Sec 284(1) TCA 1997 - Chartered Accountants Ireland

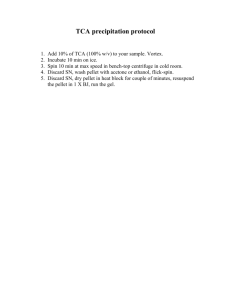

advertisement

Ken O’Brien CHARTERED TAX CONSULTANT APPLIED TAX MODULE 3 Income Tax 25th and 26th January 2013 www.charteredaccountants.ie EDUCATING SUPPORTING REPRESENTING Schedules D Cases I and II • Case I Trade • Case II Profession • Self Employed - Income Tax Income and Expenses • Accounts • Basis of Assessment • Commencement and Cessation • Expenditure • Expenditure prohibited? • Earnings Basis • AP ending in tax year • Special Rules • Wholly and Exclusively • Ex: Entertainment and Depreciation Schedules D Cases I and II • • • • What is a trade? Sec 3(1) TCA 1997 – very broad Case Law The Six Badges of Trade 6 Badges of Trade • Subject Matter • Manufactured items, Commodities, Property • Held for a short time? • Similar and frequent? • Length owned • Frequency of transactions • Supplementary Work • Advertising, office? • Circumstances • Any special ones? • Motive • Never irrelevant Trading? • • • • Jay Sugar is a self employed painter. He invests some money in shares He buys and sells shares Is he carrying on a trade or liable to cgt? Jay Sugar • • • • Apply Badges of trade to his activities Regular buying and selling? Is only one Badge met? Revenue Guidance – “whole picture” Professions • Reviewed by Courts includes Tax Consultants • Artists, Architects, Accountants • Engineers, Lawyers, Musicians, Estate Agents • Insurance Brokers, Doctors, Dentists Basis of Assessment • • • • Schedule D Cases I and II Chapter 3 of Part 4 TCA 1997 Period of Account Computational Rules Chapters 6 and 7 Part 4 TCA 1997 Amount Chargeable • 3 Key Stages 1. Taxable Profit/Loss for Period of Account 2. Allocate Profit/Loss to Year of Assessment 3. Calculate Capital Allowances for Year of Assessment Section 65 TCA 1997 General Rule Basis Period = 12 months ending in the Tax Year No Accounts ending in Tax Year Taxable on Profits of the Year of Assessment Accounting Period > or < 12 months Taxable on Profits of 12 months ending in the Tax Year Two or more accounts ending in Tax Year Taxable on profits of 12 months to later accounts Section 65 TCA 1997 Accounts Year End 31st March 2012– Accounts Y/e 31st March 2012 2012 AP y/e 31st Oct 2012 AP 16 mths 31st Jan 2014 2012 – Accounts 31/10/2012 2013 – 12 mths 31/12/2012 AP 18 mths 30th Sep 2012 2012 – 12 mths to 30/9/2012 AP y/e 30th April 2012 AP 6 mths 31/10/2012 2012 – 12 mths to 31/10/2012 Sec 66 TCA 1997 • Commencement • Year 1 • Taxable Profits = – Profits from commencement to 31st Dec Sec 66 TCA 1997 • 2nd Year • 3rd Year • Sec 65 Rules • AP Y/E in Tax Year • 2nd Year Excess Relief • Sec 66(3) • Claim by 31st Oct after 3rd Year • Profits in 3rd year reduced if profits taxed in 2nd year> actual profits Example • Trade commences 1st May 2012 • Taxable Profits are: – AP ending 30th April 2013 – AP ending 30th April 2014 €25,000 €20,000 Commencement 2012 1/5/201231/12/2012 €25,000 x 8/12 €16,666 2013 Y/E 30/4/2013 €25,000 2014 Y/E 30/4/2014 €20,000 Subject to 2nd Year Excess Claim Second Year Excess Profits Assessed Actual Profit €25,000 x 4/12 = €8,333 €25,000 €21,666 €20,000 x 8/12 = €13,333 Excess Revised 2014 €20,000-€3,333 €3,333 €16,667 Cessation of Trading • • • • When does a trade cease? Disposal of trading stock? Sale of capital assets? Gordon and Blair Ltd v The Inland Revenue Commissioners (40TC 358) Cessation Rules • Revision of penultimate year to actual • Timing of cessation to avoid underpayment • Is AP different to Tax Year? • Avoid underpayment and interest Change of Accounting Date • • • • Refer to rules in Sec 65(3) TCA 1997 Review p/y profits using new AP Are p/y profits greater after revision? Revise p/y if “yes” – additional liability Sch D Cases I and II • Tax charged on full amount of profits/gains • Section 81(2) TCA 1997 • Capital v Revenue • Wholly and Exclusively Test Expenses Disallowed • • • • • Section 81(2) TCA 1997 Not wholly and exclusively incurred Capital expenditure General Provisions eg bad debt or stock Depreciation charge per accounts Items not deductible • Sec 1080(3) 1997 – interest on overdue tax • Sec 865A(4)(b) TCA 