File

advertisement

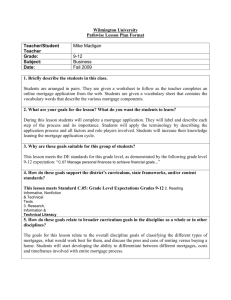

WISE: TIER II PRESENTATION Mortgages What is SIFE? Students in Free Enterprise Global non-profit organization Operates on over 50 campuses across Canada Students do projects to help people within their communities Teams present their projects for the year by competing on a regional, national and international level Mortgages: What is it? A mortgage is a long-term loan taken out to purchase a home Over time, the purchaser must pay back both the principal (amount of the loan) and the interest Interest is the charge the lender applies to your mortgage. This is done, because you are using your lender’s money instead of the lender investing it in something else. Interest is the cost of borrowing money. It is set at an annual percentage. Over time, as you pay off the interest and principal, your equity in the home will grow Equity— the portion of your home that is owned by you as opposed to the bank. Mortgages: Affordability Minimum down-payment is 5% Low down-payments require the purchaser to get mortgage loan insurance Mortgage Loan Insurance—insures the bank in case you default (fail to pay) your mortgage. You can buy the insurance in one lump sum or have it added to your monthly mortgage payments After determining that you can afford a home, you can seek pre-approval Pre-approval—is a lending institution looking at your finances and offering you a specific interest rate in writing that is available to you for a specific period of time If your calculations show that you will have trouble making monthly payments, try: 1. Paying off other debts (student loans, car loans) 2. Save to make a larger down-payment 3. Look at houses in a lower price range Mortgages: Affordability •To figure out if you can afford a mortgage, you must calculate your net worth •Net Worth = Assets – Liabilities • In order to consider lending to you your net worth must be Positive. (i.e total assets must be greater than total liabilities) • Your net worth will help the lender determine what you can afford to make as a down payment. •Down Payment—percentage of the price of the home you pay up front •Your housing costs should not exceed 32% of your gross monthly income •Housing Costs—include principal on the mortgage, interest, property taxes and heating costs •Gross Monthly Income—income from both spouses before deductions (taxes, CPP, EI) per month •Total Debt Service—all of your debts (mortgage, car loans, student loans) as a percentage of your income. If this exceeds 40%, then you cannot afford a home. Mortgages: Affordability What you need: 1. Your personal information, including identification such as your driver's license 2. Details on your job, including confirmation of salary in the form of a letter from your employer 3. Your sources of income 4. Information and details on all bank accounts, loans and other debts 5. Proof of financial assets 6. Source and amount of down payment and deposit 7. Proof of source of funds for the closing costs (these are usually between 1.5% and 4% of the purchase price) Mortgages: Affordability CMHC Mortgage Calculator: http://www.cmhc.ca/en/co/buho/buho_007.cfm Mortgages: Types of Mortgages Conventional Mortgage A mortgage loan up to a maximum of 80% of the lending value of the property. High-Ratio Mortgage A mortgage loan higher than 80% of the lending value of the property. This type of mortgage may have to be insured — by CMHC, for example — against payment default. Mortgages: Types of Mortgages Fixed Interest Rate The interest rate on the mortgage does not change for the entire contract period (e.i. five years) Variable Interest Rate The interest rate on the mortgage changes with the market rate Mortgages: Types of Mortgages Closed Mortgage Set a fixed, monthly payment for the contract period (which is usually about five years and a new rate is renegotiated after the period is over) It cannot be prepaid, renegotiated, or refinanced before the end of the contract period, except according to its terms Of you wish to pre-pay you will usually be charged large fees in order to do so Open Mortgage Variable rate, monthly payments change throughout the life of the mortgage. However, it can be prepaid at any time, without requiring the payment of additional fees. Term vrs Amortization period Term – the length of the current mortgage agreement. Typically a term will be five years or less During he term you typically have a set interest rate and set payments At the end of the term you and your mortgage broker will renegotiate your mortgage. The amortization period is the length of time over which the principle portion of a mortgage loan is scheduled to be paid down. Your amortization rate can be longer than your term. Your amortization rate affects how large your payments are Maximum amortization period is 25 years Mortgages: Real Costs 1. Mortgage Loan Insurance Premium 2. Appraisal Fees 3. Recommended that you pay a third-party to inspect the home before you make an offer to purchase. This is usually about $500 Land Registration Fees 6. Money paid upfront as part or completely of your Down Payment Home Inspection Fees 5. Your mortgage provider may ask you to have the house you want to buy appraised (priced by a third