Navigation Systems: Frans van der Zee (TNO)

advertisement

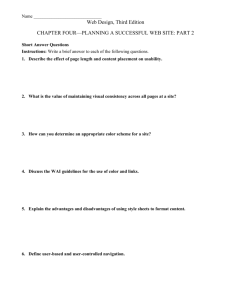

Car navigation systems Dr Frans van der Zee JIIP Annual Symposium, 17th November 2014 6th European Innovation Summit, Brussels 17 November 2014 JIIP Symposium 2014 1 1. Introduction • Car navigation around since early 20th century • Modern car navigation: start early 1980s • GPS car navigation ‘SatNav’: 1990 and beyond Etak Navigator 1985 Avto 1930 17 November 2014 Philips CarIn 1995 TomTom Go 2004 Smartphone + nav app 2009 2. SatNav: a mature innovation… • SatNav: Hardware (CPU, memory, GPS), software, maps • Very dynamic development path – 1981-1990 (development & market introduction) – 1990-2004 (GPS) – 2004-now (PND, interactive communication, smartphone) • Three main market segments (as from 2009): – Built-in ‘in-dash’ navigation systems – Portable navigation systems • ‘All-in-one’ Portable Navigation Device (PNDs) • Navigation apps (smartphone-based) 17 November 2014 JIIP Symposium 2014 3. Research & innovation landscape: critical contributions, critical players • 1985: Etak Navigator (US), Steven Lobbezzoo (Germany) • 1990: GPS ‘in dash’ car navigation in a production car – Japan in 1990 (Mitsubishi / Pioneer), followed by Toyota (1991) – Europe in 1994 (Philips CarIn in BMW 7-series) – US in 1995 (GuideStar in Oldsmobile; Magellan) • 2004: First ‘all-in-one’ Portable Navigation Device (TomTom Go) • 1999: First GPS/GSM safety phone by Benefon • 2007: iPhone introduction, apps • 2009: Google free maps 17 November 2014 JIIP Symposium 2014 4. Technologies What technologies made car navigation ‘big’? • GPS – global positioning system based on satellites and receivers • Digitalisation (digital maps, geocoding) • Memory (from CD-ROM to flash) for map storage/retrieval • Text-to-speech • Turn-by-turn guidance But also… • Dead reckoning; sensor technology • Map matching • Bluetooth • Screen technology (heading-up display, touch, colour, resolution) • Graphical user interface / graphic engine • Lithium ion battery • RDS-TMC / Live traffic 17 November 2014 JIIP Symposium 2014 5. What made it a major innovation? • Opening GPS–NAVSTAR satellite system to civic use in 2000 • Readiness of underlying innovations – – – – – Computing power and size (Moore’s law!) Software (Windows and open source: Linux, HTML) Digital maps Memory storage and retrieval External communication (mobile phone, bluetooth) • Close relation between ‘device makers’ and ‘map makers’ • Integration – making it an all-in-one portable device – “Apple-like” vision and entrepreneurship (TomTom) • Competition (price; new solutions) 17 November 2014 JIIP Symposium 2014 6. Market developments and outlook • In-dash segment: various producers, from electronics and automotive companies to PND producers (increasing strategic collaboration) • PND segment: TomTom, Garmin, MiTAC (strong consolidation, price erosion) • Nav App segment: Google, Hero (NavTeq), TomTom (Teleatlas), various specialised players • Live services: traffic information, weather forecasts, local search, dynamic routing, live point-of-interests (POIs), fuel pricing, etc • Hybrid and niche market applications • In-car entertainment / infotainment systems • Roadside assistance services / subscription services • EU’s Galileo (Positioning accurate to the decimetre; authentication feature) • HAD/self-driving/driverless car 17 November 2014 JIIP Symposium 2014 7. How did policy make a difference? • Clinton Administration decision to open up NAVSTAR for civic purposes • Emergency/safety legislation: GPS chip in mobile phones • RTD public policy: US military NAVSTAR + positioning technology • EU RTD public policy: mostly indirect, through supporting technologies and embedded innovations (integrating and building on the shoulders of other innovations (‘family of innovations’) – EU FP 5-6-7 (1998-now): some contributions, but limited, esp. to PND – Mostly incremental innovations extending/modernising SatNav systems • Next generation GNSS Galileo – to be introduced by 2017 Satellite navigation in H2020: 1st call 38 million euro, overall 140 million euro 17 November 2014 JIIP Symposium 2014 8. Europe’s role and contribution • Three main separate ‘development’ markets: US, Japan, Europe • Private companies leading – ‘closed’ innovation (automotive closed front) • Importance of integration of technologies and innovations • Importance of big electronics companies (Philips, Sony, Pioneer, Siemens, Bosch-Blaupunkt) and seed capitalists (esp. US: ETAK) in development • Japan leading in ‘in-dash’ early years until mid-1990s • Europe fast in technological development (Philips 1985, Lobbezzoo), but slower than others in market intro & roll-out (Philips CarIn system 1997) • Strategic importance of digital map and map software makers, with a telling historical development: NavTeq, ETAK, TeleAtlas • First in launching ‘all-in-one’ Portable Nav Device (PND) (TomTom, 2004) • First in launching first GPS phone (Benefon, 1999) • Limited position in smartphones, but big in maps and apps (NavTeq, now Here, owned by Nokia, TeleAtlas owned by TomTom) 17 November 2014 JIIP Symposium 2014 9 9. Lessons to be learned • SatNav is a typical example of a major innovation building on and successfully integrating other major innovations • Key elements for SatNav success: – – – – – Vision, ability to integrate Readiness and maturity of technologies and innovations Market understanding Long time horizon and deep pockets for innovation Timing (cf ETAK; Philips; TomTom) • Proof of European innovation paradox (Philips, Nokia), but also innovation success (TomTom, TeleAtlas) • Example of closed innovation, difficult-to-access world • Importance of public investment in supporting technologies (fundamental!), standards (mapping) and system development (GPS NavStar, Galileo) 17 November 2014 JIIP Symposium 2014 10