1997 – interest on overpaid tax not taxable • Sec 840 TCA 1997 Entertainment Wholly and Exclusively • • • • • Sec 81(2) TCA 1997 Apportionment where dual purpose eg car Purposes of the trade test Bentleys, Stokes and Lawless v Beeson Strong and Co of Romsey Ltd v Woodifield Capital v Revenue • Sec 81(2)(f) TCA 1997 • Walker v Joint Credit Card Co STC 427 • Hibernian Insurance Co v MacUimis (2000) ITR 495 • Accounting treatment Capital or Revenue? • Costs of promoting legislation to gain tax reliefs for staff • Legal costs to protect title to land and buildings • Cost of forming a new holding co • Revenue McGarry v Limerick Gas • Revenue • Southern v Borax • Capital Kealy v O’Mara Capital v Revenue Expenditure • Capital Expenditure – Expenditure incurred on the acquisition/construction/alteration of premises • Revenue Expenditure – Wear & Tear on property and plant (repairs /maintenance) • Sec 81(2)(f) TCA 1997 disallows capital expenditure for CT purposes • Regent Oil Company v Strick Capital Allowances • CA = “Tax Depreciation” • Plant and Machinery (Includes Fixtures and Fittings • Industrial Buildings • Initial Allowance • Annual Allowance • Accelerated Allowances • Balancing Allowances/Balancing Charge Plant & Machinery v Ind Buildings? • Legislation • Case Law • Revenue Practice Plant & Machinery v Ind Buildings? • Key Question • Does the item form part of the premises within which the trade is carried on? or • Is it an item with which the trade is carried on i.e. used in the conduct of the trade? Case Law Shove v Lingfield Park IRC v Anchor International All weather race track ≠ Plant Synthetic grass turf for indoor pitches = Plant Attwood v Anduff Car Wash Drive In and wash hall of car wash facility ≠ Plant O’Culachain v McMullan Bros Ltd Dunnes Stores v McCronin Canopies of petrol station = Plant Jarold v John Good & Sons Moveable partitioning = Plant IRC v Scottish & Newcastle Breweries Creation of ambience = Plant Electric light fittings, wall plaques, tapestries, murals and prints in hotel Suspended ceiling held part of setting ≠ Plant Items treated as P&M • Revenue generally regard the following as P&M – Central Heating – Lifts (excluding lift shafts) – Security and Fire Alarms – Heating – Ventilation – Sprinkler Systems – Shelving – Internal Communication Systems Capital Allowances • Sec 284(1) TCA 1997 1. Incurred Capital Expenditure 2. for the purposes of the trade or profession 3. Asset belongs to claimant 4. Asset is used wholly and exclusively 5. In use at the end of the basis period 6. Burden of Wear and Tear Sec 284 TCA 1997 • P&M in use at end of AP • Full year’s CA even where asset in use only for the last day of AP • Basis Periods • Sec 284(2)(b) TCA 1997 • CA restricted where Basis Period < 12 Months Basis Period • Basis period is fundamental for CAs • Identify correct Basis Period for – Assets Purchased – Asset Disposals – Periods of ownership in between • Sec 306 TCA 1997 – Basis period for a year of assessment – Period in which final profits for a tax year are computed under Case 1 of Sch D Basis Period • Sole trader makes up accounts to 30th June 2012 • Plant purchased on 1st July 2011 • Basis period for CA is 30th June 2012 • Basis periods overlapping or with a gap • CA must be attributed to a Basis Period Basis Period • Sec 306(2)(b)(ii) TCA 1997 • Sale of plant during an interval is deemed to happen in the second Basis Period • Interval for two successive years of assessments and a permanent discontinuance of trade occurs in later year Interval treated as part of first period only Capital Allowances • Sec 284(2)(ad) TCA 1997 – Rate 12.5% • Plant and machinery straight line • Sec 306 TCA 1997 – commencements and cessations • Sec 288 TCA 1997 – Balancing charges and allowances • Sec 288 TCA 97 – option to transfer at tax wdv Calculate CA and BC/BA • Tax Year 2011 • Plant Cost €20,000 • CA @12.5% = €2,500 • Machinery Sold for €2,500 – bought for €5,000. Wear and tear claimed to 2010 €3,125 • Proceeds €2,500 TWDV €1,875 • BC €625 Balancing Allowance/Charge • Sec 288 TCA 1997 • When does a BA/BC arise? – Disposal of Asset – Trade use permanently ceases – Trade ceases • Adjusts for difference between proceeds and TWDV of asset Balancing Charge Example • Asset Purchased in February 20X3 for €100,000 included in financial statements to 31 December 20X3. • Asset Disposed of June 20X6 for Proceeds of €70,000 € Cost 100,000 Wear & Tear 20X3 (12,500) Wear & Tear 20X4 (12,500) Wear & Tear 20X5 (12,500) T.W.D.V 1 Jan 20X6 62,500 Sales Proceeds 70,000 Balancing Charge (Profit) 7,500 Clawback of Capital allowances Balancing Allowance Example • Asset Purchased in February 20X3 for €100,000 included in financial statements to 31 December 20X3. • Asset Disposed of June 20X6 for Proceeds of €50,000 € Cost 100,000 Wear & Tear 20X3 (12,500) Wear & Tear 20X4 (12,500) Wear & Tear 20X5 (12,500) T.W.D.V 1 Jan 20X6 62,500 Sales Proceeds 50,000 Balancing Allowance (Loss) 12,500 Additional CA granted Deemed CAs • • • • Sec 287 TCA 1997 CAs deemed to have been claimed Applies even where no CAs claimed Notional Wear & Tear Election for BC • Sec 290 TCA 1997 • Election to reduce cost of replacement asset by amount of BC • CA calculated on Cost of new asset - BC • BC crystallises on disposal of replacement asset Gifts and Sales < MV • Sale, insurance, salvage or compensation received used to compute BA/BC • Sec 289 TCA – substitute OMV • Applies to gifts • Election under 289(6) TCA 97 for TWDV Transfers @ TWDV • • • • Sec 288 TCA 1997 Option to transfer assets @ TWDV No BA or BC on disposal Subsequent owner takes over asset at TWDV Transfers @ TWDV • Sale or transfer of P&M • Purchaser uses it for trade purposes • Seller and purchaser make an election in writing • Both are connected • Option to transfer at lower of MV or TWDV • Option not available for transfer to a company by a non company eg sole trader incorporating Fixtures & Fittings • • • • • • Sec 284 TCA 1997 Sch D Case V Rental Income Wear & Tear on capital expenditure Furniture, Kitchen Appliances, etc Wholly & Exclusively – expenditure Furnished house let on bf commercial terms • Writing down allowance over 8 years @12.5% straight line Motor Vehicles • Sec 373-376 TCA 1997 – passenger vehicles • CA Qualifying Cost restricted • Pre 30th June 2008 - €24,000 limit • Sec 380L TCA 1997 new greener rules • Proceeds restricted for BC • Sec 286 TCA 97 – Taxis and short term hire Motor Vehicles • CA on passenger motor vehicles • 12.5% Straight Line since 4th Dec 2002 • Sec 373 TCA 1997 – Cars purchased before 1st July 2008 – Maximum amount €24,000 = “Specified Amount” CA on Cars from 1st July 2008 Part 11C TCA 1997 – Sec 380K-380P Vehicle • Category A B/C D/E F/G Emission Level 0-120 g/km Maximum Amount €24,000 (Specified Amount) 121-155 €24,000 (Specified g/km Amount) 156-190g/km Lower of 50% of Retail Price or 50% SA >190g/km No CAs Taxis and Short Term Hire • No Specified Amount applies • CA of 40% • Reducing Balance Cars - BA and BC • Proceeds on sale/Deemed proceeds on disposal • Restricted where CAs were restricted Example • Sale Proceeds = €10,000 • Car Cost €30,000 • Specified Amount €24,000 • Restricted SP = €10,000 x €24,000/€30,000 Motor Leasing Expenses • Sec 380MTCA 1997 • LC x Capital Limit* Lease Price • €24,000 subject to CO2 emissions • Same categories as for CA on cars Industrial Buildings • Sec 268 TCA 1997 • Industrial Buildings or Structures • Property based tax incentive schemes Industrial Buildings • • • • • • • • Located in the State Manufacturing facilities Nursing Homes Hospitals Sports Injuries Clinics Hotels Holiday Camps Airport Buildings Industrial Buildings • Exclude site cost, associated professional fees and Stamp Duty • Where trader builds an industrial building – professional fee allowable • Refurbishment expenditure qualifies • Reconstruction, repair, provision of water, sewage, heating 10% Rule • Costs related to offices, showrooms, retail shops and dwelling houses excluded • Sec 268(8) TCA 97 – 10% rule • Where costs of construction of non qualifying area ≤ 10% of total costs • Entire construction cost qualifies IBAA • Industrial Buildings Annual Allowance • Must hold “relevant interest” at end of basis or accounting period • Sec 269 TCA 1997 – legal interest, freehold