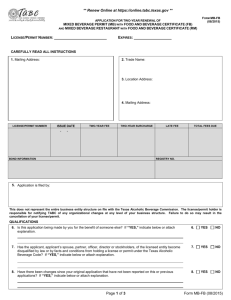

- Texas Alcoholic Beverage Commission

advertisement