Week 11

advertisement

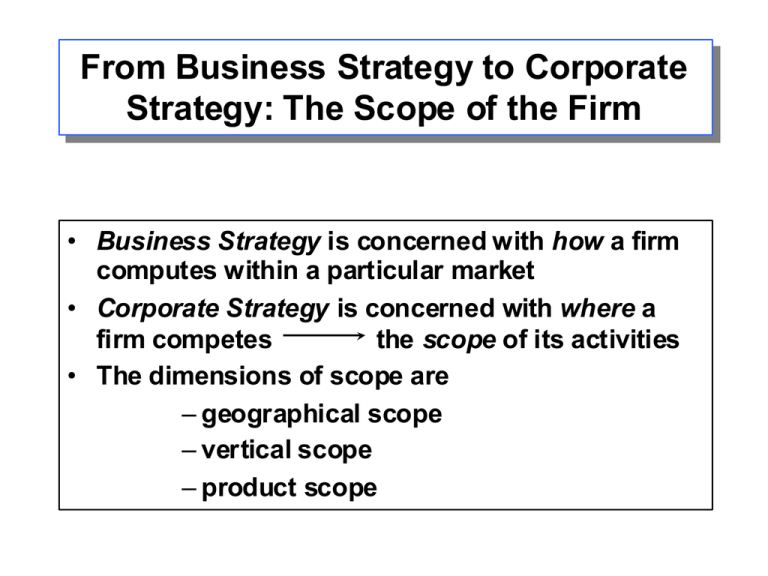

From From Business Business Strategy Strategy to to Corporate Corporate Strategy: Strategy: The The Scope Scope of of the the Firm Firm • Business Strategy is concerned with how a firm computes within a particular market • Corporate Strategy is concerned with where a firm competes the scope of its activities • The dimensions of scope are – geographical scope – vertical scope – product scope Transactions Costs and the Scope of the Firm Which is more efficient : several specialist firms linked by markets, or the combination of these specialist firms under common ownership. VERTICAL PRODUCT GEOGRAPHICAL AREAS SINGLE V1 P1 P2 P3 A1 A2 A3 FIRM V2 V3 SEVERAL V1 SPECIALIZED V2 FIRMS V3 P1 P2 P3 A1 A2 A3 Common Issue--- What are TRANSACTION COSTS of markets compared with administrative costs of the firm? Introduction (cont.) • Types of Diversification – Vertical integration • Strategy of acquiring control over additional links in value chain of producing and delivering products/services. • Backward integration – Moving closer to sources of raw materials by acquiring resource suppliers or manufacturing the components needed for production of final product. • Forward Integration – Just the opposite: moving closer to end-user (acquire retail outlets for distribution, etc.). Engineering and Design Exhibit: Vertical Integration Purchasing Backward Integration Assembly and Production After-Sale Service Forward Integration Determinants of Changes in Corporate Scope 1800 - 1975: Expansion in size & scope of biggest industrial corporations. Administrative costs of firms fell due to • Advances in transportation, information and communication technologies • Advances in management - accounting systems, decision sciences, financial techniques, organizational innovations, scientific management 1975 - 1995: Contraction in size & scope of biggest industrial corporations. Increased market turbulence, more competition, accelerated technological change Need for speed, flexibility, responsiveness Large, complex corporations become relatively less efficient The Costs and Benefits of Vertical Integration: BENEFITS • Technical economies from integrating processes e.g. iron and steel production -- but doesn’t necessarily require common ownership • Superior coordination • Avoids transactions costs of market contracts from: -- small numbers of firms -- transaction-specific investments -- opportunism and strategic misrepresentation -- taxes and regulations on market transactions Introduction (cont.) • Advantages of vertical integration – Greater control over costs and supply of components. – Avoids the transaction costs associated with dealing with vendors or retailers. – Ability to protect proprietary technology. – Ability to maintain or cultivate a company’s reputation for outstanding quality or service. The Costs and Benefits of Vertical Integration: COSTS • Differences in optimal scale of operation between different stages prevents balanced VI • Strategic differences between different vertical stages creates management difficulties • Inhibits development of and exploitation of core competencies • Limits flexibility -- in responding to demand cycles -- in responding to changes in technology, customer preferences, etc. (But VI may be conducive to system-wide flexibility) • Compounding of risk Introduction (cont.) • Disadvantages of vertical integration – Higher fixed overhead costs. – Integrated firms must deal with transfer price dilemma which can create serious morale and other internal problems. – Demand uncertainty creates problems. • Low demand can lead to underutilization of plant capacity. • High demand can result in dependence on outside suppliers. – Technological change can leave these firms stuck with old technology. When is Vertical Integration More Attractive than Outsourcing? How many firms are available to undertake the activities? Is transaction-specific investment needed? Does limited information permit cheating? Are taxes or regulation imposed on transactions? Do the two stages have similar optimal scale of operation? Are the two stages strategically similar? How uncertain is market demand? Does VI increase risk? The fewer the companies the more attractive is VI If yes, VI more attractive VI can limit opportunism VI can avoid them Greater the similarity, the more attractive is VI Greater the strategic similarity ---the more attractive is VI Greater the unpredictability ----the more costly is VI If heavy investment required and risks between stages are interrelated----VI increases risk. Designing Vertical Relationships: LongTerm Contracts and Quasi-Vertical Integration • Intermediate between spot transactions and vertical integration are several types of vertical relationships ---such relationships may combine benefits of both market transactions and internalization • Key issues in designing vertical relationships -- How is risk allocated between the parties? -- Are the incentives appropriate? Recent Trends in Vertical Relationships • From competitive contracting to supplier partnerships, e.g. in autos • From vertical integration to outsourcing (not just components, also IT, distribution, and administrative services). • Diffusion of franchising • Technology partnerships (e.g. IBM- Apple; Canon- HP) • Inter-firm networks General conclusion:- boundaries between firms and markets becoming increasingly blurred. Different Types of Vertical Relationship Degree of Commitment Low