Fixed Cost Volume Variance - McGraw Hill Higher Education

advertisement

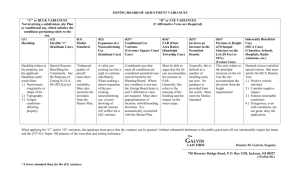

Chapter Fifteen Performance Evaluation © 2015 McGraw-Hill Education. Responsibility Accounting An accounting system that provides information . . . Relating to the responsibilities of individual managers. To evaluate managers on controllable items. 15-2 Decentralization Improves quality of decisions. Improves productivity. Improves performance evaluation. Develops lower-level managers. Advantages Encourages upper-level management to concentrate on strategic decisions. 15-3 Responsibility Centers Investment Center Profit Center Cost Center 15-4 Managerial Performance Measurement Evaluation Measures Cost Center Cost control Quantity and quality of services Profit Center Profitability Investment Center Return on investment (ROI) Residual income (RI) 15-5 Controllability Concept Managers should only be evaluated on revenues or costs they control. I’m in control Since the exercise of control may be clouded, managers are usually held responsible for items over which they have predominant rather than absolute control. 15-6 Preparing Flexible Budgets The master budget, sometimes called a static budget, is based solely on the planned volume of activity. Flexible budgets differ from static budgets in that they show expected revenues and costs at a variety of volume levels. 15-7 Determining Variances for Performance Evaluation The differences between standard and actual amounts are called variances. A variance may be favorable or unfavorable. When actual sales are less than expected, an unfavorable sales variance exists. When actual sales revenue is greater than expected revenue, a company has a favorable sales variance. 15-8 Determining Variances for Performance Evaluation Variances are not limited to the evaluation of revenues. They can also be used to understand the differences between standard and actual amounts of costs. When actual costs are less than standard costs, cost variances are favorable because lower costs increase net income. Unfavorable cost variances exist when actual costs are more than standard costs. 15-9 Sales Volume Variances The difference between the static budget sales amount and the flexible budget sales amount is a measure of the sales volume variance. Exhibit 15.2 Melrose Manufacturing Company’s Volume Variances 15-10 Interpreting the Volume Variances In a standard cost system, marketing managers are usually responsible for the volume variance. Because sales volume drives production, production managers have little control over volume variance. In the case of Melrose, the marketing manager exceeded planned sales volume by 1,000 units, resulting in an $80,000 favorable revenue variance ($80 × 1,000). The unfavorable cost variances are somewhat misleading. Melrose incurred higher costs because it manufactured and sold more units than planned. 15-11 Fixed Cost Considerations The fixed costs are the same in both the static and flexible budgets. Spending Variance The difference between the budgeted fixed costs and the actual fixed costs Fixed Cost Volume Variance The difference between costs at planned volume versus actual volume 15-12 Flexible Budget Variances For effective performance evaluation, management must compare the actual results achieved to the flexible budget based on the actual volume of activity. Here is a comparison of the standard amount and actual amount per unit for the current period for Melrose. Sales price Variable material cost Variable labor cost Variable overhead cost Variable GS&A cost Standard $ 80.00 12.00 16.80 5.60 15.00 Actual $ 78.00 11.78 17.25 5.75 14.90 15-13 Calculating Sales Price Variance Actual sales (19,000 × $78) Expected sales (18,000 × $80) Favorable total sales variance $ 1,482,000 1,440,000 $ 42,000 or Activity variance (volume) Sales price variance Favorable total sales variance $ 80,000 F (38,000) U $ 42,000 F 15-14 The Human Element Associated with Flexible Budget Variances • The flexible budget cost variances offer insight into management efficiency. • As with sales variances, cost variances require careful analysis. • A favorable materials variance could mean that purchasing agents are good negotiators or it might be caused by paying low prices for inferior goods. 15-15 Management by Exception Management focuses on areas not performing as expected. Management by exception Upper-level management does not receive operating detail unless problems arise. The vice president of operations receives summarized information from each unit. Businesses cannot afford to have managers spend large amounts of time on operations that function normally. 15-16 Return on Investment Return on investment is the ratio of income to the investment used to generate the income. ROI = Operating Income Operating Assets 15-17 Return on Investment Lumber = Manufacturing Home Building = Furniture = Manufacturing $60,000 $300,000 = 20% $46,080 $256,000 = 18% $81,940 $482,000 = 17% All other things being equal, higher ROIs indicate better performance. 15-18 Factors Affecting ROI Operating Income ROI = Operating Assets Operating Income ROI = × Sales Margin Sales Operating Assets Turnover 15-19 Factors Affecting ROI 2 Reduce Expenses 1 Increase Sales 3 Reduce Operating Assets (The investment base) Three ways to improve ROI 15-20 Residual Income Operating Income – Investment charge = Residual income Operating Assets × Desired ROI = Investment charge Investment center’s cost of acquiring investment capital 15-21 Residual Income Residual income encourages managers to make profitable investments that would be rejected by managers using ROI. Suboptimization occurs with ROI when managers benefit themselves at the expense of the company 15-22 End of Chapter Fifteen 15-23