Managerial Accounting

by James Jiambalvo

Chapter 6:

Cost Allocation and

Activity-Based Costing

Slides Prepared by:

Scott Peterson

Northern State

University

Objectives

1. Explain why indirect costs are allocated.

2. Describe the cost allocation process.

3. Discuss allocation of service department

costs.

4. Identify potential problems with cost

allocation.

5. Discuss activity-based costing (ABC) and

cost drivers.

6. Discuss activity-based management

(ABM).

Purposes of Cost Allocation

1. To provide information needed for

decision making.

2. To reduce the frivolous use of common

resources.

3. To encourage managers to evaluate

the efficiency of internally provided

services.

4. To calculate the full cost of products

for financial reporting purposes and for

determining cost-based prices.

Purposes of Cost Allocation

Rationale #1: To Provide

Information for Decision

Making

From a decision making standpoint, the

allocated cost should measure the

opportunity cost of using a company

resource.

Rationale #2: To Reduce

Frivolous Use of Common

Resources

By not allocating costs, these resources

appear “free” to the users. But resources

never come with zero costs.

Rationale #3: To Encourage

Evaluation of Services

The flip-side of the previous point (to

reduce frivolous usage); to compel the

current users to evaluate the costs and

benefits of the services for which they are

being charged (allocated).

Rationale #4: To Provide “Full”

Cost Information

1. GAAP requires full-costing for external

reporting purposes.

2. In the long-run, all costs must be

covered.

Process of Cost Allocation

Steps include:

Identify the cost objectives

Form cost pools

Select an allocation base to relate

the cost pools to the cost

objectives.

Process of Cost Allocation

Determining the Cost Objective

Cost Objective: Determine the product,

service or department that is to receive

the allocation.

Determining the Cost Objective

Forming Cost Pools

Cost pool: A grouping of individual costs,

the sum of which is allocated using a

single allocation base.

Cost pools could include:

1. Departments (maintenance or

personnel departments)

2. Major Activities (equipment setups)

Selecting an Allocation Base

1. Allocation Base: Very important to

choose a base that relates the cost

pool to the cost objectives.

2. Allocation should be based on a

cause-and-effect relationship between

costs and objectives.

3. If cause-and-effect cannot be

established, other approaches are

used.

Other Approaches to Cost

Allocation (Fixed-Indirect)

1. Relative benefits approach.

2. Ability to bear costs.

3. Equity approach.

These are all merely accounting

convention; allocation for the sake of

allocation.

Allocating Service Department

Costs

1. Manufacturing firms are often

organized either

a. By production department

b. By service department

2. Production department implies a

“direct” activity.

3. Service department implies an

“indirect” activity.

Direct Method of Allocating

Service Department Costs

The Direct Method.

Direct Method of Allocating

Service Department Costs

Bradley Furniture Example:

Allocating Budgeted and

Actual Service Department

Costs

1. Managers should allocate budgeted

rather than actual costs.

2. In this way inefficiencies cannot be

passed on to production.

Problems With Cost Allocation

1. Allocation of uncontrollable costs.

2. Arbitrary allocations.

3. Allocations of fixed costs that make the

fixed costs appear to be variable.

4. Allocations of manufacturing overhead

to products using too few overhead

and cost pools.

5. Use of only volume-related allocation

bases.

Responsibility Accounting and

Controllable Costs (1)

1. Responsibility accounting holds

someone in some unit accountable for

generating revenue and controlling

costs.

2. The trick is to find out whom to hold

accountable and at what level.

3. Managers should be held accountable

only for controllable costs.

Arbitratry Allocations (2)

1. Cost allocations are inherently

arbitrary.

2. Managers frequently make educated

guesses.

Unitized Fixed Costs and

Lump-Sum Allocations (3)

1. Unitized fixed costs pose a significant

problem.

2. Costs that are fixed (in the short run),

are often divided by some base and

allocated as variable (per-unit).

3. Importantly, this is a question of

perspective.

4. The higher up in the hierarchy the

manager is, the greater the number of

all costs that appear variable.

Lump-Sum Allocations (3)

1. The remedy is to allocate these costs, like

clerical and administrative, as lump-sum

allocations.

2. Lump-sum allocations should remain the

same, year-by-year, regardless of total

production.

3. Lump-sum allocations ignore changes in

activity-levels.

The Problem With Too Few

Cost Pools (4)

1. Too few cost pools cause serious product

costing distortions.

2. Generally, the more cost pools, the more

accuracy is enhanced.

3. Does the benefit of more accurate

allocation methods (i.e.more cost pools)

outweigh the cost of obtaining this

information?

Using Only Volume-Related

Allocation Bases (5)

1. Some manufacturers allocate

manufacturing overhead to products using

only volume measures (such as):

a. labor hours

b. machine hours

2. Not all overhead costs vary in relation to

volume!

Activity-Based Costing

Activity-Based Costing (ABC) is a

relatively recent development in

management accounting.

The Problem of Using Only

Measures of Production

Volume to Allocate Overhead

1. Traditionally firms use labor hours or

machine hours as allocation bases for

assigning overhead to products.

2. This assumes that all costs are

proportional to production volume.

3. Setup costs are not proportional.

4. For example, a setup might work for a

400,000 unit production run just as well as

a 200,000 production run.

5. Low-volume items are undercosted and

high-volume items are overcosted.

