DEBENTURES

advertisement

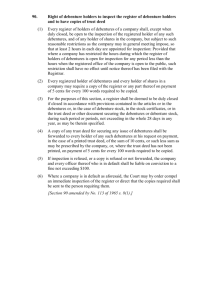

DEBENTURES The term debenture is defined in the Companies Act as, “debentures includes debenture stock, bonds &any other securities of a company whether constituting a charge on the assets of the company or not .”[Sec.2 (12)]. CHARACTERISTICS OF A DEBENTURE 1. 2. 3. 4. 5. 6. 7. 8. It is in the form of a certificate , like a share certificate. In other words it is an instrument in writing . The certificate is an acknowledgement of indebtedness. It is usually under the seal of the company but it is not necessary. A certificate signed by two directors of a company and without bearing company’s seal is a valid debenture. It is one of the series like debentures. It, usually, provides for the repayment of a specified principal sum at specified date. It provides for the payment of interest at a specified rate until the principal sum is paid back. It is generally secured by a charge , fixed or floating on any part of the company’s property or undertaking. The debentures carry no voting rights at any meeting of the company . (sec.117). KINDS OF DEBENTURES 1. 2. 3. 4. 5. 6. 7. 8. REGISTERED DEBENTURES. BEARER DEBENTURES . SECURED DEBENTURES. UNSECURED DEBENTURES. REDEEMABLE DEBENTURES. PERPETUAL DEBENTURES. CONVERTIBLE DEBENTURES . NON-CONVERTIBLE DEBENTURES. DIFFERENCE BETWEEN SHARES & DEBENTURES 1. 2. 3. 4. STATUS : A shareholder is the joint owner of the company but a debenture holder is only a creditor of the company. VOTING RIGHTS: A shareholder has a voting rights whereas a debenture holder has no such rights. INCOME: Interest on the debentures is payable whether there are profits or not. But dividend on shares is to be paid only when the company has earned profits. DISCOUNT ON ISSUE: Debentures can be issued at a discount whereas shares cannot be issued at discount . PROCEDURE FOR THE ISSUE OF DEBENTURES Debentures are issued in accordance with the provisions of the articles , usually by a resolution of the Board of directors. Once a decision is taken by the Board of directors to issue debentures the next step will be to draft prospectus relating to the issue. The provisions of section 56 relating to prospectus apply to the issue of debentures as they apply to an issue of share capital. Particulars of any commission, discount or allowance paid either directly or indirectly to any person for his subscribing or procuring subscription for debentures of the company must be filed with the registrar. [Section 129]. DEBENTURES WITH PARI PASSU CLAUSE Debentures are often issued in a series with the pari passu clause i.e. a clause whereby all debentures of a particular series, though issued at different and varying times are to rank together, as regards the security created by them. TRANSFER & TRANSMISSION OF DEBENTURES Bearer debentures are transferable by simple delivery. Registered debentures are transferable in the same manner as the shares of a company are transferred. Section 82 of the Companies Act provides that the debentures shall be a movable property, transferable in a manner provided by the articles of the company.