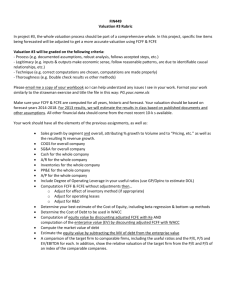

Valuation

advertisement

Valuation NYU Valuing a Business I Prof. Ian Giddy New York University What’s a Company Worth? Required returns Types of Models Balance sheet models Comparables Corporate cash flow models Estimating Growth Rates Applications Option-based models Copyright ©2004 Ian H. Giddy Valuation 3 IBM Source: biz.yahoo.com Copyright ©2004 Ian H. Giddy Valuation 4 IBM Source: biz.yahoo.com Copyright ©2004 Ian H. Giddy Valuation 5 IBM’s Financials Source: morningstar.com Copyright ©2004 Ian H. Giddy Valuation 6 Equity Valuation: From the Balance Sheet Value of Assets Book Liquidation Replacement Value of Liabilities Book Market Value of Equity Copyright ©2004 Ian H. Giddy Valuation 7 Equity Valuation: From the Balance Sheet Value of Assets Book Liquidation Replacement Or what? A New York City study estimated that the 322 trees surveyed had an average value of $3,225 per tree and a total value of $1,038,458. The value was said to be the amount the city would have to pay to replace the tree. (New York Times, 12 May 2003) Copyright ©2004 Ian H. Giddy Valuation 8 Relative Valuation In relative valuation, the value of an asset is derived from the pricing of 'comparable' assets, standardized using a common variable such as earnings, cashflows, book value or revenues. Examples include -• Price/Earnings (P/E) ratios and variants (EBIT multiples, EBITDA multiples, Cash Flow multiples) • Price/Book (P/BV) ratios and variants (Tobin's Q) • Price/Sales ratios Copyright ©2004 Ian H. Giddy Valuation 9 Comparables Value Indicator Earnings Cash Flow Revenues Book Copyright ©2004 Ian H. Giddy Average Comparable Industry Firms Deals Target Company Numbers or Projections Estimated Value of Target Valuation 10 IBM: Comparables Source: Reuters Copyright ©2004 Ian H. Giddy Valuation 11 Disney: Relative Valuation Company PE King World Productions 10.4 Aztar 11.9 Viacom 12.1 All American Communications GC Companies 20.2 Circus Circus Enterprises 20.8 Polygram NV ADR 22.6 Regal Cinemas 25.8 Walt Disney 27.9 AMC Entertainment 29.5 Premier Parks 32.9 Family Golf Centers 33.1 CINAR Films 48.4 Average 27.44 Copyright ©2004 Ian H. Giddy Expected Growth 7.00% 12.00% 18.00% 15.8 15.00% 17.00% 13.00% 23.00% 18.00% 20.00% 28.00% 36.00% 25.00% 18.56% PE ratio divided by the growth rate PEG 1.49 0.99 0.67 20.00%0.79 1.35 1.22 1.74 1.12 1.55 1.48 1.18 0.92 1.94 1.20 Valuation 13 IBM: Forward Comparables Source: morningstar.com Copyright ©2004 Ian H. Giddy Valuation 14 Corporate Cash Flow Copyright ©2004 Ian H. Giddy Valuation 15 Discounted Cashflow Valuation: Basis for Approach t = n CF t Value = t t =1 (1+ r) where n = Life of the asset CFt = Cashflow in period t r = Discount rate reflecting the riskiness of the estimated cashflows Copyright ©2004 Ian H. Giddy Valuation 16 Start with the Weighted Average Cost of Capital Choice Cost 1. Equity - Retained earnings - New stock issues - Warrants Cost of equity - depends upon riskiness of the stock - will be affected by level of interest rates Cost of equity = riskless rate + beta * risk premium 2. Debt - Bank borrowing - Bond issues Cost of debt - depends upon default risk of the firm - will be affected by level of interest rates - provides a tax advantage because interest is tax-deductible Cost of debt = Borrowing rate (1 - tax rate) Debt + equity = Capital Cost of capital = Weighted average of cost of equity and cost of debt; weights based upon market value. Cost of capital = kd [D/(D+E)] + ke [E/(D+E)] Copyright ©2004 Ian H. Giddy