Debenture - WordPress.com

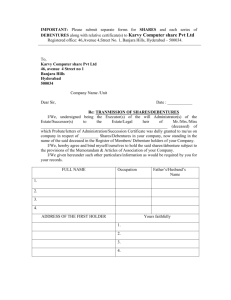

advertisement

WELCOME Govt. H.S.S Thengamam • subject • Accounting for Debenture • Topic. • Debenture Debenture - Meaning Debenture is a creditor ship security. It is a document that creates or acknowledge a debt. The debenture holder is entitled to get a fixed rate of interest. Definition The Companies Act Defines debenture as “debenture stock ,bonds and any other securities of a company, whether constituting a charge or not”. Purpose of issuing debenture • For setting up a new project. • Expansion or diversification of Existing project. • Normal capital expenditure for modernization. • Merge/Amalgamation of companies. Types of debentures • • • • • • • • • • Secured debentures. Unsecured debenture. Redeemable debentures. Perpetual debentures. Convertible debenture. Non-convertible debenture. Coupon rate debenture. Zero coupon debenture. Registered debenture. Bearer debenture Secured debenture Those debentures which are secured on particular assets called secured debenture. These debenture are also called known as Mortgage debenture. Unsecured debentures. Unsecured debentures are those which are not secured fully or partially by a charge on asset. General solvency of the company is the only security for their holders. These are also called naked debenture or simple debenture. Redeemable debenture Debentures which are repayable after a stated period of time are called redeemable debenture. Debentures issued by companies are generally of this type. Irredeemable debentures Debentures which are not repayable during the life time of the company are called irredeemable debenture. the company may repay the money at the time of liquidation or on the happening of a contingency or after the expiry of a very long period. Convertible debentures Debentures which are convertible in to shares or securities at the option of the holders, after a certain period , are called convertible debentures. Convertible debentures are two types ; 1.Fully convertible debentures. 2.Partly convertible debentures. Non-convertible debentures Debentures which are not convertible into Shares or other securities of the company are called non-convertible debentures Specific rate Debentures are usually issued with a specified rate of interest .This specified rate is called Coupon rate .It may be either fixed or floating .The floating interest is usually linked with the bank rate and yields on treasury bond plus a reward for risk Zero coupon bond A zero coupon bond is one which does not carry a specified rate of interest. In order to compensate the investors such bonds are issued at a substantial discount .The difference between the face value and issue price is the total amount of interest related to the duration of the bond. Registered debentures These are debentures which are payable to the registered holders. The names of the holders of these debentures appear both on the debenture certificate and in the company’s register of debenture holders. Bearer debentures Debentures which are payable to the bearer are called bearer debentures .The names of the debenture holders are not recorded in the register of debenture holders. They are treated as negotiable instruments and as such they are transferable by mere delivery. Trust deed A document created by the company regarding the appointment of trusters in order to protect the interests of debenture holders before they are offered for public subscription • • • • The following are those eligible to be a debenture trustee a) A scheduled bank b) A public financial institution according to sec 4 A (1) of companies act 1956 c) An insurance company d) A body corporate Difference between Share & Debenture • Share • • • • • • • Proprietor of the company • Return in the form of dividend. • Appropriation of profit • Always unsecured. • Right to attend meeting and vote • Last claim amount of capital. • No charge on the asset of the • company. • Except redeemable preference • shareholders others will get their money back only at the time of liquidation. • Debenture Creditor of the company. Return in the form of interest. Charge against profit Mostly secured. No right to attend meetings & vote. First claim amount of capital. Charge is created on the asset of the company. Debenture holder can get back their money at the time of redemption. Thank you,