among the group's members. …Encyclopedia of Public Health The past: A provider-driven system dominates The USA does not have a single healthcare system, such as the National Health Service in the UK or Canada’s Medicare. It has a system that can be characterized as a set of interlocking subsystems that serve distinct populations. For approximately two-thirds of all Americans, health insurance is a benefit obtained as part of their compensation package; the employer pays a part or the full amount of the health insurance premium. About 13% receive healthcare through the Medicare programme, which covers the elderly population (>65 years) and younger people with disabilities; it is paid for by earmarked taxes, premiums and general revenues. Certain categories of the poor (primarily women, children and the elderly) receive healthcare through the Medicaid programme, paid for from general government The key stakeholders in the system are the patients, providers, health plans/insurance companies, payers (employers) and the government. We discuss the interactions between these stakeholders, focusing primarily on the employer-based insurance system, for it is this system that covers most Americans and is where managed care originated and has had the greatest impact. In the US system, once a person accepts employment with a company or firm, the employee enrolls with one of the health insurance plans the company has contracted with The mode of payment to providers was a fee-forservice basis, which meant that providers charged a fee for every service rendered to the patient. At the end of the year, the health plans used the sum of these various provider payments as a basis for calculating the premiums they would charge employers for the coming year. Employers would either pay these increased premiums themselves or share the cost in a predetermined fashion with their employees. An important characteristic of this system is that it is essentially patient driven—the patient initiates the cascade of events that lead to a visit to the provider, payment of the provider by the health insurer, and the health insurance company being paid by the annual premiums. The second important characteristic of this system is that although it is patient initiated, it is provider controlled. Providers have complete freedom over how they treat the patients and what treatment choices they can prescribe. Physicians are paid on what is called a ‘usual and customary’ basis, giving them no incentive to rein in their fees or the services they provide. Hospitals are paid on a cost plus basis, leading them to provide more care and invest more in technology and facilities. In the absence of any controls, such a system is inherently inflationary, as there is every incentive for a provider (physician or hospital) to perform more services/procedures and charge for them. In addition, providers are paid after the service is rendered, in contrast to the pre-payment mechanism utilized under managed care The present: An employer-driven system dominates The absence of central control in the healthcare system caused costs to be passed around the chain: providers billed health insurers, and the health insurance companies in turn increased premiums for employers and employees. As long as the economy was booming and employers were able to handle the premium increases, the system worked fine. In other words, this inflationary system worked well until such time as the ultimate payers—the employers—were willing to put up with the yearly increases in health insurance premiums they paid for their employees, and the premium increases did not adversely impact their profits. This situation existed in the USA until the late 1970s/early 1980s. During the early 1970s, the earliest managed care models were being developed and the concept of a ‘Health Maintenance Organization’ (or HMO) was put forth by Dr Paul Ellwood. President Nixon signed the HMO Act in 1973, aiming to enroll 50% of all Americans in HMOs by the end of the decade. Enrolment in HMOs remained low till the early 1980s, when the first strains began to appear in the feefor-service system. Premium increases reached a stage where they began to erode company profits. The debate over rising premium costs was structured in terms of the diminishing competitiveness of American companies, especially on their ability to grow and innovate. While large employers could bear the cost increases, many small employers simply made a business decision to stop paying for health insurance for their employees, leaving many employees uninsured. By the early 1980s, healthcare costs reached a point where a majority of the payers, including both employers and the federal government, felt they had to take action. In August 1983, the federal government changed the way it paid hospitals and physicians to a prepaid system based on diagnosis. It was during this ferment of experimentation that the concept of managed care began its decade-long boom. Instead of having an open chequebook, employers decided that they would henceforth pay a fixed amount per employee or, in other words, capitate their healthcare expenditures to a set, pre-determined amount. Employers began to offer managed care plans as well as indemnity health insurance, and capped the amount they would pay for premiums. Employees who wanted traditional indemnity insurance had