Valuation 17 IBM’s Cost of Capital IBM Cost of Capital Cost Amount Weight Debt 10-year bond yield Tax rate After-tax cost 4.95% 29% 3.5% 61.9 31% Risk-free Treasury Beta Market Risk Premium From CAPM 4.50% 1.47 5.50% 12.6% 137.4 69% 9.77% 199.3 Equity Total Source: IBMfinancing.xls Copyright ©2004 Ian H. Giddy Valuation 18 Valuation: The Key Inputs A publicly traded firm potentially has an infinite life. The value is therefore the present value of cash flows forever. t = CF t Value = t t = 1 (1+ r) Since we cannot estimate cash flows forever, we estimate cash flows for a “growth period” and then estimate a terminal value, to capture the value at the end of the period: t = N CFt Terminal Value Value = N t (1 + r) (1 + r) t =1 Copyright ©2004 Ian H. Giddy Valuation 19 Dividend Discount Models: General Model Dt Vo t t 1 (1 k ) V0 = Value of Stock Dt = Dividend k = required return Copyright ©2004 Ian H. Giddy Valuation 20 No Growth Model D Vo k Stocks that have earnings and dividends that are expected to remain constant Preferred Stock Copyright ©2004 Ian H. Giddy Valuation 21 No Growth Model: Example D Vo k Burlington Power & Light has earnings of $5 per share and pays out 100% dividend The required return that shareholders expect is 12% The earnings are not expected to grow but remain steady indefinitely What’s a BPL share worth? E1 = D1 = $5.00 k = .12 V0 = $5.00/0.12 = $41.67 Copyright ©2004 Ian H. Giddy Valuation 22 Constant Growth Model Do (1 g ) Vo kg g = constant perpetual growth rate Copyright ©2004 Ian H. Giddy Valuation 23 Constant Growth Model: Example Do (1 g ) Vo kg Motel 6 has earnings of $5 per share. It reinvests 40% and pays out 60%dividend The required return that shareholders expect is 12% The earnings are expected to grow at 6% per annum What’s an M6 share worth? E1 = $5.00 k = 12% D1 = $3.00 g = 6% V0 = 3.00 / (.12 - .06) = $50.00 Copyright ©2004 Ian H. Giddy Valuation 24 Estimating Dividend Growth Rates g ROE b g = growth rate in dividends ROE = Return on Equity for the firm b = plowback or retention percentage rate i.e.(1- dividend payout percentage rate) Copyright ©2004 Ian H. Giddy Valuation 25 Or Use Analysts’ Expectations? Source: biz.yahoo.com Copyright ©2004 Ian H. Giddy Valuation 26 Shifting Growth Rate Model (1 g1) DT (1 g 2 ) V o Do t T ( k g 2 )(1 k ) t 1 (1 k ) T t g1 = first growth rate g2 = second growth rate T = number of periods of growth at g1 Copyright ©2004 Ian H. Giddy Valuation 27 Shifting Growth Rate Model: Example D0 = $2.00 g1 = 20% g2 = 5% k = 15% T = 3 D1 = 2.40 D2 = 2.88 D3 = 3.46 D4 = 3.63 V0 = D1/(1.15) + D2/(1.15)2 + D3/(1.15)3 + D4 / (.15 - .05) ( (1.15)3 Mindspring pays dividends $2 per share. The required return that shareholders expect is 15% The dividends are expected to grow at 20% for 3 years and 5% thereafter What’s a Mindspring share worth? V0 = 2.09 + 2.18 + 2.27 + 23.86 = $30.40 Copyright ©2004 Ian H. Giddy Valuation 28 Stable Growth and Terminal Value When a firm’s cash flows grow at a “constant” rate forever, the present value of those cash flows can be written as: Value = Expected Cash Flow Next Period / (r - g) where, r = Discount rate (Cost of Equity or Cost of Capital) g = Expected growth rate This “constant” growth rate is called a stable growth rate and cannot be higher than the growth rate of the economy in which the firm operates. While companies can maintain high growth rates for extended periods, they will all approach “stable growth” at some point in time. When they do approach stable growth, the valuation formula above can be