ACT-Week-5-CPA-and-Landscaping-Service-2

advertisement

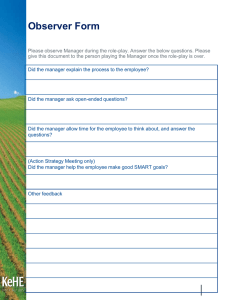

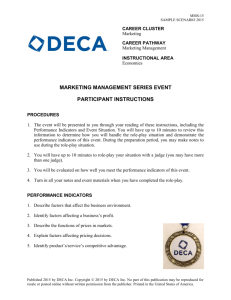

Accounting-15 State/Provincial Event #1 CAREER CLUSTER Finance CAREER PATHWAY Accounting INSTRUCTIONAL AREA Financial Analysis ACCOUNTING EVENT PARTICIPANT INSTRUCTIONS PROCEDURES 1. The event will be presented to you through your reading of these instructions, including the Performance Indicators and Event Situation. You will have up to 30 minutes to review this information to determine how you will handle the role-play situation and demonstrate the performance indicators of this event. During the preparation period, you may make notes to use during the role-play situation. 2. You will have up to 15 minutes to role-play your situation with a judge (you may have more than one judge). 3. You will be evaluated on how well you meet the performance indicators of this event. 4. Turn in all your notes and event materials when you have completed the role-play. PERFORMANCE INDICATORS 1. Demonstrate the effects of transactions on the accounting equation. 2. Prepare an income statement. 3. Prepare a balance sheet. 4. Prepare a cash flow statement. 5. Discuss the use of Generally Accepted Accounting Principles. Published 2015 by DECA Inc. Copyright © 2015 by DECA Inc. No part of this publication may be reproduced for resale or posted online without written permission from the publisher. Printed in the United States of America. Accounting-15 State/Provincial Event #1 EVENT SITUATION You are to assume the role of a CPA who specializes in accounting for small businesses in your area. A client (judge) has come to you with information from the first month of his new sole proprietorship, JOE’S LANDSCAPING SERVICE. Your client (judge) has provided the following information: January 1 January 1 January 1 January 1 January 15 January 20 January 27 January 28 January 31 January 31 Invested $50,000 cash to start the business Purchased $20,000 of equipment for cash Purchased a 1-year insurance policy for $1,200 cash Hired two part-time workers, who will work 20-hours per week @ $9.25 per hour Billed customers $7,500, for landscaping services Purchased $1,000 of supplies on account Received $3,000 from customers billed on January 15 Received utility bill for $400, due February 14 Paid part-time workers for 80-hours each Withdrew $1,000 for personal use You will explain the first month’s results to your client (judge) in a role-play to take place in your office. You will begin the role-play by welcoming the client (judge) to your office and explaining the accounting equation and how transactions impact it. Then you will explain the financial statements. Once you have finished your explanation and have answered the client’s (judge’s) questions, you will conclude the role-play by thanking the client (judge) for the business. 2 Accounting-15 State/Provincial Event #1 JUDGE’S INSTRUCTIONS DIRECTIONS, PROCEDURES AND JUDGE’S ROLE In preparation for this event, you should review the following information with your event manager and other judges: 1. Procedures 2. Performance Indicators 3. Event Situation 4. Judge Role-play Characterization Participants may conduct a slightly different type of meeting and/or discussion with you each time; however, it is important that the information you provide and the questions you ask be uniform for every participant. 5. Judge’s Evaluation Instructions 6. Judge’s Evaluation Form Please use a critical and consistent eye in rating each participant. JUDGE ROLE-PLAY CHARACTERIZATION You are to assume the role of the client who has just completed his first month of JOE’S LANDSCAPING SERVICE. You provided your accountant (participant) with information from the first month of your new sole proprietorship, JOE’S LANDSCAPING SERVICE. You provided the following information: January 1 January 1 January 1 January 1 January 15 January 20 January 27 January 28 January 31 January 31 Invested $50,000 cash to start the business Purchased $20,000 of equipment for cash Purchased a 1-year insurance policy for $1,200 cash Hired two part-time workers, who will work 20-hours per week @ $9.25 per hour Billed customers $7,500, for landscaping services Purchased $1,000 of supplies on account Received $3,000 from customers billed on January 15 Received utility bill for $400, due February 14 Paid part-time workers for 80-hours each Withdrew $1,000 for personal use 3 Accounting-15 State/Provincial Event #1 Your accountant (participant) will explain the first month’s results to you in a role-play to take place in accountant’s (participant’s) office. The accountant (participant) will begin the role-play by welcoming you to his/her office and explaining the accounting equation and how transactions impact it. Then the accountant (participant) will explain your first month’s financial statements. During the course of the role-play you are to ask the following questions of each participant: 1. Why did you include all of the revenues in January’s income statement when I haven’t been paid for all of them yet? 2. What accounts affect owner’s equity? 