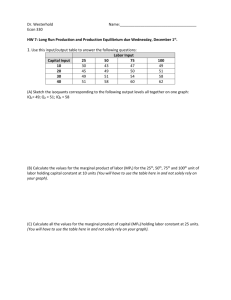

Production Theory

and Estimation

Chapter 7

• Managers must decide not only what to produce for the

market, but also how to produce it in the most efficient or least

cost manner.

• Economics offers widely accepted tools for judging whether

the production choices are least cost.

• A production function relates the most that can be produced

from a given set of inputs.

» Production functions allow measures of the marginal

product of each input.

Green Power Initiatives

California permitted and encouraged buying

cheap power from other states.

So, PG&E and Southern Cal Edison scaled

back their expansion of production facilities.

Off-Peak and Peak costs per MWh ranged

from $25 to over $65, but regulators tried to

keep prices low.

Resulting in PG&E bankruptcy

Green Power Initiatives

Carbon dioxide emission trading schemes

in Europe encouraged construction of

greener nuclear & wind generation.

Q: If you were asked to pay 3 times more for

electricity in the day than night, would you

change your usage?

The Organization of Production

Inputs

Labor, Capital, Land

Fixed Inputs

Variable Inputs

Short Run

At least one input is fixed

Long Run

All inputs are variable

Production Function With Two Inputs

Q = f(L, K)

K

6

5

4

3

2

1

Q

10

12

12

10

7

3

1

24

28

28

23

18

8

2

31

36

36

33

28

12

3

36

40

40

36

30

14

4

40

42

40

36

30

14

5

39

40

36

33

28

12

6 L

Production Function With One Variable Input

Total Product

Marginal Product

Average Product

Production or

Output Elasticity

TP = Q = f(L)

MPL =

TP

L

APL =

TP

L

EL =

MPL

APL

Production Function With One Variable Input

Total, Marginal, and Average Product of Labor, and Output Elasticity

L

0

1

2

3

4

5

6

Q

0

3

8

12

14

14

12

MPL

3

5

4

2

0

-2

APL

3

4

4

3.5

2.8

2

EL

1

1.25

1

0.57

0

-1

Production Function With One Variable Input

Production Function With One Variable Input

Optimal Use of the Variable Input

Marginal Revenue

Product of Labor

Marginal Resource

Cost of Labor

Optimal Use of Labor

MRPL = (MPL)(MR)

MRCL =

TC

L

MRPL = MRCL

Optimal Use of the Variable Input

Use of Labor is Optimal When L = 3.50

L

2.50

3.00

3.50

4.00

4.50

MPL

4

3

2

1

0

MR = P

$10

10

10

10

10

MRPL

$40

30

20

10

0

MRCL

$20

20

20

20

20

Optimal Use of the Variable Input

Production With Two Variable Inputs

Isoquants show combinations of two inputs that can produce

the same level of output.

Firms will only use combinations of two inputs that are in the

economic region of production, which is defined by the portion

of each isoquant that is negatively sloped.

Production With Two Variable Inputs

Isoquants

Production With Two Variable Inputs

Economic

Region of

Production

Production With Two Variable Inputs

Marginal Rate of Technical Substitution

MRTS = -K/L = MPL/MPK

Production With Two Variable Inputs

MRTS = -(-2.5/1) = 2.5

Production With Two Variable Inputs

Perfect Substitutes

Perfect Complements

Optimal Combination of Inputs

Isocost lines represent all combinations of two inputs that a

firm can purchase with the same total cost.

C wL rK

C Total Cost

w Wage Rate of Labor ( L)

C w

K L

r r

r Cost of Capital ( K )

Optimal Combination of Inputs

Isocost Lines

Prepared by Robert F. Brooker,

Ph.D. Copyright ©2004 by

South-Western, a division of

AB

C = $100, w = r = $10

A’B’

C = $140, w = r = $10

A’’B’’

C = $80, w = r = $10

AB*

C = $100, w = $5, r = $10

Optimal Combination of Inputs

MRTS = w/r

Prepared by Robert F. Brooker,

Ph.D. Copyright ©2004 by

South-Western, a division of

Optimal Combination of Inputs

Effect of a Change in Input Prices

Returns to Scale

Production Function Q = f(L, K)

Q = f(hL, hK)

If = h, then f has constant returns to scale.

If > h, then f has increasing returns to scale.

If < h, the f has decreasing returns to scale.