Formalization Low Informal supplier/ customer relationships Vertical integration Supplier/ customer partnerships Spot sales/ purchases Joint ventures Agency agreements Franchises Long-term contracts High High The Internationalization of Industries LO W International Trade HIGH The Process of Internationalization International Industries Global Industries --aerospace --military hardware --diamond mining --agriculture --automobiles --oil --semiconductors --consumer electronics Domestic Industries Multinational/ Multidomestic Industries --railroads --laundries/dry cleaning --hairdressing --milk LOW --retail banking --hotels --consulting Foreign Direct Investment HIGH Implications of Internationalization for Industry Analysis • • • INDUSTRY STRUCTURE Lower entry barriers around national markets Increased industry rivalry --- lower seller concentration --- greater diversity of competitors Increased buyer power: wider choice for dealers & consumers COMPETITION • Increased intensity of competition PROFITABILITY • Other things remaining equal, internationalization tends to reduce an industry’s margins & rate of return on capital Analyzing Competitive Advantage within an International Context: The Basic Framework FIRM RESOURCES & CAPABILITIES -- Financial resources THE INDUSTRY ENVIRONMENT Key Success Factors -- Physical resources -- Technology -- Reputation -- Functional capabilities -- General management capabilities COMPETITIVE ADVANTAGE THE NATIONAL ENVIRONMENT -- National resources and capabilities (raw materials; national culture; human resources; transportation, communication & legal infrastructure -- Domestic market conditions -- Government policies -- Exchange rates -- Related and supporting industries National Influences on Competitiveness: The Theory of Comparative Advantage A country is relatively efficient in the production of those products which make intensive use of resources which are relatively abundant within the country. E.g. • Philippines relatively more efficient in the production of footwear, apparel, and assembled electronic products than in the production of chemicals and automobiles. • U.S. is relatively more efficient in the production of semiconductors and pharmaceuticals than shoes or shirts. When exchange rates are well-behaved, comparative advantage emerges as competitive advantage. Porter’s Competitive Advantage of Nations Extends and modifies traditional theory of comparative advantage to take account of the following factors: • Competitive advantage is about companies --- the importance of the national environment is providing a home base for the company. • Sustained competitive advantage depends upon dynamic factors-- innovation and the upgrading of firm’s resources and capabilities • The critical role of the national environment is its influence upon the dynamics of innovation and upgrading. Porter’s National Diamond Framework FACTOR CONDITIONS RELATING AND SUPPORTING INDUSTRIES DEMAND CONDITIONS STRATEGY, STRUCTURE, AND RIVALRY 1. 2. 3. 4. FACTOR CONDITIONS. “Home grown” resources and capabilities more important than natural endowments. RELATED AND SUPPORTING INDUSTRIES. Competitive advantage occurs in “industry clusters” (e.g. semiconductors-computers-software in the U.S.). DEMAND CONDITIONS. Discerning domestic customers drive quality and innovation (e.g. Japanese camera industry) STRATEGY, STRUCTURE, RIVALRY. E.g. domestic rivalry drives innovation and upgrading. Consistency Between Strategy and National Conditions In globally-competitive industries, firm strategy needs to take account of national conditions: – U.S. textile manufacturers must compete on the basis of advanced process technologies and focus on high quality, less price-sensitive market segments – Malaysian semiconductor manufacturers can be competitive in high volume, less technologically advanced items (e.g. memory chips) – Dispersion of value chain to exploit different national environments (e.g. Nike: R&D in U.S., components in Korea and Taiwan, assembly in China, Thailand and India, marketing in Europe and North America) International Location of Production 3 considerations: – National resource conditions: What are the major resources which the product requires? Where are these available at low cost? – Firm-specific advantages: to what extent is the company’s competitive advantage based upon firmspecific resources and capabilities, and are these transferable? – Tradability issues: Can the product be transported at economic cost? If not, or if trade restrictions exist, then production must be close to the market. International Location of Industrial Activities within the Value Chain The optimal location of activity X considered independently WHERE TO LOCATE ACTIVITY X? The importance of links between activity X and other activities of the firm Where is the optimal location of X in terms of the cost and availability of inputs? What government incentives/ penalties affect the location decision? What internal resources and capabilities does the firm possess in particular locations? What is the firm’s business strategy (e.g. cost vs. differentiation advantage)? How great are the benefits of linkages through proximity? Overseas Market Entry: Alternative Modes TRANSACTIONS DIRECT INVESTMENT Exporting: Exporting: Exporting: Licensing Franchising Joint Wholly owned Spot Long-term with foreign technology venture subsidiary transcontract distributor/ and Marketing & Fully Marketing Fully actions agent trademarks distribution