Financial Accounting II (Allied)

advertisement

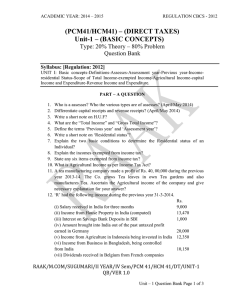

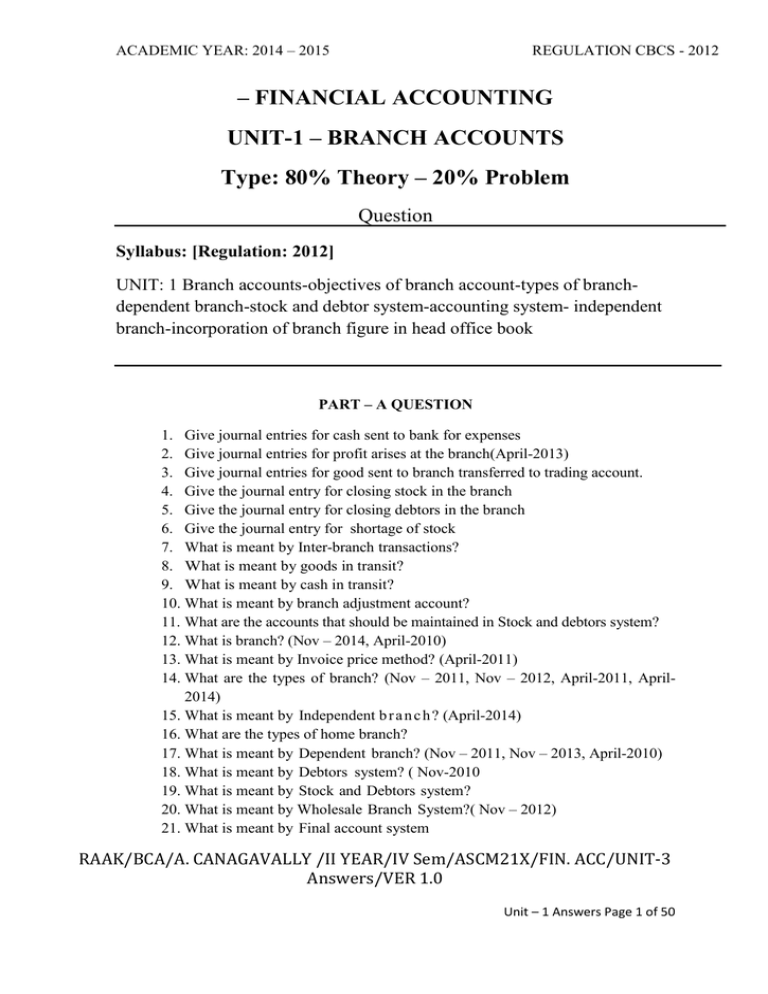

ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 – FINANCIAL ACCOUNTING UNIT-1 – BRANCH ACCOUNTS Type: 80% Theory – 20% Problem Question Syllabus: [Regulation: 2012] UNIT: 1 Branch accounts-objectives of branch account-types of branchdependent branch-stock and debtor system-accounting system- independent branch-incorporation of branch figure in head office book PART – A QUESTION 1. Give journal entries for cash sent to bank for expenses 2. Give journal entries for profit arises at the branch(April-2013) 3. Give journal entries for good sent to branch transferred to trading account. 4. Give the journal entry for closing stock in the branch 5. Give the journal entry for closing debtors in the branch 6. Give the journal entry for shortage of stock 7. What is meant by Inter-branch transactions? 8. What is meant by goods in transit? 9. What is meant by cash in transit? 10. What is meant by branch adjustment account? 11. What are the accounts that should be maintained in Stock and debtors system? 12. What is branch? (Nov – 2014, April-2010) 13. What is meant by Invoice price method? (April-2011) 14. What are the types of branch? (Nov – 2011, Nov – 2012, April-2011, April2014) 15. What is meant by Independent b r a n c h ? (April-2014) 16. What are the types of home branch? 17. What is meant by Dependent branch? (Nov – 2011, Nov – 2013, April-2010) 18. What is meant by Debtors system? ( Nov-2010 19. What is meant by Stock and Debtors system? 20. What is meant by Wholesale Branch System?( Nov – 2012) 21. What is meant by Final account system RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 1 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 22. What is meant by Foreign Branch? 23. Give journal entries for good sent to branch(April-2013) PART-B QUESTION Write down the features of dependent branch. (Nov – 2013) Give Journal entries passed in the books of head office. Questions in answer book . Questions in answer book Questions in answer book Questions in answer book . Questions in answer book Write down the objectives of branch accounting.( NOV – 2010, Nov – 2014, April-2010, April-2013, April-2014 9. Distinction between wholesale and retail profit at branch. 10. Write down the features of independent branch. 1. 2. 3. 4. 5. 6. 7. 8. PART-C QUESTION 1. 2. 3. 4. 5. Difference between Independent & Dependent Branch. (NOV – 2010) Question in answer book Question in answer book Question in answer book Question in answer book RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 2 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 UCM 21 – FINANCIAL ACCOUNTING UNIT-1 – BRANCH ACCOUNTS Type: 80% Theory – 20% Problem Question & Answers PART – A ANSWERS 1. Give journal entries for good sent to branch transferred to trading account. Goods sent to Branch A/c Dr. To Trading A/c 2. Give journal entries for profit arises at the branch(April-2013) Branch A/c Dr. To Profit and Loss A/c 3. Give journal entries for cash sent to bank for expenses Branch A/c To Bank A/c Dr. 4. Give the journal entry for closing stock in the branch Branch stock A/c To Branch Dr. 5. Give the journal entry for closing debtors in the branch Branch Debtors A/c To Branch A/c Dr. 6. Give the journal entry for shortage of stock Branch adjustment A/c Dr. To Branch Stock A/c RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 3 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 7. What is meant by Inter-branch transactions ? The head office has many branches and there is a possibility that some branch may supply goods or send cash to the other branch are called inter-branch transactions. 8. What is meant by goods in transit ? When goods are dispatched by the head office to branch and the branch does not receive it even upto the end of the year, it is known as goods in transit. 9. What is meant by cash in transit ? The cash sent by branch to H.O. or the cash sent by H.O. to branch has not been received by the other party upto the end of the year, it is known as cash in transit. 10. What is meant by branch adjustment account? This account is prepared for ascertaining the amount of gross profit earned by the branch. This is done by eliminating the profit element or the ‘loading’ included in the value of opening and closing stock at branch, goods sent to branch, less returns made by branch to head office and in surplus or shortage in branch stock etc. 11. What are the accounts that should be maintained in Stock and debtors system? Branch Stock Account. Branch Debtors Account Branch Expenses Account. Branch Adjustment account Branch profit and loss account and Goods sent to the branch account 12. What is branch? (Nov – 2014, April-2010) The word ‘branch’ is any subordinate division of a business, subsidiary shop, office etc. Business is carried out in different areas scattered over a large territory. 13. What is meant by Invoice price method? (April-2011) When the goods are sent by the head office to the branch at invoice price means cost plus some percentage of profit, the branch manager required to sell the goods at invoice price only. 14. What are the types of branch? (Nov – 2011, Nov – 2012, April-2011, April-2014) Home branch Foreign branch RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 4 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 15. What is meant by Independent branch ? (April-2014) Branch which maintains its own set of books and has freedom to operate independently. If a branch is big and carries on manufacturing operations also, it is allowed to operate freely within the framework of head office policies. 16. What are the types of home branch? Dependent branch Independent branch 17. What is meant by Dependent branch? (Nov – 2011, Nov – 2013, April-2010) These branches are inland branches wholly dependent on the head office for their requirements. These branches do not maintain their own set of books, and all the records of the branch are maintained by the head office. 18. What is meant by Debtors system? ( Nov-2010) This system is adopted in case of branches of small size. Under this system a branch account is opened separately for each branch in the books of head office. 19. What is meant by Stock and Debtors system? Profit or loss of a branch can be found out by preparing branch account , but there is another method for the same purpose is known as stock and debtors method. 20. What is meant by Wholesale Branch System?