used to estimate the “terminal value” of all cash flows beyond. Copyright ©2004 Ian H. Giddy Valuation 29 Choosing a Growth Pattern: Examples Company PWC Valuation in Nominal U.S. $ Firm DirecTV Nominal US$ Equity: FCFE Allianz Nominal Euro Equity: Dividends Copyright ©2004 Ian H. Giddy Growth Period Stable Growth 10 years 6%(long term (3-stage) nominal growth rate in the world economy 5 years 4%: based upon (2-stage) expected long term US growth rate 0 years 3%: set equal to nominal growth rate in the European economy Valuation 30 The Building Blocks of Valuation Choose a Cash Flow Dividends Expected Dividends to Stockholders Cashflows to Equity Cashflows to Firm Net Income EBIT (1- tax rate) - (1- ) (Capital Exp. - Deprec’n) - (Capital Exp. - Deprec’n) - Change in Work. Capital - (1- ) Change in Work. Capital = Free Cash flow to Equity (FCFE) = Free Cash flow to Firm (FCFF) [ = Debt Ratio] & A Discount Rate Cost of Equity Cost of Capital WACC = ke ( E/ (D+E)) Basis: The riskier the investment, the greater is the cost of equity. Models: CAPM: Riskfree Rate + Beta (Risk Premium) + kd ( D/(D+E)) kd = Current Borrowing Rate (1-t) E,D: Mkt Val of Equity and Debt APM: Riskfree Rate + Betaj (Risk Premiumj): n factors & a growth pattern Stable Growth Two-Stage Growth g g Three-Stage Growth g | t Copyright ©2004 Ian H. Giddy High Growth | Stable High Growth Transition Stable Valuation 31 Estimating Future Cash Flows Dividends? Free cash flows to equity? Free cash flows to firm? Copyright ©2004 Ian H. Giddy Valuation 32 Better Than Dividends: Free Cash Flows Revenue - Expenses - Depreciation = EBIT Adjust for tax: EBIT(1-T) Revenue -Expenses -Depreciation EBIT EBIT(1-t) +Depreciation -CapEx -Change in WC FCFF 81.20 (67.99) (4.95) 8.26 5.90 4.95 (4.31) (0.90) 5.64 + Depreciation - Capex - Ch working capital = Free Cash Flows to Firm Copyright ©2004 Ian H. Giddy Valuation 33 Deriving IBM’s Free Cash Flows Data Sales, ttm Operating costs Depreciation EBIT Tax Cap Ex Change in WC Interest expense 4Q02ttm $ 81.20 $ 67.99 $ 4.95 $ 8.26 $ 2.36 $ 4.31 $ 0.90 $ 0.15 Free Cash Flows 84% 29% $b Revenue -Expenses -Depreciation EBIT EBIT(1-t) +Depreciation -CapEx -Change in WC FCFF Copyright ©2004 Ian H. Giddy billion billion billion billion billion billion billion billion 81.20 (67.99) (4.95) 8.26 5.90 4.95 (4.31) (0.90) 5.64 Interest $ 0.15 FCFE $ 5.49 IBMvaluation.xls Valuation 34 Two Applications Copyright ©2004 Ian H. Giddy Valuation 35 Equity Valuation in Practice Estimating discount rate Estimating cash flows Estimating growth Application with constant growth: Optika Application with shifting growth: Fong Copyright ©2004 Ian H. Giddy Valuation 37 Valuing a Firm with DCF: The Short Version Historical financial results Projected sales and operating profits Adjust for noncash items Free cash flows to the firm (FCFF) Discount to present using constant growth model FCFF(1+g)/(WACC-g) Present value of free cash flows Copyright ©2004 Ian H. Giddy - Market value of debt Calculate weighted average cost of capital (WACC) Estimate stable growth rate (g) Value of shareholders equity Valuation 38 Optika: Facts The firm has revenues of €3.125b, growing at 5% per annum. Costs are estimated at 89%, and working capital at 10%, of sales. The depreciation expense next year is calculated to be €74m. Optika’s marginal tax rate is 35%, and the interest on its €250m of debt is 8.5%. The market value of equity is €1.3b. Is this firm fairly valued in the market? What assumptions might be changed? Copyright ©2004 Ian H. Giddy Valuation 39 