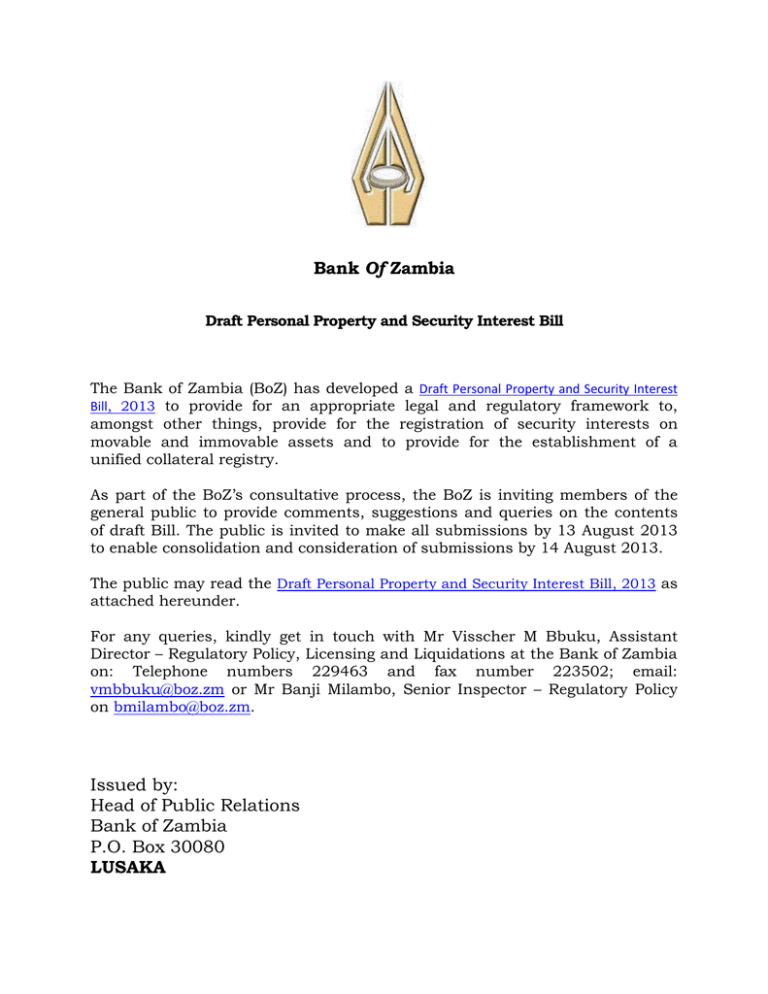

admin925Personal Property Security Intersts Bill

advertisement