Risk Management presentation

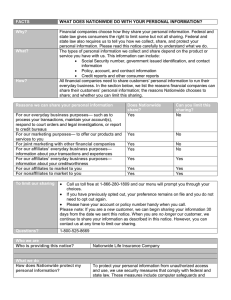

The use of asset allocation does not guarantee returns or insulate you from potential

losses.

Dollar cost averaging does not assure a profit and does not guarantee against loss in a

declining market. This type of strategy involves continuous investment in the security

regardless of fluctuating price levels of such securities. Investors should consider their

financial ability to continue purchases through periods of low price levels.

Investing involves market risk, including possible loss of principal and possible

fluctuations in value.

The Nationwide Group Retirement Series includes unregistered group fixed and

variable annuities and trust programs. The unregistered group fixed and variable

annuities are issued by Nationwide Life Insurance Company. Trust programs and

trust services are offered by Nationwide Trust Company, FSB, a division of

Nationwide Bank. Nationwide Investment Services Corporation, member FINRA.

In MI only: Nationwide Investment Svcs. Corporation. Nationwide Mutual Insurance

Company and Affiliated Companies, Home Office: Columbus, OH 43215-2220.

The Nationwide framemark, Nationwide Financial and On Your Side Interactive

Retirement Planner are service marks of Nationwide Mutual Insurance Company.

© 2013 Nationwide Financial Services, Inc. All rights reserved.

PNM-2472AO.1 (06/13)

Budgeting

Risk Management

Asset allocation

Rebalance your account

Dollar cost averaging

Investment goals

Risk Management

Agenda

Risk Management

4

Asset allocation

Risk Management

Asset allocation

5

Risk Management

6

Asset allocation

Risk Management

Aggressive

7

Asset allocation

Moderately

Aggressive

Moderate

Moderately

Conservative

Conservative

Risk Management

Rebalance your account

Source: Boost Your 401(k) Returns with Rebalancing, 401(k) Helpcenter, 02/13.

8

Risk Management

You get

a new look

at all of the

investment

options

Rebalance your account

You can use profits

to invest into

underperforming

funds that may

have merit

You potentially

smooth out

investment

returns

Source: http://money.usnews.com/money/blogs/the-smarter-mutual-fund-investor/2011/03/15/why-rebalancing-your-portfolio-is-important,

accessed 02/07/2013

9

Risk Management

Rebalance your account

10

Risk Management

•

•

11

Dollar cost averaging

Risk Management

Dollar cost averaging

12

Risk Management

Investment goals

13

Risk Management

Investment goals

14

Risk Management

Summary

15

Types of Risk

16