party) at your expense. This is usually $250-$350 Deposit 4. For low down-payments and paid either monthly or in a lump sum Percentage of purchase price paid to the provincial government. This varies from province to province Prepaid Property Taxes/Utilities The seller may have paid some property taxes and utilities in advance. As the buyer, you may have to reimburse the seller for these prepaid costs Mortgages: Real Costs 7. Property Insurance 8. Survey 9. Mortgage provider may ask for the land you purchase to be surveyed. This can cost between $1000-$2000 Legal Fees 10. Insurance required by the mortgage provider so that your house and contents may be replaced in case of accident. Remember that the mortgage provider owns a certain percentage of your home throughout the amortization period. It is their asset as well, but you must pay the monthly premiums Charged by the notary/lawyer for rendering services to close the sale. This is usually between $500$850, but differs depending on the size and complexity of the sale Land Transfer Tax Charged by the provincial government for sale of any land and is a certain percentage of the purchase price: http://www.donaldlegal.com/services.htm Mortgages: Real Costs Besides up-front costs, there are other expenses to consider: 1. Appliances. Check to see what comes with the house, if anything. 2. Gardening equipment. 3. Snow-clearing equipment. 4. Window treatments. Check to see what comes with the house. 5. Decorating materials. Paint, wallpaper, flooring and tools for redecorating. 6. Hand tools. You will need some basic hand tools for your new home. 7. Dehumidifier. May be required to control moisture levels, especially in older homes. 8. Moving Expenses. 9. Renovations or Repairs. 10. Service connection fees. Charged for utilities — telephone, gas, electricity, cable TV, satellite TV, Internet and so on. You may be asked to pay a deposit for some utilities. 11. Condominium Fees. You may have to make the initial payment for these monthly fees. Mortgages: Real Costs CMHC Home Purchase Cost Calculator: http://www.cmhc.ca/en/co/buho/hostst/wosh_007.cfm?renderforprint=1 Mortgages: Types of Homes Try to find a home that will fit your lifestyle for the next 5-10 years based on these criteria: Size 1. How many bedrooms, bathrooms? Does it have a two-car garage? Does it have a large enough yard or a home office space? Special Features 2. Does it have a pool, hot tub, bar, fireplace, or air conditioning? Stages of Life 3. Do you have young children? Do you have teenagers who will soon move out? Are you retired or close to retirement? Do you have many grandchildren in the area? Mortgages: Types of Homes When deciding where to live, you should consider: 1. Whether you want to live in a city, a town or in the countryside 2. Where you work, how easy it will be to get there and the commuting costs 3. Where your children will attend school and how they will get there 4. Whether you need a safe walking area or recreational facilities such as a park nearby 5. How close you would like to be to family and friends Mortgages: Types of Homes Buying New vs. Old: Type Old New Pros Cons Easy accesss to services (school, shopping, parks) Higher maintenance costs Landscaping has been completed Major renovations are needed in order to personalize No GST/PST Technology (such as heating/cooling) not as up-to-date Personalize your home (gardens, shrubs) GST/PST Latest codes/standards (electrical, energy efficency) Home probably not finished (driveway, basement, landscaping) Modern design incorporating latest trends Schools, parks and shopping will not be developed yet Mortgages: Types of Homes Single Detached: On its own lot such as a bungalow or bi-level Mortgages: Types of Homes Semi-detached: Two houses that share one building (such as a duplex) The owner may live in the upper level and the renter in the lower level Mortgages: Types of Homes Townhouse: Rows of houses attached to one another with small yards. They can be for rent or purchase Mortgages: Types of Homes Mobile Home: Pre-built homes that are transported to a purchased lot or leased lot and placed on top of a previously built foundation. Not all lenders will finance a mobile home. Mortgages: Types of Home Condominium form of ownership, not a type of construction. Condominiums can be high-rise residential buildings, townhouse complexes, individual houses and low-rise residential buildings Mortgages: Your Team Real Estate Agent: Help you find the ideal home. Write an Offer of Purchase. Negotiate on your behalf to help you get the best possible deal. Provide you with important information about the community, help you arrange and coordinate a home inspection and essentially save you time, trouble and money. Charge commission (a percentage of the sale price) and/or fees Mortgages: Your Team Lender/Mortgage Broker: Mortgage brokers don't work for any specific lending institution. Their role is to place the client with a lender that offers the product they require as not all lenders offer the same mortgage product ex. Free down payment, mobile homes, leased land etc. Lenders include banks, credit unions, insurance companies, finance companies Mortgages: Your Team Notary (Lawyer): to protect your legal