( Nov – 2012) Manufacturers may sell goods to the consumers either through the wholesalers and approved stockiest or through their branches. The person/corporate buy the goods at bulk for the purpose of sell. 21. What is meant by Final account system? The head office can also ascertain the profit or loss of a dependent branch by preparing branch trading and profit and loss of a dependent branch by preparing branch trading and profit and loss account at cost. 22. What is meant by Foreign Branch? The head office in inland and its branch in foreign country, these branches is called foreign branch. The foreign branch keeps their accounts not in the home currency the values will be expressed in foreign currency, now the same has to be converted into home currency. RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 5 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 23. Give journal entries for good sent to branch(April-2013) Branch a/c Dr. To goods sent to Branch A/c PART – B ANSWERS 1. Write down the features of dependent branch. (Nov – 2013) It do not maintain its books of accounts Goods are supplied by head office to the branch. Branch receives the goods and sells them as per the direction of the head office. All the expenses of branches are paid directly by the head office. The head office provides petty cash to the branch to meet some petty expenses, so only simple petty cash book is maintained at the branch The branch remits cash to the head office which are from the sale proceeds and collection from debtors in case of credit sales. 2. Journal entries passed in the books of head office (i) Branch a/c Dr. To goods sent to Branch A/c (ii) Branch A/c Dr. Invoice value of goods sent. Cash sent for expenses. RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 6 of 50 ACADEMIC YEAR: 2014 – 2015 To Bank A/c (iii) Bank A/c To Branch A/c (iv) Branch Stock A/c REGULATION CBCS - 2012 Dr Cash remitted by the branch to the H.O. (Cash consists of sales and receipts from Drs.) Dr. Branch stock (at invoice Price) and branch Branch Debtors A/c Dr. Debtors at the end of year. To Branch A/c (v) Goods Sent to Branch A/c Dr. Invoice price on goods sent to branch adjusted. To Branch A/c (Loading on the goods sent) (vi) Branch A/c Dr. Invoice value of closing stock adjusted. To Branch Stock Reserve A/c (vii) Branch A/c Dr. Profit at branch To Profit and Loss A/c (viii) Goods sent to Branch A/c Dr. Goods sent to Branch Transferred. To Trading A/c 3.Layal company opened a branch at madras on 1.1.89. From the following particulars the madras branch account for the year 1989 and 1990. (Nov – 2011, Nov – 2013) 1989 Rs. 1990 Rs. 15000 45000 Rent 1800 1800 Salaries 3000 5000 Other expenses 1200 1600 24000 60000 2300 5800 40 30 Goods sent to branch Cash sent to branch for : Cash received from the branch Stock on 31st December Petty cash on 31st December IN THE BOOKS OF HEAD OFFICE Madras branch A/c for 1989 RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 7 of 50 ACADEMIC YEAR: 2014 – 2015 Particulars REGULATION CBCS - 2012 Rs. Rs. To balance b/d Particulars Rs. Rs. NIL By cash TO Goods sent to branch 24000 15000 By Balance C/d To Cash: Stock Rent 1800 Salaries 3000 Other expenses 1200 2300 Petty cash 40 2340 6000 To General P&L A/c 5340 26340 26340 Madras branch A/c for 1989 Particulars Rs. Rs. Particulars To balance b/d Stock Petty cash Rs. Rs. By cash 2300 40 TO Goods sent to branch 60000 By Balance C/d 2340 Stock 5800 45000 Petty cash 30 5830 To Cash: Rent 1800 Salaries 5000 Other expenses 1600 To General P&L A/c 8400 10090 65830 65830 RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 8 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 4. Prepare branch accounts for the year 1994. From the following particulars the Madurai branch account for the year 1994 (Nov – 2011, Nov – 2012, Nov – 2014, April-2010, April-2011, April-2013, April-2014) Stock on 1.1.94 11200 Debtors on 1.1.94 6300 Goods sent to branch 51000 Cash sent to branch for : Rent 1500 Salaries 3000 Petty cash 500 5000 Sales at branch Cash 25000 Credit 39000 64000 Cash received from debtors 41200 Stock on 31.12.94 13600 Madurai branch A/c for 1994 Particulars Rs. Rs. To balance b/d Stock Debtors Particulars Rs. Rs. By Bank : 11200 Cash sales 25000 6300 17500 Cash from debtors 41200 TO Goods sent to branch 66200 51000 To Bank: Rent 1500 By Balance C/d Salaries 3000 Stock 13600 RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 9 of 50 ACADEMIC YEAR: 2014 – 2015 Petty cash REGULATION CBCS - 2012 500 To General P&L A/c 5000 Debtors 4100 17700 10400 83900 83900 5.From the following particulars prepare a branch account showing the profit or loss at the branch Rs. Opening stock at the branch 15000 Goods sent to branch 45000 Sales 60000 Salaries 5000 Other expenses 2000 Closing stock could not be ascertained but it is known that the branch usually sells at cost plus 20%. The branch manager is entitled to a commission of 5% of the profit of the branch before charging such commission. Branch A/c Particulars To Opening stock at the branch To Goods sent to branch Rs Particulars Rs 15000 By Sales 60000 45000 By Closing stock 10000 To Salaries 5000 To Other expenses 2000 RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 10 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 To Manager’s commission 150 To Net profit –transfer to P & L A/c 2850 70000 70000 6. A Madras head office has a branch at Salem to which goods are invoiced cost plus 20%. From the following particulars prepare branch a/c in the books of head office. (Nov – 2012, April-2011, April-2013) Stock on 1.1.96 7680 Debtors on 1.1.96 24000 Stock on 31.12.96 13440 Goods sent to branch 211872 Total sales 206400 Cash sales 110400 Cash received from debtors 88000 Salem branch A/c for 1996 Particulars Rs. To balance b/d Stock Debtors To Goods sent to branch Rs. Particulars Rs. Rs. By Bank : 7680 Cash sales 110400 24000 31680 Cash from debtors 88000 211872 By Stock Reserve 1280 By Goods sent to branch - Loading 35312 By Balance C/d Stock 198400 13440 RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 11 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 To Stock Reserve 2240 Debtors To General P&L A/c 32000 45440 34640 280432 280432 7. A head office sends goods to its branch at 20% less than the list price. Good are sold to customers at cost plus 100%. From the following particulars ascertain the profit made at the head office and the branch on whole sale basis. Particulars Head office Head office Purchases 200000 - Goods sent to branch 80000 - Sales 170000 80000 Trading , Profit & Loss A/c Particular To Purchases To Goods received from H.O To Gross Profit To Stock reserve Branch Head office Branch 200000 Particular Branch 170000 80000 - By Goods sent to 80000 branch 80000 - 115000 By Closing 16000 stock 65000 16000 315000 96000 315000 96000 115000 16000 6000 - By Sales Head office By Gross Profit RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 12 of 50 ACADEMIC YEAR: 2014 – 2015 To Net Profit 109000 16000 115000 16000 REGULATION CBCS - 2012 115000 16000 8.Write down the objectives of branch accounting.( NOV – 2010, Nov – 2014, April-2010, April-2013, April2014) To Ascertain the profit or loss of the branches To have a better control over the branches by the head office To know the financial position of the branches To enable the head office to know the requirements of goods and cash of each branch To provide suggestions for improvements To formulate further programmes and policies relating to the branches. 