Chapter 6

advertisement

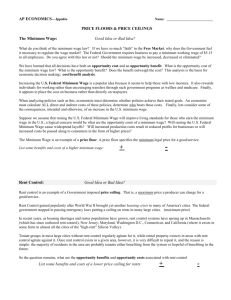

MARKETS IN ACTION 6 CHAPTER Objectives After studying this chapter, you will able to Explain how housing markets work and how price ceilings create housing shortages and inefficiency Explain how labor markets work and how minimum wage laws create unemployment and inefficiency Explain the effects of the sales tax Explain how markets for illegal goods work Explain why farm prices and farm revenues fluctuate and how speculation and price stabilization agencies influence farm prices and farm revenues Turbulent Times As more people compete for scarce land, house prices and rents rise. As new technologies replace low-skilled labor, the demand for low-skilled workers falls. Can governments control prices and wages? How do taxes affect prices and quantities, and who pays the tax, the buyer or the seller? What happens in a market when a good is made illegal? How are farm prices and incomes affected by fluctuations in harvests? Housing Markets and Rent Ceilings The 1906 earthquake in San Francisco left 200,000 people—more than half the city—homeless. By the time the San Francisco Chronicle started publishing again, a month after the earthquake, there was not a single mention of a housing shortage. The classified advertisements listed many more houses and flats for rent than the advertisements for houses and flats wanted. How did the market achieve this outcome? Housing Markets and Rent Ceilings The Market Response to a Decrease in Supply Figure 6.1 shows the San Francisco housing market before the earthquake. The quantity of housing was 100,000 units and the rent was $16 a month at the intersection of D and SS. Housing Markets and Rent Ceilings The earthquake decreased the supply of housing and the supply curve shifted leftward to SSA. The rent increased to $20 a month and the quantity decreased to 72,000 units. Housing Markets and Rent Ceilings Long-Run Adjustments The long-run supply of housing is perfectly elastic at $16 a month. With the rent above $16 a month, new houses and apartments are built. Housing Markets and Rent Ceilings The building program increases supply and the supply curve shifts rightward. The quantity of housing increases and the rent falls to the pre-earthquake levels (other things remaining the same). Housing Markets and Rent Ceilings A Regulated Housing Market A price ceiling is a regulation that makes it illegal to charge a price higher than a specified level. When a price ceiling is applied to a housing market it is called a rent ceiling. If the rent ceiling is set above the equilibrium rent, it has no effect. The market works as if there were no ceiling. But if the rent ceiling is set below the equilibrium rent, it has powerful effects. Housing Markets and Rent Ceilings Figure 6.2 shows the effects of a rent ceiling that is set below the equilibrium rent. The equilibrium rent is $20 a month. A rent ceiling is set at $16 a month. So the equilibrium rent is in the illegal region. Housing Markets and Rent Ceilings At the rent ceiling, the quantity of housing demanded exceeds the quantity supplied and there is a housing shortage. Housing Markets and Rent Ceilings With a housing shortage, people are willing to pay $24 a month. Because the legal price cannot eliminate the shortage, other mechanisms operate: search activity black markets Housing Markets and Rent Ceilings Search Activity The time spent looking for someone with whom to do business is called search activity. When a price is regulated and there is a shortage, search activity increases. Search activity is costly and the opportunity cost of housing equals its rent (regulated) plus the opportunity cost of the search activity (unregulated). Because the quantity of housing is less than the quantity in an unregulated market, the opportunity cost of housing exceeds the unregulated rent. Housing Markets and Rent Ceilings Black Markets A black market is an illegal market that operates alongside a legal market in which a price ceiling or other restriction has been imposed. A shortage of housing creates a black market in housing. Illegal arrangements are made between renters and landlords at rents above the rent ceiling—and generally above what the rent would have been in an unregulated market. Housing Markets and Rent Ceilings Inefficiency of Rent Ceilings A rent ceiling leads to an inefficient use of resources. The quantity of rental housing is less than the efficient quantity and there is a deadweight loss, illustrated in Figure 6.3 (page 125). A rent ceiling is also, usually, unfair. It does not generally benefit the poor. Rather, it hurts the mobile newcomers and favors the less mobile, established residents. Housing Markets and Rent Ceilings Figure 6.3 shows that a rent ceiling decreases the quantity of rental housing, shrinks the producer and consumer surplus by using resources in search activity, and creates a deadweight loss. The Labor Market and the Minimum Wage New, labor-saving technologies become available every year, which mainly replace low-skilled labor. Does the persistent decrease in the demand for low-skilled labor depress the wage rates of these workers? The immediate effect of these technological advances is a decrease in the demand for low-skilled