NEW! FLEXIBLE SPENDING ACCCOUNTS IN 2008

advertisement

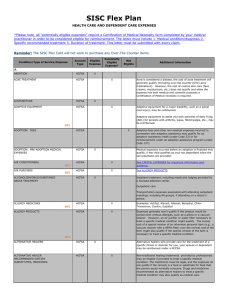

NEW! FLEXIBLE SPENDING ACCOUNTS IN 2008 FOR TRUST FUND EMPLOYEES FLEXIBLE SPENDING ACCOUNTS A Flexible Spending Account (FSA) allows you to set aside a portion of your salary to be used to reimburse yourself for qualified health care and dependent care expenses. Your taxable salary is reduced by the amount deducted from your paycheck to fund your account(s), resulting in lower income and Social Security taxes. FLEXIBLE SPENDING ACCOUNTS Two types of FSAs will be available as of January 1, 2008 1. Health Care FSA 2. Dependent Care FSA FLEXIBLE SPENDING ACCOUNTS HEALTH CARE FSA Allows you to set aside a specified amount of pretax dollars to be used for reimbursement of eligible unreimbursed medical expenses DEPENDENT CARE FSA Allows you to elect a specified amount of pretax dollars for the reimbursement of employment-related dependent care expenses that you and/or your spouse (if married) incur due to your need to work, look for work, or attend school full-time FLEXIBLE SPENDING ACCOUNTS ELIGIBILITY FOR PARTICIPATION Active indefinite Trust employees who work at least 40 hours per pay period, or active temporary employees with appointments of at least 90 days whose work schedule is at least 40 hours per pay period. FLEXIBLE SPENDING ACCOUNTS OPEN SEASON ENROLLMENT NOVEMBER 12 THROUGH DECEMBER 10 Open Season enrollment will be online through CONEXIS at www.conexis.org Follow the instructions in the handout – CONEXIS ~ Online, It’s as easy as 1,2,3 ! FLEXIBLE SPENDING ACCOUNTS 2008 annual minimum for either plan: $250.00 2008 annual maximum for either plan: $5,000.00 FLEXIBLE SPENDING ACCOUNTS HOW ACCOUNTS ARE FUNDED Pre-tax payroll deductions Funding may have an impact on your cash flow, i.e., you essentially “pay twice” for your eligible expenses, once via pre-tax payroll deduction to fund your account, and again when you actually incur and pay the expense. You will realize the FSA’s full benefit when you receive your tax-free reimbursement. You cannot transfer funds between the HCFSA and DCFSA FLEXIBLE SPENDING ACCOUNTS IMPACT ON YOUR PAY AND OTHER BENEFITS Pre-tax FSA contributions will reduce your taxable wages for income tax purposes Pay-related benefits (employer-sponsored life, disability insurance and retirement benefits) are not reduced Social Security (FICA) taxes are based on your reduced pay – future Social Security benefits may be slightly lower. FLEXIBLE SPENDING ACCOUNTS The Plan Year begins January 1, 2008 May incur claims until March 15, 2009 Must submit claims for reimbursement by April 30, 2009 You must complete a new election each year during Open Season. FLEXIBLE SPENDING ACCOUNTS “QUALIFYING LIFE EVENTS” PERMIT CHANGE Birth or adoption of a child Military deployment Change in legal marital status Death of a dependent Change in dependent eligibility Change in employment Change in child/elder care provider or significant cost change Change in employment affecting eligibility for benefits. FLEXIBLE SPENDING ACCOUNTS HEALTH CARE FLEXIBLE SPENDING ACCOUNTS (HCFSA) Allows you to set aside a specified amount of pretax dollars to be used for reimbursement of eligible unreimbursed medical expenses. HCFSA ELIGIBLE DEPENDENTS HCFSA expenses must be for you, your spouse, your child or a tax-qualified dependent. A tax-qualified dependent is someone for whom you can claim a federal tax exemption. HCFSA COST SAVINGS EXAMPLE: Estimated Eligible Expenses Prescription Drug Copays Doctor Visit Copays Annual Dental Deductible Prescription Eyeglasses Prescription Sunglasses Chiropractor Visits Unreimbursed dental expenses Total Est. 30% tax bracket SAVINGS Example $400.00 30.00 50.00 250.00 150.00 300.00 1,000.00 $2,180.00 x .30 $654.00 HCFSA EXAMPLES OF HCFSA ELIGIBLE EXPENSES Over-the-counter medicines (allergy, antacid, aspirin, etc.) Copayments, coinsurance, and deductibles (not insurance premiums) Dental care and orthodontia (children and adults) Vision care (including eyeglasses, contact lenses, saline solution, etc.) Laser vision correction Chiropractic care Diagnostic services Diabetic supplies Immunizations Hearing aids Orthopedic shoes and inserts Durable medical equipment … and more HCFSA EXAMPLES OF INELIGIBLE HEALTH CARE EXPENSES Expenses that are not deductible on your federal income tax return Controlled substances Cosmetic dental work Cosmetic surgery Diaper service Electrolysis Health care plan contributions Health club dues Vitamins or weight loss aids HCFSA WHEN TO FILE CLAIMS Claims for unreimbursed medical expenses can be submitted at any time throughout the year, regardless of the funding available in your HCFSA account. HCFSA The request for reimbursement (claim form) is on the CONEXIS website, www.conexis.org HOW TO SUBMIT A HCFSA CLAIM INCLUDE ONE OF THE FOLLOWING: Itemized statement from the service provider Insurance explanation of benefits (EOB) Pharmacy statement for prescription drugs Itemized cash register receipt for eligible OTC medications. HCFSA ITEMIZED STATEMENT MUST INCLUDE: Nature of the expense (e.g. type of service or treatment provided), or if an OTC drug, the receipt must indicate the name of the drug Date of service Name of provider Amount of the expense Patient’s name HCFSA QUESTIONS? FLEXIBLE SPENDING ACCOUNTS DEPENDENT CARE FSA Allows you to elect a specific amount of pretax dollars for the reimbursement of employment-related dependent care expenses that you and/or your spouse (if married) incur due to your need to work, look for work, or attend school full-time. DCFSA “QUALIFYING CHILD” DEFINITION An individual who is a qualifying child of the employee, (including brother, sister, stepsibling) or descendant of the child (niece, nephew, grandchild) who shares the same principal place of abode with the employee for over half the year and does not provide over half of his/her support. DCFSA EXAMPLES OF DCFSA ELIGIBLE EXPENSES Before and after school care Care for a child under age 13 Care for disabled or elderly dependent Care given by a nanny Care at a sick child facility Summer day camp Tuition for pre-kindergarten or nursery school DCFSA IRS LIMITATIONS IF YOUR SPOUSE ALSO CONTRIBUTES TO A DCFSA You are limited to a combined DCFSA contribution of $5,000 in a calendar year If you and your spouse file separate federal tax returns, the most you can contribute is $2,500 a year If you file a joint return, you can’t contribute more than you earn (or what your spouse earns, if it is less than what you earn for the year), with a limit of $5,000. DCFSA COST SAVINGS EXAMPLE Estimated Eligible Expenses Before/after school programs Summer day camp Total Est. 30% tax bracket SAVINGS Example $3,000.00 2,000.00 $5,000.00 x .30 $1,500.00 DCFSA DEPENDENT CARE CLAIMS Must be fully completed and signed, including provider certification. Dependent care claims without provider signature/certification must include itemized statement with: • • • • • Date(s) of service Dependent’s name and date of birth Itemization of charges Provider’s name, address and tax ID/SSN Note: cancelled checks, cash register receipts and credit card receipts are not acceptable. DCFSA WHEN TO FILE CLAIMS Claims for dependent care expenses can be submitted at any time throughout the year, but your dependent care account balance must be sufficient to cover the claimed amount at the time of your claim submission. DCFSA QUESTIONS? FLEXIBLE SPENDING ACCOUNTS REMINDER! CAREFULLY CALCULATE THE AMOUNT YOU ELECT TO CONTRIBUTE TO YOUR FSA ACCOUNTS. THE IRS IMPOSES A “USE IT OR LOSE IT” RULE – YOU FORFEIT ANY REMAINING MONEY IN YOUR ACCOUNT AFTER REIMBURSEMENT OF ELIGIBLE EXPENSES FOR THE YEAR. FLEXIBLE SPENDING ACCOUNTS Estimate your annual unreimbursed medical and/or dependent care expenses. Follow the step-by-step instructions to enroll online at www.conexis.org between November 12 and December 10, 2007 FSA Customer Service: (866) 279-8385 customerservice@conexis.com