9.Distinction between wholesale and retail profit at branch. Sometimes head office also sells goods at retail or list price besides sending the goods to branches at wholesale prices. The difference between the retail price and wholesale price will be the profit made by the branch. Suppose if an article costs to head office Rs. 100 and it is supplied to the branches at Rs. 160 at wholesale price but both head office and branches sell goods at Rs. 200, then, profit made by the branch will be Rs. 40 (i.e., Rs. 200 –Rs. 160) and not Rs. 100 (Rs. 200-Rs.100). The goods are sent by the head office to the branches at Wholesale price and if all the goods are sold there is no problem but if some goods remain unsold at the end of the accounting year, these unsold goods at the branches must be reduced to cost price by making a stock reserve for unrealized profit for the difference between eh wholesale and cost price and will be debited to the head office profit and loss account, as previously the head office must have earned profit while sending goods to the branches. 10.Write down the features of independent branch. () They need not depend on the Head office for their requirements of supplies of goods. They can make purchases themselves. Of course, they can also obtain supplies of goods from the head office as and when they want. RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 13 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 They can only sell goods for cash and credit at any price they consider profitable. They need not remit the money received by them from cash sales and debtors to the Head office periodically. They can retain the funds and meet their day-to-day expenses out of those funds. Finally, if they have surplus cash in their hands, they can remit the same to the Head office. They keep a complete set of books for recording their transactions. So, they can prepare their own Trial Balance, Trading and Profit and Loss Account and Balance Sheet. However, as they are ultimately responsible to the Head office, at the end of every financial period, they are required to submit a copy of their Trial Balance to the Head office PART – C ANSWERS 6. Difference between Independent & Dependent Branch. (NOV – 2010) RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 14 of 50 ACADEMIC YEAR: 2014 – 2015 Sr. Basis Independent Branch 1. Accounting System 2. Sale of Goods 3. Point of Payment of Expenses 4. 5. Remittance of Cash Trial Balance Reconciliation 7. Methods of Preparing Final Dependent Branch Independent branch keeps The accounts of branches are full system of accounting at their maintained at the Head Office level. place. At branch only Cash Register. Debtors Register are maintained. These branches sell goods These branches sell only those received from head office as goods which are supplied by the Head well as from the purchases office. They are normally not allowed made by them. to make own purchases. Branch keeps the required cash to meet the expenses of regular nature with themselves. Independent Branches are not required to remit all the cash daily to head office. A trial balance has been extracted from the ledger maintained at branch level. 6. Account REGULATION CBCS - 2012 All branch expenses of regular nature like salary, Rent normally paid directly by head office. Branch managers are allowed to incur petty expenses All the only. daily cash sale and collection from debtors will be deposited at local bank or remitted to Trial H.O. Balance is not required to be extracted as accounts are maintained at Head Office. Reconciliation between There is no need of reconciliation branch Account in books of head office and head office as accounts are maintained at Account in the books of Branch head office level itself. is to be made before finalising the Accounts. Accounting is done on the Accounting under Dependent branches double entry system basis, so can be made by three Trading/P&L different methods are Debtors system, A/c has been prepared in Final Account system and Stock and normal way. Debtors system. 2. A Limited opened a branch at Shimla in 2002. Goods were invoiced at cost plus 25%. From the following prepare ledger accounts in the books of A Limited.( April-2010) Rs. Goods sent to Shimla (Invoice Price) 40,000 Sales at Shimla : RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 15 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 Cash Sales 21,000 Credit Sales 16,000 Cash collected from debtors 14,500 Discount allowed 200 Cash sent to Branch for expenses 4,000 Stock at Branch, 31st Dec.2002 (Invoice Price) 3,200 Branch A/c Date 2002 Dec.31 Particulars To Goods sent to Date Rs . Particulars 2002 40,000 Branch A/c Rs . By Bank (Remittance) Cash sales Dec.31 21,000 Cash Form Drs. 14,500 To Bank (Expenses) 35,500 4,000 To Bank stock Reserve A/c To P & L A/c transfer By Branch Stock A/c 3,200 By Branch Debtors A/c 1,300 By Goods sent to Branch A/c 640 8,000 (loading) 3,360 48,000 48,000 Goods sent to branch A/c Date Particulars Rs . Date Particulars Rs . RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 16 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 2002 Dec.31 8,000 To Shimla Branch A/c 2002 40,000 Dec.31 (Loading) By Shimla Brach A/c 32,000 To Trading A/c (transfer) 40,000 40,000 Branch Debtors A/c Date Particulars 2002 Dec.31 Rs . 16,000 To Sales A/c Date Particulars 2002 Dec.31 Rs . 14,500 By Cash By Discount 200 1,300 By Balance c/d 16,000 16,000 Branch Stock A/c Date 2002 Dec.31 Particulars To Shimla Branch A/c Rs . Date 2002 3,200 Particulars By Balance c/d Rs . 3,200 Dec.31 RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 17 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 3200 3,200 Branch Stock Reserve A/c Date 2002 Particulars Date Rs . 640 To Balance c/d Dec.31 2002 Dec.31 Particulars Rs . By Shimla Branch A/c 640 640 640 3. A Ltd. has a branch in Calcutta. Goods are invoiced at cost plus 25%. (Nov – 2011, Nov – 2012, Nov – 2013, April-2014) ( Opening Balance Stock 3,200 Debtors 1,300 Goods sent to Branch (Invoice price) 75,000 Sales at Calcutta Cash Sales 32,000 Credit Sales 38,000 Cash collected from Debtors 33,400 Discount allowed 400 Bad Debts written off 250 Cash sent to Branch for expenses 5,500 Stock at end 7,900 Branch Adjustment A/c RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 18 of 50 Branch Stock A/c ACADEMIC YEAR: 2014 – 2015 Date Particulars REGULATION CBCS - 2012 Rs . 2 00 2 Date Particulars Rs . By Stock Reserve 640 2 00 2 To Stock Reserve 1,580 Dec.31 Dec.31 (openin g stock) (closing stock) A/c To br. Stock A/c (shortag e) 300 7,150 To Br. Exp. A/c 15,000 By Goods sent to br. A/c 6,610 To P & L A/c 15,640 15,640 Goods sent to branch A/c Date 2002 Dec.31 Particulars Rs . To br. Adjustment 2002 15,000 A/c Particulars By Br. Stock A/c Rs . 75,000 Dec.31 (loading) To Trading A/c (Transfer) Date 60,000 75,000 75,000 RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 19 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 Branch Debtors A/c Date Particulars Rs . 2002 Jan. Date Particulars Rs . 2002 To Balance b/d 1,300 Dec.31 To Branch Stock 33,400 By Cash By Branch Exp. A/c 38,000 (cr. sales) Discount 400 Bad Debts 250 By Bal. c/d 39,300 650 5,250 39,300 Branch Stock A/c RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 20 of 50 ACADEMIC YEAR: 2014 – 2015 Date Particulars REGULATION CBCS - 2012 Rs . 