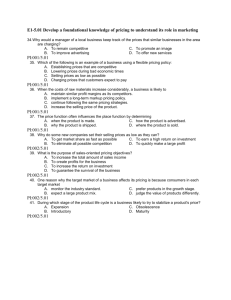

The Price

advertisement

+ Pricing Introduction The prices a company sets for its product and services must: 1) gain acceptance with the target customers and 2) make a profit for the organisation. How do you navigate it all?! Pricing Strategy Price is defined as: “The amount in money for which something is offered for sale.” A Pricing Strategy is defined as: A plan which determines the best (at the time of making) pricing decision. There are so many! Pricing Strategy When setting prices we must consider: The price that the competition charges. The cost of providing the product or service. The company’s market position e.g. is it a market leader? The type and nature of demand e.g. if an increase or a decrease in price will affect amounts purchased. The market segments (or target market) we are seeking to attract. Pricing Strategy Key Formulas Profits = Total Revenues – Total Costs OR Profits = (Prices x Quantities sold) – Total Costs Total Cost= Fixed costs + Variable Costs Price Examples Company Price Quantity Sold Total Costs A $6 200 $400 B $4 400 $1000 C $4 300 $1700 Profit Fixed & Variable Costs FIXED COSTS $ amount is the same monthly regardless of volume of Sales or Production Examples: Mortgage Rent Equipment/computer costs Utilities (sometimes) Salaries Property taxes Fixed & Variable Costs VARIABLE COSTS $ amount differs depending on level of volume of the sales or production of the product/service Examples: Raw materials Gas & electricity Supplies Commissions Labour wages Cost-Plus Pricing Selling Price = Unit Cost + Markup = FC + VC + Markup Markup % = Selling Price – Unit Cost X 100 Unit Cost Margin = Selling Price – Unit Cost The adding of a Markup to the cost ensures a profit Quantity Discount Quantity discounts: Deductions from a seller’s list price that are offered to encourage customers to buy in bulk eg. Buy a particular resort package – children fly free Cash Discounts A deduction granted to buyers for paying by cash or within a specified time. They are usually calculated on a net amount due after first deducting trade and quantity discounts from the base price. Price Lining Involves selecting a limited number of prices at which a business will sell related products. A shoe shop which will sell several styles of shoes at $69.95 and another group at $89.95. Loss Leader Pricing Selected products or services sold at cost or less To attract customers who will make other purchases too This hopefully will more than compensate for the losses on “leader” Follow the Competition Price equal to or just below the competition Watch costs relative to price to ensure profit. Penetration Pricing New product or service priced significantly below competition To win market share If sales volume is large, profit can be high. Skimming When no or limited competition High price set Watch for competitors moving in!! Super Sizing Adding a low cost to a product to increase its selling price and profitability. Eg. Supersize Fries at McDonalds It costs very little for McDonalds to add on the extra fries but they can charge more. Everyday Low Prices Low priced store Sales every week Everyday low pricing strategy Zellers, Walmart, Dollarama Negotiated Pricing A buyer makes offers to purchase and a seller makes offers to sell a particular product or service for less then the published price. Interest-Free Pricing Business offers consumers a chance to finance their purchase with low or no interest charges for the extent of the contract. Combo Pricing (bundling) Offers the consumer a deal on one part of the sale, but the business makes a large profit on the other parts it requires the customer to buy. Psychological Pricing Prices appear less than they really are Eg. 299.98 vs. $300