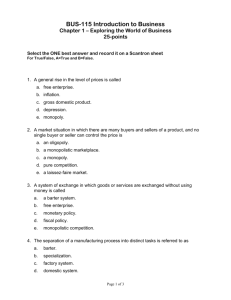

US Cyclical Indicators Emerging Market Monetary Policy

advertisement

Perspectives on U.S. and Global Economy Houston Region Economic Outlook Houston Economics Club and Greater Houston Partnership Omni Houston Hotel December 11, 2014 Ellen Hughes-Cromwick Ross School of Business Views expressed in this presentation are those of Ellen Hughes-Cromwick and are in no way attributable to the Ross School of Business at the University of Michigan Key Points Today • U.S. economy in sustained economic expansion with growth in 3% range next year; global growth at 4% • Key factors underpinning outlook include improved job and income fundamentals, a pickup in investment, low inflation, and a favorable policy mix • Global economy – especially several major emerging markets – will benefit from the drop in commodity prices • Risks and opportunities are balanced – expect more import competition given weak currencies among major exporters 1 2015 Outlook Summary • Strongest sectors of U.S. economy in 2015 likely to be: − Capital goods − Exports − Consumer spending on services • Oil price decline to provide better growth prospects for net importers – China and India • Euro area growth to improve from 2014 pace • U.K. strength this year to remain in 3% growth range 2 Global GDP Global GDP % Chg Over Prior Year 5 4.0 4.1 4.0 4.0 4 2.9 3 2 2.4 2.5 2.6 2012 2013 2014 1.5 1 0 -1 -2 -2.0 -3 2006 2007 2008 2009 2010 2011 2015 Proj. Note: Global growth rate, inflation adjusted, at market exchange; historical data are IMF World Economic Outlook (October 2014); author’s estimate for 2015 outlook 3 Emerging Market Monetary Policy • • Several emerging market central banks have adopted conventional monetary policy principles and strategies (e.g., India, Brazil) Others have struggled with adopting monetary policy objectives which focus on price stability at the expense of short-term economic growth (e.g., Turkey) India • Inflation has declined from over 10% in 2013 to 5.5% as of October 2014 • Governor Rajan has led Reserve Bank of India to keep policy interest rates at 8% • Likely to keep interest rates high until inflation can be brought to implicit target of 5% Brazil • Inflation remains elevated; central bank holding interest rates at the highest level of any EM • Weak currency has contributed to sticky inflation as wage growth remains high even though the economy is in recession and labor productivity growth is challenged Turkey • Persistently high inflation in the 9% range has contributed to currency weakness: central bank lowered the policy interest rate from 10% to 8.25% even as inflation remains high • Political economic forces prevail and could impact long term growth potential China • Incremental policy changes to help bank liquidity in the context of a housing correction; recent reduction in deposit and lending rates are modest adjustments 4 U.S. Business Cycle Monitors • BEA’s National Income and Product Accounts • Billions of chained (2009) dollars • Time series since WWII* • Calculate cumulative % change from trough for each of the 9 business cycles • Compare average performance of the 9 cycles to current cycle performance • In the following slides, the blue line is the current expansion and the green dashed line is the average of prior cycles • The data are measured from 6 quarters prior to the trough and 21 quarters beyond the trough * For detailed components of consumer spending on services, used 6 prior business cycles 5 U.S. Real GDP Real GDP Cumulative % Change From Trough Quarter 25 20 Average $1.6 Trillion Below Average 15 10 5 Current 0 Quarters Before and After the Business Cycle Trough -5 6 4 2 Trough 2 4 6 8 10 12 14 16 18 20 6 U.S. Consumer Spending on Durable Goods Real Consumer Spending on Durable Goods Cumulative % Change From Trough Quarter 45 40 Average 35 30 25 Current 20 15 10 5 0 6 4 2 Trough 2 4 6 8 10 12 14 16 18 20 7 U.S. Consumer Spending on Services Real Consumer Spending on Services Cumulative % Change From Trough Quarter 25 20 Average 15 10 Current 5 0 -5 -10 6 4 2 Trough 2 4 6 8 10 12 14 16 18 20 8 U.S. Capital Spending Nonresidential Investment Spending Cumulative % Change From Trough Quarter Nonresidential Construction Spending Cumulative % Change From Trough Quarter 35 25 Average 30 20 Average 15 25 10 5 20 Current 15 0 -5 10 -10 5 -15 Current -20 0 -25 -5 -30 6 2 2 6 10 14 18 6 2 2 6 10 14 18 9 U.S. Residential Construction and Business Equipment Spending Residential Construction Spending Cumulative % Change From Trough Quarter Equipment Investment Spending Cumulative % Change From Trough Quarter 60 70 50 60 Average 40 Current Expansionary Pace Exceeds Cyclical Average 50 Current 30 40 Current 20 30 Average 10 20 0 10 -10 0 6 3 Trough 3 6 9 12 15 18 21 6 3 Trough 3 6 9 12 15 18 21 10 U.S. Exports Exports Cumulative % Change From Trough Quarter 40 35 Current 30 25 20 Average 15 10 5 0 -5 6 4 2 Trough 2 4 6 8 10 12 14 16 18 20 11 U.S. Consumer Spending on Housing Services Consumer Spending on Services -- Housing and Utilities Cumulative % Change From Trough Quarter 25 20 Average 15 10 5 Current 0 -5 -10 6 4 2 Trough 2 4 6 8 10 12 14 16 18 20 12 U.S. Consumer Spending on Health Care Services Consumer Spending on Services --- Health Care Cumulative % Change From Trough Quarter 30 25 Average 20 15 10 5 Current 0 -5 -10 6 4 2 Trough 2 4 6 8 10 12 14 16 18 20 13 In Closing – Thank You!! • Global economy entering period well beyond financial crisis and 6 years of expansion in the U.S. • Acceleration in growth likely next year • Expect global GDP gains to be above trend • U.S. economy has several strengths centered in energy, capital goods, IT, and healthcare • Secular stagnation not likely 14