2002 Jan.1 Date Particulars Rs . To Cash Sales 32,000 2002 To Balance b /d To goods sent t o Branch A/c 3,200 Jan.1 By Branch Debtors By Branch Adjustment A/c 75,000 38,000 300 By Balance c/d 7,900 78,200 78,200 Branch Stock Reserve A/c Date Particulars 2002 To Br. Adjustment A/c Date Rs . 2002 Rs . By Balance b/d 640 By Branch Adj. A/c 1580 640 Dec. 31 Dec.31 To balance c/d Particulars 1580 Branch Expenses A/c RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 21 of 50 ACADEMIC YEAR: 2014 – 2015 Date 2002 Particulars To Cash REGULATION CBCS - 2012 Rs . Date Particulars 6,500 2002 By Branch Adjustment A/c Dec.31 To branch Dr.s A/c Discount 400 Bad Debts 250 Dec.31 Rs . 7,150 650 7,150 7,150 3. Agra head office supplies goods to its branch at Alwar at invoice price which is cost plus 50%. All Cash received by the branch is remitted to Agra and all branch expenses are paid by the head office. From the following particulars related to Alwar Branch for the year 2006, prepare Branch debtors account Branch stock account and Branch Adjustment Account in the books of the head office so as to find out the gross profit and net profit made by the branch. Rs. Stock with Branch on 1.1.2006 (at invoice price) Branch Debtors on 1.1.2006 Petty cash balance on 1.1.2996 Goods received from head office (at invoice price) Goods returned to Head Office Credit Sales Sales Returns 66,000 22,000 500 2,04,000 6,000 87,000 3,000 (already adjusted while invoicing) 2,000 Cash received from debtors 93,000 Discount allowed to debtors 2,400 RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 22 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 Expenses (cash paid by Head Office) Rs. Rent 2,400 Salaries 24,000 Petty Cash 2,000 28,400 Cash Sales 1,06,000 Stock with Branch on 31.12.2006 (at invoice price) 69,000 Petty Cash balance on 31.12.2006 100 Branch Adjustment Account Date Particulars Rs . Date Particulars RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 23 of 50 Rs . ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 To Stock reserve A/c To Goods sent to Branch A/c 23,000 By stock reserve A/c 2,000 (66,000 × 50/150) 2,000 To Branch stock A/c 22,000 By Goods sent to Branch A/c (2,04,000 × 50/150) To Shortage (Load) To Gross profit c/d 1,000 68,000 62,000 90,000 90,000 To Branch expenses A/c 62,000 By Gross profit b/d Rent 2,400 Salaries 24,000 Petty exp. 2,400 (500 + 2000 - 100) 28,800 To Branch debtors A/c discount To Shortage 2,400 (cost) 2,000 To Net profit 28,800 62,000 62,000 Branch Debtors A/c Date Particulars To Balance b/d Rs . 22,000 Date Particulars By Branch Cash Rs . 93,000 RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 24 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 A/c 87,000 To Branch stock A/c 2,400 By Branch Expenses A/c (credit sales) (Discount allowed to Debtors) By Sales Returns 3,000 By Balance c/d 10,600 1,09,000 1,09,000 Branch stock A/c Date Particulars Rs . To balance b/d 66,000 To Goods sent to Branch A/c 2,04,000 Date Particulars By branch A/c-cash sales By Branch Debtors A/ccredit sales Rs . 1,06,000 87,000 By Branch Adjustment A/c To Branches Debtors A/c Sales Return Allowance to customer On selling 3,000 price (already 2,000 Adjusted while invoicing) By Goods sent to branch A/c Returns to H.O. RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 25 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 By Shortage-in-stock A/c By Balance c/d 6,000 3,000 69,000 2,73,000 2,73,000 4. A head office sends goods to its branch at 25% less than the list price. Good are sold to customers at cost plus 60%. From the following particulars ascertain the profit made at the head office and the branch on whole sale basis. Particulars Opening stock Head office Rs. Branch Rs. 50000 30000 Purchases 150000 - Goods sent to branch 108000 - Sales 160000 80000 10000 6000 (at invoice price in case of branch) Expenses RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 26 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 Trading , Profit & Loss A/c Particulars To opening stock To Purchases Head office 50000 To Expenses To Stock reserve Particulars 30000 By Sales Branch 160000 80000 108000 - 10000 78000 315000 96000 78000 20000 150000 By Goods sent to branch To Goods received from H.O To Gross Profit Branch Head office 108000 780000 By Closing 20000 stock 278000 158000 10000 6000 By Gross Profit 13000 RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 By Stock Answers/VER 1.0 5000 reserve To Net Profit 60000 14000 83000 20000 Unit – 1 Answers Page 27 of 50 83000 20000 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 ASCM25C – FINANCIAL ACCOUNTING -II Unit-2 –DEPARTMENTAL ACCOUNTS 80% Problem – 20% Theory Question & Answers PART –A Syllabus: [Regulation: 2012] UNIT- 2 Departmental accounts: basis for allocation of expenses –inter departmental transfer at cost or selling price- treatment of expense which cannot be allocated. PART – A QUESTIONS 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. What is meant by interdepartmental transfer? . List out the objectives of departmental accounting? What is meant by department accounts? What is stock reserve? What is meant by elimination of unrealized profit? . What are the two types of departments? What is independent department? Write the basis of allocation of expenses –any two. What are direct expenses? Give some examples. What are expenses which can be apportioned? What are the three basis of interdepartmental transfer? What is meant by common expenses? What is an indirect expense? What is cost price? Write two advantages of departmental accounts. Write two needs of departmental accounts. What are the methods and techniques of departmental accounts? What is dependent department? What are the two sub-divisions of indirect expenses? What are expenses which cannot be apportioned? RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 28 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 PART – B 1. 2. 3. 4. 5. 6. 7. 8. What are the Disadvantages of departmental accounting? Explain the advantages of departmental accounting. Write down the needs of departmental accounting. Explain the ways of recording transactions in departmental accounts. Difference between branch and departmental accounts. Question and answer in answer file Question and answer in answer file Question and answer in answer file PART – C QUESTIONS 1. 2. 3. 