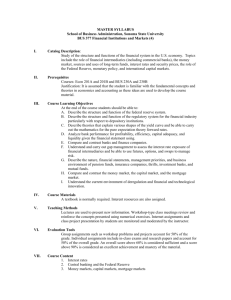

Central Bank - Rahimullah Baryalai

advertisement

Central Bank Chapter No # 4 Objectives Central Bank Function of Central Bank Monopoly of Notes Issue and Methods Monetary Policy Central Bank The central bank is the head, the leader, and the supervisor of the banking and monetary system of a country. Almost every country of the world has its own central bank. A central bank is an institution which is responsible for safeguarding the financial stability of the country. Functions of a Central Bank Sole Right of Note Issue Bankers, Agent and Adviser to the Government. Banker to Commercial Banks Controller of Credit Clearing Agent Lender of the Last resort Development role Other Functions Sole Right of Note Issue Central Bank has the Monopoly of note issue. The reasons for delegation of Authority to note issue are as follow. It brings uniformity in the system of note issue The central bank can exercise better control over the money supply in the country. Increase public confidence in the monetary system of the country. Enables central bank to control the lending operations of the commercial banks. Bankers, Agent and Adviser to the Govt. The Central Bank acts as banker agent and adviser to the Government. 1. As Banker to the Government, it receives deposits, Cheques and drafts deposited in the government account. 2. It makes short term advances to the Government. 3. It provides foreign exchange to government for the purchase of foreign goods, repaying external debts. 4. As Financial Agent it collects taxes and other payment on behalf of the Government. Banker to Commercial Banks 1. It holds cash reserves and deposits of commercial banks. 2. It rediscounts the bills of exchange of commercial banks to cover temporary difficulties. 3. Influence the creation of credit by the commercial banks in the best interest of the country. Controller of Credit Central bank tries to establish, i. Stability in the internal price level of the country. ii. Stability in the exchange rates iii. Instrument of credit control are (i) Bank Rate (ii) Open Market operation (iii) Cash Reserve Ratio. Clearing Agent As commercial banks keep there cash reserves with the Central bank so Central Bank can easily Settle the claims of various banks against each other with least use of cash. Lender of the Last resort As central bank is Supreme bank of the country, so if commercial banks are fail to meet their financial requirements so commercial bank can approach to the central bank for financial accommodation. The central bank as lender of last resort provides financial help to the commercial banks. Development Role Central bank undertakes the responsibility of economic growth with stability in the economy. It ensures that the funds available flow to the various priority sectors such as agricultures, export sector small scale sector. Other Function 1. It maintains relation with international agencies such as IMF, world bank. 2. It provides training facilities to the staff working in various banking institutions. 3. It conducts seminars, surveys and publishes and annual reports giving real economic picture of the economy. “Annual bulletin report” issued from Da Afghanistan Bank, which show information related to economy. Central Bank’s Monopoly of Note Issue & Method Monopoly of Note issue Central bank is the only authority to issue Notes in a country as we discussed early as well that issuing of notes by the central bank only have some advantages like; 1. 2. 3. 4. Uniformity in note circulation. Control over money supply Control over commercial banks Public confidence. Principle of Notes Issue Currency Principle Central bank of the country should keep 100% Gold for every note issued. It means full convertibility of notes. Banking Principle No need to keep 100% gold or silver against notes issued. The note issued in the country should be according to the needs of trade and industry. Cont…. Fixed Fiduciary System This is widely recognized as a important method of note issue. Under this system a limit of volume of currency has Been fixed by central authority. This limit is called fiduciary limit. Any note issue in this fiduciary limit is to be Backed by Government securities. Monetary Policy Monetary Policy is the deliberate exercise of the monetary authority’s power to induce expansion or contraction in the money supply. Objectives Promoting high employment. Achieving steady economic growth. Stable price level as a goal. Stability in Interest rate. Tools of Monetary Policy Tools Quantitative Control Qualitative Controls i) Open Market i) Consumer’s credit ii) Bank Rate iii) Credit Rationing iv) Varying Reserve ii) Use of moral persuasion iii) Direct Action Quantitative Instrument Open Market Operation It refers to purchase and sale of govt. securities by the central bank in open market, (Purchase and sale of any kind of paper) During inflation… Central bank sells securities which results decrease in supply of money… During deflation… Central bank purchase securities which results increase in supply of money Bank Rate Policy Bank rate is the rate of interest at which central bank advances loans to the commercial banks. When central bank increase the bank rate, commercial banks raise interest rate in giving out loans ,for decreasing the flow of money. When central bank decrease the bank rate, commercial banks lower the interest rate in giving out loans, for increasing the flow of money. Credit Rationing Under this method Central bank allots credit quota (portion) to commercial banks on basis of their business… In case of inflation… Central bank decrease credit quota… In case of deflation… Central bank increase credit quota…. Varying Reserve Ratios Central bank also control the credit by changing the reserve ratios of commercial banks which is normally 25%.... In times of inflation: Central bank increase the reserve ratio In times of deflation: Central bank decrease the reserve ratio Qualitative Controls Consumer Credit Control The consumer credit control technique of monetary management can be applied when there arises a scarcity of certain listed articles in the country. The central bank will invoke specific restrains on consumer credit by raising the required down payment and shortening the maximum period of repayment. Direct Action If commercial banks are following the policy that is inconsistent with the monitory policy of central bank… It can take direct action by imposing penalty over commercial banks…Like banning its new branches. Moral Persuasion If the commercial banks are pursuing the policy which the central bank does not like, it can call the meeting of the commercial banks and can explain to them the difficulties which the central bank of the country is facing. Central bank can also give them threats that if they do not follow the policy, so Central bank would not supply credit in times of crisis to them. Its only for short period of time.