SDLT and Property Investment Issues

advertisement

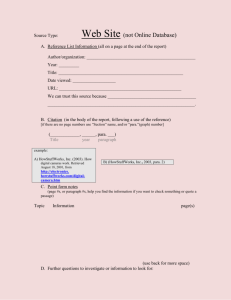

SDLT and Investment Property Patrick Cannon, 15 Old Square www.patrickcannon.net Old ‘Split Title’ Structures ► Re-uniting legal and beneficial interests ► What to do? ► Use of SDLT 60 self-certificates Beneficial Owner Nominee Company Whiteacre Legal title Partnerships ►A and B set up a partnership. A contributes land worth £10m, B contributes £5m cash and the £5m is repaid to A so that both partners have contributed a net £5m. ► How does new para 17A, Sch 15 FA 2003 apply? – withdrawal of money within 3 years of contribution of land Para 17A problem on way in A puts in land £10m B puts in cash £5m £5m out Partnership Tax on 50% of £10m + 50% of £5m under para 10 + £5m under 17A? Para 17A problem on way out A takes out remaining £5m B puts in remaining £5m and takes land out £5m cash in and £10m land out £balance of £5m cash out Partnership Tax on 50% of £10m + 50% of £5m under para 18 + £5m under 17A? Sub Sales A £100 B £150 C Sub-Sales and Development Scenarios ► Agreement for leases in development agreements ► When lease is granted? Overlap credit for rent but what about the premium? ► What if developer nominates an investor to take grant of formal lease? SDLT x 3? ► Vendor/builder agreements ► Purchaser/builder agreements Leases and development scenarios Freeholder Agreement for lease Developer Cash Formal lease Cash Occupier Overage Issues ► Pay tax upfront and then adjust within 30 days of overage event ► ‘Contingent’ – assume payable ► ‘Uncertain’ – use reasonable estimate ► ‘Unascertained’ – reasonable estimate ► Deferment of tax ► Can you discount for likelihood of payment? ► Continuing legal liability for overage on disposal of the land Group Relief Mini-GAAR ► New sub-para (4A) of para 2 Sch 7: Group relief not allowed if transaction– (a) Not bona fide commercial reasons, or (b) Forms part of arrangements where a main purpose is the avoidance of liability to tax How much of a threat is this really? Possible ‘White List’? SDLT problems with chattels ► Box 1 of SDLT 4 v2 asks you to state the consideration apportioned to ‘chattels’ on a business sale ► How to value chattels? Auction room; Special purchaser; Retail? ► Enquiries about sales at or just under the threshold points: £60k, £250k and £500k ► Goodwill – inherent or moveable? Morvic Pty Ltd v Commissioner of State Revenue (Vic) (2002) Certificates of Value v Linked Transactions ► ‘Larger transaction or series of transactions’: Stamp Duty ► ‘Single scheme, arrangement or series of transactions’: SDLT ► Classic 5 houses at £120,000 each? ► Box 13 on form SDLT 1 ► Are non-land transactions ‘linked transactions’? Building agreements? ► Buy to let investors and agencies problem Disclosure and SDLT Returns ► HMRC enquiries in SDLT ► Langham ► SP v Veltema 1/06 ► Sale retentions? SDLT Scheme Disclosure (1) ► From 1 August 2005 for commercial property of £5m or above ► Arrangements enabling an SDLT advantage ► No reference number procedure ► No premium fee or confidentiality filters ► Time limits SDLT Scheme Disclosure (2) ► No ‘White List’ ► The Excluded Arrangements ► The Listed Steps A to F ► Rules 1 and 2 ► Inclusion of unlisted step SDLT and Investment Property Patrick Cannon, 15 Old Square www.patrickcannon.net