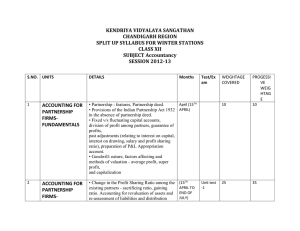

Document

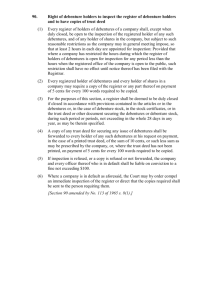

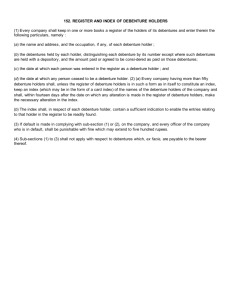

advertisement

Issue of debentures MEANING AND NATURE OF DEBENTURE Debenture is a written instrument acknowledging a debt and containing provisions as regards repayment of interest at a fixed rate. Debenture includes debentures, stock, bonds and any other securities of a company whether constituting a charge on the assets of the company or not. Debenture represents a debt. DISTINCTION BETWEEN A SHARE AND A DEBENTURE Basis of distinction share debenture 1. capital vs. loan Share is a part of Debenture owned capital. constitutes a loan. 2. Reward for investment Reward is a payment of dividend. The raward is payment of interest. 3. Fluctuations in the rate of interest and dividend The rate of The rate of dividend may interest is fixed. vary from year to year depending upon the profit decisions of directors and members. 4. Charge vs. appropriations Payment of dividend is an appropriation out of profits and this cannot be made if there is no profit. Payment of interest is a charge against profits and is to be made even if there is no profit. 5. Priority as to payment Payment of dividend of interest\dividend gets no priority over the payment of interest Payment of interest gets priority over the payment of dividend. 6. Priority as to repayment of principal during winding up. Payment of share capital is made after the repayment of debentures. Payment of debentures is made before the payment of share capital. 7. Secured by charge Shares are not secured by any charge. Debentures are usually secured by a charge. 8. Restrictions on the purchase by company. Sec. 79 imposes certain restrictions on issue of shares at discount No restrictions is imposed on the issue of debentures at discount. 9. Restrictions on the purchase by company. Sec.77 imposes restriction on the purchase of shares by the company. No restriction is imposed on the purchase of by debentures by the company. 10. Voting rights. Shareholders generally enjoy voting rights. Debenture holders do not have any voting rights (except at their class meeting). 11. Redemption Equity shares cannot be redeemed during the lifetime of the company. Debentures are to be redeemed during the lifetime of the company. 12. convertibility Equity shares can never be convertible. Debentures can be convertible. 13. Trust deed Share trust deed is not required to be executed. Debenture trust deed is required to be executed. KIND OF DEBENTURES The different type of debentures are under: (A). naked debentures or unsecured debentures which are not secured on any asset. (B). secured debentures are those which are secured either on a particular asset or on all the asset of the company in general. (c). First mortgage debentures are those which have a first claim on the asset charged. (d).second mortgage debentures are those which have a second claim on the asset charge. (e) Redeemable debentures are those which are repayable after a specified period in lump sum or by instalments during life time of the company. (f) Irredeemable debentures are those which are not redeemable during the life time of the company. Registered debentures are those which are payable to those persons whose name appears in the Register of debentures. Bearer debentures are those which are payable to the bearer thereof. Convertible debentures are those, the holders of which have the right to convert into shares. Non-convertible debentures are those debentures which cannot be convertible into shares. ISSUE OF DEBENTURES The procedure for the issue of debentures is exactly the same as in the case of shares. Therefore, the pattern of accounting entries on the issue of debentures is basically similar to the one on the issue of shares. The only differences are that the term ‘debenture’ is substituted for the word ‘share’ and the percentage of interest is pre-fixed to the term ‘debenture’. From the point of consideration, the debentures may be issued in the following three ways: 1. 2. 3. Issue of debentures for cash; Issue of debentures for consideration other than cash; Issue of debenture as a collateral security: Issue of debenture as a collateral security means the issue of debentures as an additional security against the loan in addition to any other security that may be offered. JOURNAL ENTRIES FOR THE ISSUE OF DEBENTURES 1. When the application money is received Bank Account Dr. Debenture Application Account Cr 2. When the application money is transferred: Debenture Application Account Dr. Debentures Account Cr. 3. When the allotment money is due: Debenture allotment Account Dr. Debentures Account Cr. 4. When the allotment money is received: Bank Account Dr. Debenture Allotment Account Cr. 5. When the call money is due: Debenture call Account Dr. Debentures Account Cr. 6. When the call money is received: Bank Account Dr. Debenture Call Account Cr. PRO FORMA ENTRY- CONTD. When debentures are issued in consideration of assets: Land and Building Account Dr. XXXX Plant and Machinery Account Dr XXXX Furniture and fittings Account Dr. XXXX Any other assets Account Dr. XXXX Debenture Account Cr. XXXX (Being the issue of debenture against assets)