to pay more for premiums. The health plans assumed responsibility for providing the contractually agreed-upon services to employees from within that capitated amount(now called ‘pmpm’ or per member per month). For example, an employer with 100 employees would agree to pay a health insurance plan a pmpm rate of US$ 50 for every covered employee. Every month, the employer would thus pay US$ 5000 (US$ 50 for each of the 100 covered employees) to the health plan, which would have to provide all agreed-upon healthcare to these 100 employees from this US$ 5000. The most important consequence of this paradigm was that the risk was now shifted from the employer to the health plan. In the previous fee-for-service era, the employer potentially had unlimited risk for employees’ healthcare expenditures. Under managed care, employers had capped their financial liability at the negotiated pmpm rate. The health plan assumes responsibility under the managed care arrangement. For example, the health plan in the example mentioned above will make a profit if it provides care to the enrolled population for less than US$ 5000 per month. On the other hand, if a few patients require very expensive care (for example, a heart transplant) the plan will lose money, as the cost of providing this care will easily exceed US$ 5000. Health services in the USA are predominantly provided by private sector hospitals, physicians and communitybased organizations. Financing of healthcare is divided approximately evenly between the government and private sector. The government pays for healthcare through two large programmes which are focused on specific populations: Medicare and Medicaid. Preferred Provider Organizations (PPOs) Health Maintenance Organizations (HMOs) Point of Service (POS) MANAGED CARE PLAN DIFFERENCES Health Maintenance Organizations (HMO) These have exclusive networks of providers. If you are in an HMO it will not usually pay any part of your bill if you choose a provider outside of the HMO’s network without prior authorization. HMOs do not require their members to pay a deductible although there may be a Co-payment each time you receive services. Point of Service Plans (POS) These permit members to see providers outside the network. The insurance company will help pay part of the bill but will not pay as much as it would if you go to a provider within the network. For example, if you see a physician inside the network, the insurance company will pay all of the costs except any required copayment. If you choose to see a physician outside the network, then the insurance company may only pay 70-80% of the costs. You would be responsible for paying the physician the remaining 2030% of the costs. Preferred Provider Organizations (PPOs) These are more like traditional insurance companies. Once you meet the deductible, the insurance company will pay a certain percentage of the health care bill. However, you must go to one of the network providers to get the highest level of coverage. A PPO will pay a smaller percentage of the bill if you go to a provider outside of the network. For example, the insurance company may pay 80% of the costs if you seek care from an in-network provider, but only 50-60% of the costs if you seek care from a non-network provider. Health Maintenance Organization as a terminology was coined by Dr. Paul Elwood (USA) in the early 1970’s as an advancement in the development of Private Provider Group Practice then prevalent in California, USA. HMOs are designed to deliver quality health care to a designated population in a cost effective manner, through health care providers paid either a fixed budget or discounted fees. They use a value-driven system of managed care to provide affordable health services The financial burden of risks of over-using health services are borne by the HMO, its service providers or a combination. There are various explicit and implicit rules that govern the risk-sharing. The member must receive health care from HMO - approved provider. HMOs have exclusive provider networks. They may also use primary care providers (PCP) as gatekeepers. Gatekeepers are responsible for arranging a patient’s referral to a specialist or admission to a hospital. While most HMOs use gatekeepers, some HMOs have open access plans. These plans allow the patient to choose any PCP or specialist in the network without a referral. Many HMOs also use reimbursement systems to encourage providers to be more cost conscious. HMOs may contract directly with physicians in the community, or may contract with networks of physicians. This arrangement is called a network or IPA model HMO HMOs may have their own physicians on salary or in an exclusive contractual arrangement. This is called a groupor staff-model HMO. HMOs sometimes give physicians or other health care providers’ financial incentives to be more efficient managers of care. While these payment mechanisms provide an incentive to reduce unnecessary care, some people worry that these payment mechanisms also may provide incentives to withhold necessary care. In contrast, some people were concerned that traditional feefor-service gave physicians incentives to providing unnecessary care They assume contractual responsibility for assuring the delivery of a stated range of health care services including at least in-patient hospitalization and ambulatory care services. They