or leasehold • Held by person who incurred expenditure Rates of IBAA • From 1st April 1992 – 4% pa net of grants • From 4th December 2002 – Hotels @4% • Transitional provisions – 15% for 6 years and 10% in Year 7 • IB life of 25 years from date first used • Hotels – 25 years for expenditure from 4/12/2002 – 7 years for expenditure 26/1/1994-4/12/2002 – 10-50 years in other cases Calculating IBAA • Sec 279 TCA 1997 – special rules • IBAAs normally given to person – who incurred the construction expenditure or – who holds the relevant interest in relation to that expenditure IBAA – First Sale • Sale of IB before it is used or • Sale of IB within 2 years after it commences to be used • Purchaser deemed to have incurred capital expenditure on construction on date purchase price is paid • Amount of deemed expenditure – distinguish between Non Builder and Builder Expenditure by Non-Builder • Building constructed by non-builder • Purchaser deemed to have incurred expenditure on date of purchase on lower of – Actual construction costs or – Net price paid by taxpayer Expenditure by Builder • • • • Building sold by a builder Purchaser claims IBAA on net price paid Includes builder’s profit Where > 1 sale before building used or within 1 year after it commences to be used – Deemed expenditure = lower of net price paid on first sale and net price paid on last sale Net Price Paid • • • • B x C/(C+D) B = Purchase Price C = Construction Costs D = Site Cost Example Sale by Builder • • • • • • Purchase price = €1m Construction costs = €500k Site Cost = €350k Purchased new and unused B x C/(C+D) = €1,000,000 x €500,000/(€500,000+€350,000) = €588,235 • IBAA claimed on €588,235 Example Sale by non Builder • • • • • • Purchase price = €1m Construction costs = €500k Site Cost = €350k Lower of Actual Construction Cost = €500,000 or €1,000,000 x €500,000/(€500,000+€350,000) = €588,235 • IBAA claimed on €500,000 Sale of Industrial Building • Sec 274 TCA 1997 • Sale within tax life of IB – Balancing Charge or Balancing Allowance • Sale outside tax life of IB – No Balancing Charge or Balancing Allowance Balancing Charge/Allowance • Sec 274 TCA 1997 • Balancing Charge/Allowance – Relevant Interest in IB is sold – Relevant Interest, being leasehold, ends – Building is demolished or destroyed or ceases altogether to be used – Consideration other than rent is paid for a lesser interest created our of the relevant interest Balancing Charge/Allowance • Sec 274 TCA 1997 Balancing Allowance Balancing Charge •Amount of residue of expenditure > Sale, Salvage or Compensation •Residue of Expenditure = Unused Capital Allowances •Amount of residue of expenditure < Sale, Salvage or Compensation •BC cannot exceed CA actually made •Residue of Expenditure = Unused Capital Allowances Loss Relief • • • • Sec 381(3) - Current Year Losses Sec 392 TCA – Augment Loss with CA Sec 382 TCA – Carry forward of losses Sec 388 TCA – Terminal Losses Losses • Calculated in same way as adjusted profit • In practice, based on loss for AP ending in tax year • Commencement rules as for profits • Time limit Sec 381(6) – within 2 years Current Year Losses • Order of set off Sec 381(3) against other income in year of loss 1. Against earned income 2. Against unearned income 3. Against earned income of spouse 4. Against unearned income of spouse Capital Allowances and Losses • Sec 392 TCA • Losses can be created or increased • CA for the year of assessment – not CA carried forward • Offset CA against BC first CA and Losses Example • • • • Taxable Profits 2012 Capital Allowances Sec 381 Loss Spouse Salary 2012 €5,000 (€7,000) (€2,000) €30,000 • Claim Sec 381 Loss by 31/12/2014 Terminal Loss Relief • Sec 385 - 390 TCA 1997 • Permanent discontinuance of trade/profession • Loss can be set off against profits of previous 3 years of assessment Pro Forma Computation Profit before tax per Accounts Add Back x Depreciation x Entertainment x Private use of Car x Balancing Charge x x Deduct Rental Income x Investment Income Adjusted Profit x x X Capital Allowances x x Taxable Profits x Self Assessment • • • • • • Part 41 TCA 1997 Chargeable persons Sec 950 