labor, a fall in the wage rate, and a decrease in the quantity of labor supplied. Figure 6.4 on the next slide illustrates this immediate effect. The Labor Market and the Minimum Wage A decrease in the demand for low-skilled labor is shown by a leftward shift of the demand curve. A new labor market equilibrium arises at a lower wage rate and a smaller quantity of labor employed. The Labor Market and the Minimum Wage In the long run, people get trained to do higher-skilled jobs. The supply of low-skilled labor decreases, which is shown by a leftward shift of the short-run supply curve. The Labor Market and the Minimum Wage If long-run supply is perfectly elastic, the equilibrium wage rate returns to its initial level (other things remaining the same). The Labor Market and the Minimum Wage The Minimum Wage A price floor is a regulation that makes it illegal to trade at a price lower than a specified level. When a price floor is applied to labor markets, it is called a minimum wage. If the minimum wage is set below the equilibrium wage rate, it has no effect. The market works as if there were no minimum wage. If the minimum wage is set above the equilibrium wage rate, it has powerful effects. The Labor Market and the Minimum Wage If the minimum wage is set above the equilibrium wage rate, the quantity of labor supplied by workers exceeds the quantity demanded by employers. There is a surplus of labor. Because employers cannot be forced to hire a greater quantity than they wish, the quantity of labor hired at the minimum wage is less than the quantity that would be hired in an unregulated labor market. Because the legal wage rate cannot eliminate the surplus, the minimum wage creates unemployment Figure 6.5 on the next slide illustrates these effects. The Labor Market and the Minimum Wage The equilibrium wage rate is $4 an hour. The minimum wage rate is set at $5 an hour. So the equilibrium wage rate is in the illegal region. The Labor Market and the Minimum Wage The quantity of labor employed is the quantity demanded. The quantity of labor supplied exceeds the quantity demanded. Unemployment is the gap between the quantity demanded and the quantity supplied. The Labor Market and the Minimum Wage The Minimum Wage in Practice The United States has passed the Fair Standards Labor Act, which currently sets the minimum wage at $5.15 per hour. This minimum wage has historically fluctuated between 35 percent and 50 percent of the average wage of production workers. Most economists believe that minimum wage laws increase the unemployment rate of low-skilled younger workers. Taxes Who Pays a Sales Tax? Demand and supply analysis shows how the buyer and the seller share the payment of a tax. Buyers respond to the price with the tax, because that is the price they must pay. Sellers respond to the price without the tax, because that is the price they receive. The tax is a wedge between the price paid and price received, which changes the incentives faced by buyers and sellers. Taxes Figure 6.6 shows the effects of a sales tax on CD players. The equilibrium price with no tax is $100. A tax of $10 per CD player is introduced. The curve S + tax shows the new supply curve. Taxes The vertical distance between the original supply curve and the supply curve with the tax is equal to the amount of the sales tax. Buyers would have to pay $110 to induce firms to offer the original quantity for sale. Taxes The tax changes the equilibrium price and quantity. The quantity decreases. The price paid by the buyer rises to $105 and the price received by the seller falls to $95. Taxes The government collects a tax revenue on the decreased quantity. The buyer and the seller share the tax payment. In this example, they share it equally. But it doesn’t always turn out that way. Taxes The division of the tax between the buyer and the seller depends on the elasticities of demand and supply. Tax Division and Elasticity of Demand To see the effect of the elasticity of demand on the division of the tax payment, we look at two extreme cases. Perfectly inelastic demand: the buyer pays the entire tax. Perfectly elastic demand: the seller pays the entire tax. The more inelastic the demand, the larger is the buyers’ share of the tax. Taxes In this figure, demand is perfectly inelastic—the demand curve is vertical. When a tax is imposed on this good, the buyer pays the entire tax. Taxes In this figure, demand is perfectly elastic—the demand curve is horizontal. When a tax is imposed on this good, the seller pays the entire tax. Taxes Tax Division and Elasticity of Supply To see the effect of the elasticity of supply on the division of the tax payment, we again look at two extreme cases. Perfectly inelastic supply: the seller pays the entire tax. Perfectly elastic supply: the buyer pays the entire tax. The more elastic the supply, the larger is the buyers’ share of the tax. Taxes In this figure, supply is perfectly inelastic—the supply curve is vertical. When a tax is imposed on this good, the seller pays the entire tax. Taxes In this figure, supply is perfectly elastic—the supply curve is horizontal. When a tax is imposed on this good, the buyer pays the entire tax. Taxes Sales Taxes in Practice Taxes usually are levied on goods and services