SBCG Application Package - Georgia State Small Business Credit

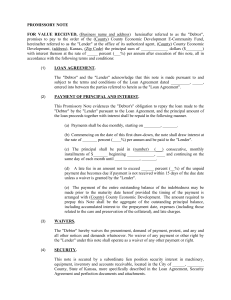

advertisement