LW361 MS 2013 - University of Brighton

advertisement

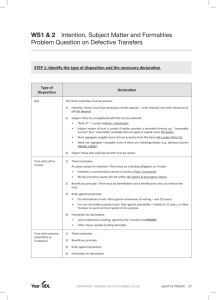

University of Brighton Brighton Business School LW361 - Equity & Trusts – May/June 2012-2013 Suggested Outline Answers ________________________________________________________________ Question One The question is concerned with the three certainties. a) This is a discretionary trust and whilst there is certainty of intention and certainty of subject matter, the issue concerns certainty of objects. The 'is or is not' test established by McPhail v Doulton should be explained and the different interpretations given to the test in Re Baden discussed. In the latter case, the test was applied to 'relations' and although the judges differed as to the definition of relations (which would be relevant to mention here), the trust was held to be valid. (b) This disposition to the grandchildren will fail for lack of certainty of subject matter. Clearly, Gordon owns more than two antique tables but he has not made it clear which two are to be held on trust for his grandchildren.- see Re London Wine, Re Goldcorp. (c) This is a fixed gift as the money in the account is to be divided equally, i.e. the employees will receive a fixed amount. The issue is certainty of objects because in order to divide the money equally, it will be necessary to have a list of the beneficiaries. The class of beneficiaries is conceptually certain and provided there is evidential certainty, i.e. sufficient evidence of past employees, the gift would succeed. (d) The subject matter of the disposition is certain as are the potential objects but the question is whether there is a trust obligation imposed on Jane, i.e. whether there is certainty of words/intention to create a trust. The use of precatory words should be discussed and the test established in Re Adams and Kensington Vestry applied. If there is no certainty of intention on the part of Gordon, Jane would take the residue free of any trust obligation. Page 1 of 8 LW361: Equity and Trusts (MS) May/June 2013 Question Two Part (a) This is concerned with s53(1)(b) Law of Property Act 1925 which requires that a declaration of trust of land is evidenced in writing and signed by the settlor. Non-compliance (as in the question) renders the trust unenforceable by the beneficiary. However, compliance may take place after the declaration - Gardner v Rowe. Part (b) This is concerned with s53(1)(c) Law of Property Act 1925 which requires a disposition of a subsisting equitable interest to be in writing and signed by the disponer or his duly authorised agent. Cliff is clearly the beneficiary under a bare trust and has instructed the trustee to transfer his equitable interest and the legal interest which they hold as nominee to his wife, Denise. In Vandervell v IRC, it was held that when the equitable interest and legal interest pass together to a third party, this is not caught by s53(1)(c) above. Part (c) Edward is a beneficiary with a life interest in a trust set up by his father. He has directed his trustees to transfer his subsisting equitable interest to his sister. This transaction is clearly a disposition of a subsisting equitable interest - Grey v IRC and will be void unless Edward complies with s53(1)(c) Law of Property Act 1925. Part (d) When Holly transferred the shares to her solicitors to hold on trust, she did not identify the beneficiaries, and therefore they held the shares on resulting trust for Holly - Vandervell v IRC. When six weeks later she asked them to hold the shares on trust for her eldest daughter, Jane and eldest son, Keith - it has to be considered whether she is disposing of a subsisting equitable interest, in which case she will have to comply with s53(1)(c) Law of Property Act 1925. Two cases are relevant - Grey v IRC and Vandervell No.2 both of which should be explained. Students should consider criticism of the latter decision. Page 2 of 8 LW361: Equity and Trusts (MS) May/June 2013 Question Three It should be explained that the normal way of creating a trust is for the settlor to declare that a trust is intended and to transfer the property to trustees. Until those elements are fulfilled, the trust is incompletely constituted and cannot be enforced as a trust by the would-be beneficiaries. If the settlor had simply declared that he would himself hold certain of his own property as trustee no such transfer of the property would be necessary and the trust would be immediately constituted. However, as the statement indicates, if the settlor had promised to settle property then even if the trust were incompletely constituted, provided the beneficiaries (or trustees) had given consideration for the settlor's promise, they could seek specific performance as there would be a simple contract between the settlor and the beneficiaries. To claim the contractual equitable remedy of specific performance, the consideration must be valuable and of a type recognised by equity (which includes marriage consideration) - Pullan v Koe. If such consideration were lacking, then the settlor would be free to resile from the promise unless the rule in Re Rose applied or it would be considered unconscionable for the settlor to resile - Pennington v Waine, e.g. where a would-be beneficiary had acted to his detriment in reliance on the promise. It is unlikely that a would-be beneficiary would be able to rely on the Rule in Strong v Bird in the event that the trustee was appointed