chapter 9

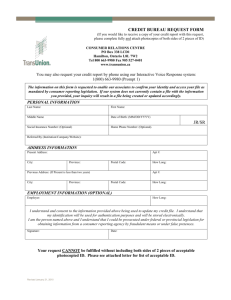

advertisement

The Arbitrage Pricing Theory

(Chapter 10)

Single-Factor APT Model

Multi-Factor APT Models

Arbitrage Opportunities

Disequilibrium in APT

Is APT Testable?

Consistency of APT and CAPM

Essence of the Arbitrage Pricing Theory

Given the impossibility of empirically verifying

the CAPM, an alternative model of asset

pricing called the Arbitrage Pricing Theory

(APT) has been introduced.

Essence of APT

– A security’s expected return and risk are

directly related to its sensitivities to changes

in one or more factors (e.g., inflation, interest

rates, productivity, etc.)

Essence of the Arbitrage Pricing Theory

(Continued)

– In other words, security returns are generated by a

single-index (one factor) model:

rj,t A j β1, jI1,t ε j,t

where:

I1,t Val u eof Factor (1) i n pe riod(t)

β1, j be taof se cu rity(j) with re spe ctto Factor (1)

– or, by a multi-index (multi-factor) model:

rj,t A j β1, jI1,t β 2, jI 2,t . . . + βn, jIn, t ε j,t

Single-Factor APT Model

(A Comparison With the CAPM)

CAPM (Zero Beta Version)

Factor = Market Portfolio

APT (One Factor Version)

Factor = “Your Choice”

Actual Returns:

Actual Returns:

rj,t A j β jrM, t ε j,t

rj,t A j β1, jI1,t ε j,t

Expected Returns:

Expected Returns:

E(r j ) E(rz ) [E(rM ) E(rz )]β j

E(r j ) E(rz ) [E(I 1 ) E(rz )]β1, j

FactorPrice*

Market Risk Premium

* Note: In thetext,lambda ( ) denotes

factorprice.

Single-Factor APT Model

(A Comparison With the CAPM)

Continued

CAPM (Zero Beta Version)

Continued

Portfolio Variance:

σ 2 (rp ) βp2 σ 2 (rM ) σ 2 (ε p )

APT (One Factor Version)

Continued

Portfolio Variance:

2

2

2

σ 2 (rp ) β1,

σ

(I

)

σ

(ε p )

p

1

m

wh e re βp

m

x β

j j

j1

wh e re β1,p

x β

j 1, j

j1

m

σ 2 (ε p )

m

x 2jσ 2 (ε j )

j1

Assu m i n gC O V(ε j , ε k ) 0

σ 2 (ε p )

x 2jσ 2 (ε j )

j1

Assu m i n gC O V(ε j , ε k ) 0

Multi-Factor APT Models

One Factor

rj, t A j β1, jI1,t ε j,t

E(r j ) E(rz ) [E(I1 E(rz )]β1, j

2

2

2

σ 2 (rp ) β1,

σ

(I

)

σ

(ε p )

p

1

Two Factors

rj,t A j β1, jI1,t β 2, jI 2,t ε j,t

E(r j ) E(rz ) [E(I1 ) E(rz )]β1, j [E(I 2 ) E(rz )]β 2, j

2 2

2 2

2

σ 2 (rp ) β1,

σ

(I

)

β

σ

(I

)

σ

(ε p )

p

1

2,p

2

Multi-Factor APT Models

(Continued)

N Factors

rj,t A j β1, jI1,t β 2, jI 2,t . . . + βn, jI n, t + ε j,t

E(r j ) E(rz ) [E(I1 ) E(rz )]β1, j

[E(I 2 ) E(rz )]β 2, j

+....

+ [E(I n ) E(rz )]βn, j

2 2

2

2

2

2

2

σ 2 (rp ) β1,

σ

(I

)

β

σ

(I

)

.

.

.

+

β

σ

(I

)

+

σ

(ε p )

p

1

2,p

2

n, p

n

The Ideal APT Model

Ideally, you wish to have a model where all of

the covariances between the rates of return to

the securities are attributable to the effects of

the factors. The covariances between the

residuals of the individual securities,

Cov(j, k), are assumed to be equal to zero.