Returns to Scale

Constant Returns

to Scale

Prepared by Robert F. Brooker,

Ph.D. Copyright ©2004 by

South-Western, a division of

Increasing

Returns to Scale

Decreasing

Returns to Scale

Empirical Production Functions

Cobb-Douglas Production Function

Q = AKaLb

Estimated using Natural Logarithms

ln Q = ln A + a ln K + b ln L

The Production Function

A Production Function is the maximum feasible

quantity from any amounts of inputs

If L is labor and K is capital, one popular

functional form is known as the Cobb-Douglas

Production Function

The Production Function (con’t)

Q = a • K

b1•

L b2

is a Cobb-

Douglas

Production Function

The number of inputs is typically greater than

just K & L. But economists simplify by

suggesting some, like materials or labor, is

variable, whereas plant and equipment is

fairly fixed in the short run.

The Short Run

Production Function

Short Run Production Functions:

Max

Q

output, from a n y set of inputs

= f ( X1, X2, X3, X4, X5 ... )

FIXED IN SR

VARIABLE IN SR

_

_

Q = f ( K, L) for two input case, where K is Fixed

© 2011 Cengage Learning. All Rights Reserved. May

not be scanned, copied or duplicated, or posted to a

publicly accessible website, in whole or in part.

The Short Run

Production Function (con’t)

A Production Function with only

one variable input is easily

analyzed. The one variable input is

labor, L. Q = f( L )

Average Product = Q / L

output

per labor

Marginal Product = Q/L =Q/L =

dQ/dL

output

attributable to last unit of labor

applied

Similar to profit functions, the Peak of

MP occurs before the Peak of average

product

When

MP = AP, this is the peak of the

AP curve

Law of Diminishing Returns

INCREASES IN ONE FACTOR OF PRODUCTION,

HOLDING ONE OR OTHER FACTORS FIXED,

AFTER SOME POINT,

MARGINAL PRODUCT DIMINISHES.

MP

A SHORT

RUN LAW

point of

diminishing

returns

Variable input

Bottlenecks in Production

Plants

Boeing found diminishing returns in ramping up

production.

It sought ways to adopt lean production

techniques, cut order sizes, and outsourced

work at bottlenecked plants.

Increasing Returns and Network

Effects

There are exceptions to the law of

diminishing returns.

When the installed base of a network product

makes efforts to acquire new customers

increasing more productive, we have

network effects

Outlook and Microsoft Office

Table 7.2:

Total, Marginal & Average Products

Total, Marginal & Average Products

Marginal Product

Average

Product

3

4

5

6

7

8

The maximum MP occurs before the maximum AP

When MP > AP, then AP is RISING

IF YOUR MARGINAL GRADE IN THIS CLASS IS HIGHER

THAN YOUR GRADE POINT AVERAGE, THEN YOUR G.P.A.

IS RISING

When MP < AP, then AP is

FALLING

IF YOUR MARGINAL BATTING AVERAGE IS LESS THAN

THAT OF THE NEW YORK YANKEES, YOUR ADDITION TO

THE TEAM WOULD LOWER THE YANKEE’S TEAM BATTING

AVERAGE

When MP = AP, then AP is at its

MAX

IF THE NEW HIRE IS JUST AS EFFICIENT AS THE AVERAGE

EMPLOYEE, THEN AVERAGE PRODUCTIVITY DOESN’T

CHANGE

Three stages of production

Three stages of production

Stage 1: average product rising.

Increasing returns

Stage 2: average product declining (but marginal

product positive).

Decreasing returns

Stage 3: marginal product is negative, or total

product is declining.

Negative returns

Determining the Optimal Use of

the Variable Input

HIRE, IF GET MORE

REVENUE THAN

COST

HIRE if

TR/L > TC/L

HIRE if the marginal

revenue product >

marginal factor cost:

MRP L > MFC L

AT OPTIMUM,

MRP L = W MFC

MRP L MP L • P Q = W

wage

W

•

W MFC

MRPL

optimal labor

MPL

L

Optimal Input Use at L = 6

Table 7.3

© 2011 Cengage Learning. All Rights Reserved. May

not be scanned, copied or duplicated, or posted to a

publicly accessible website, in whole or in part.

Production Functions with multiple

variable inputs

Suppose several inputs are variable

greatest output from any set of inputs

Q = f( K, L ) is two input example

MP of capital and MP of labor are the derivatives of

the production function

MPL = Q/L = Q/L

MP of labor declines as more labor is applied. Also

the MP of capital declines as more capital is

applied.

