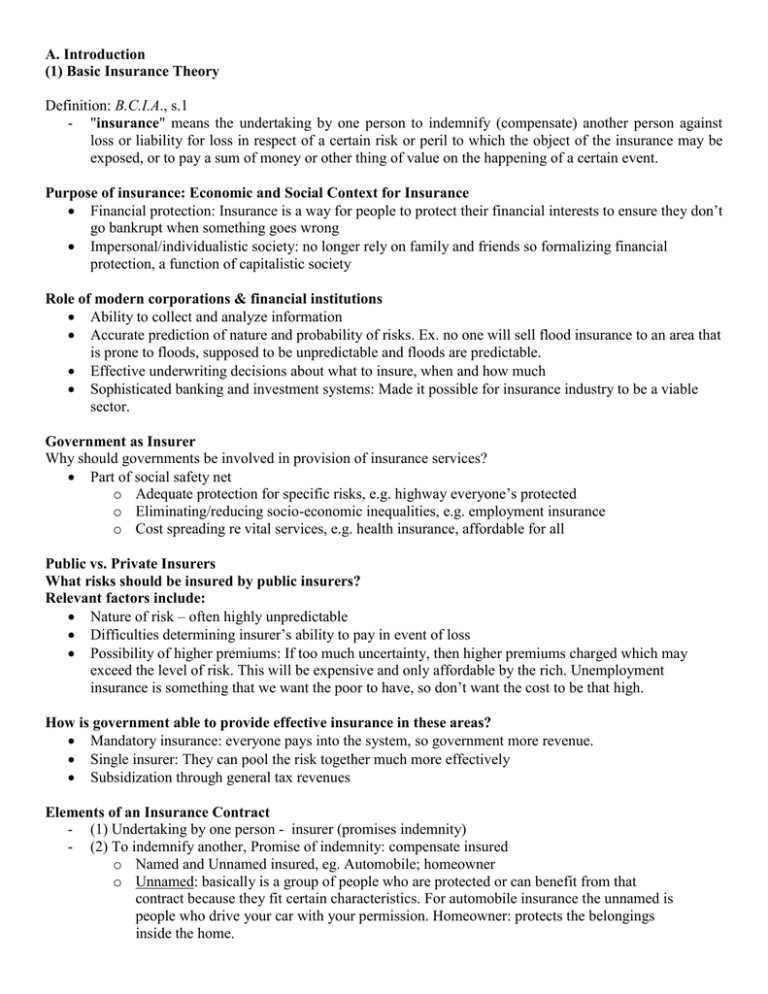

2. Duration of Insurance Contract

advertisement