executor of the settlor's estate (relying on dicta in Re Wale) because the rule in Strong v Bird requires a continuing intention on the part of the settlor to create the trust and the statement suggests that this is lacking - Re Gonin. If the settlor's promise was contained in a voluntary covenant, then the would-be beneficiaries might have a remedy if the settlor reneged on his promise to settle because a covenant is a specialty contract and no consideration is necessary. For example, if the beneficiaries were party to the covenant then, under the common law, they could sue for damages - Cannon v Hartley. If the covenant had been made not with the beneficiary but with trustees, then whilst a number of first instance cases indicate that the trustees would be directed not to sue on behalf of the beneficiaries - Re Pryce, Re Kay, the beneficiaries could rely on The Contracts (Rights of Third Parties) Act 1999. The Act would apply to covenants made on or after 11 May 2000 if the specialty contract purported to confer a benefit on the beneficiary unless, on a proper construction of the contract, it appeared that the parties did not intend the term to be enforceable by third parties. The effect of s1(5) of the Act should be explained. If the promise were contained in a covenant, there is also the argument that there is a completely constituted trust of the covenant - Fletcher v Fletcher. However, the questionable aspects of this decision should be considered, e.g. it is unlikely that the settlor intended to create such a trust - Re Schebsman. Page 3 of 8 LW361: Equity and Trusts (MS) May/June 2013 Question Four The student might begin by explaining the presumption of advancement and identifying the relationships when it applies. If the transferor, e.g. a father, intending to retain a beneficial interest and making a transfer for an illegal purpose such as avoidance of his liability to tax or creditors, transfers the shares to his son, then a gift is presumed. The burden of proof is upon the transferor to rebut the presumption in order to recover the property. The transferor will be unable to rebut the presumption without relying on evidence of his illegal purpose - Chettiar v Chettiar If the illegal purpose had been abandoned, then the transferor may introduce evidence of his illegal purpose in order to rebut the presumption - Tribe v Tribe. The student should then explain the converse presumption of a resulting trust, i.e. the presumption against a gift, which applies in all other relationships other than from husband to wife, father to child and person in loco parentis to a child when the presumption of advancement mentioned above applies. Thus if a transferor transfers or purchases shares in the name of another, the transferee is presumed to hold the shares on a presumed resulting trust for the benefit of the transferor. If the transferor made the transfer in order to advance some illegal purpose, e.g. to claim certain welfare benefits in the cases of Tinsley v Milligan and Silverwood v Silverwood all the transferor needs to show is that the transfer was made in order to raise the presumption, i.e. he does not need to rely on his illegal motive in order to regain the property. These cases, the facts of which should be explained, demonstrate the so called reliance principle - the principle that illegality is only relevant if it is relied upon in evidence by the claimant. The outcome of the case, depending on the relationship of the parties and which presumption applies is obviously arbitrary and unsatisfactory as the statement suggests. . In its 2010 report 'The Illegality Defence', the Law Commission recommended the abolition of the presumption of advancement. This recommendation was adopted by the Government and s199 of the Equality Act 2010 abolishes the presumption. However, this section has not yet come into force and when it eventually does so it will not be retrospective in effect. The Law Commission also recommended that the courts be given a statutory discretion to decide the effect of illegality when a trust is created in order to conceal the beneficiary's interest in the trust property in connection with a criminal purpose. The statutory discretion would apply whether or not the criminal purpose was acted upon and whether it was the beneficiary or the trustee who intended to use the trust arrangement to conceal the real ownership of the trust property. In exercising the statutory discretion, certain factors would be taken into account by the court including: the conduct and intention of all the parties; the value of the equitable interest at stake. The Government has indicated that it will not be implementing this recommendation in the current Parliamentary session although it has not been abandoned altogether. Page 4 of 8 LW361: Equity and Trusts (MS) May/June 2013 Question Five As legal title to the property is in John's name and 'Equity follows the law', Jenny must prove, using trust principles, that she has a share in the beneficial interest. It is highly unlikely that she will be able to prove that he holds the property on express trust for her as there is no evidence in writing of a signed declaration to that effect as required by s53(1)(b) Law of Property Act 1925. By relying on the presumption of advancement, it can be assumed that the £15,000 given to Jenny by her grandmother (who was acting in loco parentis while Jenny's parents were abroad) was a gift. Therefore