integral- & sales integralonly ted only ted Key issues: • Is the firm’s competitive advantages based upon firm-specific or country-specific resources and capabilities? • Is the product tradable and what are the barriers to/ costs of trade? • Does the firm possess the full range of resources and capabilities needed to serve the overseas market? Introduction (cont.) • Global diversification – Usually motivated by desire to grow (Boeing, Kellogg’s, Caterpillar). – Simplest route is exporting. – Others include licensing or franchising. – Most complex route is to establish wholly-owned subsidiaries. Introduction (cont.) – Challenges in global diversification: • Most difficult challenge is to appreciate the unique cultures and customs of foreign markets. – Need for products to be adapted to accommodate these markets. Alliances and Joint Ventures: Management Issues • • • Benefits: ability to combine different resources and capabilities of separate partners, ability to learn from one another. Problems: management differences between the two partners. Conflict potential greatest where the partners are also competitors. Collaborating with competitors: benefits seldom shared equally. Determinants of distribution of benefits: – Strategic intent of the partners- which partner has the clearer vision of the purpose of the alliance? – Appropriability of the contribution-- which partner’s resources and capabilities can more easily be captured by the other? – Absorptive capacity of the company-- which partner is the more receptive learner? Multinational Strategies: Globalization versus National differentiation The case for a global strategy: • National preferences in decline-- possible to view the Ted Levitt world becoming a single, if segmented, market. “Global-ization • Access to global scale economies--cost savings in purchasing, Thesis” manufacturing, product development and marketing. • Strategic strength from global positioning-- but Hamel & Prahalad locating in multiple national markets, by locating in multiple Thesis national markets, the global competitor can cross-subsidize to attack nationally focused rivals. Need to access market trends and technological Kenichi Ohmae’s “Triad Power” developments in each of the world’s major economic Thesis centers- N. America, Europe, EastAsia. } Strategy and Organization of the MNC: The Evolution of Multinational Strategies and Structures : (1) Pre 2nd WW: Era of the Europeans The European MNC as Decentralized Federation : • National subsidiaries self-sufficient and autonomous • Parent control through appointment of subsidiaries senior management • Organization and management systems reflect conditions of transport and communications at the time e.g. Unilever, Phillips, Courtaulds, Royal Dutch/Shell. Strategy and Organization of the MNC: The Evolution of Multinational Strategies and Structures: (2) Post 2nd WW: U.S. Dominance American MNC’s as Coordinated Federations : • National subsidiaries fairly autonomous • Dominant role as U.S. parent-- especially in developing new technology and products • Parent-subsidiary relations involved flows of technology and finance, and appointment of top management.e.g. Ford, GM, Coca Cola, IBM Strategy and Organization of the MNC: The Evolution of Multinational Strategies and Structures: (3) 1970’s and 1980’s: The Japanese Challenge The Japanese MNC as Centralized Hub • Pursuit of global strategy from home base • Strategy, technology development, and manufacture concentrated at home • National subsidiaries primarily sales and distribution companies with limited autonomy. e.g. Toyota, NEC, Matsushita Matching Global Strategies and Structures to Industry Conditions Degree of globalization depends upon the benefits of global integration versus the benefits of national differentiation. Key issue: --How important are global scale economies? --How different are customer requirements between countries? Benefits of global integration • Jet engines • Consumer • Telecommunications electronics equipment • Cement • Packaged grocery products Benefits of national differentiation Marketing Global Strategies and Situations to Industry Conditions: Firm Success in Different Industries Philips General Electric local responsiveness responsiveness Telecommunications Equipment Kao P&G Unilever local responsiveness global integration Matsushita Branded, Packaged Consumer Goods global integration global integration Consumer Electronics NEC Erickson ITT local - Global industry - Substantial national - Requires both global - Matsushita the most successful - Philips the survivor - GE sold out differentiation, few global scale economies - Kao has limited success outside Japan - Unilever and P&G most successful integration and national differentiation. - NEC only partially successful - ITT sold out - Ericsson most successful Reconciling Global Integration with National Differentiation: The Transnational Corporation Tight complex controls and coordination and a shared strategic decision process. Heavy flows of technology, finances, people, and materials between interdependent units. The Transnational: an integrated network of distributed interdependent resources and capabilities. – Each national unit and source of ideas, skills and capabilities that can be harnessed to benefit whole corporation. – National units become world sources for particular products, components, and activities. – Corporate center involved in orchestrating collaboration through creating the right organizational context.