Public School Finance Update PowerPoint

PUBLIC SCHOOL FINANCE

UPDATE

July, 2011

Leanne Emm

Assistant Commissioner

303-866-6202 emm_l@cde.state.co.us

Agenda

• Where we have been

• Where we are

• Where we are going

• Other items of interest

Where We Have Been

FY2009-10 & FY2010-11

FY2009-10 Fiscal Health Analysis

• Produced by the Office of the State Auditor

• One district – three warning indicators

• Five districts – two warning indicators

• Two or more indicators – districts provide information incorporated into report

• Present to Legislative Audit Committee

– August 22nd

FY2010-11 Year-End

Final Per Pupil Funding

• “Rescissions with Per Pupil Funding” spreadsheet posted on the CDE website

• ADE financial data & allocations to Charters and CPP

FY2010-11 Accreditation Report

Two new questions - Financial Transparency

C.R.S. 22-44-301 through 304

• Has the school district complied with all of the reporting requirements of the Public School

Financial Transparency Act?

• Has the school district’s charter school(s) complied with all the reporting requirements of the Public

School Financial Transparency Act?

Financial Transparency

HB 10-1036 requires each “Local Education

Provider” (LEP) to post financial information online, in a downloadable format, for free public access.

• LEP is defined as:

• A School District:

• A Board of Cooperative Services (BOCES);

• A Charter School Institute;

• A District Charter School; and

• An Institute Charter School.

Financial Transparency

Commencing July 1, 2010:

• District Adopted Budget for FY09-10 and FY10-11

• District Financial Audit

• Quarterly Financial Statements

• Salary Schedules or Policies

Additionally Commencing July 1, 2011:

• Accounts Payable Check Registers

• Credit, Debit and Purchase Card Statements

Financial Transparency

Additionally Commencing July 1, 2012:

• Investment Performance Reports

Personal information relating to payroll, including but not limited to payroll deductions or contributions, or any other information that is confidential or otherwise protected from public disclosure is not required to be posted.

Financial Transparency

– Available online and updated within sixty days after the completion or receipt of the applicable report, statement, or document

– Maintain the prior two budget years’ financial information on-line until the end of the current budget year

– CDE Website – template as prescribed by HB

10-1036 http://www.cde.state.co.us/cdefinance/sfFinancialTransparency.htm

Where We Are

FY2011-12

State of Colorado

General Fund Revenue - $7.12 Billion

2011-2012

Other

3,4%

Excise Taxes

30,7%

Income Taxes

65,9%

Source: 2011/2012 Budget in Brief; Joint Budget Committee

State of Colorado

General Fund - $7.01 Billion

General

Government

0.7%

2011-2012

Other

3,5%

Human

Services/Health

Care

32,6%

Education (K-12)

40.4%

$2.83B

Source: 2011/2012 Budget in Brief; Joint Budget Committee

Higher Education

8,9%

Corrections/

Judicial

13.9%

Federal, State and Local Funding for Public Schools

2011-2012 $6.1 Billion

School Finance

Act

$5,212.7B, 85%

Categorical

Programs

$406.1M, 7%

Other Federal

Funds

$434.5M, 7%

Other State

Funds

$84.1M, 1%

2011-12

Total Program Funding - School Finance Act

$5,212.7 Billion

Other State

Funds,

$664.50M, 13%

Property Tax,

$1,738.52M,

33%

State General

Fund,

$2,671.85M, 51%

Specific

Ownership,

$137.83M, 3%

Per Pupil Funding - Base

• 2011-2012

– Base Funding - $5,634.77

• Increase of $105.06 from prior year

• Inflation of 1.9%

• Amendment 23 1% is no longer in effect in 2011/2012

Per Pupil Funding - Factors

• Base funding is adjusted by factors

– Cost of Living

– Personnel costs

– Size of district

– At-risk funding

– On-Line funding

Creates Total Program

• 2011-2012

– SB230 - Negative Factor of 12.97% applied to Total Program

School Districts by Pupil Count

$9 000

$8 000

$7 000

$6 000

$5 000

$4 000

$3 000

$2 000

$1 000

$0

Per Pupil Funding Calculation

Two Examples

Size

Cost of Living

Base Funding

District A District B

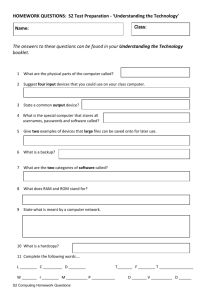

Appropriated Total Program Funding by Component,

With and Without Negative Factor

Size;

$261

At-Risk;

$284

Other;

$120

All Other

Factors;

$759

COL;

$868

Negative

Factor

($774)

Base;

$4 454

Base;

$4 454

Total Program Funding:

$5,987.1 million

Total Program Funding:

$5,212.7 million

Federal, State and Local Funding for Public Schools

2011-2012 $6.1 Billion

School Finance

Act

$5,212.7B, 85%

Categorical

Programs

$406.1M, 7%

Other Federal

Funds

$434.5M, 7%

Other State

Funds

$84.1M, 1%

Categorical Programs

2011-2012 = $406.1 Million

CTE; $23,58

GT; $9,20

Expelled; $7,49

Comprehensive

Health; $1,01

Small

Attendance; $0,96

ELPA; $24,38

Transportation;

$50,83

ECEA; $288,63

Other; $41,0

Dropout; $3,0

Federal Funds

2011-2012 = $434.55 Million

Title I; $197,2

Nutrition;

$156,5

Title II; $36,8

Nutrition; $4,2

Read-to-

Achieve; $4,4

School

Counselor

Corps; $5,0

Hold-harmless

Full-day K, $7.2

Other State Funds

2011-2012 = $84.1 Million

Other State;

$1,4

Capital

Construction/

Facilities,

$35.04

School For Deaf and Blind; $11,8

Facililty

Schools; $15,1

June 2011 Revenue Forecasts

• Legislative Council and OSPB

– Both better than the March 2011 forecast.

• $67.5 million from SB11-230 potentially available

• Solid evidence of recovery – still evidence of struggles – slow recovery

$67.5 Million

• Supplemental appropriation process – next legislative session

• Changes in enrollment, at-risk, assessed values and specific ownership tax

• Not available until appropriated!

Risks to Economic Recovery

• Nationally, 8.8 million jobs lost between

January 2008 and February 2010

• Jobs added: 1.8 million

• Debt, housing, European economy, Japan, monetary policy and the Middle East will impact the recovery.

Colorado Risks

• Tight credit for businesses and consumers.

• High debt and unemployment

• Uncertainty in financial and housing markets.

Where We Are Going

FY2012-13

FY2012-13 – June Forecast

OSPB

Inflation Estimate

Potential Growth in Total Program

3.5%

$261 million

Legislative

Council

2.6%

$207 million

Late February 2012 – actual inflation

$6 000,0

$5 000,0

$4 000,0

$3 000,0

$2 000,0

$1 000,0

$000,0

Fully Funded Total Program

Total Program Less Rescissions

/Legislative Actions

2008-09

Actual

$5 354,8

$5 347,3

State of Colorado

Total Program Funding in millions

2009-10

Actual

$5 717,3

$5 586,1

2010-11

Actual

$5 822,3

$5 439,9

Gaps represent rescissions

2011-12

ESTIMATE

$5 999,9

$5 223,8

2012-13

PROJECTION

OSPB - 3.5%

Inflation

$6 248,5

FY2012-13

• Potential is high for further reductions

• Growth in students and caseloads continue to pressure the General Fund

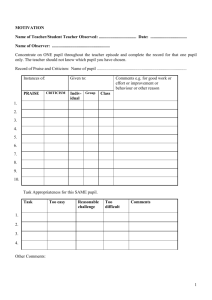

• State Education Fund balance diminishing

$600,0

$500,0

$400,0

$300,0

$200,0

$100,0

$0,0

Revenues

Expenditures

Fund Balance

FY2007-08

$424,9

$301,5

$349,3

State Education Fund in millions

FY2008-09

$475,7

$494,0

$331,0

FY2009-10

$339,5

$482,3

$188,2

FY2010-11 Estimate

$376,9

$423,4

$141,7

Other Topics of

Interest

SB11-230 Bonded Indebtedness

•Changes the date in which the limit to bonded indebtness is determined

•Mainly benefits those districts that are hitting their limit and is declining in assessed value

•Changes the date to measure the limit to previous December valuation

Alternative School Finance Models

• Pilot program authorized by HB10-1183 to encourage school districts and charter schools to collect data that will be used to compare the effects of alternative school finance funding models with those of the current funding method.

• Districts/charter schools apply to participate – applications available in August

• Additional information and the application may be accessed on the CDE website: http://www.cde.state.co.us/index_finance.htm

Upcoming Training Sessions

• Student October Webinar Trainings from 9:30 –

11:30 on the following dates.

– Tuesday, August 9 th

– Wednesday, August 17 th

– Monday, August 22 nd

– Friday, September 2 nd

– Wednesday, September 7 th

• The PSFU Audit Office will be providing resources and answering questions about pupil count audits.

• You may register for one of the trainings at:

– http://www.cde.state.co.us/scripts/StuOctWorkshop11/start.asp

Upcoming Training Sessions

• On-line Pupil Count Webinar

– Wednesday, August 24 th at 10:00 am

• Chart of Account Changes for FY2011-12 and FPP

Handbook Update Webinar

– October timeframe

– Assuming the FPP Handbook changes have been approved by the FPP committee by this time

Other Topics

• Possible Federal requirement for individual charter schools to have a separate independent annual financial audit performed and issued to its authorizer and the Department.

• The Governmental Accounting Standards Board

(GASB) has recently issued exposure drafts related to “Pension Accounting and Financial

Reporting”. These exposure drafts may impact the financial reporting and disclosures for school districts. If you have concerns, the GASB requests comments by September 30, 2011.