Jenny has made a direct contribution to the purchase price of the house and whilst this would enable her to plead that John holds the house on resulting trust for her proportionate to her contribution, it should be noted that a resulting trust is out of favour in respect of the family home. Rights crystallise at the time of purchase so Jenny's help with the mortgage repayments would not count, and quantification of her share would be purely arithmetical based only on her direct contribution. Jane should be advised that she should rely on a common intention constructive trust. Firstly, it appears that there was a common intention that the house was 'theirs' and an excuse of sorts was made for putting it in John's name. The excuse cases could be mentioned when discussing the express common intention constructive trust. In LLoyds Bank v Rosset, Lord Bridge stated that there were two elements - firstly an understanding/agreement demonstrating an express common intention between the parties regarding the beneficial interest and secondly detrimental conduct. Jane could refer to her assistance with the mortgage and utility bills and the re-decoration she undertook as evidence of such conduct. Alternatively she could plead that her direct contributions gave rise to an inferred common intention constructive trust and constituted both proof of the common intention and detrimental conduct. Relevant cases should be cited. Reference should be made to the dicta in Jones v Kernott and Stack v Dowden that the common intention should be deduced objectively having regard to a number of factors, which factors are also taken into account when quantifying the beneficial interest. These include: how the purchase was financed (where the discount for John and the direct contributions by Jane would be relevant); whether the parties had children; any discussion at the time of the purchase; how they discharged outgoings and so on. Students could attempt to quantify Jane's share having regard to these factors. Finally Jane could rely on proprietary estoppel although this is a remedy in which the court balances the party's expectation against the detriment suffered and the equity is satisfied by the minimum award to do justice. Relevant cases should be cited throughout. Page 5 of 8 LW361: Equity and Trusts (MS) May/June 2013 Question Six The student could begin by explaining the nature of an unincorporated association Conservative and Unionist Central Office v Burrell. The question asks how the club should be dissolved - this can come about in five ways which should be discussed. These were identified in GKN Bolts & Nuts Sports and Social Club and include the situation (similar to that in the problem) where the substratum, upon which the club was founded has gone, so that the club no longer has any effective purpose, or by agreement of all persons interested (such as the members in the present case). The next point is the destination of the two funds which can be divided into two parts. Regarding the fund in favour of Ruth - the student could discuss three possible options firstly that the surplus is held on resulting trust for the subscribers. The case which illustrates this is Re Abbott. A fund had been collected from identifiable subscribers for the maintenance and support of two elderly deaf sisters. No arrangement was made regarding any surplus remaining in the fund on their death and the question arose as to whether the monies had been given to the old ladies absolutely in which case it would form part of their estate, or whether it was subject to an obligation requiring that the fund be used for no purpose other than the maintenance and support of the two sisters, in which case the surplus would be held on resulting trust for the subscribers. The second option is that the subscribers intended the fund to be an outright gift in which case it would pass to Ruth's estate. The case which illustrates this is Re Andrews Trust. The Bishop of Jerusalem had died and a fund was set up to finance the education of his seven young children. When their education had been completed, there remained a surplus of monies in the fund and the same question arose as to whether the monies had been given absolutely or subject to a trust for a particular purpose. The fund was regarded as an absolute gift. Whilst the decision in these two cases should have been based on the intention of the subscribers when they made their contribution, it is widely believed that the court took a pragmatic approach based on the fact that the beneficiaries in Re Abbott were dead whereas in Re Andrews, they were alive. If that approach were followed in the instant case, then the surplus would result back to the subscribers. The third option that the fund passes as bona vacantia to the Crown would be appropriate where the subscribers were anonymous, but in the problem case, it would seem that the subscribers can be identified. Page 6 of 8 LW361: Equity and Trusts (MS) May/June 2013 With respect to the club's funds, there are two approaches which have been adopted by the court (both first instance) which should be discussed - Re West Sussex Constabulary Benevolent Fund, in which a resulting trust approach was applied regarding those parts of the surplus which arose from identifiable donations and legacies, whilst those parts of the surplus arising from members' subscriptions and raffles and entertainments were regarded as having been given on a