12 th November, 2010 2 nd WORKSHOP ON

advertisement

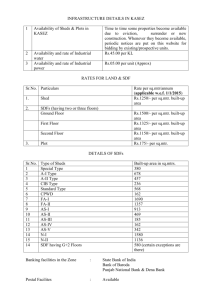

11th-12th November, 2010 2nd WORKSHOP ON “POWER SECTOR REFORMS” 1 BRIEF HISTORY OF IESCO 1998 Creation Registration Commencement of Business 2 OBJECTIVE OF PERFORMANCE CONTRACT (2010): GOP/MOWP is committed to ensure that Distribution Companies can have: 1. Effective Management 2. Efficient and Quality Service 3. Adequate Operational Autonomy 4. Effective & Strong BOD 5. Effective Internal Controls 6. Business Plans Implementation 3 OBJECTIVE OF COMPANIES ORDINANCE 1984 & UNDERLYING CORPORATE GOVERNANCE Objective of Ordinance is to run corporate sector professionally by ensuring in Companies the: Implementation of Business plans Formulation of Human Resource Management policies Capital expansion plans Comprehensive Financial Statements and Audit Effective Internal Controls Report on Governance, Risk & Compliance issues Effective Role of management & Board of Directors Safeguard the Interest of Shareholders (St 290) Does not the Companies Ordinance, 1984 more elaborately cover all the Objectives that Performance Contract intends to??? 4 HOW IESCO IS CURRENTLY BEING GOVERNED! Regulators IESCO Auditors Monitoring Agencies 5 AREA OF CONCERN! If we all think that Power Sector is still in crisis despite the presence of so many regulators, regulations and Audits then what is the root cause? Either the focus on the implementation of the existing laws missing OR More efforts are exerted in inventing the new ones OR We have no plan as how to implement it OR Regulations are not in accordance with the need Under this scenario, something has to be done so that Single Performance Contract be able to turn around the whole Power Sector? 6 COMMENTS ON PERFORMANCE CONTRACT All the objectives of Performance Contract are covered in Ordinance Legal backup – Missing Focus on “Scoring of points – results in narrowing down approach” Environment differs from company to company Format is defective as even if the company achieves 100% of the targets set for all the KPI’s, the maximum score achieved will only be 65 out of 100 Budgeting control concept has not been properly incorporated & needs to be reviewed Contd…7 COMMENTS ON PERFORMANCE CONTRACT Strangely targets have been laid for accidents ??? Not fair to link targets with units sold as long as power shortage is there Companies concern may be taken to assign weightages Concerns of Labor union need to be addressed Punitive clauses relating to termination to be revisited 8 SUGGESTIONS FOR IMPROVEMENTS As the expectations from Performance contract are very high and this document has become a last resort to turn the table, therefore it needs to be ensured that: Is the Contract being made between the right persons ? Will it not interfere in the autonomy of the company ? Should it not be between IESCO Management & BOD? Whole exercise of revisiting the performance contracts and KPI may be started from afresh by formulating a joint committee of DISCOs, MOW&P, Donors & Private Sector professionals to achieve the objectives as desired 9 KPIs Operational & Commercial Performance - 50% Line Losses Collection Ratio Total Score 2009-10 Jul to Sep 10 15.00 11.25 7.50 To Achieve Max Marks Remarks -10 No Cushion for Companies having low losses to be at 10% +5 No Cushion for Companies having low losses to be at 10% Target for collection for DISCOs having low recovery should be above 100 % + 10 Targets based on NEPRA Performance Standards, so