4. What are the bases of apportionment of expenses? Question and answer in answer file Question and answer in answer file Question and answer in answer file ----- RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 29 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 ASCM25C – FINANCIAL ACCOUNTING -II Unit-2 –DEPARTMENTAL ACCOUNTS 80% Problem – 20% Theory Question & Answers PART –A 1. What is meant by interdepartmental transfer? Whenever goods or services are provided by one department to another their cost should be separately recorded and charged to that department benefiting thereby and credited to that providing it. 2. List out the objectives of departmental accounting? To check out interdepartmental performance Evaluate the performance of the department with previous period result. . To help the owner for formulating right policy for future. To assist the management for making decision to drop or add a department To provide detail information of the entire organization To assist management for cost control 3. What is meant by department accounts? An organization may produce or buy and sell several products or perform different services under the same roof or from the same premises. The modern practice is to divide the organization into independent departments, each of which may deal in a particular class or goods or render a specialized type of service 4. What is stock reserve? RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 30 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 Unrealized profit included in unsold inventory at the ending of accounting period eliminated by creating an appropriate stock reserve by debiting the amount profit and loss account. 5. What is meant by elimination of unrealized profit? When profit added in the inter-department transfers the loading included in the unsold stock at the end of the year is to be excluded before final accounts are prepared so as to eliminates any anticipatory profit included therein. 6. What are the two types of departments? Independent department Dependent department 7. What is independent department? Departments which work independently of each other and have negligible inter department transfer are called Independent Departments. 8. Write the basis of allocation of expenses –any two. Rent, rates and taxes - Floor area occupied. Salaries - Time allocated to each department. Selling expenses, Bad debts - Sales of each department Carriage inwards - Purchases of each department 9. What are direct expenses? Give some examples. Expenses which are directly identified with or incurred for particular departments are called as direct expenses. Example: Wages, insurance of stock etc. RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 31 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 10. What are expenses which can be apportioned? All indirect expenses which are amenable for division on some logical or appropriate basis among the departments should be charged to the departments after dividing them on suitable basis. 11. What are the three basis of interdepartmental transfer? Cost Ruling market price Cost plus agreed percentage of profit. 12. What is meant by common expenses? Common expenses, the benefit of which is shared by all the departments and which are capable of precise allocation are distributed among the departments concerned on some equitable basis considered suitable in the circumstances. 13. What is an indirect expenses? Expenses which cannot be identified with a particular department, but incurred for their common benefit. 14. What is cost price? When the good are sold at the price of which incurred for the production of a goods that means the cost of goods sold is called as cost price. 13. Write two advantages of departmental accounts. Evaluation of performance Growth potential of each department RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 32 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 Judgment of efficiency Planning and control 14. Write two needs of departmental accounts. To have comparative results of departments To assesses the stock position of each department To analyze the result of each department and to draw up a trend for the future. 15.What are the methods and techniques of departmental accounts? 1. Preparation of trading and profit and loss account, 2. Maintenance of Records, 3. Departmentalization of expenses 16. What is dependent department? Departments which transfer from one department to another department for further processing are called dependent departments. 17. What are the two sub-divisions of indirect expenses? Expenses which can be apportioned Expenses which cannot be apportioned 18. What are expenses which cannot be apportioned? Expenses which have no connection with the departments or those which have no reasonable basis for apportionment must be shown in the general profit & loss a/c. RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 33 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 PART-B 1. What are the Disadvantages of departmental accounting? 1. There may be a lack of communication among the different departments. For example, production may be so isolated from marketing that the people making the product do not get the proper feedback from customers. 2. Individual employees may begin to identify with their department and its goals rather than with the goals of the organization as a whole. For example, the purchasing department may find a good value somewhere and buy a huge volume of goods that have to be stored at a high cost to the firm. Such a deal may make the purchasing department look good, but it hurts the overall profitability of the firm. 3. The company’s response to external changes may be slow. 4. People may not be trained to take different managerial responsibilities; rather, they tend to become narrow specialists. 5. People in the same department tend to think alike (engage in groupthink) and may need input from outside the department to become more creative. 2. Explain the advantages of departmental accounting. Evaluation of performance: The performance of each department can be evaluated separately on the basis of trading results. An endeavor may be made to push up the sales of that department which is earning maximum profit. Growth potential of each department: The growth potential of a department as compared to others can be evaluated. Judgement of efficiency: It helps to calculate stock turnover ratio of each department separately, and thus the efficiency of each department can be calculated. Planning and control: Availability of separate cost and profit figures for each department facilitates better control. Thus effective RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 34 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 planning and control can be achieved on the basis of departmental accounting information. Justification of capital outlay: It helps the management the justification of capital outlay in each department. to determine 3.Write down the needs of departmental accounting. To compare the results of each department with the results of previous years and ascertain the trend. To know the comparative results of different departments in the same year. To assess the position of stock in each department. To identify areas weakness for cost control and improvement of efficiency. To decide upon expansion, discontinuation and investment policies. 