serve a voluntarily enrolled population. Health care is delivered through a proper referral system. The premium is fixed, regardless of utilization. There may be a fixed co-payment (direct or indirect) for use of certain services. The HMO assumes some of the financial risk or gain. The National Health insurance Scheme in Nigeria is designed to be driven through the operation of Health Maintenance Organizations (HMOs). These may be Private or Public Companies; for-profit and not-forprofit registered entities with the aim of ensuring the provision of qualitative and cost effective health care services to contributors under the Scheme. REGISTRATION OF HMOS (contd) ENTRY The Council shall approve and register for the Scheme private and public Health Maintenance Organizations Act 35 of 1999 Section 19 (1) The registration of an organization under the scheme shall be in such form and manner as may be determined from time to time, by the Council, using guidelines, which shall include provisions requiring the organization to:(a) Be financially viable before and after registration; (b) Make complete disclosure of the ownership structure and composition of the organization; (c) Have an account with one or more banks approved by the council (d) Be insured with an insurance company acceptable to the Council; and (e) Give an undertaking that the organization shall manage and invest the funds accruing to it from contributions received in pursuant to this decree in accordance with guidelines to be issued, from time to time, by the Council The registration of HMOs will go through the following sequence: The Scheme shall upon receipt of an application, carry out through its staff or through its authorized agent a survey of and inspection of the facilities of the HMOs and ascertain the following: i. The Board of Directors of the HMOs to ascertain whether or not they are fit and proper persons to run or manage HMOs ii. The policy documents and manuals of the HMOs. iii The organizational structure of the HMO with a view to ascertaining how the structure could enhance the efficiency and ability of the HMO. iv The management team of the HMO. v The provider network of the HMO including development and management networks. vi Health management procedures vii Marketing management procedures. viii Information management process that shall include computer based technology ix Evidence of registration with Corporate Affairs commission and minimum paid-up capital x Certificate of mandatory deposit of 25% of paid-up capital with Central Bank of Nigeria. xi Evidence of tax payment and returns, and adherence to legal obligations under the NHIS xii Minutes books with a view to ascertaining attendance of Directors and adherence to these rules and regulations by the Board of Directors and Management team. The Scheme shall register or reject the application. The Scheme shall issue a certificate of registration to every successful HMO, which is subject to review every four years. Consequences Of Registration on HMO Any HMO registered under the Scheme shall: Be a corporate body capable of suing or being sued and of doing or causing to be done all such things as may be necessary for or incidental to the exercise of its powers or the performance of its functions in terms of its rules. Carry on business registration. Assume liability for and guarantee the benefits offered to its contributors and their dependents. as an HMO after due Establish a bank account in a bank appointed by NHIS into which shall be paid every contribution by or on behalf of a contributor. No person shall have any claim on the assets or rights or be responsible for any liabilities or obligations of an HMO except in so far as the claim has arisen or the responsibility has been incurred in connection with transaction relating to the business of the HMO. The assets, rights, liabilities and obligations of an HMO existing immediately prior to its registration, shall vest in the HMO without any formal transfer or cession. • All moneys and assets belonging to an HMO shall be kept by that HMO and every HMO shall maintain such books of accounts and other records as may be necessary for the purposes of such HMO • Every HMO shall have its registered office(s) in Nigeria HMO shall carry on any business other than the business of health care management as provided by the Decree. The funds management of the HMO should be in accordance with specific guidelines that prevent fraud on solvency problems. HMOs shall be prohibited from directly engaging in any business that is not related to health. HMO's may not be directly affiliated to banks HMOs shall observe prescribed standards of reporting fund holdings for verification purposes. ROLES OF HMOS Register employers/employees. Collect contributions of above Register providers, after ensuring they meet minimum NHIS standards Ensure qualitative and cost effective health care services to contributors through Health Care Providers (HCPs). Ensure proper adherence to referral procedures Pay capitation fees and fee-for-service to HCPs Render returns to NHIS Maintain ethical marketing strategies Put in place effective quality assurance systems Ensure smooth change of provider (if requested by the contributor) within the stipulated period Organize risk management enlightenment for contributors and providers Provide health promotion and education