margin for +10% above target is difficult 25.00 6.25 8.25 Transformer Failure Rate 2.00 1.00 2.00 Line Failure Rate - Below 20 Min 2.00 1.50 2.00 Line Failure Rate - Above 20 Min 2.00 1.00 2.00 Defective Meters 4.00 3.00 4.00 + 20 In IESCO, proportion of defective meters is low Financial Performance - 8% 8.00 4.50 6.75 + 10 Why O&M Expenses linked with Units Sold? Capitalization - 5% 5.00 5.00 3.75 10.00 4.50 - + 10 Scoring criteria is against the Budgeting Concept 5.00 4.50 4.00 HR Management – 12% 12.00 12.00 10.00 Employee Safety – 10% 10 - Total Scoring 100 54.50 Capital Expenses – 10% Customers Relations Mgt – 5% 4 Target Illogical 52.25 10 PROJECTS BEING UNDER TAKEN 11 Power Dist & Enhancement Project (ADB) Electricity Dist & Transmission Improvement Project (WB) Proj.Cost: US$58.496M Exp:US$16.288M Proj.Cost: US$30.06M Exp:US$4.23M Strengthening of Infrastructure Installation of TOU Meters Achiev: 25 % AMI (Advanced Metering Infrastructure) (at Feasibility work Stage) Calculation of T/F wise Losses (pilot project undertaken) ERP Implementation (at Feasibility & Prep. Stage) (Projects Being Undertaken) Collection through Bar-Code Readers (expected Dec 10) Consumer Census (Compl. Date Dec 10) Coding & Tagging of T/Fs (Initial Stage) SCADA (at Feasibility study Stage) GIS based Asset Management (pilot project under survey) 12 FINANCIAL POSITION OF FY2010-11 Summary of Major KPI’s indicating consumer satisfaction T & D Losses Collection (Pvt.) Consumers Collection (Gov.) Consumers = = = 9.2% 100% 56% Financial Summary indicating Sound financial position: Rs. in Million FY (Qtr 1) 10-11 Prov. FY 08- 09 (Audited) FY (Qtr 1) 09-10 FY 09- 10 (Audited) Sales Revenue 38,348 13,842 50,219 17,785 Other Income 1,432 473 1,722 383 GOP Subsidy 11,339 4,468 15,816 Total Revenue 51,119 18,783 Power Purchase Price 43,866 Description Operating Expenses Depreciation Total Expenses Rising Operating Profit As on 30 Sep 10 Description Amou nt (Mil) Receivables from Gov t 7,500 5,740 Receivables from Pvt 2,771 67,757 23,908 Total Receivables 10,271 14,096 57,429 14,211 3,674 926 4,048 1,230 930 231 929 241 48,470 15,253 62,405 15,682 2,649 3,530 5,352 8,226 Subsidy Receivable Gross Receivables 6,698 16969 Power purchase payable (6,311) Surplus of Receivables Over Payables (A+B-C) 10,658 Indicates Short Term Strong Liquidity Position 13 SUMMARY OF AJK TARIFF ISSUES Present Tariff of AJK Rs. 5.50 / Unit Paid by AJK Rs. 2.59 / Unit Deficit Rs. 2.91 / Unit Share of AJK in Govt Billing 38% Share of AJK in Total Billing 9.5 % Total Receivables from AJK as on 30 Sep 2010 4,909.981 Million AJK does not want to pay at Govt Notified Rates Note: Avg Sale is 900 Million units per year 14 MAJOR BOTTLENECKS & SUGGESTION FOR IMPROVEMENT Sr Bottle Necks Suggestions 1 Recovery from Govt. Departments GOP to take serious Note of it & remove the Budgetary Constraints for Govt Department to ensure timely payments to Discos 2 Increasing interference of Sales Power Sector to be declared exempt from Sales Tax Tax Department Audit 3 Claim of Sales Tax Department to Charge Sales Tax on Supplies to AJK depsite Presidential Order in 2002 to not to Charge Sales Tax on Electricity Supply to AJK Power Sector to be declared Zero Rated or Exempt from the Application of Sales Tax to avoid Cash flow problems as huge amounts of funds of Discos are Blocked as Sales Tax Refund 4 Unpaid subsidies Outstanding Subsidies to be cleared & for future Electricity Tariff may be increased to cover the Gap between Notified & Determined Tariff 5 High cost of borrowing The Cost of fund against the Relenet Loans to be reduced from 17% to 12% 6 High Corporate Income Tax Rates Separate Income Tax Package for Power Sector 7 Defective Notification of AJK Tariff To be made in line with the understanding between GOP and Govt. of AJK 8 Delay in Determination of Tariff To be made in time 9 Political Influence Must be avoided for Autonomy of the Companies. 