PowerPoint Presentation - Skeie Drilling & Production

advertisement

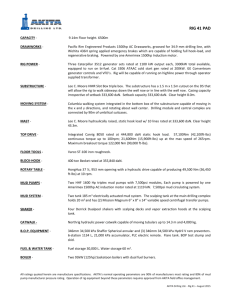

Pareto Securities’ 15th annual Oil & Offshore Conference September 10, 2009 Marketing Presentation Page 1 KFELS N-Class harsh environment jack-up drilling/production rigs Marketing Presentation Page 2 TABLE OF CONTENTS / AGENDA 1 Company Introduction 2 Rig Concept and Design 3 Market/Financials 4 Summary Marketing Presentation Page 3 COMPANY INTRODUCTION – Skeie Drilling & Production ASA (SKDP) SKDP established September 2006 and located in Kristiansand, Norway 49% Owned by Skeie Technology AS, 5% by Keppel O & M and 46% by external investors Commercial and technical services hired from Skeie Technology Operational Management: Skeie Rig Management with support from Pier Offshore Management Services Signed contract for design and construction of three KFELS Class N Jack-up Unit with delivery Q1-2010, Q3-2010 and Q4-2010 OTC listed in Oslo Marketing Presentation Page 4 COMPANY SET-UP Pier Offshore Management Services AS OSM Consultants AS Skeie Technology AS Sub Management Agreement Skeie Rig Management AS (ex Offshore Production Sub Supervision Agreement Business Management Agreement Norsupply AS Skeie D&P Services AS) Head Management Agreement Marketing Presentation Supervision Agreement ProdJack 1 ProdJack 2 ProdJack 3 Page 5 CONSTRUCTION PROGRESS 2007 2008 2009 2010 D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D N D J F M A M J J A S O N D N D Contract signed - Rig #1 - Rig #2 - Rig #3 Engineering - Rig #1 - Rig #2 - Rig #3 Procurement - Rig #1 - Rig #2 - Rig #3 Major deliveries - Rig #1 - Rig #2 - Rig #3 Construction - Rig #1 - Rig #2 - Rig #3 Fabrication/assembly - Rig #1 - Rig #2 - Rig #3 Erection - Rig #1 - Rig #2 - Rig #3 Mechanical - Rig #1 - Rig #2 - Rig #3 Testing/commissioning - Rig #1 - Rig #2 - Rig #3 Delivery - Rig #1 - Rig #2 - Rig #3 Marketing Presentation Page 6 OPERATIONS PREPARATIONS • Skeie Rig Management (wholly owned SKDP subsidiary) to operate the rigs with support from Pier Offshore. • Key onshore and offshore management positions and section leaders already recruited • Training and competency development programs under development • QHSE management systems established • Maintenance systems • Logisitcs (spare parts) Marketing Presentation Page 7 TABLE OF CONTENTS / AGENDA 1 Company Introduction 2 Rig Concept and Design 3 Market/Financials 4 Summary Marketing Presentation Page 8 RIG CONCEPT AND DESIGN COMBINED DRILLING AND PRODUCTION OPERATIONS Standard Jack-up – ”no” clearance between the legs w/jacking system and cantilever New N-Class Marketing Presentation Page 9 RIG CONCEPT AND DESIGN SPECIFICATIONS FOR DRILLING OPERATIONS Drill Floor located on the substructure above the cantilever. Cantilever capable of being skidded fore and aft with center line (primary Cantilever position) of rotary up to 75 ft (22.86m) aft of stern It can be relocated 26 (7,92m) ft to port (secondary Cantilever position) The Drill Floor can be skidded 20 ft (6.1m) port and starboard of the Cantilever centerline both in primary position and in secondary position Max operation envelop over a pre-installed Jacket/Wellhead Platform: 75 ft aft of Transom, 20 ft to starboard of hull centerline and 46 ft to port of hull centerline. Marketing Presentation Page 10 RIG CONCEPT AND DESIGN COMBINED DRILLING AND PRODUCTION OPERATIONS The Cantilever and Drill Floor can be repositioned 26ft (7.92M) to the Port side of the Vessel, to allow space for installation of a future production process module. Marketing Presentation Limits Area: Height: 12,918 sq ft (1,200M2) 52.5ft (16M) Page 11 RIG CONCEPT AND DESIGN PRODUCTION CONCEPTS WITH STANDARD UNITS/EQUIPMENT Marketing Presentation Page 12 RIG CONCEPT AND DESIGN ALTERNATIVE PRODUCTION Marketing Presentation Page 13 TECHNICAL COMPARISON WITH PEERS AS DRILLING RIGS RIG DESIGN Class