a) The HMOs shall develop Operational Manuals in line with the Operational guidelines made by the Scheme. b) The HMOs shall provide relevant data for planning and improvement of health delivery system. c) The HMOs shall develop efficient and functional health services marketing and financial management programmes for overall benefit of the Scheme. d) The HMO shall develop Disease Management Guidelines, which shall make providers to achieve both high quality and cost effective care. e)The HMOs shall engage in contributor education services, provider education services, and all such services shall be documented and made available to contributors and the interested public. f) HMOs shall have primary and specialist contracted providers in the geographical areas covered by their operation. g) The HMO shall show evidence of minimum information and data collection and storage facilities. Standardised reporting would be required by the NHIS and this shall determine the minimum information systems capability of the HMO. Role of HMO in Operation of Health Care delivery System: The HMOs shall develop a health care organizational structure that will ensure that: There is a well-developed and utilized Primary Care Provider (PCP) network system. The PCP shall be the first port of call for every contributor. The PCP can where necessary, utilize or engage ancillary services. HMOs shall be free to contract ancillary service providers to offer services that cannot be given in-house by components in its mainline provider network. Academic Health Centres shall be free to register with HMOs for ambulatory, hospital, specialist ancillary and rehabilitative care. Government hospitals, clinics and other facilities shall be used as components in HMO provider network provided that these facilities shall meet all registration requirements set for providers. Referrals and or hospitalization may require pre-notification by providers to HMOs. Emergencies may be dealt with as best possible without prior notification to HMOs provided that PCPs notify the relevant HMOs within 48 hours of the handling or referral of such emergency cases. HMO may use a case manager system to reduce cost without compromising quality. In chronic or high cost – problems, the referrals specialist may function as PCP for that specific case Role of HMO in Drug Benefits Administration HMOs shall ensure that providers adhere to the generic drug policy of NHIS in order to control cost. The Scheme shall negotiate Average Wholesale Price discounts (for generic drugs) The Scheme, HMOs and pharmacy providers shall cooperate to rebuild acceptable channels of distribution of drugs and materials to eliminate fake products. NHIS shall develop drug formularies. NHIS may adopt drug utilization review programs in order to streamline management of pharmaceutical services. Contracts between HMO and Providers a) Every contract between an HMO and a provider shall include the following The operating hours at which the provider shall be ready to receive contributors and such hours shall not be less than six hours a day: Monday to Friday and three hours on weekends. The acceptance by the provider of responsibility for providing care in emergencies 24 hours a day, and 365 days in the year. The agreement shall include the arrangement for securing this and the system of notifying contributors of these arrangements. A maximum number of contributors and their dependants based on the facilities of the provider Agreement to accept contributors applying to them up to the maximum number without discrimination. A provider cannot reject a patient except on appeal stating the exceptional circumstances. If the Scheme is satisfied with these reasons it would have power to require another provider to accept that patient. Agreement to stock drugs on the list approved for the Scheme and to obtain them only from approved suppliers (in the case of Pharmacy Providers). Agreement that all contributors shall be given adequate treatment. A provider shall not see a contributor as a private patient. Agreement to send patients only to approved specialists or facility. agreement to use only registered ancillary services Agreement to register all births on certificates supplied by the government. Agreement to be insured against malpractice for claims for the stipulated amount. The HMO shall provide every registered Primary Provider with a list of approved or registered: b) i Blood banks ii Hospitals iii Pharmacies iv X-ray and Medical laboratories v Specialists in areas of medicine and medical care c) Providers shall be inspected periodically. HMO representatives shall be allowed reasonable and meaningful access to the provider's premises, all records relevant to the operations of the scheme. EXIT Allowing HMO's to haphazardly enter and leave the market contributes in no small way to market instability and erodes consumer confidence. For this reason the HMOs shall be required to observe the following: HMO's shall give a reasonable notice of at least 6 months to providers HMO's shall provide a plan demonstrating how claims and obligations will be settled. A processing fee shall be paid to the NHIS regulatory agency to cover the cost of overseeing an orderly exit. HMO's shall submit yearly actuarial opinion of adequacy of resources reserves, and premiums to provider claims. CONCLUSION THANK YOU FOR LISTENING