4. Explain the ways of recording transactions in departmental accounts. a) Unitary method: Under this method, the accounts of each department are kept separately. The results of the various departments are finally combined together in one general P & L account. b) Tabular or columnar method: • Under this method, the accounts of each department are kept in columnar form with a separate column for each department and also with a separate column for the total. The tabular method is more popular and is adopted by almost all the departmental undertaking, Under this method, at the end of the accounting year, Trading and P & L account is prepared with separate amount column for each of the department and also for the total. The trading and P & L of a departmental organization kept in the columnar basis is called Departmental Trading and P & L account. In trading account, opening stock, purchases, direct expenses and Gross profit are debited and sales and closing stock credited. Indirect expenses have to be apportioned between the departments and debited to the P&L account. 5.Difference between branch and departmental accounts. RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 35 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 BRANCH: Branches are separated from the main organization. DEPARTMENTS: Departments are attached with the main organization under a single roof. BRANCH: Branches are the outcome of tough competition and expansion of business. DEPARTMENTS: Departments are the result of fast human life. BRANCH: Branches are geographically separated. DEPARTMENTS: Departments are not separated rather existed under a same roof. BRANCH: Branches are of different types like dependent, independent and foreign. DEPARTMENTS: There is no such classification in department because all are common under the same roof. BRANCH: Allocation of branch common expenses does not arise. DEPARTMENTS: Allocation of departmental common expenses is a tough job. BRANCH: To find out the net result of the organization, the reconciliation of different branch account is a main job. DEPARTMENTS: In departmental accounting, no reconciliation is necessary because there is a central account division. 6. Question and answer in the hard copy 7. Question and answer in the hard copy 8. Question and answer in the hard copy PART C RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 36 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 5. What are the bases of apportionment of expenses? SI.NO Sales 1 EXPENSES BASIS OF APPORTIONMENT expenses as traveling Sales of each department salesman, salary and commission, selling expenses service, discount debts, after sales allowed, bad freight outwards, provision for discount on debtors, sales manager's salary and other benefits etc. 2 All expenses relating to building as rent, rates, taxes, air conditioning expenses, heating, insurance building etc. Area or value of floor space 3 Lighting Lighting points in the department 4 Workmen’s amenities and welfare expenses Number of workers in each department 5 Workmen’s compensation insurance, ESI, PF etc. payable at employer Wages of each department 6 Premium for loss of profits insurance 7 Power 8 Depreciation of assets, fire insurance, repairs on such assets. Value of each assets possessed by each departments 9 Factory manager’s salary Time devoted to each department 10 Carriage inwards Purchase value Profit of each department in the previous year Consumption as per meter, horse power, time and hours. 6. Question and answer in the hard copy RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 37 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 7. Question and answer in the hard copy 8. Question and answer in the hard copy RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 38 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 ASCM21X – FINANCIAL ACCOUNTING -II Unit-III – HIRE PURCHASE AND INSTALLMENT 80%Problem – 20% Theory Question Bank Syllabus: [Regulation: 2012] UNIT-3 Hire purchasesystem: meaning and legal position- accounting aspects – default and repossession-hire purchase trading account Installment purchase system: meaning and legal possession-distinguish between hire purchase system and installment purchase system –accounting treatments. QUESTIONS PART – A 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. Define the Hire Purchase System? What is the meaning of Hire Purchase system? What is Re-possessed stock?(APRIL2013) (NOV 2011) What is an Instalment Purchase system? APRIL 2012 Define Instalment Purchase system? What do you understand by Hire Purchase Trading Account? APRIL 2012 What is the EntryFor Purchase of Asset? What is the Entry for Down payment of Asset What is the Entry for Interest Due? What is the Entry for Instalment paid? What is the Entry for Depreciation charged? What is Transfer of interest and Depreciation to Profit & Loss Account? What is Entry for sale of Asset? What is the Entry for down payment received? RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 39 of 50 ACADEMIC YEAR: 2014 – 2015 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. REGULATION CBCS - 2012 What is the Entry for interest due? What is Entry for instalment received? What is the Entry for transfer of Hire Sales to Trading A/c? What is the Entry for transfer of Interest to P & L A/c? Who is Hire purchaser? Who is Hire vendor? What is meant by rebate? What is meant by down payment? What is meant by partial repossession? Write any two contents of Hire purchase agreement. Define Hire purchase agreement? Distinguish between cash price and hire purchase vendor.(APRIL 2013) (NOV 2011) PART – B 1. What are the Characteristics or features of Hire-Purchase System?APRIL2013 2. What is the difference between hire purchase system and Installment payment system? 3. What are the conditions when a Hire-Purchase Transaction takes place? 4. What are the Features of Instalment Payment System?APRIL 2012 5. What are the Advantages of Hire Purchase System? 6. What are the disadvantages of hire purchase system? 7. Question and answer in answer file 8. Question and answer in answer file 9. Question and answer in answer file PART – C 1. What is Difference between Hire Purchase System and Instalment Purchase System.NOV 2011 2. Question and answer in answer file 3. Question and answer in answer file 4. Question and answer in answer file ----- RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 40 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 41 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 ASCM21X – FINANCIAL ACCOUNTING -II Unit-III – HIRE PURCHASE AND INSTALLMENTSYSTEM 80%Problem – 20% Theory Question & Answers PART –A 1. Define the Hire Purchase System? “Hire Purchase System is a system under which money is paid for goods by means of periodical installments with the view of ultimate purchase. All money being paid in the meantime is regarded as payment of hire and the goods become the property of the buyers only when all the installments have been paid-Carter “The hire-purchase is a form of trade in which credit is granted to the customer on the security of a lien on the goods.” —J. Stephenson 2.What is the meaning of Hire Purchase system? A system by which a buyer pays for a thing in regular installments while enjoying the use of it.During the repayment period, ownership (title) of the item does not pass to the buyer. Upon the full payment of the loan, the title passes to the buyer. 