Operating water depth (ft) Drilling depts (ft) Hull size (ft) (LxBxD) Leg length (ft) Cantilever outreach (ft) BOP (psi rating) Mud Pumps Liquid mud capacity (bbls) Bulk mud capacity (bbls) Drawworks (hp) Top Drive Cranes Main Power(hp) Variable Deck Load (st) Accomodation Keppel N-Class MSC CJ70-X150A DNV 400 (430) 35,000 264/289/35 598 75 15,000 3 (space for 4) 6,600 15,892 4,600 1 000 tons/2x1150 HP 3 13,050 4,535 120 DNV 492 30,000 291/336/38 673 90 15,000 4 6,793 15,723 4,600 750 tons/1150 HP 3 14,484 4,600 120 MSC CJ62-S120 MSC CJ70-X150A 1) DNV 380 30,000 256/296/35 541 60 15,000 3 5,400 14,027 3,000 750 tons/2x1150 HP 3 6,880 3,693 115 DNV 492 40,000 291/336/38 673 90 15,000 4 6,793 15,723 4,600 1 000 tons/2x1150 HP 3 14,484 5,200 120 1) Enhanced version of the existing CJ-70 design with increased drilling depth, increased variable deck load and 1000 t top drive. Source: Company, ODS Petrodata Marketing Presentation Page 14 TABLE OF CONTENTS / AGENDA 1 Company Introduction 2 Rig Concept and Design 3 Market/Financials 4 Summary Marketing Presentation Page 15 Skeie Drilling & Production (SKDP) Turnkey contract with the world’s leading jackup builder Turnkey contracts signed with Keppel FELS for construction of 3 ultra harsh environment jackup rigs Deliveries in March, August and December 2010 All in average delivered cost of ~USDm 477 per unit (total USDm 1.430) All 3 units are fully financed with 11 % equity and 89% in debt (incl. convertible bonds) Low construction risk at Keppel Fels - the world’s leading jackup builder Favorable payment schedule: 50% at delivery for the first 2 units, 35% for the third unit Marketing Presentation Page 16 Financial Highlights • All rigs fully financed - Equity - Convertible bonds - Secured bonds (2. priority) - Senior secured loan facility (1. priority) • Bond loans may be replaced once the rigs are secured contracts • New rig of equal design up approx. 120 MUSD per rig (3x120=360 MUSD) • Delivery time new rig equal design end 2011, beginning 2012 Marketing Presentation Page 17 Skeie Drilling & Production (SKDP) combined drilling/production units The jackups are purposed built for the NCS and other harsh environment areas Superior deck-load capacity Deeper water capabilities Significantly larger air-gap than a standard jackup (up to 62 meters) Big drilling envelope – up to 64 wells without moving the rig Dual mode value enhancing for oil companies. Provides early cash flow from smaller fields Increases oil recovery rates A combined mode contract could bode for even longer contracts. Oil companies likely to pay for upgrade and downtime related to this Two existing jack ups and one under construction of the CJ70 design with similar capabilities for drilling & production Maersk Innovator and Maersk Inspirer PetroProd has one under construction The construction cost for the SKDP rigs is significantly lower than a new CJ70, > 100 MUSD Operators prefer jackups for semis Marketing Presentation Jackups give less risk for downtime caused by harsh weather Blow Out Preventer (BOP) on deck compared to BOP on seabed for floaters, thus reduced operational risks The North Sea part of the NCS is to a large extent shallow water Page 18 Strong markets with several near term contract opportunities – Limited no. of rigs approved for NCS Currently 6 jackups operating on the NCS. Hereof 5 units operating as drilling rigs Hereof 2 units matching the capabilities to the SKDP rigs: Maersk Inspirer, rebuilt for drilling & production and Maersk Innovator operating as drilling rig, but can be rebuilt for drilling & production Extremely difficult for existing rigs to be approved for NCS There is one CJ70 unit to be constructed for PetroProd suited for drilling & production Marketing Presentation Page 19 Contract Status Jackups, Norway CURRENT OPERATOR NAME SKDP 1 PetroProd West Epsilon SKDP 3 Maersk Guardian Rowan