with an inelastic demand. The quantity purchased does not decrease by much after the tax is imposed. The government collects relatively larger tax receipts. Taxes Taxes and Efficiency Except in the extreme cases of perfectly inelastic demand or supply when the quantity remains the same, imposing a tax creates inefficiency. Figure 6.9 shows the inefficiency created by a $10 tax on CD players. Taxes With no tax, the market is efficient and the sum of consumer surplus and producer surplus is maximized. A tax shifts the supply curve, decreases the equilibrium quantity, raises the price to the buyer, and lowers the price to the seller. Taxes The tax revenue takes part of the consumer surplus and producer surplus. The decreased quantity creates a deadweight loss. Markets for Illegal Goods The U.S. government prohibits trade of some goods, such as illegal drugs. Yet, markets exist for illegal goods and services. How does the market for an illegal good work? A Free Market for Drugs To see how the market for an illegal good works, we begin by looking at a free market and see the changes that occur when the good is made illegal. Markets for Illegal Goods Figure 6.10 shows the market for a drug such as marijuana. The equilibrium is at point E. The price is PC and the quantity is QC. Markets for Illegal Goods A Market for Illegal Drugs Prohibiting transactions in a good or service raises the cost of such trading. If sellers (drug dealers) are penalized, we must add the cost of breaking the law to the minimum supply price. Markets for Illegal Goods If the penalty on the seller is the amount HK, the quantity supplied at a market price of PC is QP. A new supply curve passes through point H. The new equilibrium is at point F. The price rises and the quantity decreases. Markets for Illegal Goods Starting again at the equilibrium point E, suppose that buyers are penalized (and not sellers). Now, we must subtract the cost of breaking the law from the maximum price that the buyer is willing to pay. Markets for Illegal Goods If the penalty on the buyer is the amount JH, the quantity demanded at a market price of PC is QP. A new demand curve passes through point H. The new equilibrium is at point G. The market price falls and the quantity decreases. Markets for Illegal Goods But the opportunity cost of buying this illegal good rises because the buyer pays the market price plus the cost of breaking the law. Markets for Illegal Goods Now suppose that both buyers and sellers are penalized for trading in the illegal drug. We add the cost of breaking the law to the minimum supply price and get a new supply curve. Markets for Illegal Goods The new equilibrium is at point H. The quantity decreases to QP . The market price is PC. The buyer pays PB and the seller receives PS. Markets for Illegal Goods Legalizing and Taxing Drugs An illegal good can be legalized and taxed. A high enough tax rate would decrease consumption to the level that occurs when trade is illegal. Arguments that extend beyond economics surround this choice. Stabilizing Farm Revenues An Agricultural Market The supply of farm products is heavily influenced by natural forces (weather, insects, etc.) beyond the control of farmers. Consumer demand for farm products is inelastic. These two characteristics combine to make the market for farm products and farm revenues volatile. Stabilizing Farm Revenues Figure 6.11(a) shows the market for wheat. Once the crop is planted, supply is perfectly inelastic along the momentary supply curve MS0. The price is $4 a bushel and farm total revenue is $80 billion. Stabilizing Farm Revenues A poor harvest decreases supply. Farmers lose $20 billion of total revenue on the decreased quantity sold. But they gain $30 billion from the higher price. Because demand is inelastic, total revenue increases—to $90 billion. Stabilizing Farm Revenues Now a bumper harvest increases supply. Farmers lose $40 billion of total revenue on the original quantity because the price falls. They gain only $10 billion from the increased quantity. Because demand is inelastic, total revenue decreases—to $50 billion. Stabilizing Farm Revenues Speculative Markets in Inventories Speculative markets have developed for the inventories of those farm products that can be stored over long periods of time. Inventory holders speculate by: Buying for inventory when the expected future price exceeds the current price. Selling from inventory when the current price exceeds the expected future price. Stabilizing Farm Revenues Figure 6.12 shows how inventory speculation changes the outcome. Supply is now perfectly elastic at the price expected by inventory holders—supply curve S. A poor harvest decreases production but inventories are sold off. Stabilizing Farm Revenues A bumper crop increases production, but some of the extra output goes into inventory. The price is stabilized at the inventory speculators’ expected price. Stabilizing Farm Revenues In reality, speculation decreases but does not completely eliminate price fluctuations. While speculation does not stabilize farmers’ revenues, it changes the effects of bumper harvests and crop failures. Farmers’ total revenues now increase with bumper crops and decrease with crop failures. MARKETS IN ACTION THE END 6 CHAPTER