interests, (ex. ensuring the property you are thinking of buying does not have any building or statutory liens or charges or work or clean-up orders associated with it.) He or she will also get a copy of the Land Title Mortgages: Your Team Home Inspector: the home inspector will tell you if something is not functioning properly, needs to be changed or is unsafe. You will also be informed of repairs that need to be made and maybe even where there may have been problems in the past. Mortgages: Your Team Insurance Broker: Lenders insist on property insurance because your property is their security for your loan. Property insurance covers the replacement cost of your home, so premiums may vary depending on its value. Mortgage life insurance provides coverage for your family if you die before your mortgage is paid off. This type of insurance is often available through your lender, who then simply adds the premium to your regular mortgage payments. However, you may want to compare rates between both an insurance broker and your lender. Mortgages: Your Team Surveyor: If the seller does not have a Survey or Certificate of Location, you will probably need to get one for your mortgage application. If the Survey in the seller's possession is older than five years, it will probably need to be updated. Remember that you must have permission from the property owner before hiring a surveyor to go onto the property. Ask your real estate agent to help co-ordinate this with the owner. Mortgages: Your Team Appraiser: appraisal should include an unbiased assessment of the property's physical and functional characteristics, an analysis of recent comparable sales and an assessment of current market conditions affecting the property. Mortgages: Where to Start 1. Word of Mouth 2. Internet 3. Drive in neighbourhoods that you want to live in and look for homes with “For Sale” signs on the property. Usually these signs have contact information on them, such as a phone number New Developments 6. Check out the Classified section of newspapers and research in real estate magazines if you have access to them. These real estate magazines are usually free “For Sale” Signs 5. Go online to various websites to check listings Newspapers and Realtor Magazines 4. Ask people that you know in your work, family, friends, church or other places if they know of any homes for sale Drive around new developments and subdivisions if you’re looking for a new home Real Estate Agent Talk to a real estate agent; they will know the multiple listings in the local area Mortgages: Making an Offer After you have found the home you want, you and your real estate agent, along with your notary will make an Offer of Purchase. Offer of Purchase—a written contract setting out the terms under which the buyer agrees to buy the home. If the Offer to Purchase is accepted by the seller, it forms a legally binding contract that binds those who have signed it to certain terms and conditions. Mortgages: Making an Offer Included in an Offer of Purchase are: 1. 2. 3. 4. 5. Your legal name, the name of the vendor and the legal civic address of the property. The purchase price offered. The chattels (extras) that will be included in the purchase price (for example, window coverings, appliances). Whatever items in or around the home that you think are included in the sale should be specifically stated in your offer. The amount of deposit. Clauses for the date of nullity and approval by your lender and notary Mortgages: Making an Offer 6. 7. 8. 9. The closing day (date you take possession of the home) — usually 30 to 60 days from the date of agreement. It can also be 90 days or longer. Generally, an Offer to Purchase obliges the purchaser to take possession of the house and property on a certain date. As of the closing date, the purchaser is responsible for taxes, utilities, repairs and maintenance. Request for a current land survey of the property. Date when the offer becomes null and void — that is, it is invalid. Any other conditions that go with the offer, including property inspection and approval of mortgage financing. Mortgages: Making an Offer You Your real estate representative helps you prepare an Offer to Purchase. This offer should include all the details of the sale. Your real estate representative or lawyer will then present the offer to the vendor, who will accept (Situation 1), make a counter-offer (Situation 2) or reject (Situation 3). Vendor Situation 1 The vendor accepts your offer. The deal is concluded. Situation 2 You sign the offer back to the vendor with a higher The vendor accepts this counter-offer. The deal is The vendor may make a counter-offer, asking for a price than your original offer, but lower than the concluded. higher price or different terms. vendor’s counter-offer. Situation 3 You reject the counter-offer and decide not to The vendor may make a counteroffer, asking for a make a subsequent counter-offer. higher price or different terms. If a counter-offer is returned to you at a higher price, ensure that you know exactly how much you can afford before you start negotiating. You don’t want to get caught up in the heat of the moment with costs you can’t afford. The sale doesn’t go through and your deposit is returned. Questions?