Register on form TR1/ROS Pay and File Deadlines Interest, Surcharge, Penalties Revenue Audits Chargeable Person? • Company Director not fully PAYE or15% s/h? • Rental Income Losses? • Owner of foreign bank account/offshore fund? • Employee exercising share options? • Yes • Yes • Yes • Yes PAYE Taxpayers • Gross non- PAYE income <€50,000 • Net assessable non-PAYE income < €3,174 • TB 62 • If non-PAYE income is coded self assessment does not apply Directors • SP IT/1/93 • Directors liable to file Tax Returns under self assessment • Exclusions for – Directors of shelf companies – Directors of dormant companies – Temporary directorships prior to commencement of trading Directors Non Proprietary Directors • < 15% Share Capital • Not otherwise chargeable persons • All income subject to PAYE Proprietary Directors • >15% control of ordinary share capital • Spouses/Civil Partners brought within self assessment where joint assessment applies Tax Returns • Sec 951 TCA 1997 – obligation to file • Filing deadline 31st October – Extension (non stat) to mid November for ROS • Chargeable person must file Tax Return – unless Revenue confirm in writing that he is not obliged to file • Sec 1084(4) TCA 1997 – first year of setting up trade or profession – Filing date is 31st October two years later Tax Payment • Sec 958 TCA 1997 • Preliminary Tax due 31st October • 100% p/y or 90% current year or 105% prepreceding year • BES/Film Relief excluded • Extension to mid November for ROS pay and filers • PT 2012 – include 5% USC charge on specified property reliefs if based on 100% Self Assessment Example John’s situation October 2012 • 2011 Tax liability €15,000 • 2011 Preliminary tax paid €14,000 • 2012 Estimate of tax €12,000 What do you advise John? Self Assessment Solution 2011 Tax Return File by 31/10/2012 2011 Balance Due Pay €1,000 by 31/10/2012 2012 Preliminary Tax Pay €12,000 by 31/10/2012 Tax Returns • • • • Form 11 – self assessment Form 12 – Employees, non prop dirs Both on www.revenue.ie Filing using ROS has advantages – Extension to mid Nov for pay & file; faster refunds/assessments – Most charge persons now within e filing Mandatory e-Filing • • • • Phased in since 2009 Compulsory electronic payment and filing Section 917EA TCA 1997 Exclusions if taxpayer does not have capacity to e file and pay – Revenue approval • Insufficient access to internet • Prevented by reason of age or physical infirmity Mandatory e-Filing • Phase 1 1st January 2009 – LCD cases • Phase 2 Companies with – turnover> €7.3m – > 50 employees – All public bodies Mandatory e-Filing • Phase 3A From 1st June 2011- Self Employed individuals: – filing Form 46G – subject to High Earner Restrictions – Acquiring or benefitting from Foreign Life Policies; Offshore Funds or products – Claiming certain residential property based incentives and IBAAs Mandatory e-Filing • Phase 3A From 1st June 2011 All – Companies – Trusts – Partnerships – Collective Investment Undertakings (CIUs) – European Economic Interest Groupings(EEIGs) Mandatory e-Filing • Phase 3B From 1st October 2011 Employers with > 10 Employees • Phase 4 VAT Registered Cases Chargeable Persons claiming certain reliefs Mandatory e-Filing Phase 4 RACs contributions PRSA contributions Overseas Pension contributions AVCs Sportspersons Retirement Relief Artists Exemption Woodlands Exemption Patent Income Exemption Tran border Relief BES Seed Capital Relief Film Relief Significant Buildings/Gardens Interest for shares/loans to company/partnership Mandatory e-Filing • • • • Penalties for non-compliance Sec 917EA TCA 1997 – penalty €1,520 Section 1084 TCA 1997 surcharge Specified taxpayer could be liable to – Penalty for not filing online – Penalty for not paying PT online – Surcharge for not filing Notice of Assessment • • • • Sec 954 and 955 TCA 1997 4 year time limit where full disclosure Review notice of assessment immediately 30 days to appeal Interest and Penalties • Sec 1080 TCA 1997 • Interest if late payment or PT insufficient • Rates – From 1/4/1998 to 31/3/2005 0.0322% per day – From 1/4/2005 to 30/6/2009 0.0273% per day – from 1/7/2009 0.0219% per day • Runs from due