Optika Growth Tax rate Initial Revenues COGS WC Equity Market Value Debt Market Value Beta Treasury bond rate Debt Spread Market risk premium Revenues next year -COGS -Depreciation =EBIT EBIT(1-Tax) +Depreciation -Capital Expenditures -Change in WC -Free Cash Flow to Firm Cost of Equity (from CAPM) Cost of Debt (after tax) WACC Firm Value 5% 35% 3125 89% 10% 1300 250 1 7% 1.50% 5.50% T+1 3281 2920 74 287 187 74 -74 -16 171 12.50% 5.53% 11.38% 2681 optika.xls Equity Value Copyright ©2004 Ian H. Giddy 2431 Valuation 40 Growth Tax rate Initial Revenues COGS WC Equity Market Value Debt Market Value Beta WACC: Treasury bond rate Debt Spread ReE/(D+E)+RdD/(D+E) Market risk premium Optika Revenues next year Value: -COGS -Depreciation FCFF/(WACC-growth rate) =EBIT EBIT(1-Tax) +Depreciation -Capital Expenditures Equity Value: -Change in WC Firm Value - Debt Value -Free Cash Flow to Firm Cost of Equity (from CAPM) = 2681-250 = 2431 Cost of Debt (after tax) WACC Firm Value 5% 35% 3125 89% 10% 1300 250 1 7% 1.50% 5.50% T+1 3281 2920 74 287 187 74 -74 -16 171 12.50% 5.53% 11.38% CAPM: 7%+1(5.50%) Debt cost (7%+1.5%)(1-.35) 2681 optika.xls Equity Value Copyright ©2004 Ian H. Giddy 2431 Valuation 41 Valuing a Firm with DCF: The Extended Version Historical financial results Adjust for nonrecurring aspects Gauge future growth Projected sales and operating profits Adjust for noncash items Projected free cash flows to the firm (FCFF) Year 1 FCFF Year 2 FCFF Year 3 FCFF Year 4 FCFF Discount to present using weighted average cost of capital (WACC) Present value of free cash flows Copyright ©2004 Ian H. Giddy + cash, securities & excess assets - Market value of debt … Terminal year FCFF Stable growth model or P/E comparable Value of shareholders equity Valuation 42 Valuation Example: Shifting Growth Fong Industries (Pte) Ltd Singapore Profit & Loss (S$'000) FYE 30 Jun Turnover 1994 1995 1996 1997 1998 1999 9,651 57,888 125,010 120,323 136,003 134,813 Directors' Fees & Rem Amortisation Depreciation Interest Expense Bad Debts W/O Fixed Assets W/O FX loss 107 0 639 227 249 269 1,041 445 368 279 1,277 615 820 280 3,812 1,002 964 39 4,494 697 85 961 35 4,673 1,078 100 543 282 Profit b/f Tax 933 1,250 3,774 6,897 4 1,990 838 Assoc Co (74) 933 Tax Profit a/f Tax Effective Tax Rate 1,990 3 930 1,990 0.32% 0.00% EBITDA ISC Copyright ©2004 Ian H. Giddy 3,745 792.51% 841.57% 108.17% (14) 1,176 3,811 6,883 96 292 929 178 742 884 2,882 6,705 24.83% 24.38% 2.59% (768) (7) (156) 7,292 1,799 37 838 11.46% EOI 27 3,009 489.27% -19.65% 6,270 625.75% 108.37% 9,597 890.26% #### 12,113 1737.88% Valuation 43 Valuation Example: Shifting Growth Fong Industries Growth1 Growth2 Tax Revenue Expenses EBIT WC b (unlevered) b (levered) Kd MVe MVd Combined Rm Rf Ke WACC 25% 5% 25% 134,813 91.01% 7,580 10% 1.06 1.09 5.50% 218,993 7,379 226,372 12.00% 4.00% for 3 years thereafter effective (S$'000); T0 of Revenue (S$'000) of Revenue (S$'000) (S$'000) (S$'000) PERMkt 32.66 Revenue -Expenses -Depreciation EBIT EBIT(1-t) +Depreciation -CapEx -Change in WC FCFF Firm Value Equity Value PERcomputed 147,773 140,394 20.94 T1 168,516 153,375 4,533 10,608 7,956 4,533 4,533 3,370 4,586 T2 210,645 191,719 4,533 14,394 10,795 4,533 4,533 4,213 6,582 4,586 6,582 T3 263,307 239,648 4,533 19,125 14,344 4,533 4,533 5,266 9,078 187,655 196,733 T4 276,472 251,631 4,533 20,308 15,231 4,533 4,533 1,317 13,915 $0.65 12.69% 12.41% fong.xls Copyright ©2004 Ian H. Giddy Valuation 44 Case Study: IBM Constant growth model valuation: FCFF 5.64 WACC 9.77% Growth rate 5.70% Firm Value