contractual basis. As the transferees had received what they bargained for, the surplus was not returned to them but went as bona vacantia to the Crown. In Re Bucks Constabulary Fund, a contractual approach was applied, and the surplus (regardless of its source) was held for the members in accordance with an implied term in the contract inter se. It is generally thought that the view adopted in Re Bucks is the most appropriate as it fits in with the modern attitude towards gifts to, and asset holding by, an unincorporated association. It has been followed recently in other first instance cases - Horley Town Football Club and Hanchett-Stamford. As the senior members of the club paid twice as much by way of annual subscription as the junior members, the surplus funds should be distributed amongst members proportionate to their contribution. Question Seven In an often quoted passage in Bray v Ford, Lord Herschell said that it is an inflexible rule of the court of equity that a person in a fiduciary position is not, unless otherwise expressly provided, entitled to make a profit; he is not allowed to put himself in a position where his interest and duty conflict. The rationale for the rule is that the fiduciary could be swayed by personal interest rather than by duty, thus prejudicing those whom he is bound to protect. The rule is applied strictly by the English courts and is wide in its scope. Classic decisions such as Keech v Sandford, Regal Hastings, Boardman v Phipps should be cited as illustrations. A less restrictive attitude has been taken by courts in other jurisdictions, e.g. Peso Silvermines v Cropper; Queensland Mines v Hudson, Consul Development v DPC Estates, but the student could identify how this approach might be open to abuse. The fiduciary duty of a director is now found in s176 Companies Act 2006 and largely consolidates the case law on this topic. The proprietary and personal remedies should be discussed with reference to decided cases, e.g. Lister & Co v Stubbs, Sinclair Investments and the contrasting controversial decision of Attorney General for Hong Kong v Reid, identifying the ability to trace with the proprietary remedy but possible hardship which might be caused to third parties, e.g. creditors of a bankrupt fiduciary. Page 7 of 8 LW361: Equity and Trusts (MS) May/June 2013 Question Eight (a) Pennington v Waine concerned an ineffectual transfer of shares to the transferee which the court held took effect in equity because it would have been unconscionable for the transferor (Ada Crompton) to change her mind in circumstances akin to proprietary estoppel. The decision has been criticised - it goes much further than Re Rose, in which a transfer of shares had been made to the donee with all that remained to be done being registration of the shares by the company. It also goes further than Choithram as there had been a transfer by Mr Pargarani (as donor) to Mr Pargarani (as trustee of the donee foundation). It is criticised on the basis that it concerns the transfer of beneficial ownership yet is based on the vague and subjective concept of unconscionability. It has not been overruled but students could mention Zeital v Kaye which appears to be a return to more orthodox principles. (b) Re Gillingham Bus Disaster Fund - a surplus remained in a disaster appeal fund. The fund was non-charitable and although most of the donations to the fund were made anonymously, the court held that the surplus should be held on resulting trust to await claims by donors. That decision was clearly impractical and has been highly criticised, the better solution being that the fund should have been regarded as bona vacantia and passed to the Crown to be used for some useful purpose. (c) Lister & Co v Stubbs concerned a bribe received by an agent, i.e. a fiduciary, which had been invested successfully by him in shares and land. The court was unable to find that the principal had a proprietary interest in the bribe, i.e. Stubbs did not hold the bribe on constructive trust for Lister & Co. Consequently, the principal was unable to claim the profitable investments which had been made by Stubbs using the bribe money. Instead, Stubbs merely had a personal duty to account for the bribe, the relationship being one of creditor and debtor. This decision has been criticised as it allowed Stubbs to profit from his wrongdoing but has been followed recently in Sinclair Investments in order to enable creditors of a bankrupt fiduciary access to his assets, including those purchased with the bribe. (d) In Re James, it was held that the rule in Strong v Bird applied to the situation where a donor died intestate and the donee (to whom the imperfect gift had been made) took out letters of administration, i.e. became the administrator of the donor's estate. The facts of the case were that the deceased donor handed over the deeds of a house to a housekeeper. On the death of the donor, the housekeeper was granted letters of administration and legal title to the house then automatically vested in her capacity as administratrix. As she now had legal title, the imperfect gift was perfected. This extension of the rule in Strong v Bird was criticised by Walton J in Re Gonin because, unlike executors under a will, the deceased does not nominate the administrator, who could apply for letters of administration in order to perfect an imperfect gift made by the deceased. Page 8 of 8 LW361: Equity and Trusts (MS) May/June 2013