10 High Generation Cost Generation Mix need to be focused on 15 DAMAGES OCCURRED DUE TO HEAVY RAIN/ FLOOD ON 27.07.2010 TO 29.07.2010 Sr. Description Unit Total Amount ( Rs ) 1 Structure No 304 4,295,154 2 Transformers No 255 62,206,766 3 Accessories No 19,900 7,906,717 4 Cables MTR 19,996 4,351,136 Grand Total (Rs) 78,759,773 Contd…16 THANK YOU 17 KEY PERFORMANCE INDICATORS Description FY 08 FY 09 FY 10 Jul-Oct 10 Consumers, Mil. 1.88 1.98 2.06 2.08 Peak Load, MW 1,522 1,643 1,968 1,479 U. Purchased, GWh 8,061 8,071 8,396 3,247 U. Sold 7,232 7,201 7,572 2,950 Losses, % 10.3% 10.8% 9.8% 9.2 % NEPRA Target 12% 11% 10% 10% Var. from NEPRA 1.7 0.2 0.2 0.8 Collection Ratio (Govt) % 97.1 91.3 83.6 67 Collection Ratio (Pvt) % 98.9 98.4 100.0 100 Collection Ratio (Total) % 98.4 96.6 95.9 92 AT&C Index (Govt) 87.1 81.4 75.4 61 AT&C Index (Pvt) 88.7 87.8 90.2 91 AT&C Index (Total) 88.3 86.2 86.5 84 * Tariff Determination under consideration 18 IESCO ON GOING PROJECTS Transformer Coding Transformer Coding of 19 Feeders Having maximum quantum of loss from each Division have been completed in September 2010. Transformer coding of 3 Division i.e. City, Westridge & Tariqabad is completed in October, 2010 and remaining i.e. Cantt, S/Town & Rawat will be Completed in November, 2010 Installation of Meters o 50 KVA capacity (General Duty Transformers) three feeders of Islamabad Circle and Capt. Aamir Shaheed Feeder of Rawalpindi Circle fully completed CONSUMER CENSUS Consumer census started by Barqab in Rawalpindi Circle as a pilot projects was abnormally delayed. Now IESCO has decided to get it done by its own employee. Format for Consumer Census is being printed and provided to the field formation in November, 2010 Survey will be conducted and completed in December 2010 19 BILLING AND COLLECTION THROUGH SCANNERS Billing collection through scanners/barcodes readers will be started in December, 2010 as certain preparatory meetings have been held in this context. This will help to improve the collection / remittance mechanism besides rapid flow of information about payment made by the customers on daily basis upto the level of SDO. AUTOMATED METER READINGS INFRASTRUCTURE Survey is being conducted by M/S Nortech Hungry based company for AMI it will help on the following areas. Load Management Outage Data Transformers wise Losses Detection of Theft Improvement in Customer Services 20 SAMPLE FLASH REPORT Operational & Commercial Performance - 50% Target 100% Achievement 100% Score Result Weighted Score 10 % 10 % 7.5 9% 15 Collection Ratio 100 % 100 % 18.75 105 % 25 Transformer Failure Rate 16.3 % 16.3 % 1 14.65 % 2 Line Losses Result Weighted Score Line Failure Rate - Below 20 minutes 183 183 1 164 2 Line Failure Rate - Above 20 minutes 14 14 1 12.6 2 6.4 % 6.4 % 2 5.12 % 4 Cash in Transit (Monthly Average) 7% 7% 1.5 6.3 % 3 O&M Expenses (Rs/kWh) 0.51 0.51 2.5 0.45 5 75 % 75 % 3.75 79 % 5 Secondary Transmission & Grid Station 75 % 75 % 3.75 83 % 5 Distribution of Power (DOP) 90 % 90 % 1.5 100 % 2 Energy Loss Reduction Program (ELR) 