less debt Equity value 146.51 billion -61.86 billion 84.65 billion divided by 1.69 gives $ 50.09 per share 2-stage growth model valuation Stage 1 10% Stage 2 5.70% End of year Revenue -Expenses -Depreciation EBIT EBIT(1-t) +Depreciation -CapEx -Change in WC FCFF Total PV Total PV less debt Equity value 2002 81.20 -67.99 -4.95 8.26 5.90 4.95 -4.31 -0.90 5.64 2003 89.32 -74.79 -5.45 9.09 6.49 5.45 -4.74 -0.99 6.20 2004 98.25 -82.27 -5.99 9.99 7.14 5.99 -5.22 -1.09 6.82 2005 108.08 -90.49 -6.59 10.99 7.85 6.59 -5.74 -1.20 7.51 2006 118.88 -99.54 -7.25 12.09 8.64 7.25 -6.31 -1.32 8.26 6.20 5.65 6.82 5.66 7.51 5.68 8.26 5.69 176.00 -61.86 billion 114.13 billion divided by 1.69 gives 2007 130.77 -109.50 -7.97 13.30 9.50 7.97 -6.94 -1.45 9.08 235.25 244.34 153.32 2008 138.23 -115.74 -6.94 15.55 11.10 6.94 -6.94 -1.53 9.57 $ 67.53 per share IBMvaluation.xls Copyright ©2004 Ian H. Giddy Valuation 46 Summary: The Building Blocks of Valuation Choose a Cash Flow Dividends Expected Dividends to Stockholders Cashflows to Equity Cashflows to Firm Net Income EBIT (1- tax rate) - (1- ) (Capital Exp. - Deprec’n) - (Capital Exp. - Deprec’n) - Change in Work. Capital - (1- ) Change in Work. Capital = Free Cash flow to Equity (FCFE) = Free Cash flow to Firm (FCFF) [ = Debt Ratio] & A Discount Rate Cost of Equity Cost of Capital WACC = ke ( E/ (D+E)) Basis: The riskier the investment, the greater is the cost of equity. Models: CAPM: Riskfree Rate + Beta (Risk Premium) + kd ( D/(D+E)) kd = Current Borrowing Rate (1-t) E,D: Mkt Val of Equity and Debt APM: Riskfree Rate + Betaj (Risk Premiumj): n factors & a growth pattern Stable Growth Two-Stage Growth g g Three-Stage Growth g | t Copyright ©2004 Ian H. Giddy High Growth | Stable High Growth Transition Stable Valuation 47 Copyright ©2004 Ian H. Giddy Alternatives Valuation 48 What’s a Company Worth? Alternative Models The options approach Option to expand Option to abandon Creation of key resources that another company would pay for Patents or trademarks Teams of employees Customers Examples? Copyright ©2004 Ian H. Giddy Valuation 50 What’s a Company Worth? The Options Approach Value of the Firm or project Present Value of Expected Cash Flows if Option Excercised Copyright ©2004 Ian H. Giddy Valuation 51 The Value of a Corporate Option Having the exclusive rights to a product or project is valuable, even if the product or project is not viable today. The value of these rights increases with the volatility of the underlying business. The cost of acquiring these rights (by buying them or spending money on development - R&D, for instance) has to be weighed off against these benefits. Copyright ©2004 Ian H. Giddy Valuation 52 Extreme Situations: Equity is Like an Option Assets Liabilities Debt Value of future cash flows Contractual int. & principal No upside Senior claims Control via restrictions Equity Residual payments Upside and downside Residual claims Voting control rights Copyright ©2004 Ian H. Giddy Valuation 53 Marvel in Trouble, 1996 Banks Icahn et al. Choices: Accept Perelman’s plan Sell the debt at $.14-$.17 Reject plan and propose own Perelman Copyright ©2004 Ian H. Giddy Secured and senior Get fully repaid under plan Controls Marvel equity NPV is negative Option value may be positive Valuation 54 Next… Valuation Acquisition Copyright ©2004 Ian H. Giddy LBOs Restructuring Valuation 55 Copyright ©2004 Ian H. Giddy Valuation 56 Copyright ©2004 Ian H. Giddy Valuation 57 Valuation Acquisition LBOs Restructuring More to come… Copyright ©2004 Ian H. Giddy Valuation 59