25_3020_KimKushm...ettertoIASBfinal

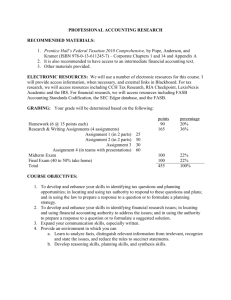

advertisement