Isoquants & LR Production Functions

ISOQUANT

MAP

In the LONG RUN, ALL factors are

variable

Q = f ( K, L )

ISOQUANTS -- locus of input

combinations which produces the

same output

Points A & B are on the same

isoquant

SLOPE of ISOQUANT from A to

B is ratio of Marginal Products,

called the MRTS, the marginal rate

of technical substitution = -K /L

K

Q3

C

B

Q2

A

Q1

L

Optimal Combination of Inputs

• The objective is to minimize cost for a given output

• ISOCOST lines are the combination of inputs for a given cost,

C0

• C0 = CL·L + CK·K

• K = C0/CK - (CL/CK)·L

• Optimal where:

» MPL/MPK = CL/CK·

» Rearranged, this becomes the equimarginal criterion

Optimal Combination of Inputs

Equimarginal Criterion:

Produce where

MPL/CL = MPK/CK where

marginal products per dollar

are equal

at D, slope of

isocost = slope

of isoquant

Use of the Equimarginal Criterion

• Q: Is the following firm EFFICIENT?

• Suppose that:

» MP L = 30

» MPK = 50

» W = 10 (cost of labor)

» R = 25 (cost of capital)

• Labor: 30/10 = 3

• Capital: 50/25 = 2

• A: No!

Use of the Equimarginal Criterion

A dollar spent on labor produces 3, and a dollar

spent on capital produces 2.

USE RELATIVELY

MORE LABOR!

If spend $1 less in capital, output falls 2 units, but

rises 3 units when spent on labor

Shift to more labor until the equimarginal condition

holds.

That is peak efficiency.

Production Processes and Process Rays

under Fixed Proportions

If a firm has five computers and

just one person, typically only one

computer is used at a time. You

really need five people to work on

the five computers.

The isoquants for processes with

fixed proportions are L-shaped.

Small changes in the prices of

input may lead to no change in the

process.

M is the process ray of one

worker and one machine

people

5

4

M

3

2

1

1 2 3 4 5 6 7 8 9

computers

Allocative & Technical Efficiency

Allocative Efficiency – asks if the firm using the

least cost combination of input

It satisfies: MPL/CL = MPK/CK

Technical Efficiency – asks if the firm is maximizing

potential output from a given set of inputs

When a firm produces at point T

rather than point D on a lower

isoquant, that firm is not

producing as much as is

technically possible.

D

T

Q(1)

Q(0)

Overall Production Efficiency

Suppose a plant produces 93% of what the

technical efficient plant (the benchmark)

would produce.

Suppose a plant produces 85.7% of what an

allocatively efficient plant would produce,

due to a misaligning the input mix.

Overall Production Efficiency = (technical

efficiency)*(allocative efficiency)

In this case: overall production efficiency =

(.93)(.857) = 0.79701 or about 79.7%.

Returns to Scale

If multiplying all inputs by (lambda) increases the

dependent variable by,the firm has constant returns

to scale (CRS).

Q = f ( K, L)

So, f(K, L) = • Q is Constant Returns to Scale

So if 10% more all inputs leads to 10% more output the

firm is constant returns to scale.

Cobb-Douglas Production Functions are constant

returns if a + b 1

Cobb-Douglas Production Functions

Q = A • Ka • Lb is a Cobb-Douglas Production Function

IMPLIES:

Can be CRS, DRS, or IRS

if a + b 1, then constant returns to scale

if a + b< 1, then decreasing returns to scale

if a + b> 1, then increasing returns to scale

Suppose: Q = 1.4 K .35 L .70

Is this production function constant returns to scale?

No, it is Increasing Returns to Scale, because 1.05 > 1.

Reasons for Increasing & Decreasing

Returns to Scale

Some Reasons for IRS

Some Reasons for DRS

The advantage of

Problems with coordination

specialization in capital and

labor – become more adept at

a task

Engineering size and volume

effects – doubling the size of

motor more than doubles its

power

Network effects

Pecuniary advantages of

buying in bulk

and control – as a organization

gets larger, harder to get

everyone to work together

Shirking increases

Bottlenecks appear – a form of

the law of diminishing returns

appears

CEO can’t oversee a

gigantically complex operation

Interpreting the Exponents of the

Cobb-Douglas Production Functions

The exponents a and b are elasticities

a is the capital elasticity of output

The a is [% change in Q / % change in K]

b is the labor elasticity of output

The bis a [% change in Q / % change in L]

These elasticities can be written as EK and E L

Most firms have some slight increasing returns to scale.

Empirical Production Elasticities

Table 7.4: Most are statistically close to CRS or have IRS

˟ such as management or other staff personnel.