Gorilla 06 Maersk Gallant Maersk Giant Maersk Inspirer SKDP 2 Maersk Innovator FOLLOWING OPERATORS AREA UNDER CONSTRUCTION SEA UNDER CONSTRUCTION SEA StatoilHydro NOS UNDER CONSTRUCTION SEA Dong Talisman NOS BG CNR/BG NOS ConocoPhillips Lundin/ConocoPhillips NOS Talisman NOS StatoilHydro NOS UNDER CONSTRUCTION/Skeie Skeie Energy Energy SEA ConocoPhillips NOS FIRM CONTRACT c OPTION YARD / UNDER CONSTRUCTION CURRENT COUNTRY SGP SGP NORWAY SGP NORWAY UK/NOR/UK NORWAY NORWAY NORWAY SGP/NOR NORWAY CONTRACTOR Skeie D&P Larsen O&G Seadrill Skeie D&P Maersk Contractors Rowan Companies Maersk Contractors Maersk Contractors Maersk Contractors Skeie D&P Maersk Contractors WD (ft) 430 492 400 430 350 400 400 350 490 430 490 2009 2010 2011 J F MA MJ J A S O N D J F MA MJ J A S O N D J F MA MJ J A S O N D 2 2 c 2 c c c c c 2 c c 1 c c c 1 c COMMENT 2 2 2 2 2 2 2 2 2 2 2 2 2 2 c c c c c c c 2 2 2 2 2 2 2 DONG, Talisman 150d, then Talisman 2yrs c from c c Q1 c c09c BGhas 1 yr rolling options. c c c c c c c c c c c c c c Varg, Yme c c c c c c c Expected to be 5-8 years c c c c c c c 3-5 years + 2 x 1 y opts 2 2 2 2 2 2 2 c c c c c c c 2 2 c 2 c c c c c 2 c 2 2 c 2 c c c c c 2 c 2 2 c 2 c c c c c 2 c 2 2 c 2 c c c c c 2 c 2 2 c 2 c c c c c 2 c 2 2 c 2 c c c c c 2 c 2 2 c 2 c c c c c 2 c 2 c 2 c c c c c 2 c 2 c 2 c c c c c 2 c 2 c 2 c c c c c 2 c c 2 c 1 c c c 2 c c 2 c 1 c c c 2 c c 2 c 1 c c c 1 c c 2 c 1 c c c 1 c 2 c 1 c c c 1 c 2 c 1 c c c 1 c c 1 c c c 1 c 1 c c c 1 c 1 c c 1 1 c 1 c c 1 1 c c c 1 1 c c c 1 1 c c c 1 1 c 1 2 Rowan Gorilla VI: AOC declined. Rowan has re-submitted AOC application in April/May 2008. Mobilization from UK to be delayed BG: - Planned mobilization to Norway around Q1 2009, depending on well in progress in UK Marketing Presentation Page 20 c c 1 1 c c c 1 1 c c c 1 1 c c 1 1 1 c Norway Jackups Supply & Demand: 2005-2013 20 ©2008 18 SKDP 1, PetroProd 1 & SKDP 2 & 3 due out of the yard. 16 14 Rowan Gorilla VI - Uncertain supply AOC Declined AOC resubmitted in Q2 08, to be clarified around YE 08 12 10 8 6 4 2 0 jan.2005 jul.2005 jan.2006 jul.2006 jan.2007 jul.2007 Existing contracts Possibles Marketing Presentation jan.2008 jul.2008 Options Supply jan.2009 jul.2009 jan.2010 jul.2010 jan.2011 jul.2011 Requirements Including Rowan Gorilla VI jan.2012 jul.2012 Last Updated: 29.08.08 Page 21 JU demand Norway: ConocoPhillips took Innovator and Gallant this week ….needs another rig for min 5Y according to the demand below Source: Pareto Source: Pareto Research Marketing Presentation Page 22 Oil production Marketing Presentation Page 23 Replacement Rate, Oil Reserves vs Exploration Drilling Ratio vs Oil Price Repl. Rate/Expl. Ratio Oil Price 200 200 % ©2008 180 % 180 160 % 160 140 % 140 120 % 120 100 % 100 80 % 80 60 % 60 40 % 40 20 % 20 0% jul.94 0 jul.95 jul.96 Source: SEB Enskilda, Company Research Marketing Presentation jul.97 jul.98 jul.99 Oil Price jul.00 jul.01 jul.02 jul.03 jul.04 Replacement Rate, Oil Reserves jul.05 jul.06 jul.07 Expl. Drilling Page 24 Summary • Contract signed with Skeie Energy for rig # 2 for minimum 3 years • SKDP prequalified by major oil companies • Several bids submitted for NCS operators. Together with a number of new prospects for 2010-2011 SKDP maintains its optimism that alle three rigs will be on contract within the end of 2008. • Extremely difficult and costly to enter NCS for existing rigs • Identical newbuild N-Class rigs have a price increase of more than USDm 120 with delivery 4th quarter 2011 • Full financing of all three rigs in place, 1st priority bank loans completed • Equity issue ≈ 28 MUSD medio September 2008 (bond loan agreement) 100% underwrited by Skeie Technology and Keppel O & M Marketing Presentation Page 25 Contact details: Skeie Drilling & Production ASA Tordenskjoldsgate 9 4612 Kristiansand Norway Telephone: +47 38 04 19 40 Fax: +47 38 04 19 41 Marketing Presentation Page 26