3. What are the main principles that guide accrual accounting? You are not to make any comments after the event is over except to thank the participant. Once the accountant (participant) has finished the explanation and has answered your questions, the accountant (participant) will conclude the role-play by thanking you for the business. SOLUTION ASSETS Cash A/R Supplies = Prepaid Insurance Equipment LIABILITIES+ O/E A/P +50,000 +50,000 -20,000 +20,000 -1,200 +1,200 +7,500 +7,500 +1,000 +3,000 Joe, capital +1,000 -3,000 +400 -400 -1,480 -1,480 -1,000 -1,000 4 Accounting-15 State/Provincial Event #1 JOE’S LANDSCAPING SERVICE Income Statement For the Month of January Revenues Expenses Salary Expense Utility Expense Total Expenses Net Income $7,500 1,480 400 1,880 $5,620 JOE’S LANDSCAPING SERVICE Owner’s Equity Statement For the Month of January Beginning Equity Add: Investments Net Income $0 50,000 5,620 55,620 55,620 1,000 54,620 Less: Drawings Ending Equity JOE’S LANDSCAPING SERVICE Balance Sheet January 31st Assets Cash Accounts Receivable Supplies Prepaid Insurance Equipment TOTAL ASSETS $29,320 4,500 1,000 1,200 20,000 56,020 Liabilities Accounts Payable 1,400 Owner’s Equity Joe’s, Capital 54,620 LIABILITIES AND OWNER’S EQUITY 56,020 5 Accounting-15 State/Provincial Event #1 JOE’S LANDSCAPING SERVICE Cash Flow Statement For the Month of January Operating Activities Cash Received from Customers Cash Paid for Insurance Cash Paid for Salaries Net cash from operating activities Investing Activities Purchase of Equipment Net cash from investing activities Financing Activities Investment by owner Drawing by owner Net cash from financing activities NET INCREASE IN CASH Cash at Beginning of Period Cash at End of Period Key Points $3,000 (1,200) (1,480) 320 (20,000) (20,000) 50,000 (1,000) 49,000 29 ,320 0 29,320 (Answers to Judge’s Questions) 1. Revenues must be recognized when earned, under accrual accounting, not when paid. May mention the Revenue Recognition Principle. 2. Revenues and investments increase owner’s equity and expenses and drawings decrease owner’s equity. OR Net income and investments increase owner’s equity and net loss and drawings decrease owner’s equity. 3. The revenue recognition principle and the matching principle (aka expense recognition principle) guide accrual accounting. The revenue recognition principle says that you must recognize revenue in the period in which you do the work. The matching principle (aka expense recognition principle) says you must match expenses to the revenues they help generate. 6 Accounting-15 State/Provincial Event #1 JUDGE’S EVALUATION INSTRUCTIONS Evaluation Form Information The participants are to be evaluated on their ability to perform the specific performance indicators stated on the cover sheet of this event and restated on the Judge’s Evaluation Form. Although you may see other performance indicators being demonstrated by the participants, those listed in the Performance Indicators section are the critical ones you are measuring for this particular event. Please note that an overall score of 70% indicates a minimum level of acceptable performance. Evaluation Form Interpretation The evaluation levels listed below and the evaluation rating procedures should be discussed thoroughly with your event chairperson and the other judges to ensure complete and common understanding for judging consistency. Level of Evaluation Interpretation Level Exceeds Expectations Participant demonstrated the performance indicator in an extremely professional manner; greatly exceeds business standards; would rank in the top 10% of business personnel performing this performance indicator. Meets Expectations Participant demonstrated the performance indicator in an acceptable and effective manner; meets at least minimal business standards; there would be no need for additional formalized training at this time; would rank in the 70-89th percentile of business personnel performing this performance indicator. Below Expectations Participant demonstrated the performance indicator with limited effectiveness; performance generally fell below minimal business standards; additional training would be required to improve knowledge, attitude and/or skills; would rank in the 50-69th percentile of business personnel performing this performance indicator. Little/No Demonstration Participant demonstrated the performance indicator with little or no effectiveness; a great deal of formal training would be needed immediately; perhaps this person should seek other employment; would rank in the 0-49th percentile of business personnel performing this performance indicator. 7 ACCOUNTING, 2015 Participant: _____________________________ JUDGE’S EVALUATION FORM STATE/PROVINCIAL EVENT #1 I.D. Number: ____________________________ INSTRUCTIONAL AREA Financial Analysis Did the participant: Little/No Value Below Expectations Meets Expectations Exceeds Expectations PERFORMANCE INDICATORS 1. Demonstrate the effects of transactions on the accounting equation? 0-1-2-3-4-5 6-7-8-9-10-11 12-13-14-15 16-17-18 2. Prepare an income statement? 0-1-2-3-4-5 6-7-8-9-10-11 12-13-14-15 16-17-18 3. Prepare a balance sheet? 0-1-2-3-4-5 6-7-8-9-10-11 12-13-14-15 16-17-18 4. Prepare a cash flow statement? 0-1-2-3-4-5 6-7-8-9-10-11 12-13-14-15 16-17-18 0-1-2-3-4-5 6-7-8-9-10-11 12-13-14-15 16-17-18 0-1-2 3-4-5 6-7-8 9-10 5. 6. Discuss the use of Generally Accepted Accounting Principles? Overall impression and response to judge’s questions TOTAL SCORE 8 Judged Score