APT With an Unlimited Number of

Securities

Given an infinite number of securities, if

security returns are generated by a process

equivalent to that of a linear single-factor or

multi-factor model, it is impossible to

construct two different portfolios, both having

zero variance (i.e., zero betas and zero residual

variance) with two different expected rates of

return. In other words, pure riskless arbitrage

opportunities are not available.

Pure Riskless Arbitrage

Opportunities

(An Example)

Note: If two zero variance portfolios could be

constructed with two different expected rates

of return, we could sell short the one with the

lower return, and invest the proceeds in the

one with the higher return, and make a pure

riskless profit with no capital commitment.

Pure Riskless Arbitrage

Opportunities

(An Example) - Continued

Expected Return (%)

0.25

C

D

B

A

E(rZ)1

E(rZ)2

0

-0.5

0

0.5

1

Factor Beta

1.5

“Approximately Linear” APT Equations

The APT equations are expressed as being

“approximately linear.” That is, the absence of

arbitrage opportunities does not ensure exact

linear pricing. There may be a few securities with

expected returns greater than, or less than, those

specified by the APT equation. However, because

their number is fewer than that required to drive

residual variance of the portfolio to zero, we no

longer have a riskless arbitrage opportunity, and

no market pressure forcing their expected returns

to conform to the APT equation.

Disequilibrium Situation in APT:

A One Factor Model Example

Portfolio (P) contains 1/2 of security (B) plus 1/2 of the

zero beta portfolio:

β1,P .5 β1,B .5 β1,Z .5(2.0) .5(0) 1.0

Portfolio (P) dominates security (A). (i.e., it has the same

beta, but more expected return).

Expected Return (%)

B

20

P

E(rP)

E(I1)

Equilibrium Line

E(rA)

A

E(rZ)

Beta

0

0

0.5

1

1.5

2

2.5

Disequilibrium Situation in APT:

A One Factor Model Example

(Continued)

Arbitrage: Investors will sell security (A). Price

of security (A) will fall causing E(rA) to rise.

Investors will use proceeds of sale of security (A)

to purchase security (B). Price of security (B)

will rise causing E(rB) to fall. Arbitrage

opportunities will no longer exist when all assets

lie on the same straight line.

Anticipated Versus Unanticipated Events

Given a Single-Factor Model:

rj,t A j β1, jI1,t ε j,t

{Equ ation#1}

S inceE( ε) 0, we can stateth at:

E(r j ) A j β1, jE(I 1 )

or

A j E(r j ) β1, jE(I 1 )

{Equ ation#2}

Substituting the right hand side of Equation #2 for Aj in

Equation #1:

rj,t E(r j ) β1, jE(I 1 ) β1, jI1,t ε j,t

rj,t

E(r j )

+

β1, j[I1,t E(I 1 )] ε j,t

Actual

Anticipated

Unanticipated

Return

Return

Return

Anticipated Versus Unanticipated Events

(Continued)

Note: If the actual factor value (I1,t) is exactly

equal to the expected factor value, E(I1), and the

residual (j,t) equals zero as expected, then all

return would have been anticipated:

rj,t = E(rj)

If (I1,t) is not equal to E(I1), or (j,t) is not equal to

zero, then some unanticipated return (positive or

negative) will be received.

Anticipated Versus Unanticipated Events

(A Numerical Example)

Given:

E(rZ ) .06 E(I 1 ) .12 I1,t .15 ε j,t .01 β1, j .5

Expected Return:

E(r j ) E(rZ ) [E(I1 ) E(rZ )]β1, j

= .06 + [.12- .06].5

= .09

Anticipated Versus Unanticipated Return:

rj,t E(r j ) β1, j[I1,t E(I 1 )] ε j,t

= .09 + .5[.15- .12]+ .01

=

.09

Anticipated

.015+ .01

Unanticipated

Anticipated Versus Unanticipated Returns

(A Graphical Display)

rj,t = .115

.105

E(rj) = .09

E(rZ) = .06

.03

0

0.03

0.06 0.09

E(rZ)

0.12

E(I1)

0.15

I1,t

0.18

0.21

Consistency of the APT and the CAPM

I1,t

I2,t

M,I1

M,I2

AI1

AI2

rM,t

0

0

rM,t

Consider APT for a Two Factor Model:

E(r j ) E(rZ ) [E(I1 ) E(rZ )]β1, j [E(I 2 ) E(rZ )]β2, j

In terms of the CAPM, we can treat each of the factors in

the same manner that individual securities are treated: (See

charts above)

– CAPM Equation:

E(r j ) E(rZ ) [E(rM ) E(rZ )]βM, j

Note that M,I1 and M,I2 are the CAPM (market) betas of

factors 1 and 2. Therefore, in terms of the CAPM, the

expected values of the factors are:

E(I 1 ) E(rZ ) [E(rM ) E(rZ )]β M, I 1 Equation1

E(I 2 ) E(rZ ) [E(rM ) E(rZ )]β M, I 2 Equation2

By substituting the right hand sides of Equations 1 and 2

for E(I1) and E(I2) in the APT equation, we get:

E(r j ) E(rZ ) ([E(rM ) E(rZ )]β M, I 1 ) β1, j

+ ([E(rM ) E(rZ )]β M, I 2 ) β 2, j

E(r j ) E(rZ ) [E(rM ) E(rZ )](β M, I 1β1, j β M, I 2β 2, j )

Note th at: β M, j β M, I 1β1, j β M, I 2β 2, j

S i n ce: E(r j ) E(rZ ) [E(rM ) E(rZ )]β M, j

There are numerous securities that could have the same

CAPM beta (M,j), but have different APT betas relative to

the factors (1,j and 2,j).

Consistency of the APT and CAPM (an example)

– Given: Factor 1 (Productivity) M,I1 = .5

Factor 2 (Inflation)

M,I2 = 1.5

Security 1,j

______ ____

1

0

2

.4

3

.8

4

1.2

5

1.6

6

2.0

2,j

____

.667

.534

.400

.267

.134

0

M,I1 1,j + M,I2 2,j = M,j

___________________

.5(0) + 1.5(.667) = 1.00

.5(.4) + 1.5(.534) = 1.00

.5(.8) + 1.5(.400) = 1.00

.5(1.2) + 1.5(.267) = 1.00

.5(1.6) + 1.5(.134) = 1.00

.5(2.0) + 1.5(0) = 1.00

Assuming the market is efficient, all of the

securities (1 through 6) will have equal returns on

the average over time since they have a CAPM

beta of 1.00. However, some would argue that it is

not necessarily true that a particular investor

would consider all securities with the same

expected return and CAPM beta equally desirable.

For example, different investors may have

different sensitivities to inflation.

Note: It is possible for both the CAPM and the

multiple factor APT to be valid theories. The

problem is to prove it.

Empirical Tests of the APT

Currently, there is no conclusive evidence either

supporting or contradicting APT. Furthermore, the number

of factors to be included in APT models has varied

considerably among studies. In one example, a study

reported that most of the covariances between securities

could be explained on the basis of unanticipated changes in

four factors:

– Difference between the yield on a long-term and a

short-term treasury bond.

– Rate of inflation

– Difference between the yields on BB rated corporate

bonds and treasury bonds.

– Growth rate in industrial production.

Is APT Testable?

Some question whether APT can ever be

tested. The theory does not specify the

“relevant” factor structure. If a study shows

pricing to be consistent with some set of

“N” factors, this does not prove that an “N”

factor model would be relevant for other

security samples as well. If returns are not

explained by some “N” factor model, we

cannot reject APT. Perhaps the choice of

factors was wrong.

Using APT to Predict Return

Haugen presents a test of the predictive power of APT

using the following factors:

– Monthly return to U.S. T-Bills

– Difference between the monthly returns on long-term

and short-term U.S. Treasury bonds.

– Difference between the monthly returns on long-term

U.S. Treasury bonds and low-grade corporate bonds

with the same maturity.

– Monthly change in consumer price index.

– Monthly change in U.S. industrial production.

– Dividend to price ratio of the S&P 500.

Haugen presents continued . . .

Using data for 3000 stocks over the period 1980-1997,

he found that the APT did appear to have only limited

predictive power regarding returns.

He argues that the “arbitrage” process is extremely

difficult in practice. Since covariances (betas) must be

estimated, there is uncertainty regarding their values in

future periods. Therefore, truly risk-free portfolios

cannot be created using risky stocks. As a result, pure

riskless arbitrage is not readily available limiting the

usefulness of APT models in predicting future stock

returns.