The ABC Approach

1. Identify the major activities that cause

overhead costs to be incurred.

2. Group costs of activities into cost

pools.

3. Identify measures of activities (the cost

drivers)

4. Relate costs to products using the cost

drivers.

The ABC Approach

Examples of Activities

1.

2.

3.

4.

5.

Processing purchase orders.

Handling materials and parts.

Inspecting incoming material and parts.

Setting up equipment.

Producing goods using manufacturing

equipment.

6. Supervising assembly workers.

7. Inspecting finished goods.

8. Packing customer orders.

Examples of Associated Costs

1. Various labor costs.

2. Depreciation.

Examples of Cost Drivers

1.

2.

3.

4.

5.

6.

7.

8.

Number of purchase orders processed.

Number of material requisitions.

Number of receipts.

Number of setups.

Number of machine hours.

Number of assembly labor hours.

Number of inspections.

Number of boxes shipped.

Pros and Cons of ABC

Benefits:

1. ABC is less likely than traditional costing to

undercost or overcost products.

2. ABC may lead to improvements in cost

control.

Limitations:

1. Expensive relative to traditional system!

“You Get What You Measure”

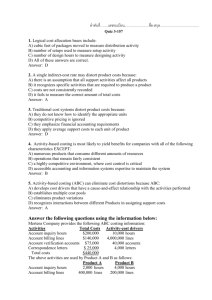

Quick Review Question #1

1. The direct method of allocating costs:

a. Allocates service department costs

to other service departments.

b. Allocates only direct costs.

c. Allocates service department costs

to production departments only.

d. Both (b) & (c).

Quick Review Answer #1

1. The direct method of allocating costs:

a. Allocates service department costs

to other service departments.

b. Allocates only direct costs.

c. Allocates service department costs

to production departments only.

d. Both (b) & (c).

Quick Review Question #2

1. In the cost allocation process, the cost

objective is:

a. The allocation base used to

allocate the costs.

b. A grouping of individual costs

whose total is allocated using one

allocation base.

c. The product, service or department

that is to receive the allocation

d. None of these.

Quick Review Answer #2

1. In the cost allocation process, the cost

objective is:

a. The allocation base used to

allocate the costs.

b. A grouping of individual costs

whose total is allocated using one

allocation base.

c. The product, service or department

that is to receive the allocation.

d. None of these.

Quick Review Answer #2

2. Units produced = 2,000, units sold =

1,800, contribution margin ratio is

37%, fixed S & A expenses are

$90,000. Fixed mfg. Expenses are

$80,200 By how much is net income

greater under full costing than variable

costing?

a. $8,020

b. $80,200

c. $9,000

d. $17,020

Quick Review Question #3

3. The errant process of treating fixed

costs a variable, or a per-unit basis, is

called?

a. A cost driver.

b. A cost object.

c. Unitizing fixed costs.

d. An arbitrary allocation.

Quick Review Answer #3

3. The errant process of treating fixed

costs a variable, or a per-unit basis, is

called?

a. A cost driver.

b. A cost object.

c. Unitizing fixed costs.

d. An arbitrary allocation.

Quick Review Question #4

4. What does it mean to “Get

What You Measure?”

Quick Review Answer #4

Appendix: Activity-Based

Management (Four-Steps)

1.

2.

3.

4.

Determine major activities.

Identify resources used by each activity.

Evaluate the performance of the activities.

Identify ways to improve the effficiency

and/or effectiveness of the activities.

Step 1: Determine major

activities through interviews

and observations

a. Determine customer locations, determine

availability of stock, and prepare delivery

schedules.

b. Pick orders from warehouse.

c. Load trucks.

d. Deliver merchandise.

Step 1: Determine major

activities through interviews

and observations

(continued)

e. Return merchandise to stock if not

acceptable to customer or customer not

home.

f. Wash delivery trucks (each night).

g. Schedule truck for routine service and

nonroutine repairs.

Step 2: Identify Resources

Used By Each Activity (ex.)

1. Return merchandise to stock (e)

a. Different item received than ordered

b. Customer not home at time of delivery

2. Wash delivery trucks (f)

a. How many trucks washed per night?

b. Salary/wage costs associated with

employees

c. Cleaning supplies, materials,

equipment depreciation

Step 3: Evaluate The

Performance Of The Activities

1. Benchmarking.

2. Compare with other firms.

3. How do costs compare with others?

Step 4: Identify Ways To

Improve The Efficiency And/Or

Effectiveness Of The Actvities

1. Suggest improvements based on

analysis.

2. Best practices at other firms.

3. Examples:

Have sales staff seek customer input.

Have clerk call customers the day prior

to delivery to assure someone is home

(note: dentists office now do this

regularly).

Consider converting part-time positions

to full-time or outsourcing washing.

Conclusion

1. ABM focuses on process improvements.

2. ABC focuses on costing.

3. ABM often identifies “low hanging fruit,” or

costs which are out of line with

benchmarks.

4. ABM can produce substantial returns.

Copyright

© 2004 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that

permitted in Section 117 of the 1976 United States

Copyright Act without the express written permission of the

copyright owner is unlawful. Request for further information

should be addressed to the Permissions Department, John

Wiley & Sons, Inc. The purchaser may make back-up

copies for his/her own use only and not for distribution or

resale. The Publisher assumes no responsibility for errors,

omissions, or damages, caused by the use of these

programs or from the use of the information contained

herein.