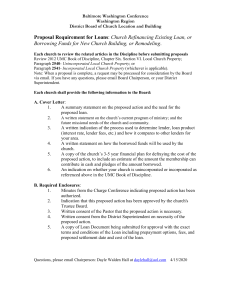

SBCG Application Package - Georgia State Small Business Credit

advertisement