3.What is Re-possessed Stock? (APRIL2013) (NOV 2011) Asperhire-purchaseagreement,thevendorhasgoteveryrighttore-possessthe goodssoldtothehire-purchaserif thelattermakethedefaultin thepaymentofany instalmentandforfeittheamountofinstalmentalreadyreceivedandtreatingthe instalmentsashirecharges.Inthecircumstances,vendormaytakebackthe possessionoftheentiregoodsi.e.,CompleteRe-possessionorhecanrepossesonly a partofthegoodssoldfromthedefaultingbuyer,i.e.,PartialRe-Possession. 4.What is an Installment Purchase system? APRIL 2012 Instalment payment system (also called the deferred instalments) is a system where the buyer is given the ownership as well as the possession of the goods at the time of signing the contract. The buyer has the facility to pay the price in instalments. 5.Define Installment Purchase system? According to J.B. Batliboi, Instalment Purchase System is a system under there is an agreement to purchase and pay by instalments, the goods which become the property of the Purchaser immediately when he receives the delivery of the same. RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 42 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 6.What do you understand by Hire Purchase Trading Account? APRIL 2012 When numerous goods of small value are sold by firm on hire purchase system. It becomes inconvenient to maintain separate account of each customer; also it would be very difficult for the vendor to calculate interest in respect of every sale. Under such circumstances a Hire Purchase Trading Account is prepared to ascertain Profit or Loss on such sale separately. This method is also known as Debtor Method. 7.What is the Entry For Purchase of Asset? Asset A/c Dr. To Vendor A/c 8.What is the Entry for Down payment of Asset Vendor A/c Dr. To Bank/Cash A/c 9.What is the Entry for Interest Due ? Interest A/c Dr. To Interest Vendor A/c 10.What is the Entry for Instalment paid? Vendor A/c Dr. To Bank A/c 11.What is the Entry for Depreciation charged? Depreciation A/c Dr. To Assets A/c 12.What is Entry for transfer of interest and Depreciation to Profit & Loss Account? P & L A/c Dr. To Depreciation A/c To Interest A/c 13.What is Entry for goods sold on hire purchase agreement? RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 43 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 Hire purchaser A/c Dr. To Hire Sale A/c 14.What is the Entry for down payment received? Bank/Cash A/c Dr. To hire purchaser A/c 15.What is the Entry for interest due? Hire purchaser A/c Dr. To Interest A/c 16.What is Entry for instalment received? Bank A/c Dr. To Hire Purchaser A/c 17.What is the Entry for transfer of Interest to P & L A/c? Interest A/c Dr. To Profit & Loss A/c 18. What is the Entry for transfer of Hire Sales to Trading A/c? Hire Sales A/c Dr. To Trading A/c 19. Who is Hire purchaser? A hire purchaseris aperson who possesses the goods under hire purchase agreementfor use within an option to either purchase it or return after use. 20. Who is Hire vendor? A hire vendor is a person who sells the goods under hire purchase agreement. 21. What is meant by rebate? It is an amount which is claimed by the hire purchaser from the hire vendor in case if he decides to remit the balance of the purchase price (future installments) in lump sum without continuing the hire purchasing agreement. 22. What is meant by down payment? RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 44 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 This istheadvancepayablebybuyer whilesigningthehirepurchase agreement. Itis also a partof the hirepurchase price. 23. What is meant by partial repossession? The hirer did not pay installment amount the part of the goods only took by the hire vendor and left the remaining goods with the hirer equal to the value of amount paid by the hirer. 24. Write any two contents of Hire purchase agreement. Thehirepurchasepriceof thegoodsfor whichthe agreementis made Thenumberofinstallmentsinwhichthehire purchase pricehasto be paid 25. Define Hire purchase agreement? It is an agreement between hire purchaser and hire vendor according to section 2(c) of the hire purchase act, 1972 for purchasing of goods according to agreement. 26. Distinguish between cash price and Hire purchase price? (APRIL 2013) (NOV 2011) Cash price is the retail price of the articles at which they can be purchased immediately for cash. Hire purchase price is the total amount payable by the buyer for goods agreed in instalments. But in this, cash price and interest is included. PART- B 1. What are the Characteristics or features of Hire-Purchase System? APRIL2013 The characteristics of hire-purchase system are as under Hire-purchase is a credit purchase. The price under hire-purchase system is paid in instalments. The goods are delivered in the possession of the purchaser at the time of commencement of the agreement. Hire vendor continues to be the owner of the goods till the payment of last installment. The hire-purchaser has a right to use the goods as a bailer. Each instalment is treated as hire charges The hire-purchaser has a right to return the goods before the last instalment is paid. The hire-purchaser becomes the owner of the goods after the payment of all instalments as per the agreement. RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 45 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 If there is a default in the payment of any instalment, the hire vendor will take away the goods from the possession of the purchaser without refunding him any amount. If the goods are repossessed, the values of goods on that date and the instalments paid are added and the total hire purchase price is reduced. The balance is payable by the hire vendor to the hirer, 2. What is the difference between hire purchase system and Installment payment system? Instalment Payment System is system of purchase and sale of goods in which title of goods is immediately transferred to the purchaser at the time of sale of goods and the sale price of the goods is paid in instalments. In the event of default in payment of any instalment, the seller has no right to take back goods from the possession of the purchaser. He can file a suit for the recovery of the outstanding balance of the price of goods sold. The followings are the differences between Hire-purchase system and Instalment payment system: In Hire-purchase system, the transfer of ownership takes place after the payment of all instalments while in case of Instalment payment system, the ownership is transferred immediately at the time of agreement. In Hire-purchase system, the hire-purchase agreement is like a contract of hire though later on it may become a purchase after the payment of last instalment while in Instalment payment system, the agreement is like a contract of credit purchase. In case of default in payment , in Hire-purchase system the vendor has a right to back goods from the possession of the hire-purchaser while in case of Instalment payment system, the vendor has no right to take back the goods from the possession of the purchaser; he can simply sue for the balance due. In Hire-purchase system, if the purchaser sells the goods to a third party before the payment of last instalment, the third party does not get a better title on the goods purchased. But in case of Instalment payment system, the third party gets a better title on the goods purchased. In Hire-purchase system the provisions of the Hire-purchase Act apply to the transaction while in case of Instalment payment system, the provisions of Sale of Goods Act apply to the transaction. 