90 % 90 % 1.5 100 % 2 100 % 100 % 0.75 110 % 1 Defective Meters - 7-12m as % of total Financial Performance - 8% Capital Expenditure Project Implemen.15% Capitalization (Completion of A90 Form) Capital Expenses Rural Electrification (RE) Contd…21 SAMPLE FLASH REPORT D Customer Relations Management - 5% Target 100% Achievement 100% Score Result Weighted Score Result Weighted Score i New Connections 100 % 100 % 1 100 % 1 ii Customer Facilitation 100 % 100 % 1 100 % 1 iii Efficiency of Supply Complaint Resolution 100 % 100 % 1 100 % 1 iv Efficiency of Billing Complaint Resolution 100 % 100 % 2 100 % 2 E Human Resource Management - 12% i Officers Strength - Occupancy Ratio 89 % 89 % 2 89 % 2 ii Staff Strength - Occupancy Ratio 87 % 87 % 2 87 % 2 iii Resolution of Disciplinary Cases 77 % 77 % 1 77 % 1 iv Settlement of Audit Paras 85 % 85 % 1 85 % 1 v %age of Officers Trained During the Year 1% 1% 3 1% 3 vi %age of Staff Trained During the Year 2% 2% 3 2% 3 F Employee Safety - 10% i No. of Accidents - Fatal 3 3 - - 6 ii No. of Accidents - Non-Fatal 6 6 2 4 4 Total Scoring 65.50 100 22 23 STATUS OF VARIOUS ACTIVITIES & PROJECTS BEING UNDERTAKEN 24 DAMAGES OCCURRED DUE TO HEAVY RAIN/ FLOOD ON 27.07.2010 TO 29.07.2010 Sr Description Name of Circle Islamabad Rawalpindi Attock Jehlum Chakwal IESCO TOTAL Unit Amount ( Rs ) 1 HT Structure No 57 35 59 2 15 188 2,780,154 2 LT Structure No 32 21 46 0 17 116 1,515,000 3 T/F 200 KVA No 20 40 5 0 0 86 28,234,916 4 T/F 100 KVA No 19 17 25 1 6 68 18,827,208 5 T/F 50 KVA No 25 11 23 2 11 72 11,540,904 6 T/F 25 KVA No 7 1 11 0 5 24 3,086,239 7 T/F 15 KVA No 1 0 2 0 0 3 328,919 8 T/F 10 KVA No 0 0 0 0 2 2 188,580 9 Steel Cross Arms No 56 60 41 0 33 190 547,192 10 Dropout Cutout No 97 186 282 3 182 750 2,093,895 11 ACSR 7/.186 MTR 1400 1200 0 0 0 2600 174,200 12 ACSR 7/.0132 MTR 3500 0 5640 0 820 9960 470,000 13 11KVA Disc insuiators No 147 60 127 0 79 413 213,941 14 11KVA PIN insulators No 156 60 174 0 65 455 57,850 15 11 KV pins No 131 60 174 0 65 430 88,415 16 11 KV Capacitor Bank No 0 0 1 0 0 1 350,000 17 Stay Rod No 21 0 22 0 0 43 63,966 18 Stay Wire KG 1400 0 220 0 0 1620 243,000 25 DAMAGES OCCURRED DUE TO HEAVY RAIN/ FLOOD ON 27.07.2010 TO 29.07.2010 Name of Circle Sr Description Unit Islamabad Rawalpindi Attock Jehl um Chakwal IESCO TOTAL Amount ( Rs ) 19 11 KV 500 MCM 5/C cable MTR 2115 600 0 0 0 2715 1,508,825 20 11 KV S/C AWG Cable MTR 0 600 0 0 0 600 894,000 21 Termination Kit 500 MCM cable No 8 0 0 0 0 8 24,228 22 Strraight joint Kit (500 MCM) No 90 0 0 0 0 90 700,380 23 Straight joint Kit (4AWG) No 25 0 0 0 0 25 476,825 24 4 Way switch No 3 0 0 0 0 3 2,400,000 25 Pvc 4/c 37/.083 cable MTR 776 300 76 0 0 1152 638,856 26 Pvc S/c 37/0.83 cable MTR 750 0 0 0 0 750 86,250 27 PVC 4/c 19/0.083 MTR 1120 600 155 0 0 1876 516,310 28 PVC 4/c 19/0.052 cable MTR 0 0 45 0 0 95 10,260 29 PVC 2/C 7/0.052 cable No 1600 0 0 0 0 7600 212,800 30 LT Kit(19/0.083) No 30 0 0 0 0 30 65,480 31 LT Kit(37/0.083) No 130 0 0 0 1350 130 106,340 32 LT conductor(7/00.122) MTR 2850 0 3770 0 0 7780 248,960 33 D Shackle Assembly No 52 0 43 0 0 95 8,740 34 LT Spool Inulator No 122 0 43 0 0 165 3,300 35 Earh Rod No 60 0 0 0 0 60 24,720 36 Earth Wire KG 260 0 0 0 0 260 29,120 Grand Total 78,759,773 26 HOW IESCO IS CURRENTLY BEING REGULATED IESCO Major Monitoring Agencies Regulators Audits NEPRA Ministry (W&P) Statutory Audit SECP Fed Board Revenue Government Audit PPRA Auditor Gen Pakistan Internal Audit Transition Committee Tax Audit FBR 27