date of tax Late Filing Surcharge • Sec 1084 TCA 1997 • No credit for PAYE for proprietary directors • Surcharge considered part of income tax for year Surcharge Return filed < 2 months late 5% Surcharge Max €12.695 Return filed > 2 months late 10% Surcharge Max 63,458 Risk Management Issues • Maintain a client database • Use a standard Client Tax Return Checklist – updated annually • Check PT payment is sufficient • Advise client in time to avoid late payment Risk Management • • • • • Use a systematic approach for all clients Review computations Identify high risk cases Checklists are only a tool Take objective view of both old and new clients Tax Calculations and Returns • Late filing • Late filing for single or separate assessments • Late payment • PT underpaid • Incorrect assessment not addressed within 30 days Key Technical Issues 1. Tax Residency Status of client 2. Client and spouse/civil partner – Residence, Ordinary Residence, Domicile 3. Is the client a chargeable person? 4. Method of assessment joint; single; separate 5. Sources of Income and Expenditure and records Key Technical Issues 6. Claim for credits, reliefs and deductions – Prior 4 years? 7. Changes in status since previous year's Return? – Marital; Accounting Year End; trading activities? 8. PRSI and USC properly calculated? 9. Correct taxes paid on time ? Tips to Minimise Risks Preliminary Tax Tax Return Filing ROS Advantages Notice of Assessments •Exclude BES/EIIS and Film Relief in 100% P/Y calculation •PT based on joint liability for married couples/civil partners •If 100% p/y, 90% of current year or 105% pre-preceding year tests not met balance of tax due 31st October in tax year and interest will be due •Mandatory filing may apply •Mid-November pay and file extension •Certainty on notice of assessment contents •Automatic receipts •Payment not debited until mid-Nov if filed early •Refunds tend to issue earlier •Check PAYE Tax Credit Certs to ensure PT calculations correct and no unforeseen underpayments •PAYE Anytime tab •Review NOA on receipt to ensure 30 time limit for appeal not missed •Establish reason for under/overpayment Professional & Ethical Skills • • • • • • Module 2 professional approach Income Tax/USC/PRSI= high risk 55% Tax compliance and consulting Research should be rigorous Excellent communication skills require Review competency issues Research and Risk Management Engagement Payments Prior Year Review Other •Does the EL cover the work? •Fees agreed? •Permitted service? •ROS authorisations signed? •Previous Year PT sufficient? •Reconciliation of under/overpayment carried out? •New clients – copies of P/Y Tax Returns and computations? •Is file up to date? •Check P/Y income tax compliance for background to consultancy work •Good checklists •Reliable systems of control for tax compliance •Research planning •Third party assistance •Other taxes •Analysis of errors to learn from Communication Skills • • • • • Adapt standard letters for client Form of communication? Regular meetings with clients Revenue submissions – RM policies Written communications – language and conclusions • Communications based on current tax law and Revenue practice Professional Obligations • Ethical Values • New engagement – professional clearance • Rules for Professional Appointment • Competency Issues • Obtain ex client permission to discuss affairs with new agent Module Round Up • Residence, ordinary residence and domicile • Calculate income liable to Irish tax • Remittance basis Module Round Up • Income sources and categories • Schedule D, Cases I/II, Case III, Case IV, Case V • Capital Allowances • Schedule F • Schedule E • Employed v Self Employed Module Round Up • • • • • Calculation of Income Tax liability Personal credits and deductions PRSI and USC Joint, Single and Separate Assessment High Earner Restriction Module Round Up • Self Assessment System • Preliminary Tax calculation • Advising client on the correct amount to pay • Paying and filing on time • Completion of Income Tax Return • Mandatory eFiling Module Round Up • • • • Risk Management issues Communication Skills Professional Obligations Ethical Values