3. What are the conditions when a Hire-Purchase Transaction takes place? RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 46 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 Thus hire-purchase means a transaction where the goods are sold by vendor to the purchaser under the following conditions: The goods will be delivered to the purchaser at the time of agreement. The purchaser has a right to use the goods delivered. The price of the goods will be paid in instalments. Every instalment will be treated to be the hire charges of the goods which is being used by the purchaser. If all instalments are paid as per the terms of agreement , the title of the goods is transferred by vendor to the purchaser. If there is a default in the payment of any of the instalments, the vendor will take away the goods from the possession of the purchaser without refunding him any amount received earlier in the form of various instalments. 4. What are the Features of Instalment Payment System? APRIL 2012 The features of Instalment payment are as follows: Under this system, there will be an outright sale of goods/assets. The possession as well as the ownership is passed to the buyer right at the time of signing the contract. The buyer can make the payment in instalments. In case of default in payment, the seller cannot reposes the goods, but he can sue the buyer for the recovery of unpaid price. The buyer cannot exercise the option of returning the goods and terminate the contract, unless the same becomes void or voidable under the contract act. 5. What are the Advantages of Hire Purchase System? (1) Convenience in Payment: The buyer is greatly benefited as he has to make the payment in installments. This system is greatly advantageous to the people having limited income. (2) Increased Volume Of Sales: This system attracts more customers as the payment is to be made in easy installments. This leads to increased volume of sales. (3) Increased Profits: Large volume of sales ensures increased profits to the seller. (4) Encourages Savings: It encourages thrift among the buyers who are forced to save some portion of their income for the payment of the installments. This inculcates the habit to save among the people. RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 47 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 (5) Helpful For Small Traders: This system is a blessing for the small manufacturers and traders. They can purchase machinery and other equipment on installment basis and in turn sell to the buyer charging full price. (6) Earning Of Interest: The seller gets the installment which includes original price and interest. The interest is calculated in advance and added in total installments to be paid by the buyer. (7) Lesser Risk: From the point of view of seller this system is greatly beneficial as he knows that if the buyer fails to pay one installment, he can get the article back. 6. What are the disadvantages of hire purchase system? (1) Higher Price: A buyer has to pay higher price for the article purchased which includes cost plus interest. The rate of interest is quite high. (2) Artificial Demand: Hire purchase system creates artificial demand for the product. The buyer is tempted to purchase the products, even if he does not need or afford to buy the product. (3) Heavy Risk: The seller runs a heavy risk under such system, though he has the right to take back the articles from the defaulting customers. The second hand goods fetch little price. (4) Difficulties in Recovery of Installments: It has been observed that the sellers do not get the installments from the purchasers on time. They may choose wrong buyers which may put them in trouble. They have to waste time and incur extra expenditure for the recovery of the installments. This sometimes led to serious conflicts between the buyers and the sellers. (5) Break Up Of Families: The system puts a great financial burden on the families which cannot afford to buy costly and luxurious items. Recent studies in western countries have revealed that thousands of happy homes and families have been broken by hire purchase buying’s. RAAK/BCA/A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X/FIN. ACC/UNIT-3 Answers/VER 1.0 Unit – 1 Answers Page 48 of 50 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 PART- C 1. What is Difference between Hire Purchase Systemand Instalment Purchase SystemNOV 2011 Basis HirePurchaseSystem InstalmentPaymentSystem Natureof Contract Itisanagreementofhiring ItisaContractofSalefrom Beginning Transferof ownership Rightof Repossession Rightof Forfeiture Instalment Ownershipinthegoodspasses fromvendortopurchaserafter thepaymentoflastinstalment Thevendorhastherightto repossessthegoods. Incaseofdefault,vendorhas therighttoforfeitthe instalmentsalreadypaid. Ownershipinthegoods passesfromsellertobuyers afterthecontractissigned. Thesellerhasnorightto repossessthegoods Incaseofdefault,seller cannotforfeittheinstalments alreadypaid RightofDisposal Purchaserhasnorightto sellthegoodstillthefinal instalmentispaid. Rightofreturn goods Risk Repossession of goods Instalment Thepurchaserhastheoptionto returnthegoodsandterminate theagreement Anylosstogoodshastobe bornebythehirevendor. Asthebuyeris theownerof thegoodsfromthevery beginning,hecandisposeof thegoodsashelikes. Thebuyerhasnorightto terminatethecontract. Anylossofgoodswillhaveto bebornebythebuyer The Hire vendor can repossess the goods if instalment is not paid. Seller cannot repossess the goods. He can sue the buyer for dues. Each Instalment includes Hire charges and part payment of the cash price Each Instalment includes interest and part payment of cash price. RAAK/BCA /A. CANAGAVALLY /II YEAR/IV Sem/ASCM21X /FIN. ACC/UNIT-3 Answers/VER 1.0 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 ACADEMIC YEAR: 2014 – 2015 REGULATION CBCS - 2012 ASCM21X –FINANCIAL ACCOUNTING -II Unit-V– MECHANISED SYSTEM OF ACCOUNTING 80%Problem – 20% Theory Question Bank Syllabus: [Regulation: 2012] UNIT-V- Mechanized System of Accounting: Advantages - Limitations - EDP. QUESTIONS PART – A 1. 2. 3. 4. What is mechanized system of accounting? What are the advantages of mechanized system of accounting? What are the limitations of mechanized system of accounting? What do you mean by EDP? PART – B 1. Explain in detail about the advantages of mechanized system of accounting? 2. Explain in detail about limitations of mechanized system of accounting? 3. What are the tools used in mechanized system of accounting? ----- RAAK/BCOM&C.A/A.CANAGAVALLY /IIYEAR/III Sem/ /FIN.ACC /UNIT-1 QB/VER 1.0 Unit – 1 Answers Page 2 of 50